Catching fraudsters with Machine Learning – Feature Space

Feature Space helps financial institutions detect fraud with advanced AI deployed at the heart of institutions IT systems.

Feature Space is a London based FinTech start-up using machine learning to detect fraudulent payments for banks and payments providers. Improved detection of fraud improves the customer experience while reducing fraud costs for the payment provider. As of 2020 Feature Space has deployed its fraud detection solutions globally with customers as diverse as HSBC, IATA and Danske Bank [1].

Fraud costs the industry billions per year

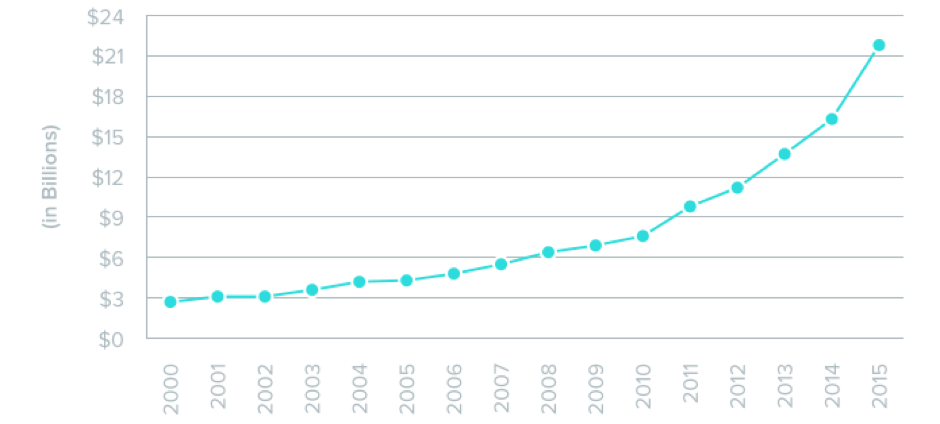

A rapidly growing problem – annual global fraud losses (in Billions) [2].

Fraudulent transactions cost an estimated $27.85 billion per year in 2019, amounting to 6.86 cents in every $100 (down from 6.95 cents in 2018) [3]. Payment providers automated systems have to make instantaneous decisions to permit or reject transactions – even minor delays cause customer considerable frustration.

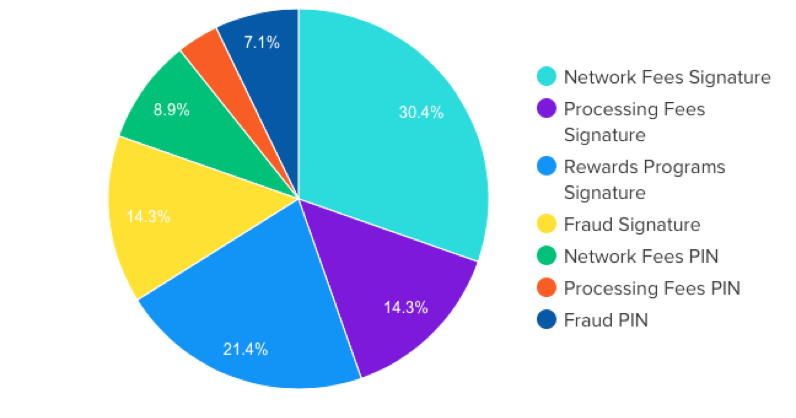

A significant cost for debit card issues – breakdown of debit card issuer costs [4].

A complex chain of events takes place before after a customer inserts their card in a machine. The information from the payment and card is sent from the Merchant, through a complex web of agents (such as acquirers, payment processors and other facilitators) before reaching the card issuer. Upon receiving the payment information, the card issuer runs fraud algorithms to determine if the payment is fraudulent. Transactions tagged as legitimate are processed by the issuer, while fraudulently tagged transactions are rejected.

