Peloton: Riding Quarantine into a Demand Boom

Peloton has taken advantage of the nationwide stay at home orders that have caused a surge in demand for at-home fitness solutions.

Overview

Nationwide stay at home orders have caused traditional gyms and boutique fitness studios to shutter their doors, leaving many Americans looking for at-home alternatives. Peloton’s digital operating model has allowed them to capitalize on this forced shift in consumer behavior. Peloton is described by the founders as a “media-technology-retail-logistics” company that sells digitally connected cycles, treadmills and subscriptions to fitness classes. With over 2M subscribers, only 17% of their revenues in Q2 2019 were generated through subscriptions and the rest are from hardware sales.

Digital Operating Model

While quarantine requirements have boosted the demand for Peloton’s products, their platform business model was designed to thrive in a digital world. There are four key components that have allowed Peloton to create value and capture a winning share of new at home fitness demand.

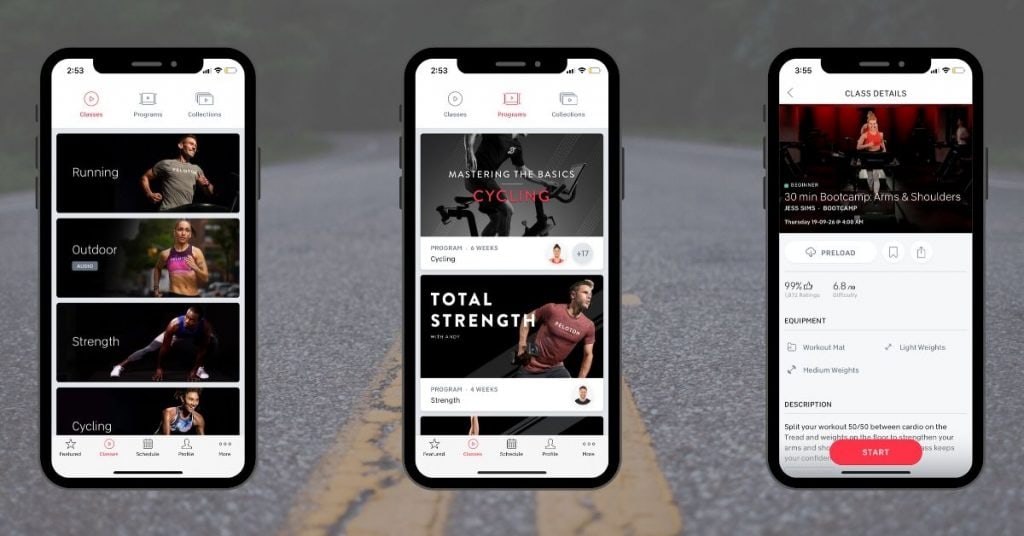

1. Peloton Digital App

One of the key components of Peloton’s success during the pandemic is their digital platform which houses all of the workout content. The Peloton platform provides remote access to both live classes and thousands of on demand classes in varying formats. With such an established and diverse library, Peloton became an obvious choice for consumers looking for at home workout options. During the pandemic, Peloton has extended their free trial from one month to 90 days in the hopes of attracting more users.

2. Vertical Integration

Peloton controls their user’s entire workout experience – from the hardware and software to the content and fulfillment. Peloton fulfills 58% of the orders received, helping ensure they have ability to meet an increase in demand. Additionally, 85% of peloton users own a Peloton piece of hardware, cementing consumer stickiness. Intentionally integrating across the supply chain protected Peloton from COVID disruptions and allowed them to continue to meet consumer expectations. This business decision and emphasis on experience has resulted in a NPS of 86.

3. Digital Community

Peloton also benefits from a highly engaged and loyal online community that generates network effects. During a highly stressful and uncertain time, Peloton classes offer support and a way to clear your mind. The motivational instructors make the workouts extremely engaging and garner dedicated followers; Peloton has over 700K followers on Instagram. Additionally, the platform allows for user engagement, letting you see who is in the class and connect with your friends. This makes it extremely similar to an in-person class and attracts those that are missing the social aspect of studio workouts.

4. Revenue Streams

By utilizing fintech platform Affirm to offer a monthly financing plan, Peloton has made an originally steep purchase price of $2000 more accessible and increased their target consumer segment. Particularly in a recessionary period like COVID, consumers are more willing to make small monthly payments for the bike. Additionally, Peloton benefits from monthly recurring revenue from the 2M content subscribers and recently lowered the fee to 12.99/month. Compared to other fitness companies, this secure cash flow likely gave them more room to weather the pandemic.

Growth in Corona

Peloton has seen an expansion in their target consumer base for two reasons. Due to the pandemic, there has been an emphasis on wellness that, combined with more time available in the day, has increased overall demand for workout classes. Second, those who traditionally work out in gyms have been forced to seek at-home alternatives.

The Peloton app has seen a surge in user engagement and acquisition. YoY app downloads have increased more than 400% in March and early April. Peloton has not commented on the number of new hardware customers but there are a few signs that point to increased demand. Delivery times, which are usually one to two weeks for bikes, have now been quoted at four to seven weeks. Additionally, a program where users could buy bikes that have been returned after the 30 day at home has been discontinued. This indicates that there are enough consumers that are willing to pay full price and more customers are keeping the bike after the 30-day trial period.

While Peloton has largely succeeded during the pandemic, they have also faced challenges – forced to shutter their showrooms, cancel in studio classes and suspend the delivery of their treadmills.

