ClassPass: Navigating the Challenges of Building a Sustainable Marketplace Model

The up-and-down story of this consumer subscription startup illustrates the difficulty and importance of getting the platform business model right.

Among the wave of consumer subscription startups that have been founded in the last 5 years, ClassPass is one of the most well-funded and well-known. Founded in 2013, ClassPass offers fitness subscription packages, allowing consumers to take a number of classes at a variety of studios for a monthly fee. For every class taken, ClassPass pays the studio a pre-negotiated amount (undisclosed, but reports suggest $7-$20+ depending on how popular the class is).

In late 2015, ClassPass seemed to be flying high – it had just raised a fresh round of capital and had been widely praised for nailing the consumer subscription model. However, in April 2016, in a tacit acknowledgement that its model was unsustainable, ClassPass raised prices on its unlimited plans to nearly $200 per month (a year prior, prices had been $99 per month) – in the process, it lost 10% of its customers. Just half a year later in November 2016, ClassPass eliminated unlimited plans altogether. And in July 2017, ClassPass raised a “down round”. ClassPass’s challenges highlight several difficulties related to growing and scaling marketplace business models, some generalizable and others specific to ClassPass.

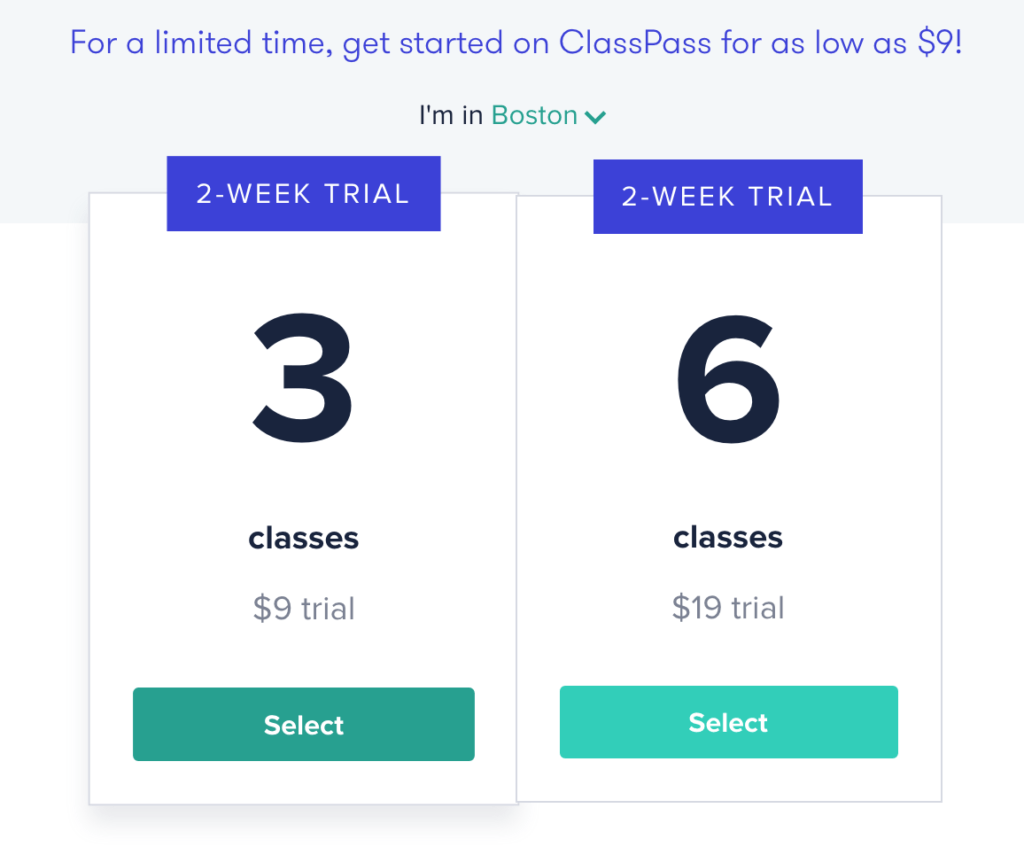

Building a marketplace takes significant upfront investment to attract participants. Almost all platform businesses incur significant costs initially to build scale. For example, in its first two years, ClassPass raised over $80m of funding just to get to 15 million cumulative reservations (i.e., $5 of capital investment per reservation, with low single digit or negative gross margins). Even today, ClassPass offers a variety of high cost promotions. For example, a 6-class trial in Boston is $19 for new users – at an assumed cost of $10 per class (could be far higher), ClassPass would lose over $40 per trial user – if the user never returns, the transaction would yield -200% gross margin, not including the marketing costs to bring the user to trial. Many marketplace businesses fail because they can’t convince VCs that the near-term cash outlay will be compensated by the long-term economics of the business model.

Unit economics are crucial – beware of the “negative” network effect. In order to convince VCs to invest in such costly upfront spend, marketplace platforms need to demonstrate a path to positive unit economics (e.g., LTV / CAC). In ClassPass’s case, though the unlimited plan was an effective marketing tool, it yielded unsustainable unit economics. For example, a “super-user” could pay $100 per month and attend 30 classes a month – at $10 per class (again, could be much higher), ClassPass loses $200 per month on that customer. This created a perverse “negative” network effect, where ClassPass’s most loyal, most supportive members actually were the least economical. Unsurprisingly, ClassPass eventually eliminate unlimited plans altogether, moving to fixed-class plans (e.g., 5 classes per month).

