Amazon: The New King of Music?

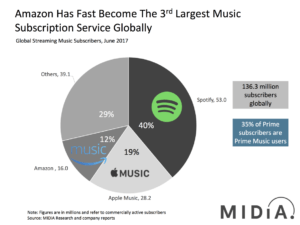

Amazon has become the third largest music subscription globally [1]. Should Apple and Spotify be scared? Yes.

Amazon Music captures value by strengthening the Prime ecosystem

Amazon Music now captured the hearts of 16M subscribers, commanding a 12% global market share of music streaming [1]. Amazon offers three tiers of music streaming services: “Prime Music” free for access to a library of 2M ad-free songs or “Music Unlimited” at either a $3.99/mo. subscription to play on the Echo only or $7.99/mo. for Prime members opening the subscription to all devices ($9.99/mo. for non-Prime members) [2].

Source: MiDIA analysis [3]

The way Amazon Music creates value to users and artists is no different from other streaming services: artists receive license fees from whenever users listen to their songs and users benefit from on-demand access (across personal devices) to millions of songs, personalized playlists, and song-discovery.

What does meaningfully differ, however, is Amazon’s enhanced ability to capture value through it’s broader Prime ecosystem:

- Prime-member 2x sales uplift: If Amazon can use Amazon Music as a spearhead to gain new customers or a benefit to build loyalty and retain customers in Prime membership, it would help boost Amazon.com retail sales: Prime members tend to spend double the mount of non-Prime customers [4].

- Echo adoption and voice shopping: Of Amazon, Apple, and Spotify, Amazon was until just a month ago with Apple’s HomePod launch the only speaker-integrated streaming service. To the extent that Amazon Music drive Echo adoption, this will further enhance the strength of the Prime ecosystem: ~32% of Echo owners use Alexa to buy through Amazon Prime [5] and spend ~$1,700 on Amazon vs. ~$1,300 for ordinary Prime members [6] – around 30% more in sales.

- Better recommendations/ads: Music tastes reveal a lot about our personalities, preferences, and daily patterns which Amazon can use to improve their recommendations to target offerings and ads.

Despite Amazon Music being a new entrant, Spotify and Apple should worry

Even though Amazon Music Unlimited (Prime Music launched in mid 2014, but had a limited library) was late to the game launching only in late 2016 [7], the competitive dynamics of music streaming platform markets enabled the service to take share.

While users wouldn’t want to subscribe to an endless number of streaming services due to subscription costs, multi-homing is high for artists and users face low switching costs to jump between services. Network effects matter to the extent that users want to have a large library, but this library can easily be negotiated with artists who would consider Amazon’s reach worthy of the time and energy to sign a royalty deal. Together, this means that there is room for more than one player in the industry.

This is why Amazon can play along:

- Unlock Prime members: Amazon already has more than 40 million Prime members in its ecosystem [1]. All Amazon has to do is to persuade these users to make the switch (e.g., through incentives such as Prime rebates).

- Echo and third-party Alexa speakers: 31 million Echo family speakers have found their way to our homes (Amazon currently demands ~70% smart speaker market share [2]), and is investing heavily to expand reach by embedding Alexa into third-party speakers, like the recent Sonos One. When users ask Alexa to play music, Amazon Music will be the default – no installation required. Spotify has no hardware ownership and Apple’s $349 price tag of the HomePod is likely to exclude many homes from getting one (vs. Echo’s $99).

- Easy sign-up: Amazon already has your credit card on file. All you have to do is press play.

So … what can Apple and Spotify do to fend off this threat?

- Exclusivity: Apple has in the past negotiated exclusive content with artists like Prince and Taylor Swift. Spotify records “Spotify Sessions” with famous bands.

- Strengthen network effects: Spotify not only provides a streaming service, but also an online community where users can create and share playlists with each other. If the community becomes strong, switching costs go up.

Sources:

[1] https://musicindustryblog.wordpress.com/2017/07/14/amazon-is-now-the-3rd-biggest-music-subscription-service/

[2] https://www.amazon.com/gp/dmusic/promotions/PrimeMusic

[3] https://musicindustryblog.wordpress.com/2017/07/14/amazon-is-now-the-3rd-biggest-music-subscription-service/

[4] https://www.cnet.com/news/amazon-raises-us-monthly-prime-subscription-18-percent/

[5] http://www.businessinsider.com/what-people-do-with-amazon-echo-chart-2017-2

[6] https://www.digitalcommerce360.com/2018/01/03/us-shoppers-echo-device-spend-significantly-more-amazon/

[7] https://www.theverge.com/2016/10/12/13244158/amazon-music-unlimited-launch-echo-availability-price

[8] https://www.voicebot.ai/2018/01/26/cirp-says-18-million-smart-speakers-sold-q4-2018-bringing-installed-base-45-million/

[9] https://insights.spotify.com

Photo credit: https://www.pcmag.com/review/348717/amazon-music-unlimited