Betterment: Winning in the wealth management space

Betterment: Winning in the wealth management space

Overall wealth management industry

In the last ten years, the landscape of the wealth management industry has shifted tremendously: the robots are taking over the field of personal wealth management. Robo advisors, also known as automated online advisors, are technology-based investment platforms that offer fully automated online investing. In a broader sense, the Robo advisor may also include human advisors for a price but only for services that require human assistance (e.g., taxes, retirement, or estate planning)

Broadly, today every investor has three options available as highlighted below in Figure 1. Many investors are shifting towards Robo-advisors as it helps investors to avoid tedious complex market decisions (required in Do-it-yourself model) and to avoid making payments (required in financial advisor model)

Figure 1

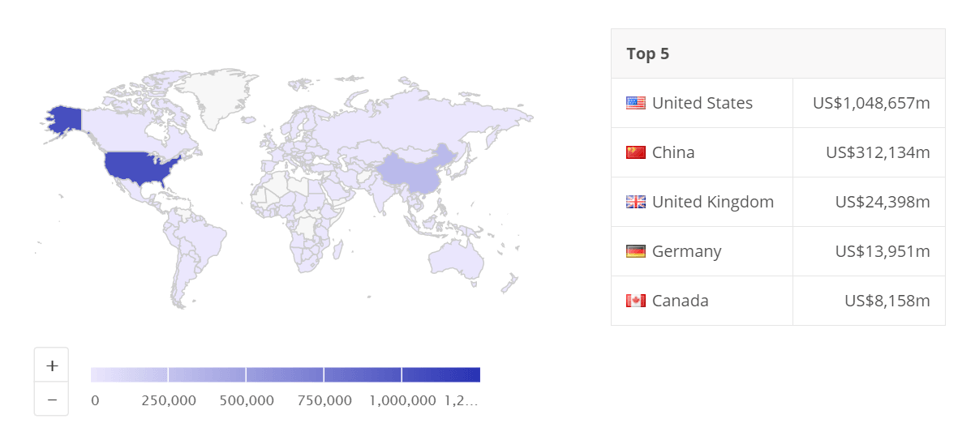

As of early 2020, the assets under management in this segment amount to US$ 1,442 billion, with a projected growth rate of 21.0% (CAGR 2020-2023). Currently, the average assets under management per user in the Robo-Advisors segment amount to US$20,452 in 2020. Globally, the US is the leading player currently accounting for 70% of total AUM currently as shown in Figure 2.

Figure 2

Evolution of the wealth management industry

Cost is falling to low-time low: Competition and technology brought down fees and increased speed to the market. In today’s low-interest-rate environment, most investors are looking for alternative low-cost investment and Robo-advisors fill that void. Secondly, portfolio-rebalancing used to be a manual process. With Robo advisors, rebalancing is done automatically without any cost.

Democratized Access to Quality Investing: Quality investment options are available to a wider potential customer base with lower costs than ever before. Low costs, low minimum balances, automatic investments lead to wide access to investment options.

Ancillary services are becoming key to retain customers: In the digital era, customers are looking for a one-stop solution for all their financial needs. Customers are looking to get investing and banking products in one platform, along with tax-saving needs across all products.

Background on the Betterment:

The Robo-advisor industry grew out of the 2008 market collapse as small investors pulled their money out of equities and sat on their cash. Betterment, along with few other players, stepped into this void and encouraged investors to invest in diversified portfolios using algorithms.

In short, Betterment is an automated, goal-based investing Robo-advisor. As of April 2019, Betterment had $16.4 billion of assets under management, making it one of the biggest Robo-advisors in the market. Betterment’s current business model includes three areas of business: retail investment, a platform for advisors, and a 401(k) for mid-market business.

The company’s personalized financial advice uses principles-based Robo-advisor technologies such as computer algorithms. Betterment also provides a hybrid model, i.e. licensed financial advisors provide over-the-phone consultations to customers who opt for additional support.

Betterment business model is designed to become leaders robo-advising space.

Betterment is a customer-centric product designed to provide low cost and diversified investing experience in one platform. Their strategy is focused on customers, product and experience.

A wide spectrum of Customers: Betterment caters to a wide spectrum of investors by offering two different products – (1) Betterment Digital with no minimum balance and charge of 0.25% of AUM annually (2) Betterment Premium provides unlimited phone access to advisors for a 0.40% fee and $100,000 account minimum. They also cater to both business and retail customers. In addition, Betterment is one of the few Robo-advisors who provide the option to invest in ESG portfolio, and thus excluding many companies with environmental/social issues – hence attracting Millenial and Gen Z customers.

Diversification of Product: In addition to providing multiple investing options, Betterment also provides a high-yielding savings account since 2019. It comes with an interest rate of 1.83%. with no minimum balance requirement. A checking account is rolling out in 2020.

Great customer experience: Betterment boasts one of the easiest accounts to set up. Betterment presents you with an asset allocation suggestion and its associated risk, which you can change by adjusting the percentage of equity versus fixed income held in the portfolio. Additionally, Betterment presents with free portfolio rebalancing.

Conclusion

With ever-changing wealth management space in the digital age, Betterment has pioneered the space by staying ahead of trends and designing customer-centric processes and products. Going forward, Betterment has to continually innovate its products to stay ahead of peers in this crowding space of wealth management.

Sources

- https://www2.deloitte.com/content/dam/Deloitte/de/Documents/financial-services/Deloitte-Robo-safe.pdf

- https://www.statista.com/outlook/337/100/robo-advisors/worldwide

- https://www.marketwatch.com/press-release/united-states-robo-advisory-market-2020-industry-demand-status-with-recent-trends-size-and-share-analysis-by-with-top-players-forecast-2019-12-04

- https://investorjunkie.com/robo-advisors/5-ways-they-changed-industry/

- https://en.wikipedia.org/wiki/Betterment_(company)

- https://www.nerdwallet.com/reviews/investing/advisors/betterment

- https://www.investopedia.com/betterment-review-4587887

- https://investorjunkie.com/reviews/betterment/

- https://investorjunkie.com/best-robo-advisors/

- https://www.investopedia.com/study-affluent-millennials-are-warming-up-to-robo-advisors-4770577

Thanks for the article! As a user of Betterment, I agree with the point about user experience and a customer-centric focus, it’s really easy to use and one of the reasons why I chose them (and their 1.84% APY of course). It’s easy to see how they are building one by one different products and services that could replace a bank in the near-term. It’s going to be difficult for larger organizations to respond to companies such as Betterment, with less overhead and no need for physical space.