A New Approach to Fraud Detection

Payment providers have traditionally developed their own fraud detection algorithms using tools like regression models and rules-based approaches. This approach has two limitations. Firstly, the regression models are built from historical data so can only detect past fraud trends. As the models need to be updated their predictive capacity lags the behaviour of fraud. Secondly, banks have not shared transaction data, so banks are limited by the data they have available.

Feature Space solves both of these limitations with their proprietary AI fraud detection system. The machine learning algorithms learn to spot new behaviour, rapidly adapting to new fraud behaviours. Embedding their system in banks results in network effects as more customers provides more data to train the algorithm and improve fraud detection.

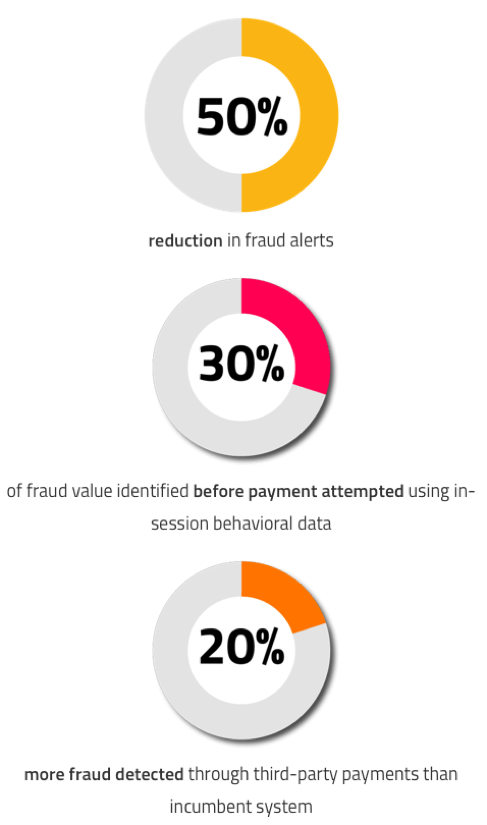

Benefits to a tier 1 UK bank after implementing Feature Space fraud detection: 50% reduction in fraud alerts, 30% of fraud identified before payment attempted, 20% more fraud detected [1].

Improved fraud detection benefits banks by increasing the detection (and cancellation) of actual fraudulent activities, that the bank often reimburses customers for. In addition, the system reduces misdiagnosed transactions that are cancelled or held up, negatively impacting customer’s user experience.

