Blue River Technology: The Field of Machine Learning

Blue River Technology is bringing machine learning to the field. Their "See & Spray" technology is able to distinguish between wanted crops and unwanted pests to apply only pesticide where it is needed most, saving farmers money, improving yields, and helping the environment all at the same time.

It seems like everywhere we look machine learning and AI are becoming critical parts of companies’ strategic growth plans. From self-driving cars to the smartest advertising consumers have ever seen, machine learning seems to be everywhere including places where you’d maybe least expect it – agriculture.

John Deere acquired Blue River Technology in 2017 for $305M, a significant premium over their most recent previous post-money valuation of $87M[1]. Blue River Technology is using machine learning to build more intelligent on farm machinery to help farmers make data driven decisions in the field, improve their profitability, and respond to changing environmental and consumer trends. Their first product, the “See & Spray” technology, uses machine learning to more precisely apply pesticides to a field by using sensors, including cameras, to identify pests and target pesticides only to the areas that need it[2].

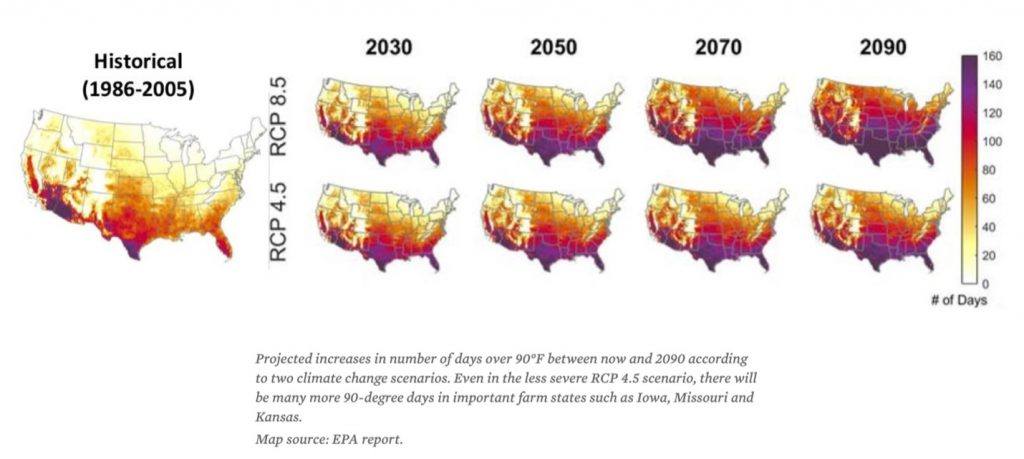

