Airbnb: To be, or not to be

Airbnb is facing unprecedented challenges due to COVID-19 hit. Even if Airbnb can weather the current crisis, can it sustain its business model?

Global travel and tourism, among many industries that are affected by global pandemic, are experiencing the worst hit. Taking a snapshot of tourism losses is difficult, as the data changes as quickly as the virus spreads. The World Travel and Tourism Council projects a global loss of 75 million jobs and $2.1 trillion in revenue if the pandemic continues for several more months.

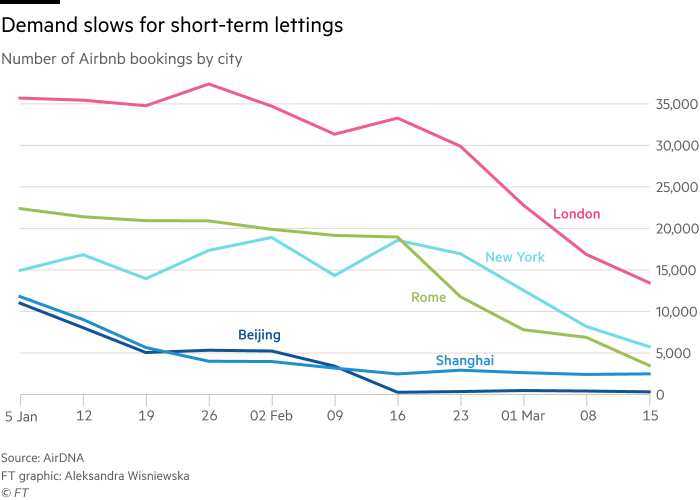

Airbnb, right before the planned IPO, faces the biggest challenge to the company’s seemingly unstoppable growth. As the global travel and tourism sector grinds to a halt following travel bans and flight cancellations, demand for short-term rental homes has drastically dropped. Airbnb is not an exception. As a result, Airbnb lowered its internal valuation to $26 billion, which is a 16% drop from the $31 billion valuation Airbnb received at its most recent private fundraising round, according to PitchBook.

Will this be the end of Airbnb? Can Airbnb weather the crisis and rebound?

<Exhibit A. Demand reduction of Airbnb >

Early responses

Amidst global health crisis, on March 14, Airbnb announced extenuating circumstances policy: all guests booked for check-ins between March 14 and May 31 were eligible for full-refund cancellations, overruling stricter cancellation policies chosen by hosts. It was a move to respond to guests’ concerns and safety. Airbnb said it acknowledged that the decision to offer guests a refund had caused hardship for many hosts but prioritized the health of the public and its communities. However, the policy upset many hosts who lost significant income due to sweeping cancellation following the announcement. Subsequently, Airbnb apologized to hosts and set up a $250m relief fund to help see them through the crisis. Regardless of the effectiveness of keeping the relationships, Airbnb’s top-line and bottom-line would suffer from these policies. As a result, Airbnb reportedly canceled all marketing activities, put its founders’ salaries on hold, and slashed those of top executives by half.

Enhanced Cleaning Initiative

This week, Airbnb’s CEO Brian Chesky announced that the company is establishing new cleaning guidelines for hosts, effective from May, placing 24 hours between all bookings at all times. It derives a new cleaning protocol with guidance from experts, including Dr. Vivek Murthy, former U.S. Surgeon General, while the CDC recommends the 24-hour rule. The protocol will offer detailed guidance on how to keep rooms clean during the coronavirus pandemic, and forms part of a broader cleanliness drive it calls its “Enhanced Cleaning Initiative.” The company said hosts who agree to adopt the new protocol will get a special call-out on their listing page, so guests will know they’ve committed to following more rigorous cleaning and sanitization practices.

