A Storm is Coming for Blizzard Entertainment

Blizzard struggles to innovate even though it boasts a high profile lineup of gaming franchises. As the competition heats up with new entrants from Apple and Google, Blizzard is not set up to survive for long.

The Gaming Industry

The video game industry has been valued at over $120 billion and climbing with digital innovation in computing graphics and cloud based streaming solutions at the epicenter of its growth[i]. Recently Google and Apple have begun competing in the space, each vying for a piece of the pie from legacy gaming incumbents like Nintendo and Valve. However, another incumbent, Activision Blizzard, is not positioned to succeed in this increasingly competitive and rapidly changing market. As improved technology, like AR/VR, and 4K streaming solutions continue to be developed, Blizzard has become too slow and too comfortable to successfully innovate and will likely be left behind over the next few years.

Blizzard’s Successes and Downfalls

Blizzard Entertainment was founded in 1994 and has been around for over 25 years with several extremely popular flagship games like World of Warcraft (WoW), Diablo, StarCraft, and Overwatch.[ii] World of Warcraft, which is based on a flat monthly subscription pricing model, is estimated to have produced approximately $2.1 billon in revenue per year during its peak, making WoW one of the most successful video game franchises of all time.

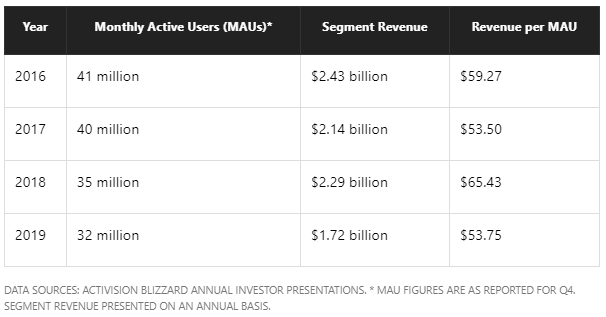

Yet, since 2002, Blizzard developed only one original game, Overwatch[iii]. Over the past two decades, Blizzard has captured value for their shareholders by harvesting their impressive but decreasing revenues from their old legacy game franchises through subscriptions or microtransactions (Exhibit 1). In 2016, Activision Blizzard employed an innovation by acquisition model by acquiring King, the famed mobile gaming company that created Candy Crush. This acquisition fits perfectly Blizzard’s model of highly addictive and worn-out games.

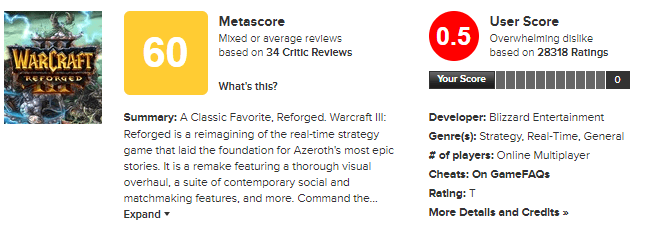

Fast forward to present day, where Blizzard’s latest game release was – you guessed it – another iteration of an old franchise favorite, Warcraft III: Reforged. Released on January 28, 2020, Reforged broke records for negative reviews from users. On Metacritic, the rotten tomatoes of video games, users gave Reforged a 0.5 out of 10 (Exhibit 2)[iv]. The poor reception of a new Warcraft iteration illustrates that not only is the loyal fan base diminishing, but also the quality of Blizzard games is now in question. Many of the poor reviews come from bugs in the game that make it almost unplayable. As a gaming veteran of over 25 years, this is detrimental to their brand perception of producing high quality game. Blizzard’s strategy of riding on the laurels of their stale digital innovations is quickly becoming irrelevant.

The Competition Raises the Bar

Blizzard should be most concerned about the innovations that their fellow gaming incumbents have been making over the years. Large players like Nintendo, Valve, Sony, and Microsoft have reacted in three different ways to recent industry trends:

- Increased user experience and flexibility (Nintendo, Sony)

- Investments in technology like 4k, AR/VR, and cloud-based streaming, etc. (Sony, Valve, Microsoft)

- Manage community for third-party marketplace for indie games with cult-like followings (Steam, Nintendo)

Another situation that Blizzard has yet to react to, is the entrance of Apple and Google in the past year. Industry trends are indicating that there may be a huge disruption in gaming for the future – a streaming subscription model (i.e. Netflix for games). In late 2019, Apple officially launched Apple Arcade.[v] Google quickly followed suit with an announcement for Google Stadia in 2020[vi].

