Platform Scalability & Sustainability at Venmo

Venmo is the person-to-person money transfer app of choice for Millennials in the U.S. due to its scalability and marketing in the 2010’s, but it’s sustainability is under threat with new entrants and Gen-Z coming of age.

Company

Venmo is a free mobile app that enables users to make person-to-person money transfers for shared expenses (e.g. splitting dinner), services rendered (e.g. helping a friend move), and goods sold (e.g. businesses selling products). The app is only available in the United States and has over 70 million annual users including 2 million businesses who accept Venmo.

Using Venmo

Venmo setup requires users to connect a bank account which is used to fund their balance and will be debited to execute transactions that exceed their balance. An example use case is a group of five friends going to dinner, wanting to split the bill, but the restaurant only being able to split it three ways. One person can pay the bill and send Venmo requests, noting that it is for dinner. The attendees receive the request and complete it. The requestor has funds added to their balance and can keep the balance in Venmo or transfer to their bank.

Value Creation

Venmo creates value through three features: secure person-to-person money transfers via mobile devices, large network of users able to receive transfers regardless of their bank, and a newsfeed feature offering transaction documentation and visibility of friends’ payments.

Secure Money Transfers: Venmo is not a bank; it is regulated as a money service business. Venmo works with a bank partner to hold all funds in users’ accounts. Venmo offers immediate Venmo balance transfers between users via a virtual ledger. The ability to transfer money between users replaces check writing and cash payments. The value of offering these transfers via a mobile app is that they can be completed remotely and without the inconvenience of carrying a checkbook or chase.

User Network: With over 70 million users, Venmo’s network is a major value creator. If you are out with a group, especially Millennials, it is likely many use Venmo. You can search users based on their name, phone number, or email address. The large user base offers network effects and increases the convenience offered. Additionally, if a person is not on the app, you can send them money, and they will receive an invite to join and accept the funds.

Social Newsfeed: The app offers visibility into who is transacting and what they are paying for. This visibility creates value by encouraging collaborative purchasing and applying pressure friend who never pay you back on time.

Value Capture

Venmo captures value by receiving interest from its bank partner on balances held in users’ accounts, from interchange fees charged to businesses, and from fees for premium features like using a credit card to fund your balance or expediting withdrawals (which usually take 2-3 days).

Scalability

Venmo’s scalability is high. The app is free to use, only premium features charge fees. Furthermore, the app encourages adoption once one member of a community becomes a user. The ability to send money to non-users, have them receive an invite to join, and unlock the funds creates incentive for sign up. The primary barriers to scalability are non-U.S. status (the app does not allow users to transact with people in other countries) and the requirement of connecting a bank to fund the account (81% of Americans have bank accounts).

