Care.com – Family Care Marketplace

Care.com – an online market connecting families with caregivers

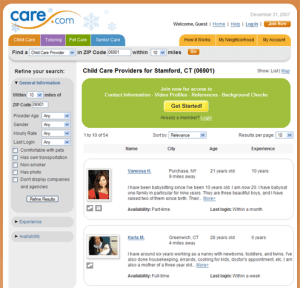

Care.com is an online marketplace aimed at making it “easier and more reliable for people to find and manage family care.” The primary business model is connecting families looking for care (9.3mm currently) with caregivers looking for employment (7.3mm). Care.com helps families address a wide spectrum of needs: child, senior, and special needs care as well as tutoring, pet care and housekeeping. On the site, families can vet and connect with caregivers in a low-cost, reliable and convenient way. Caregivers can create online personal profiles, describe their skills / experience and better market themselves.

Care.com exhibits strong indirect network effects; like many two-sided platforms, there is a virtuous cycle as caregivers are attracted to the large pool of families seeking services (and vice versa). There are direct network effects as well: the platform’s search portal includes a wide range of reviews, references and social connections which are enhanced by additional members (within your geographic area). Put simply, the larger the platform the better the company can deliver on its value proposition. The company has experienced strong growth in members (and revenue) since its founding in 2007 with 16.5 million members across 16 countries. Like other companies benefiting from network effects, scale acts as a powerful barrier to entry, and Care.com’s rapid growth has allowed it to beat its close competitors (Sittercity and Urbansitter). These network effects are particularly powerful as most of its true competitors lack any scale whatsoever (most sitters/ tutors are found on a one-off basis)…but the inherent fragmentation of the market means that the company must achieve a certain penetration within local markets to provide sufficient value for both sides.

To foster growth, Care.com offers free membership which allows families to view caregiver profiles and post a limited number of jobs. The company captures value by allowing families to upgrade to “premium” subscription membership with access to preliminary background checks, references, unlimited job postings and unlimited messages to caregivers. The pricing of this premium offering varies by city, and including 1 month ($37 per month), 3 month and annual packages ($147). As of Q2’15, ~254 thousand members are paying for Care.com, with an average monthly revenue per member (“ARPM”) of $36. It appears the company has prioritized achieving significant scale, and though it has seen rapid growth in the number of paying members (doubled vs. 2012), the ARPM has only modestly grown ($34 in 2012) and the number of paying members is a very small fraction of the total membership.

My biggest concern is the sustainability of the company’s growth. The company is not currently profitable basis and customer acquisition costs have been rapidly rising…Care.com spent $101 per new subscription (TV, search ads, etc.) in 2014, is up from $67 in 2012. A key demonstration of the power of the company’s network effects will be its ability to continue to attract users using unpaid sources. While I have not been able to find a percent breakdown, the company says “an increasing number of members have come from word-of-mouth referrals, search engine optimization, re-use, etc.)”. I am not sure why the company has not tried to better market its services with lower cost marketing channels (e.g. social media). Another big risk area is their ability to maintain a strong user base. The company says the average subscription lifetime is ~8 months, but without churn data it is hard to tell to what extent users drop off from the site…40% of the company’s matches are for full-time jobs, which would suggest there would be some natural churn in this business.

Care.com has successfully augmented its core offering to better create and capture value across both sides of its platform. To make its platform more comprehensive, the company now offers ancillary services, like “HomePay,” which is a payroll and tax product for families that employ household workers (e.g. families can make electronic payments to caregivers from their mobile device). Offerings like HomePay better entrench members and differentiate the platform from other local search services (e.g. Yelp, Craigslist). Another positive move was the acquisition of Citrus Lane, a subscription e-commerce business targeting moms (subscribers receive a monthly box of products for their children). Citrus Lane has a community of moms who share product recommendations and parenting advice. This appears to be a powerful addition, enhancing the direct network effects among its family users by attracting a more engaged use base. Finally, Care.com has utilized partnerships to grow its membership; the company has announced an integration into HomeAway’s app and an offering with Opentable/Fandango. I will be curious to see if the company can continue to find additional services and partnerships, as these will increase membership engagement and improve the lifetime value of each of its members, accelerating the virtuous cycle.

Very interesting post. This company is spot on in terms of value proposition, considering the booming demand for caregivers in Western aging societies. Although, one thing that worries me about Care.com’s operating model is about safety: the customer only has access to background check information about the caregiver if they pay a premium fee – that means that a free user of the service is exposed to bad quality service, which can be fatal when it comes to care service. I would be interested to know how they will bring more safety and security to their service, and if they encountered problems in the past related to those issues.

I agree that safety is definitely a critical risk area for Care.Com. They have a “Safety Center” on their website with a number of resources and info to help both sides of the platform address safety concerns (it includes recommendations for screening / interviewing, monitoring caregivers, avoiding scams, etc.). A quick search has shown that there have been instances of fraud / safety concerns already, but this is probably an area where the strength of their network / scale is a differentiating factor …because they capture reports of safety violations from other members they would argue the safety of their platform is a competitive advantage vis-a-vis other sites.

Does it company also make money off targeted advertisements? I bet there are plenty of companies that would love to post targeted Mom related ads on this platform, helping to increase profits. I don’t believe the ads would prove to be a hinderance if they were correctly targeted to the end consumer.

From my research it seems they’re really only making money off of the subscriptions (and some of their ancillary offerings). They do have some targeted ads but it’s a very small portion of their revenue currently – I completely agree with you that it could be very helpful to their bottom line if done in a measured way. Their average customer would certainly be a very attractive target for many advertisers (~85% of customers are females with children in the household)

Great post – particularly your assessment of both the direct and indirect network effects in play.

You hinted at “natural attrition” in your post, but I thought this was worth highlighting as a really big concern for the company. Disintermediation would seem like the company’s greatest retention issue, where high quality care givers build a sufficient book of business and no longer return to the platform. It would seem that the many strategic moves that they’ve made recently, like HomePay, are actually to increase stickiness of the system – not just value capture tools.

On the two-sided ecosystem, it appears that Care.com’s recurring revenue model is subscription based for the Care-Receiver side. They have taken the initiative to provide value in “Home Pay” that seems to be driving recurring revenue. Is this enough? I am not sure but they would be wise to experiment and find traction on other services of value to Care-Receivers. I agree that Corporate or B-B solutions need to be pursued. This can be a gateway to enormous populations that will find value in the Care-Receiver platform.

On the Care-Giver side of the platform, Data is the key. If they can build silos or populations based on specialties and expertise of Caregivers, they will have an enormous opportunity in matching Companies and Organizations with Customers, Patients and Members. Take, for example, Diabetes. If you have a Caregiver who specializes in Diabetes caregiving, you have an entire ecosystem of Companies who are trying to reach potential patients; Diabetes Prevention (Diet/Nutrition, Exercise, Research, Trials), Diabetes Treatment (Pharma, Products, Health Providers, Nutrition, etc). The Caregiver is a gateway to the Patient. They are incredibly influential. Patient outreach is increasingly challenging for many sectors. Patient Engagement, Education and Awareness are critical to Products, Pharma, Providers, Payers, Health IT and other Healthcare related sectors. Care.com has the ability to create multiple populations according to market demand.

It is my belief that Precision trumps Scale. Just look where Media is headed. Yes, Scale is important but do not discount Precision Populations. Care.com has the ability to aggregate the Data and deliver Precision Populations to a very, very valuable (and growing) Care Community.

Tim Schreier

New York, NY