The Future of Gaming and Blizzard

As hardware is always a limitation for playing high graphic games, companies like Apple and Google’s Stadia are banking on new type of gaming experience using subscription based streaming platforms. Even the incumbents are making investments in immersive user experiences through flexible game play and AR/VR capabilities. Unfortunately, Blizzard’s franchise fatigue is getting old fast and with even negative backlash over games like Reforged that should have been a home run. Blizzard should be looking for big moves if it wants to continue in this competitive digital landscape, possibly through acquisition of an innovative gaming company with fresh ideas. Should Blizzard continue to stagnate, it is possible that Tencent, the largest video game publisher in the world, might increase its 5% stake in the company.

[i] Webb, Kevin. “The $120 billion gaming industry is going through more change than it ever has before, and everyone is trying to cash in”. Retrieved from: https://www.businessinsider.com/video-game-industry-120-billion-future-innovation-2019-9

[ii] Blizzard Company Website. Retrieved from: https://www.blizzard.com/en-us/company/about/profile.html

[iii] Planes, Alex. “Is Activision Blizzard Running Out of Ideas?” Retrieved from: https://www.fool.com/investing/2020/02/10/is-activision-blizzard-running-out-of-ideas.aspx

[iv] Metacritic review for Warcraft III: Reforged. Retrieved from: https://www.metacritic.com/game/pc/warcraft-iii-reforged

[v] Leswig, Kif. “Apple releases its gaming subscription service, Apple Arcade”. Retrieved from: https://www.cnbc.com/2019/09/19/apple-launches-arcade-gaming-service.html

[vi] Google Store Website. Retrieved from: https://store.google.com/us/product/stadia

Very interesting article!

Blizzard seems to be a great example of a company that has rested on its laurels for too long. As a teenager, I used to play WoW and it was a fantastic game at the time. But customers grow up and games become outdated – you need to innovate with original titles to attract the next generation of gamers.

I do wonder what the industry structure will look like in 5-10 years. Will Apple and Google be able to successfully move into content creation themselves? If they did, this would be almost a exact parallel to Netflix – who first started by distributing content from other studios, before moving into content creation. To do that, they would need to access the top creative talent – which Google already seems to be doing in Montreal, a gaming talent hotspot (see article below). My opinion is Apple and Google will succeed, but it will take far longer – given most blockbuster original games take 4+ years to develop. Either way, the future doesn’t look bright for Blizzard.

Reference Article:

https://toronto.citynews.ca/2019/12/08/google-taps-into-montreals-rich-gaming-industry-for-stadia-content/

It’s interesting that most of the competitors you point out are developing some sort of hardware for playing games. This strikes me as somewhat contrary to the Mattress Firm story (https://d3.harvard.edu/platform-digit/submission/mattress-firm-losing-by-betting-on-bricks-in-the-age-of-clicks/?section=2917&sort=post_date-new) in which creating physical platforms worked worse than creating a digital product or platform.

Do you think that creating their own video game online store, or physical game-playing device could help them stay afloat while they improve the quality of their games?

Very interesting article! As a WoW player myself I’m really sad to see the directions they took with different games and the lack of understanding of their users and fans. It seems that the acquisition of Blizzard by Activision changed their focus and innovation process.

The Warcraft 3: Reforged release is surprising, such an easy way to attract old customers and they made so many mistakes. I share Colm Farrell concern on how the industry is going to look in a few years, and if this type of game studio is now just part of a niche segment for old gamers looking for some nostalgic memories.

Fascinating look at Blizzard vs. incumbents and new players! I wonder what it is about Blizzard that makes it incapable of competing over such a long period of many years against these new entrants — infrastructure, talent, architecture? What makes it so difficult for Blizzard to evolve vs. some of the other digital players (who arguably are old and have less experience), and what are some steps that it could take to become competitive again? Very interesting point about Tencent at the end — what types of capabilities or strategies would it deploy that would create value for Blizzard?