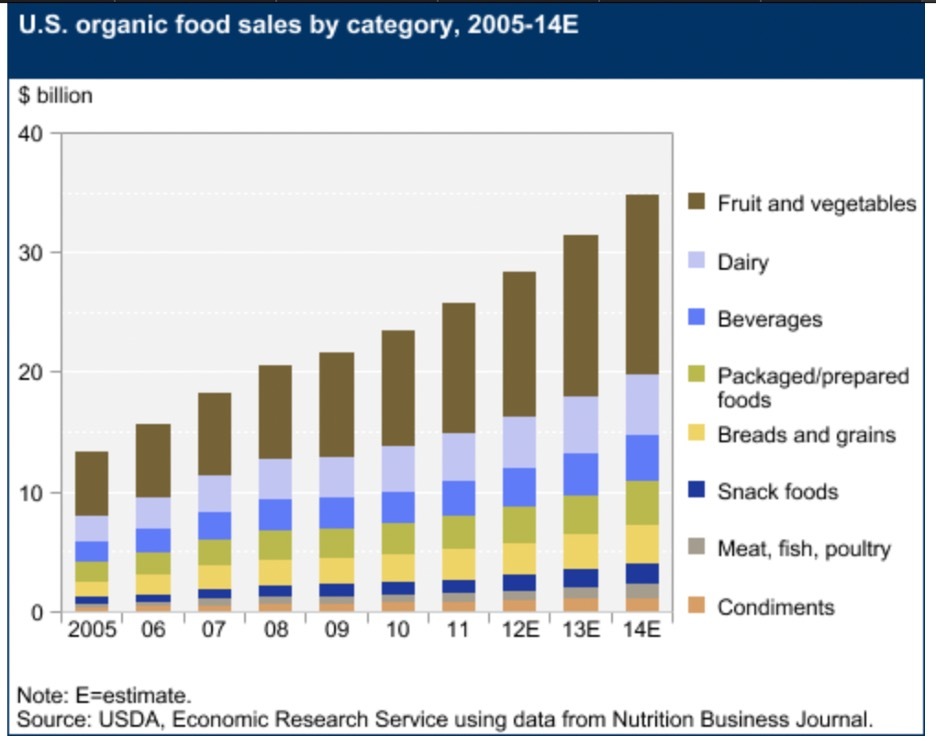

The agriculture industry is changing before our eyes as growers and manufacturers alike face unparalleled challenges. First and foremost, our population is growing, and arable land is shrinking[3]. Climate change threatens this industry as precipitation patterns change, temperatures rise, and new pests and pathogens take root in the ecosystem[4]. Further, as consumers care more about the environment and their own health, they are putting pressure on companies to produce more organic food, use less pesticides and reduce their carbon footprint[5]. And finally, with declining crop prices and increasing costs of inputs like seeds and pesticides, farmers are struggling to hold on to profitability in an already low margin industry[6].

Exhibit 1: Average rising temperatures in US

Exhibit 2: Rise of organic food sales

Exhibit 3: Forecasted grower cash income[7]

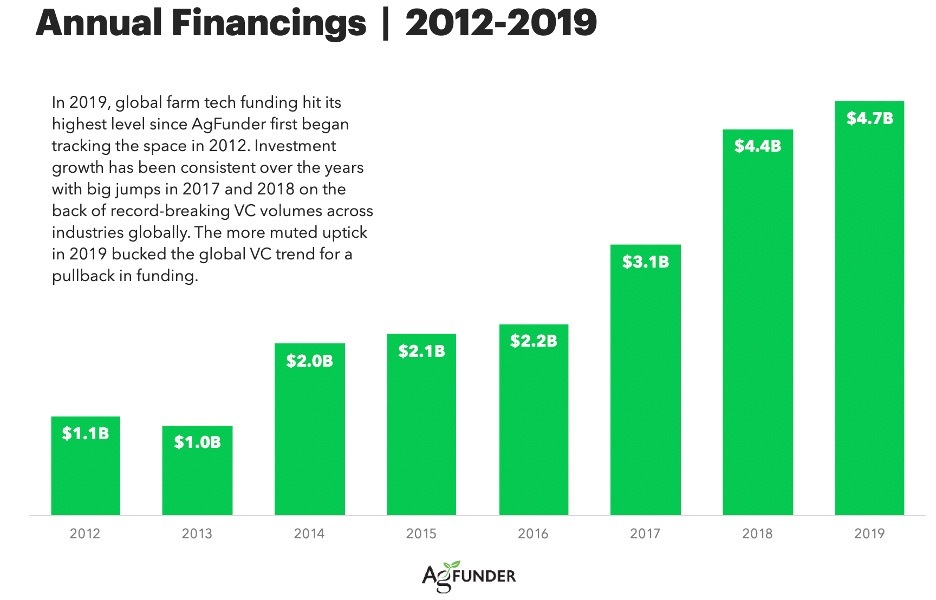

To respond to these changing trends and the pressures faced by the agriculture industry, investments in agriculture technology (“ag tech”) has risen substantially. Investments in ag tech have grown at ~6.8% CAGR, with over $4.7B invested in 2019, as investors realize the opportunity to be gained in this field ripe for disruption[8].

