Toku: Pioneering the Future of Fintech with AI-Driven Recurring Payments

Discover how Toku is reshaping the fintech world with its AI-powered approach to streamline and secure recurring payments, boosting customer experience and operational efficiency.

Toku’s Innovative Business Model

Toku‘s business model is centered around providing a streamlined and secure solution for B2C recurring payments. Their platform caters to a variety of consumer-facing industries, where regular payments are a norm, such as utilities, insurance, and subscription-based services. The essence of their model lies in simplifying these regular transactions for both the businesses and their end consumers.

Translation: Designed for collecting recurring payments – Education, highways, insurance, communications, financial companies, real state, memberships, basic services.

The way Toku operates is by integrating advanced AI technology into their payment system. This technology optimizes the payment process, from how customers are contacted for payments to how transactions are processed. By using AI, Toku can intelligently determine the most effective communication methods, whether it be through email, SMS, or other digital channels, ensuring that the payment collection is both efficient and customer-friendly.

Toku was the first Chilean women-founded company to be part of Y Combinator!

Click here to know more

Toku’s Pioneering Use of Artificial Intelligence

Central to Toku’s innovative approach is its strategic application of artificial intelligence, which plays a dual role in optimizing customer interactions. Firstly, the AI algorithms are adept at selecting the most suitable communication channel for each customer, whether it be email, SMS, or other digital platforms, ensuring the approach is tailored to individual preferences and behaviors.

Secondly, AI is employed to interact directly with customers. Initially, Toku’s AI was closely monitored, with human intervention planned if there was over a 20% chance of the AI providing an incorrect response. However, as the AI system has evolved and become more sophisticated, the need for human backup has significantly diminished. Now, instances of direct human intervention are rare, showcasing the AI’s improved accuracy and reliability. This progression highlights Toku’s commitment to enhancing every transaction, making it smooth, secure, and user-friendly while maintaining a high standard of customer service.

Creating Value with AI Technology

Toku’s deployment of AI is instrumental in creating significant value in two primary domains: customer experience and operational efficiency.

Enhancing Customer Experience with AI: Toku’s AI technology significantly elevates the customer experience in financial transactions. By integrating diverse payment methods into a cohesive platform, Toku ensures seamless and user-friendly transactions. This ease of use is critical for fostering customer trust and loyalty. The traditionally complex financial transaction process is transformed into a streamlined and enjoyable experience. Additionally, Toku’s AI-driven communication systems offer personalized interactions, adapting not only the content but also the channel and timing of communications to align with customer preferences, further enhancing user satisfaction.

Optimizing Operational Efficiency: Optimizing Operational Efficiency: Toku’s AI technology significantly streamlines operational processes. The AI’s capacity to analyze extensive data sets enables it to predict the most effective communication and transaction methods. Crucially, this optimized efficiency extends beyond customer communication, encompassing the entire payment processing cycle. The AI’s ability to accurately forecast successful transaction methods diminishes the occurrence of failed transactions, thus enhancing overall revenue collection. Importantly, Toku’s clients are seeing improved payment rates without the need for extensive call centers or traditional, labor-intensive collection methods. This evolution in operational strategy represents a shift towards more technologically driven, cost-effective, and customer-friendly approaches in financial transaction management.