Redesigning the products

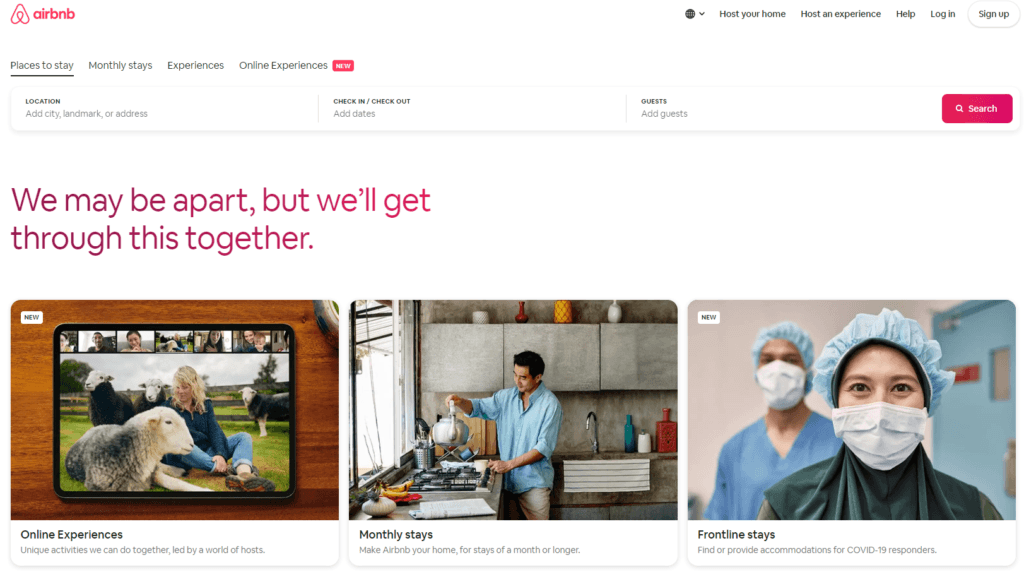

Airbnb responded to the crisis from different angles that it redesigned its home screen and app landing pages. As shown in Exhibit B, Airbnb changed its home screen and added new offerings; Monthly stays and Online experiences. In addition, it offers “Frontline stays,” which is designed for medical professionals and first responders places to stay that allow them to be close to their patients and safely distanced from their own families.

“Online experiences”, where hosts offer online classes such as a cooking class and a cocktail mixing show, came to a surprise to Airbnb that the new service showed early signs of success and may become a future business for the company. Airbnb, after coming up with the idea, did trial runs with selected hosts with mic set-ups and launched with 50 people. Soon more than 100 hosts offered experiences online and thousands more who’ve offered to host experiences. Some of the most popular offerings were sold out quickly.

<Exhibit B. Redesigned web page of Airbnb>

Post COVID-19

It is not clear and is unpredictable whether the future of travel and tourism will be restored to normal anytime soon. Many say the industry will be back to normal or even bigger due to counteraction to quarantine and stay-at-home. At the same time, many agree that the restoring will take at least a year, if not years. Nevertheless, Airbnb should have plans for post COVID-19 situation. What can it do better to boost up demand and assure the safety of guests?

Focusing on domestic and rural tourism

Even if the crisis subsides and lockdown is over, people will not be comfortable traveling abroad because of high risks associated with international travel such as airport, aircraft, etc. In other words, the demand for traveling, if any, will be concentrated on domestic. On top of that, rural areas, where population density is much low, will become hotspot for city-escapers. As proof of the trend, for example, the demand for homes in mountain areas has risen sharply for people who want to get away from crowded cities. On the other hand, short-term rent in metropolitan areas will experience a longer downturn in tourism because of safety concerns and reduced number of international travelers. It might not be the best outcome for Airbnb, but the company should focus its effort to attract domestic travelers to rural getaway areas where Airbnb can capture some amount of rebounding demand.

Sophisticated marketing

As of now, Airbnb limited its marketing spend to cope with the crisis. However, sooner or later, it has to revitalize marketing. And at that time, it should be big as well as ever more sophisticated. As mentioned, the demand for travel will not be the same as pre-COVID era, at least for years. Customer behaviors will not be the same. Airbnb should not only advertise the places but also educate guests that they can travel again without safety concerns. It should target guests with enhanced focus. My hypothesis is that guests who traveled high-risk destinations, such as wildlife excursion and underdeveloped countries, before the crisis will be likely to resume their travel sooner than others. Those risk-takers should be Airbnb’s first target. It can leverage its data and analytics capability to figure guests’ tendencies and behaviors out. After generating demand for the risk-takers, Airbnb can market the result to the rest of the population that it is safe to travel again.

