Bagging Up Value at Instacart

In 10 years Instacart has grown from a scrappy startup to a household name with a $13B valuation. Is their business model sustainable at scale though?

What is Instacart?

Founded in 2012 by former Amazon engineer Apoorva Mehta, Instacart has grown to become one of the biggest grocery delivery companies in the country. The Instacart platform serves as a marketplace, connecting over 750 grocers and retailers, 600,000 gig-workers, and 9.6M+ consumers1. While initially starting out in San Francisco, Instacart has spread across the US and Canada. Today, 85% of Americans and 90% of Canadians can use Instacart to deliver groceries to their home in under an hour2.

How does Instacart create and capture value?

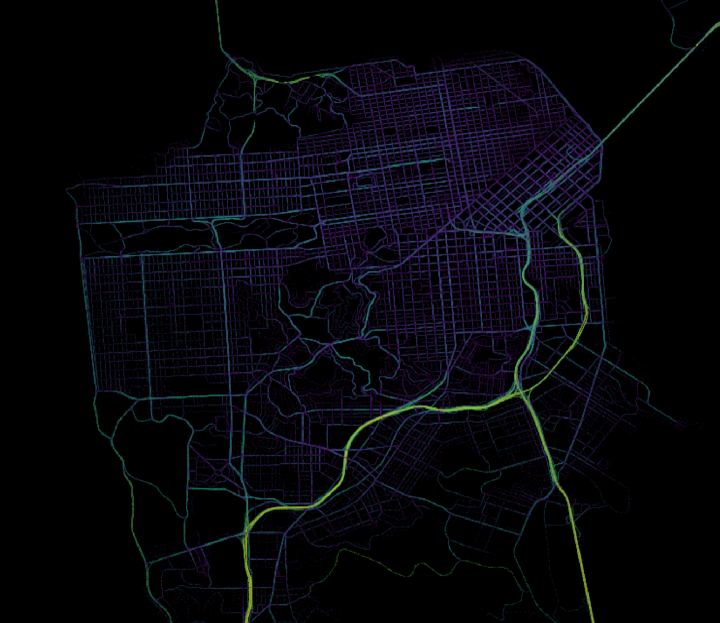

Instacart creates value in three ways: They (1) aggregate nearby grocer inventory, (2) provide convenient home delivery to customers, and (3) allow traditional grocers without e-commerce capabilities to reach consumers online. On one side of Instacart’s platform are Instacart’s grocer and retail partners, on the second side are Instacart’s personal shopper and driver network, and on the third side are customers. On the grocer side, partner inventory is loaded onto Instacart’s platform and kept up to date through a variety of APIs and 3rd party aggregators3. On the consumer side, customers open the Instacart app and see the inventory of all nearby grocers that have partnered with Instacart. Customers finalize their order with the grocer through the platform and set a pick-up time, putting in motion a complex series of logistics operations3. The customer’s order is sent to Instacart’s shopper network, where a nearby shopper opens the platform and can choose to accept the order. Once accepted, they are responsible for quickly getting to the store, navigating it, and tracking down all the items on the customer’s list (or finding a suitable replacement). Once the items have been selected and bagged, the in-store shopper delivers the groceries to the customer. Routing drivers from grocers to customers is a complicated process. Instacart uses machine learning models to find the fastest route to the customer taking into account past trips to that area/location, how many other customer orders can be batched together for delivery, time of day, traffic conditions, weather conditions, etc4.

All of this allows customers to do their grocery shopping from the comfort of their couches. Instacart also benefits from network effects on its platform. The more customers are on the platform, the more enticing it is for grocers to partner with Instacart. Similarly for consumers, the more grocers there are on the app in their area, the more likely they are to use the app. Instacart captures the value created through a variety of fees: Instacart charges a 5% service fee on each order. Additionally, customers can either pay $99/yr for free delivery or pay $3.99 for each same-day delivery over $35.

Is Instacart scalable and sustainable?