Value Capture at Toku

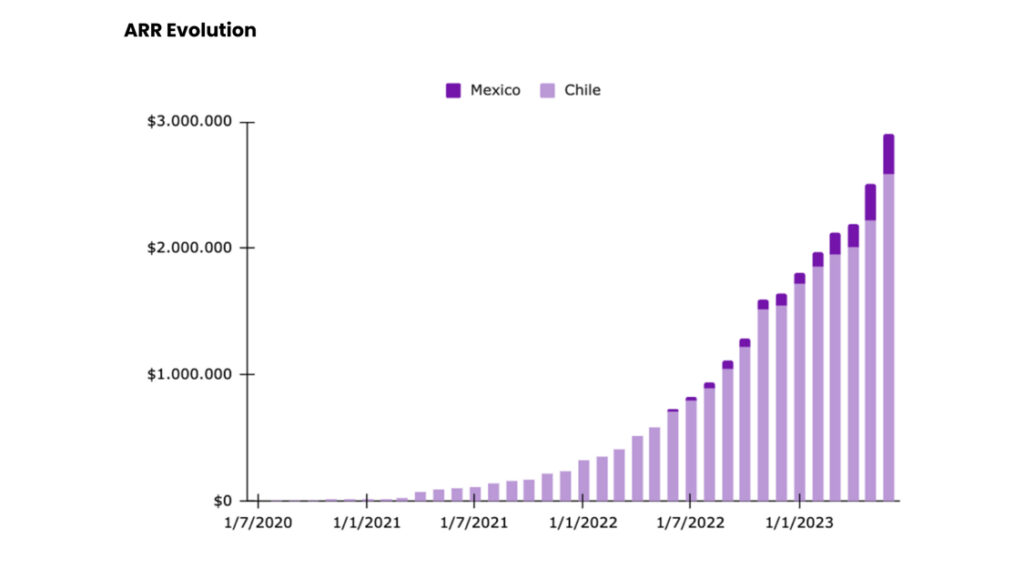

Toku’s innovative use of AI not only drives value creation but also plays a pivotal role in capturing that value. One of the key aspects of value capture is reflected in their ARR (Annual Recurring Revenue) growth. By streamlining recurring payments and enhancing customer experiences, Toku has steadily increased its ARR over time. This consistent revenue stream allows for sustainable business growth and investment in further innovation, solidifying Toku’s position as a leader in the fintech sector. Below, you can find the evolution of Toku’s ARR, showcasing their ability to capture the value they create.

Source: Toku’s Investor Update – Q2 2023

Navigating the Challenges of AI

Toku’s journey in leveraging AI for fintech solutions, while pioneering, is facing several challenges:

Data security is of utmost importance in the fintech sector, where transactions involve sensitive personal information. With the ever-evolving landscape of cyber threats, Toku recognizes the necessity of a proactive and dynamic approach to security. To address this challenge effectively, Toku has taken steps to establish privacy agreements in each one of the countries where they operate. They have sought legal advice to ensure compliance, demonstrating their commitment to safeguarding customer data and maintaining trust in their services.

Equally critical is the task of maintaining regulatory compliance. The financial industry is governed by a complex web of regulations that are not static but constantly evolving. This is especially challenging for a company that is expanding into different countries in LATAM. Toku takes this regulatory landscape very seriously, not just for legal adherence but also for maintaining customer trust and institutional credibility.

As Toku’s operations expand and scale, ethical dilemmas regarding AI use emerge. Transparency in AI processes becomes a pressing challenge, along with the need to mitigate bias in AI algorithms. Navigating these complexities is essential for Toku to sustain its growth and innovation, all while upholding high standards in the rapidly evolving fintech landscape.

Effectively managing these multifaceted challenges is key to Toku’s continued success. It involves a balance of technological advancement, ethical consideration, and agile adaptation to regulatory changes. As Toku continues on its path of innovation, its ability to navigate these complexities will be a significant determinant of its future in the fintech landscape.

Next Steps for Toku

In conclusion, Toku stands as a pioneering force in the fintech sector, harnessing the power of AI to streamline financial transactions and enhance customer experiences. As they navigate challenges related to data security, regulatory compliance, and the evolving landscape of AI, Toku remains at the forefront of innovation. With a dynamic approach, Toku is poised to continue its growth trajectory while delivering exceptional value to both businesses and consumers in the fintech realm.

Nice Post Carmen! A key point on Fintech based models is the Cybersecurity measures in place other privacy to protect the data.It would be interesting to see what measures they have in place for this.

Interesting post! I can see how AI is powering the finance industry. For Toku, it makes communication more targeted and saves manual time. I also witnessed how finance companies are adopting machine learning algorithms for effective fraud detection and transaction success prediction. Expect to see more sophisticated AI employment in the finance industry in the next few years!