Exhibit 4: Growth of ag tech investments

John’s Deere’s acquisition of Blue River was a direct response to this changing landscape. The opportunity that Blue River presents is obvious – if growers can run their operations more efficiently by using fewer inputs and increasing yields, not only will they improve their profitability but as a society we will be better able to respond to the growing food security crisis. Further, more efficient application of inputs such as pesticides or water will help reduce the environmental strain that we are putting on a climate in crisis. As John Deere is the market leader in farm machinery based on 2020 revenue[9], this acquisition was a great strategic play. This gives them exclusive rights to use Blue River Technology products on their machinery as well as helps provide a new outlook on R&D and innovation for the company.

Blue River Technology’s “See & Spray” technology works by using cameras to analyze each individual plant with machine learning supported by an expansive database of plant imagery to identify weeds and to only treat those weeds with pesticides[10]. This approach allows farmers to use less pesticides, which is lower cost and preferred by consumers, as well as improve the yields of harvests. The machine learning platform behind “See & Spray” is PyTorch, an open-source machine-learning platform developed by Facebook[10].

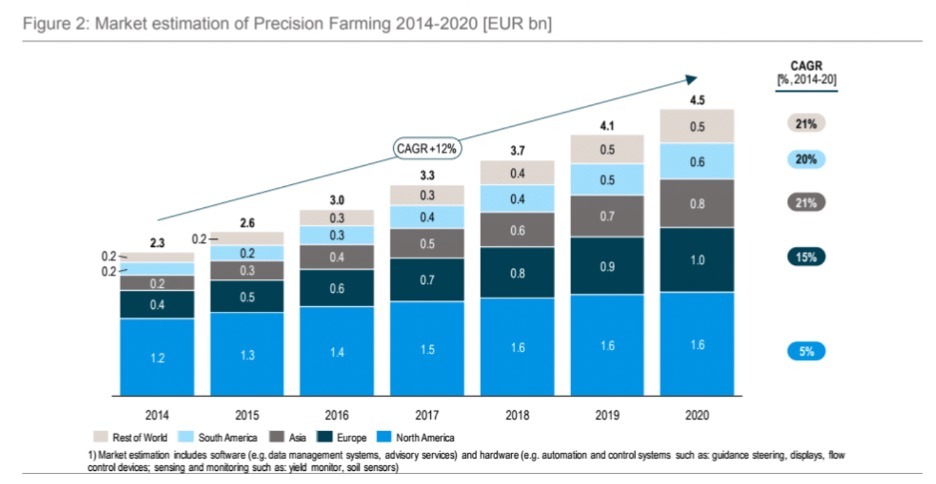

While technology such as “See & Spray” seems like a no-brainer when considering the challenges in agriculture today, a challenge that Blue River faces is the adoption of their technology. Historically, growers have had some hesitancy to adopt technology due to the investment it requires or concerns about data privacy. However, adoption of technology in agriculture has been rising suggesting this might be less of a concern moving forward.

Exhibit 5: Global adoption of precision agriculture[11]

While it is not clear how much the See & Spray technology costs for growers, to increase adoption as well as to increase the data flowing through the algorithm, Blue River should consider giving this technology to growers free of charge. While this would be a significant investment in the near term, it would pay off in the long term if Blue River, with the support of parent John Deere, can penetrate the market quickly.

Blue River should also consider the owner of their data. While it is not clear if Blue River or the grower owns their data, data privacy has been a concern to growers in the past. Blue River will need to earn the trust of growers that their data is safe and secure. Given the volume of data required to fine tune these models, Blue River could run into a bit of a collective action problem if growers are not willing to opt in with their data. However, I think many growers will determine that the efficiency and profitability gains of this technology will outweigh data concerns.

Finally, it seems up until now that Blue River has operated largely independently from its parent John Deere. However, John Deere is prioritizing AI as a key part of their strategy moving forward[12]. Blue River will likely become an even more important asset to John Deere and might face pressure to expand quickly beyond their core competency of the “See & Spray” technology. Will Blue River be ready to take on the challenge and move quickly? In order to do so, Blue River and John Deere are going to need to thoughtfully combine their R&D and data analytics teams so as to not lose the competitive edge that Blue River has had so far. However, it is likely necessary for John Deere integrate Blue River more fully into their organization in order to take the most advantage of opportunities for synergies and to truly embrace AI as the agriculture technology of the future.

