Lending Club: Creating the Marketplace Lending Business Model

Can Lending Club disrupt the personal lending marketplace?

Marketplace lending, also commonly referred to as peer-to-peer (P2P) lending, has rapidly gained market share over the last decade. Companies such as Lending Club (NYSE: LC) create two-sided platforms in which borrowers and lenders can be matched. In 2017 marketplace lenders accounted for 36.2% of personal loan originations in the United States, up from less than 1% in 2010, and research firms predict continued growth of 20% per year over the coming five years. [1],[2]

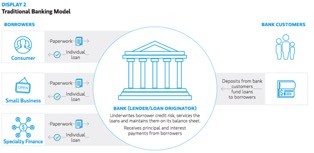

Exhibit 1 outlines the main differences between marketplace lenders and traditional lenders. Broadly, marketplace lenders create platforms through which investors can directly screen borrowers, invest capital, and achieve returns. Traditional lenders serve as intermediaries that conduct many of these functions for investors – in exchange, traditional lenders receive a larger spread (between investor returns, denominated by the interest rate on deposits, and the interest rate paid by borrowers). Traditional lenders also absorb any payments risk.

Exhibit 2: Marketplace vs. traditional lending models[3]

Marketplace lenders’ architecture offers two main innovations over traditional lenders: a superior credit scoring model and a lower cost of service.

Credit scoring model: Traditional lenders outsource the credit scoring process to third parties such as the Fair Isaac Corporation, which produces commonly-used FICO scores. Marketplace lenders typically keep credit scoring in-house, and incorporate more data (e.g., transaction / purchase data) into credit scoring decisions. This interdependent architecture (as opposed to traditional lenders’ modular architecture) allows marketplace lenders to understand borrower risk better than traditional lenders and underwrite loans to a wider range of consumers.

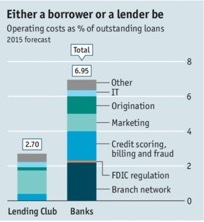

Lower cost to serve: As shown in Exhibit 2, marketplace lenders have lower costs of loan service, mainly driven by the elimination of branch banking costs. This allows Lending Club to better serve unprofitable banking customers.

Exhibit 2: Marketplace lenders’ cost structure[4]

Marketplace lenders such as Lending Club create value in several ways. First, they offer unsecured personal loans, which almost all traditional banks do not offer. Second, they reduce transaction costs for both borrowers and lenders, leading investors to achieve higher returns while borrowers receive lower interest rates than could be achieved through the traditional banking system.

Lending Club captures this value through a fee-based model. Lending Club charges both origination fees and ongoing loan service fees. However, the majority of the company’s revenue comes from loan origination. This revenue model matches with the company’s incentives; by providing additional value to borrowers and lenders, Lending Club maximizes the number of transactions happening on its platform — and thus better utilizes its large IT, platform, and data science investments. Two-sided marketplace business models, such as Uber, Airbnb, and Lending Club display significant network effects that lead towards “winner-take-most” market outcomes. Thus, I feel this value capture model is appropriate.

Marketplace lending represents a new, disruptive model of lending that may soon come to dominate several segments of the U.S. lending market. Lending Club has established a lower-cost network of lenders and borrowers than traditional lenders. Its innovative profit formula prioritizes people overserved or not served by banks: repeat borrowers of small, personal loans. Fueled by this asymmetric motivation, Lending Club continues to move upstream to more profitable segments and disrupt the personal loan industry.

[1] Transunion Q2 2018 Industry Insights Report. https://www.transunion.com/blog/consumer-credit-origination-balance-delinquency-trends-q2-2018

[2] IBISWorld P2P Lending Platforms in the U.S Report. https://clients1-ibisworld-com.ezp-prod1.hul.harvard.edu/reports/us/industry/default.aspx?entid=4736

[3] “An Introduction to Alternative Lending.” Morgan Stanley Investment Research, July 2018. https://www.morganstanley.com/im/publication/insights/investment-insights/ii_anintroductiontoalternativelending.pdf

[4] “Peer Pressure: Lending Club.” The Economist, December 2014. https://www.economist.com/finance-and-economics/2014/12/11/peer-pressure

Extremely interesting article and a potential threat to some of the U.S’s largest banks. My main thoughts on this:

1. I wonder whether Lending Club will expand beyond personal loans. As you mention, banks stay away from these loans (either because they are unprofitable or they have poor data) and instead prioritize mortgages, credit cards, and car loans. I am curious to see how effective this model translates to new lending products. I think it will ultimately come to Lending Club’s ability to develop new credit risk models as they have already done so in personal loans.

2. I also wonder the competitive response of large banks. I would think banks are increasingly improving their algorithms beyond a simple FICO score, but am curious how the credit models between banks and Lending Club compare. Right now, most unsecured lending by banks is via highly profitable credit cards, giving Banks a strong incentive to keep the status quo. It almost seems like a case of disruptive innovation, in which Lending Club is sneaking up on bank’s highly profitable unsecured lending (credit cards) by offering customers a better rate, and that by the time Banks react it will be to late to recover their market share lost to Lending Club.

3. While personal loans are funded through investors lending on Lending Club, I can only imagine Banks have a far superior cost of funding advantage, mainly because of their access to basically free deposits. I wonder whether Lending Club is devising a strategy to overcome this inherent disadvantage.