Safety statistics

It will not be enough to convince many risk-averse people by showing others are traveling. It takes extra care and robust proof to get them back. The best way to show them it’s safe is by providing data and statistics. Airbnb should leverage its data analytics and partner with municipal government to create safety map. In the map, Airbnb can layout population density, level of public hygiene, and any past incidents including crime, infectious disease, etc. around its accommodations, so that travelers can measure the safety before making travel decisions.

Untact safety checks

It should also track the cleaning practice of hosts remotely and verify the safety of guests. On hosts’ side, Airbnb should develop visual analysis tools that can assess the tidiness and cleanness of accommodations. When guests enter the place, guests should take photo or video shots and send it to Airbnb, so that the company can analyze whether the hosts are following cleaning protocols. Airbnb also can deploy mystery shoppers to check the rental homes are well managed and safe. On guests’ side, Airbnb should verify vaccination status for highly contagious and fatal diseases, including COVID-19 (hopefully when the vaccine is available). While this practice can raise concerns for privacy, it is important to keep people and the community safe for the longevity of the company. Airbnb can start the verification as an opt-in base first and observe the reaction from both guests and hosts. Since many vaccinations last for life, the verification would provide a high level of trust about safety for both parties.

Conclusion

Airbnb has the capability of digital innovation as we can see from its rapid product redesigning, even though it faces almost a life or death crisis. While the company really cannot control the current situation, it should derive plans for post COVID-19 era to revive its business once everything is over. It should first target guests and travelers who are willing to take more risks in the short-term. Then, it can educate the world that its products are safe. It should leverage data analytics to provide statistics and information about the level of risks associated with diseases. It should develop assessment tools that can measure the cleanness and hygiene of rental homes remotely. The future of the world, let alone the travel industry, is unpredictable but those who come up with most digitally innovative ideas will survive.

Sources

https://www.curbed.com/2020/4/7/21204484/coronavirus-quarantine-escape-pad-rural-cabin-escape-airbnb

https://www.bbc.com/news/technology-52184497

https://www.cnn.com/travel/article/vacation-rentals-coronavirus/index.html

https://www.pymnts.com/coronavirus/2020/airbnb-to-launch-covid-19-safety-program-for-rentals/

https://www.businessinsider.com/airbnb-24-hours-between-rentals-limit-covid-spread-2020-4

https://www.airbnb.com/resources/hosting-homes/t/coronavirus-updates-34

Thanks for sharing this! You provided some great ideas for steps that Airbnb can take to try and recover beyond COVID; in particular, I really liked the safety statistics idea, since as a guest I end up spending a ton of time tying to piece together a view of how safe a property’s location is.

I do think there is one more step they need to take: shoring up support among hosts. I fear that this experience will drive a lot of hosts off the platform, either out of necessity (their property goes into foreclosure because they can’t make their mortgage payments), fear (the uncertainties / risks associated with being an Airbnb host now seem too high), or frustration (they’re annoyed by the cancellation policies that Airbnb has forced into place). Maybe the relief fund that you mentioned is sufficient, but I feel like money is only part of the solution and there also need to be some higher-touch, highly-empathetic communication to hosts.

I absolutely agree with your thoughts. It is very important to manage both sides of the platform. Airbnb can actively provide information, customer trends, community network, and even basic tools for cleaning, maintenance, and PPE for hosts to use.

Fascinating read! I also found the safety statistics to be a really compelling angle. Beyond being a mechanism to revitalize demand and put future travelers at ease, I think this is a huge opportunity to strengthen Airbnb’s partnership with local governments. In some high density cities, the portfolio of properties on their platform might be at a critical mass to inform public health trends that may help local governments respond to this pandemic. Safety data could be the lowest hanging fruit but a stronger relationship with local governments could also open up the ability for hosts to use their properties for public service like the frontline initiatives. If Airbnb explored this option with local governments, this could expand to be a robust crisis response service that they offer to governments when disaster strike (floods, fires, earthquakes, etc) and immediate housing is needed for affected citizens. This type of product offering could also tap into government budgets and be a significant revenue stream that also creates a more resilient business model. It would be in the moments with traditional travel business is low that this government service would increase. Also, this would offer the government a quick and easy solution that scales to the level of their need. Feels like it could be a win-win to me.