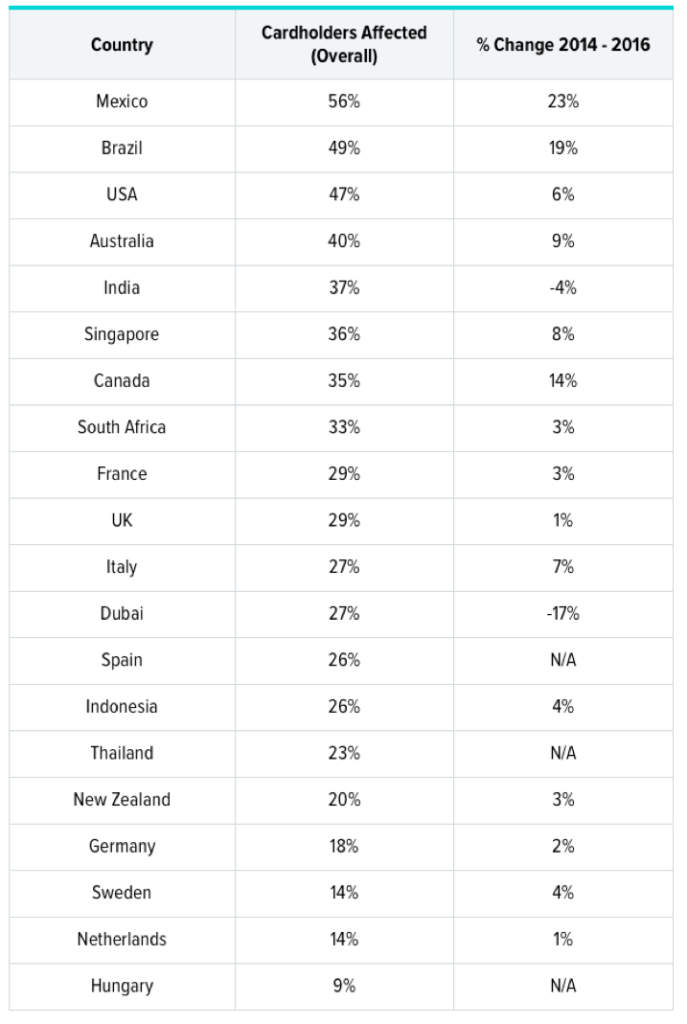

Fraud impacts many consumers in developed and developing markets – cardholders impacted by fraud (by country) [5].

How does Feature Space make money?

Feature Space operates a straight forward subscription style service with an upfront connection fee. The connection fee covers the cost of connecting the banks payment processing system to Feature Space’s fraud detection system. The system can either be connected remotely, with software routing the banks payments through Feature Space’s system in Cambridge UK, or an on-site system deployed whereby Feature Space deploys hardware at the customer’s IT offices to integrate with their systems. Once connected, customers pay an agreed upfront fee per transaction for the life of the agreement (often five years).

Growing pains

Although Feature Space can provide financial institutions with greatly improved fraud detection, potential customers need to overcome their own resistance before outsourcing fraud detection. Financial institutions resistance to change is driven by a general aversion to risk with new IT systems, data privacy & control issues, and overburdened IT departments not wanting to outsource. Furthermore, the integration of Feature Space’s system is time consuming and technically challenging due to the inherent complexities of each IT institutions IT systems.

Integrating and on boarding new customers is also a challenge for Feature Space. As the company has expanded geographically, it has encountered greater variation in its customers’ requirements for integration. These can be in the form of hardware and software integration of the IT systems, to regulatory and legal issues (such as mandatory limits on the transfer of data out of a country).

Feature Space’s rapid expansion, and high upfront cost for connecting customers, has drained cash out of the company. This cost is justified by high future earnings per transaction. New technology or economic disruption (like Covid) threaten this economic model.

Positioning for the future

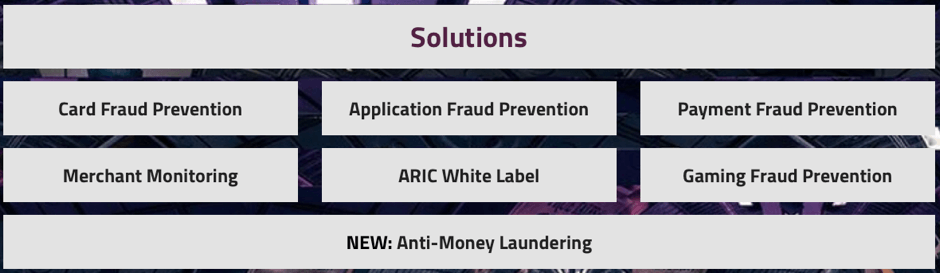

Despite these challenges, Feature Space has significant opportunities, as it can leverage its embedded systems and trusted relationships with financial institutions, with world class machine learning technology to offer customers more products and services. Already Feature Space is expanding its offering to anti-money laundering, merchant payment monitoring and gaming services [6].

Feature Space listed solutions [1].

To capitalise on this opportunity, and improve the economics of its current business model, Feature Space should focus on streamlining its integration processes. Developing highly adaptable plug and play systems to integrate on-site with customers will rapidly improve the speed and cost to connect customers. Building these products with future growth designed into the architecture will allow future products and services to be deployed rapidly and affordably.

Sources

[1] Company Website https://www.featurespace.com.

[2] The Nilson Report, Issue 1096, October 2016.

[3] The Nilson Report, Issue 1164 November 2019.

[4] Pulse via Food Marketing Institute 2012.

[5] ACI Payment Systems, 2016.

[6] Interview with Feature Space Sales Manager for Asia-Pacific.