Sustainability

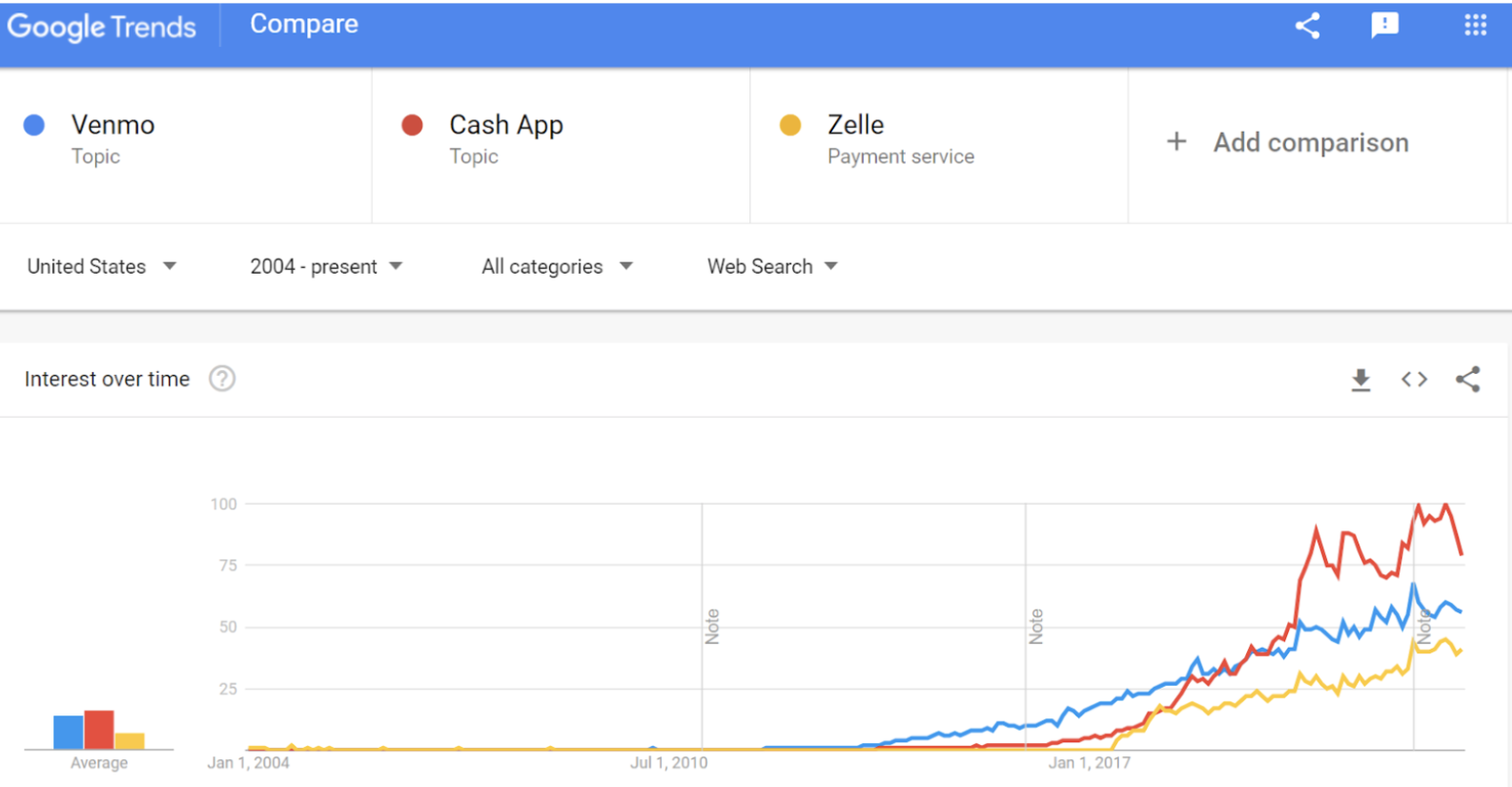

Venmo’s sustainability is dependent on the power of its network effects, not its functionality. There are low barriers to entry for functionality. Several competitors have replicated the money transfer system (i.e. CashApp and Zelle) and achieving money service business regulatory status is straightforward. Venmo’s network effects come from the fact that the more people in a social group have Venmo, instead of competitors, the more likely the app will gain more adoption. We can best view Venmo’s network effects by its penetration into different generations. Venmo is the payment app of choice for Millennials based on marketing investments from the 2010’s. Gen-Z poses a risk to Venmo’s sustainability, as they prefer CashApp based on current trends.

If Venmo is unable to penetrate Gen-Z, they are unlikely to sustain the network effects needed to maintain market share. CashApp offers an especially strong threat, as it has lowered the user age requirement to 13 (Venmo’s is 18) in an attempt to gain market share. Venmo needs to invest in acquiring Gen-Z customers to protect its sustainability. Outside of that threat, the threat of disintermediation is low, as a return to the inconvenience of cash and checks would be the only possible disintermediator.

Thank you for this insightful post, Elizabeth! I largely agree with your points around value creation; however, I think the social newsfeed value creation lever can have a few drawbacks. For one, users can set their transactions to “private” or “friends only”, which negates this value-add feature for the platform. I was also told by a vendor that hackers take advantage of the social newsfeed to target individuals or small businesses (I switched my transactions to private after that). I also question the actual value-add to seeing some of my connections pay rent or pay someone for a drink (I find this somewhat creepy and invasive). In regards to Venmo’s sustainability, I agree with you in that it could be displaced by Zelle and Cash App (my mom and all of her friends use Cash App for reference). Zelle also has a huge advantage through its direct banking partnerships.

Venmo’s sustainability is a really interesting question. When it first launched, it seemed like such an innovative service and seemed to catch on like wildfire. But you’re totally right– there’s ultimately not that much that differentiates it from other apps, from a functional perspective at least. And I don’t know that I’ve seen it innovate much over the last few years. I wonder what their internal vision of future growth looks like. Is it new functionality? Is it more partnerships with businesses? Is it penetrating underbanked communities? Really interesting to consider! Thanks for sharing.

Thanks for the very interesting post, Elizabeth! I think it’s relevant to analyze Venmo in the context of its ownership by PayPal, which acquired Venmo in 2012. Could Venmo be a “loss-leader” to on-board clients into the broader PayPal ecosystem, where the company is actually able to generate a profit from them? Or is PayPal waiting for the right moment to fully integrate Venmo into is broader service offering, brand and ecosystem?

Thank you for this post, Elizabeth! it’s been interesting to read it and find out more about the app I absolutely had to download to be socially accepted here :)) In terms of threat to users and therefore threat to scalability (especially internationally, but also locally within the US), I think Revolut represents a major one: they have a very strong position in Europe, they entered the US as well, and while it allows for easy transfers between people (very similar to Venmo), it also has additional features, such as stock & crypto investing, breakdown of expenses, currency exchange, etc. Would be interesting to see if Revolut eats into Venmo’s market share, or will pose a threat for other fintech apps.

Thanks for the post, Elizabeth! As a millennial, Venmo is basically synonymous with peer-to-peer money transfers so I had never doubted its sustainability until now! The two apps are also owned by giants in the fintech industry (Square owning CashApp and PayPal owning Venmo) so it’d be fascinating to see how each player tries to leverage its existing customer base to bolster their respective app’s ecosystems and attempt to build competitive moats (via network effects) for an easily replicable service offering that cannot be differentiated based on functionality.

Thanks for the post!

Venmo is indispensable in the US. Even though the core functionalities are similar to PayPal, Venmo offers much better UX. Its social component allows for viral growth(network effects) and the many functionalites make it a powerful tool. All being said, it is still not clear to me why PayPal has not fully integrated with Venmo and continues to compete with it in some markets.