Disintermediation is a significant risk. For ClassPass, disintermediation risk originates from the supply side, where the most popular studios can threaten to move off the platform to capture better economics for themselves. In order to entice these popular studios to stay, ClassPass needs to pay higher rates per class. A revenue model that doesn’t differentiate between high-cost and low-cost studios (e.g., ClassPass’s old unlimited or fixed-class plans) compounds this risk as it erodes unit economics. For ClassPass, unlike for many other platforms, supplier bargaining power is more significant because they can actually move off-platform and become competitors – studios like SoulCycle are big enough to not need ClassPass, and actually competes for customers.

ClassPass’s business model through 2017 occupied an uncomfortable position – it needed consumers who liked the platform, but not too much, and studios that were popular enough to attract customers, but not too popular. This was an unsustainable spot to be in. As a result, in late 2017, ClassPass dropped its fixed-class model and moved to a credit-based model where consumers purchase monthly credits and apply those toward classes that cost different numbers of credits. In doing so, ClassPass can better match their revenues with the cost of servicing customers and improve unit economics. Though this shift puts ClassPass toward a more sustainable future, it may limit consumer adoption and result in near-term churn as the platform becomes a less good deal for certain users. Ultimately, ClassPass’s long-term success will depend on its capacity to create value as an intermediary and its ability to respond to competition from companies like MindBody (entrenched in many studios as their software management system). But at least for now, it seems to have found a more sustainable way to capture value from its offering.

Sources:

- Chernova, Yuliya. “ClassPass Taps $70 Million in ‘Down’ Round.” Wall Street Journal, June 16, 2017, sec. Pro Private Markets. https://www.wsj.com/articles/classpass-taps-70-million-in-down-round-1497639263.

- “ClassPass.” Crunchbase. Accessed March 5, 2018. https://www.crunchbase.com/organization/classpass.

- Crook, Jordan. “ClassPass Sacrifices 10% of Customers in Pursuit of Healthier Margins.” TechCrunch (blog). Accessed March 5, 2018. http://social.techcrunch.com/2016/09/27/classpass-sacrifices-10-of-customers-in-pursuit-of-healthier-margins/.

- Kaufman, Hayley. “ClassPass Raises Prices and Local Fitness Buffs Fume – The Boston Globe.” BostonGlobe.com. Accessed March 4, 2018. https://www.bostonglobe.com/lifestyle/health-wellness/2016/04/14/passclass-raises-prices-and-local-fitness-buffs-fume/DyytoAkysVE5iqMVnuznRJ/story.html.

- Kosoff, Maya. “ClassPass Raises Its Prices Again, and Its Loyal Fans Aren’t Handling It Well.” The Hive. Accessed March 5, 2018. https://www.vanityfair.com/news/2016/04/classpass-raises-prices-again-in-new-york-city.

- ———. “Leaked Documents Reveal ClassPass’s Plan for World Domination.” The Hive. Accessed March 5, 2018. https://www.vanityfair.com/news/2016/06/leaked-documents-reveal-classpass-surprising-next-move.

- O’Brien, Sara Ashley. “ClassPass Kills Beloved Unlimited Plan.” CNNMoney, November 2, 2016. http://money.cnn.com/2016/11/02/technology/classpass-eliminates-unlimited-plan/index.html.

- ———. “ClassPass Once Again Changes Its Business Model.” CNNMoney, March 1, 2018. http://money.cnn.com/2018/03/01/technology/classpass-credit-model/index.html.

- Reader, Ruth. “Is The ClassPass Model Sustainable?” Fast Company, October 19, 2016. https://www.fastcompany.com/3061728/is-the-classpass-model-sustainable.

Great post! As a ClassPass user for the last few years, it’s been interesting to see their transition in business models. I’ve experienced Unlimited, 3/5/10-packs, and now credits. ClassPass has also been creating digital content, likely to compete with new players like Peloton. I am amazed at ClassPass’ ability to pivot as they discover new things about their business, I think they are one of the best companies at adapting and it gives me greater hope in their ability to succeed long term.

Great post – it reminded me of a Planet Money podcast about the economics of gym memberships (https://www.npr.org/sections/money/2014/12/17/371463435/episode-590-the-planet-money-workout) which talks about how gyms make the most money if they have subscribers who never actually show up. While ClassPass is a completely different model, it seems like they have a similar problem with the economics not working out because of all their super users working out too much. I wonder if adopting gym membership pricing schemes (yearly deals vs. monthly costs) would attract a similar user who signs up to feel good about themselves during resolution season but never shows up after February.

Great post. Something that always confused me was how they were going to retain members. They raised the price while I was living in New York and I had enough friends who were on the fence about their experience that they dropped their subscriptions when it happened. So much of getting users justifying their payment for the gym relies on their belief that it will be a lifestyle and well used purchase for them. With the disparate experiences of different gyms/workout environments I wondered how they could make this sticky once the novelty of trying new classes inevitably wore off. Ultimately, people seem to find one gym/studio they like throughout the process, and therefore, as you mentioned, disintermediation looms large. While the company builds on the rise of healthy lifestyles as a fad / desirable space to be in, it doesn’t seem to be providing enough benefit to either the user or the studios to have long term sustainability.

James thank you for the post. I agree with Laura’s confusion regarding how ClassPass will be able to sustain their retention. Not only on the membership side but also on the fitness studio side. I also observed the price increase a couple years ago in reaction to studios dropping the number of class spots they listed on the platform, or dropping off the platform entirely. As members dropped in reaction to studios dropping and simultaneous price increases, you saw ClassPass react with severe price discounting tactics aimed at retaining the membership base that provides the value that attracts studios to the platform. As you discussed in your post, it seems like the credit based method is an interesting strategy but may only reinforce a downward spiral of consumer leaving the platform and eroding value for studios.