Sources:

1 Louisa Burwood-Taylor, “John Deere Acquires ‘See & Spray’ Robotics Startup Blue River Technology for $305M“, AgFunder News, September 6, 2017, https://agfundernews.com/breaking-exclusive-john-deere-acquires-see-spray-robotics-startup-blue-river-technology-305m.html, accessed April 19, 2021.

2 James Murray, “Boss of John Deere subsidiary on how it’s using machine learning in agriculture”, NS Agriculture, January 20, 2020, https://www.nsagriculture.com/analysis/machine-learning-agriculture-blue-river/, accessed April 19, 2021.

3 Jordan Strickler, “Blue River Technology Uses Facebook AI for Weed Control”, Forbes, August, 7 2020, https://www.forbes.com/sites/jordanstrickler/2020/08/07/facebook-ai-is-getting-into-agriculture/?sh=7dcb08973ab6, accessed April 19, 2021.

4 “Climate Change and Agriculture: A Perfect Storm in Farm Country”, Union of Concerned Scientists, March 20, 2019, https://www.ucsusa.org/resources/climate-change-and-agriculture, accessed April 19, 2021.

5 “Organic Market Summary and Trends”, USDA, February 12, 2021, https://www.ers.usda.gov/topics/natural-resources-environment/organic-agriculture/organic-market-summary-and-trends/, accessed April 19, 2021.

6 Tony Dreibus, “Ag Census: Input Costs Rise, Farm Income Declines Amid Low Commodity Prices”, SuccessfulFarming, April 18, 2019, https://www.agriculture.com/news/business/ag-census-input-costs-rise-farm-income-declines-amid-low-commodity-prices, accessed April 19, 2021.

7 “Farm Business Income”, USDA, February 5, 2021, https://www.ers.usda.gov/topics/farm-economy/farm-sector-income-finances/farm-business-income/, accessed April 19, 2021.

8 “2020 Farm Tech Investing Report”, AgFunder, published 2020, https://research.agfunder.com/2020/2020-farm-tech-report.pdf, accessed April 19, 2021.

9 I. Wagner, “Revenue of the world’s largest farm machinery manufacturers 2020”, Statistica, March 11, 2021, https://www.statista.com/statistics/461428/revenue-of-major-farm-machinery-manufacturers-worldwide/, accessed April 19, 2021.

10 Mike Murphy, “The future of famring is one giant A/B test on all the crops in the world at once”, Protocol, August 11, 2020, https://www.protocol.com/the-future-of-farming-is-math, accessed April 19, 2021.

11 Ivanov Ignor, “Digital Technologies in Agriculture: adoption, value added and overview”, Medium, February 5, 2018, https://medium.com/remote-sensing-in-agriculture/digital-technologies-in-agriculture-adoption-value-added-and-overview-d35a1564ff67, accessed April 19, 2021.

12 Spencer Chin, “AI meets the farmer, helping make each plant count”, Fierce Electronics, March 26, 2020, https://www.fierceelectronics.com/sensors/ai-meets-farmer-helping-make-each-plant-count, accessed April 19, 2021.

Wow — what a fascinating product and application of AI! Great write-up!!

I would be curious to get your take on what the logical conclusion of this advancement in ag-tech. Are we moving towards completely automated farming? Are John Deere/Blue River well-positioned for this AI-driven agricultural industry? Do you anticipate resistance from families who often are farmers over multiple generations?

Great post, thanks Julia! Regarding data ownership, do you know to what extent farmers are able to download/use the data? I’m sure many insights could be gleaned from this type of technology, including yield, crop quality, crop disease warnings, etc. If I were a farmer I ‘d love a dashboard showing me all this data!

Super interesting post, Julia! How do you think AI in Ag will impact the labor needed in farming? Do you see a drastic reduction coming in the next 10 years? How does the see and spray impact labor in the short term?

Thank you for sharing, Julia! I wonder if the farmers are getting any sort of training on how to interpret the data beyond of what is shown on their dashboard. I think this technology has the potential to benefit smaller scale farmers across the country.