On the surface, the answer to this would appear to be yes. In 10 years, Instacart has grown from delivering in a single city to more than 5500 across the US and Canada. Like many high-growth, VC-backed start-ups, Instacart focused on scaling fast, dominating the market, and figuring out the economics later. From a strategy perspective, this makes a lot of sense for three reasons: (1) At the early stages, there’s very little that differentiates Instacart from any other grocery delivery services, (2) switching costs between delivery platforms are low for customers, and (3) Getting large will allow Instacart to leverage economies of scale to bring down costs and bargain on prices with grocer partners. Instacart successfully scaled quickly, but it’s highly uncertain as to if they’ll figure out their economics with their current business model. The core of Instacart’s problem is the same problem that prevented grocers from pursuing delivery outside of a few premium offerings: the high costs to physically pick and deliver customers’ items.

Instacart does not publish details of its financials. However, they only became cash flow positive for the first time in 2020, while buoyed by the pandemic and stay-at-home orders5. With the pandemic boom fading and their 40% valuation slash in 2022, it is once again uncertain as to if Instacart will find a way to make their current business model profitable. One pivot Instacart is considering is leveraging the vast amounts of customer data they collect to become more of an advertising and analytics platform for grocers5. However, grocers are becoming increasingly wary of Instacart’s scale and the risks of outsourcing all of their e-commerce operations and customer data to Instacart. While grocers previously fled to Instacart following Amazon’s acquisition of Whole Foods, several major grocers have now started to launch their own e-commerce offerings such as Walmart+ and Shipt (acquired by Target). Instacart is an innovative platform, but its future and sustainability at scale are far from certain.

References:

- Instacart revenue and Usage Statistics (2022). Business of Apps. (2022, September 6). Retrieved November 2, 2022, from https://www.businessofapps.com/data/instacart-statistics/

- Hammersley, H. (2022, June 6). Instacart’s venture into food delivery: How will it affect delivery drivers’ strategy? Gridwise. Retrieved November 2, 2022, from https://gridwise.io/blog/rideshare/instacarts-venture-into-food-delivery/#:~:text=Instacart%20is%20still%20the%20%231,access%20to%20the%20Instacart%20program.

- Flickerbox. (2021, August 18). The story behind an Instacart Order, part 1: Building a Digital Catalog. Instacart Corporate. Retrieved November 2, 2022, from https://www.instacart.com/company/how-its-made/the-story-behind-an-instacart-order-part-1-building-a-digital-catalog/

- Space, time and groceries – tech at Instacart. (n.d.). Retrieved November 2, 2022, from https://tech.instacart.com/space-time-and-groceries-a315925acf3a

- Browning, K., & Griffith, E. (2022, April 29). Instacart searches for a direction as its pandemic Boom fades. The New York Times. Retrieved November 2, 2022, from https://www.nytimes.com/2022/04/29/technology/instacart-valuation-pandemic.html

Thank you for sharing!

We have a very similar platform in Chile called Cornershop, and it works AMAZING.

When we arrived at the US I was so excited to use Instacart and have the same amazing experience as back home. Sadly most times I use it to buy groceries almost half of what I order is not in stock when the app says it is. I’ve been analyzing the reason and maybe it’s because Instacart’s suppliers consist on some small-ish stores that maybe don’t update their inventory as quicky as a Walmart or Wallgreens might.

I think their major challenge is stock and for shoppers to keep good communication with the end customer when stockouts happen.

I totally agree with you, I think this is a sustainable business, but it leverages relationships to a very high level, and since it’s not very asset intensive they might face competition in the future if they don’t keep a tight and efficient value chain.

This was great!

Thank you

Interesting post! The chart is really helpful and illustrative. I’m curious about the sustainability and scalability of Instacart – it seems that the capabilities required by Instacart and Uber Eats are pretty similar, do you see a potential competition or collaboration between the two? How can Instacart differentiate (in addition to scaling to benefit from network effect?)