Betterment on disrupting the financial service industry

Unlike the disruption that we have seen in the retail space with Amazon, transportation with Uber, and movie industry with Netlflix, there isn’t a single tech firm leading the future of financial services. Betterment hopes to play that role.

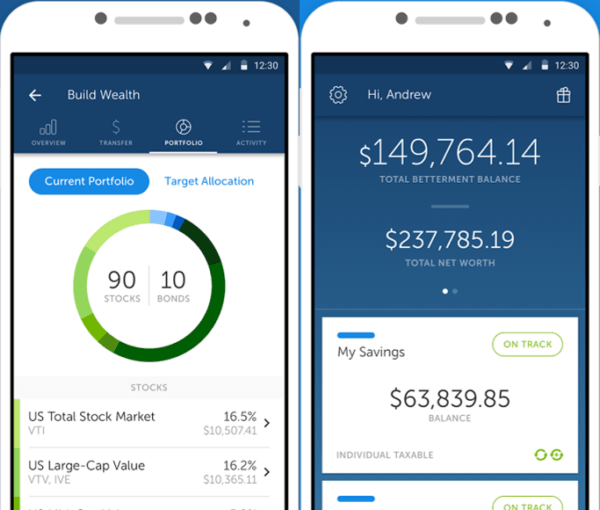

Betterment is a “robo-advisor” that provides automated and goal-based investment advice to retail investors. It offers clients the opportunity to consolidate their investment portfolio in one platform. Betterment value proposition can best be explained with self-driving cars. Just like customers with self-driving cars do not need to bother about how they get to their destination, Betterment hopes to help clients achieve their objective of reaching a financial objective. Betterment seeks to relieve the burden of retail investors managing their assets to achieve a future obligation.

Betterment is leveraging technology to offer its services. It uses an algorithm to offer investment advice to customers and helps clients consummate these transactions to build their portfolio. This offers new opportunities for individuals by raising the efficiency of completing everyday tasks. Stein, the CEO of Betterment, explains that technology has made investment advisers like Betterment essential to everyday retail investors. “The world is becoming more and more complex,” says Stein. “Now, if you’re a trader in the markets, you’re up against all kinds of algorithms on the other side, and who-knows-what-technology the big funds and investment houses have…” We believe everyone should have the best technology – every retail investor, every mom and pop, should have the best technology, helping them make the most of their money, and so we’re applying that. We believe the future is far more advised as a result, than it has been.”

Prior to Betterment, it was expensive for retail investors who didn’t have a lot of money to obtain financial advice. Betterment is therefore democratizing access to financial advice and allowing its retail clients to compete favorable in the market.

The robo-advising has a variety of benefits over traditional wealth management:

- More cost efficient for customers as traditional wealth management advisors typically charge between 1-2% on the overall account balance. Betterment has a significantly lower fee structure, charging between 0.15-0.35%.

- Leverages algorithms that limits human intervention and is highly scalable.

- Offer customers convenience as interactions/transactions can be conducted on their mobile phones

- Betterment’s business model has significant operating leverage. This results in a negligible marginal cost to serve additional customers, allowing Betterment to keep fees low as it adds more customers

Sources

https://www.betterment.com/

https://www.equities.com/news/betterment-ceo-jon-stein-on-disrupting-the-investing-industry