Is this growth sustainable?

Peloton is operating in an extremely crowded and competitive space. They need to capitalize on the current mass movement towards digital fitness and speed up the pre-existing trend of shifting from boutique to home fitness. The pandemic has speed up this adoption for a subgroup of people who will continue to work out at home using Peloton’s digital offering. As we enter a recessionary period, consumers will look for more cost-effective ways to get the same boutique fitness experience. The large existing class library and brand awareness makes Peloton very well positioned to meet the at home fitness consumer needs.

Customers that purchased Peloton hardware during the pandemic will continue to pay their monthly subscription fees. With a $2000 price point and a 93% retention rate, customers who purchased the bike during COVID will continue to use the bike because of the high investment and superior experience.

Some of the newfound demand will begin to fade as stay at home orders relax and consumers begin to return to other workouts. However, Peloton has a 10% conversion rate from their digital platform to a hardware purchase. With such a large increase in digital members, Peloton will be able to convert free trials to customers who use the bundle and have a higher LTV.

One concern with this surge in demand is around TAM. I’m concerned that they have cycled through their target segments faster than originally anticipated and, post pandemic, there will not be many people left to sell to. To sustain this level of growth, they will need to leverage their brand awareness and network effects to increase subscription revenues. Peloton should create more lower priced products and classes focused on fast growing segments (i.e yoga, strength) that do not require their hardware. This will expand their TAM, diversify revenue from hardware purchases and help to attract users that are about to end the 90-day free trial.

Peloton’s growth will subside from current highs but will still see an uptick from pre-COVID rates. Peloton will sustain benefits from the pandemic through an accelerated at-home fitness trend and can capitalize on the increased brand awareness to capture demand.

Sources:

https://www.cnbc.com/2020/03/31/peloton-much-stronger-after-coronavirus-analysts-say.html

https://www.wsj.com/articles/peloton-may-feel-the-recessionary-burn-11587466800

Thanks Ali, super interesting! I’m a huge fan of Peloton and while I don’t own the hardware, I’ve been a subscriber of their app since January of this year. I used to use the app in Shad, but now I’m finding it’s a great source of at-home workout content. I’d say it’s very likely that I’ll upgrade to a bike or treadmill in the wake of Covid – so I’m part of that 10% that moves up market from their subscriber base! It’s great that they have been able to capitalize on a trend that’s bolstered growth for them while not changing much about their business model – which definitely seems to be an anomaly these days. I agree with your point around the TAM being capped out, and not a lot of room left to grow. I’m curious to see how they expand on double down on certain product offerings (new hardware?) to continue to allow for growth post-Covid. Will be very interesting to follow!

Very interesting article Ali especially with consumers looking for various platforms to maintain some sense of normalcy from physical exercise. I agree that Peleton is uniquely positioned as a digital platform to leverage their content creation expertise to develop and refine workouts to engage at home consumers. I am concerned however that the 90 day free trial does not truly convert users into full time adoptors for two main reasons 1.) other competitors are currently and are planning on providing free workout (ex. Orange Theory) content post COVID and 2.) consumers may want to ‘run’ back into the gym and classes once stay at home mandates and businesses return to normal. However, I am really interested to see what other offers Peleton provides to retain the customers it has acquired during these times.

This is a great post and its really interesting to hear about how Peloton is doing in response to COVID-19. I agree with you, the high price tag locks in the customers since they feel obligated to continue their subscription and this is a great tactic. I was also reading about Tonal, which has been dubbed the “Peloton for weight training”. It costs $3000 and similarly, sales tripled within a week of social distancing orders. It would be truly interesting to see how all these companies perform once the pandemic is a thing of the past.

Thanks again for a great post!

Great post, thank you! I think another factor to consider with this shift towards the digital experience without the actual hardware bike is the increasing leverage of the most popular instructors. Ultimately, without the hardware investment, customers’ switching costs have decreased significantly, and the only thing stopping them from switching platforms is their allegiance to a specific instructor. That not only means that Peleton needs to invest even more into content curation, but also that instructors who are very popular are at higher risk of leaving the Peleton platform to pursue their own venture.

Super insightful article, on the competitive market a major threat is the entry of Equinox with Variis by Equinox. Which will combine workouts from all major Equinox brands including Soul Cycle in addition to having an extremely similar bike hardware product. This could make the model very competitive and result in customer churn to increase. Another concern is the sustainability of hardware sales since I do anticipate second hand bikes being available in the market. Lastly, with more digital workout subscription services being rolled out including Variis by Equinox, we may have competitive wars like the Streamer Wars.

Thanks for the piece Ali! I appreciated your insights on looking at Paloton’s TAM. I would assume that the market is not saturated in the international market, and this could yield interesting opportunity for expansion globally. Paloton was very well-positioned to grow in this crisis and before considering the quality of product they have had and the brand trust created even before this crisis. As spending for users become limited, ensuring the quality and service becomes important when purchasing.

Great article Alli! It’s interesting to hear this perspective. I researched Variis by Equinox and SoulCycle and felt the same things. Price war at some point seems very likely. What I really like about Peloton is the 90-day free trial that they have released, as opposed to a $40 monthly offering from Variis, which has caused an outrage. Peloton can win this through the community building that they are replicating online and the more virality the app has, higher chances of customers sticking to the app. As SoulCycle ramps up the delivery of its own bike, we’ll have to wait and watch whether Peloton sees a drop. Post covid, I would be more concerned about the need for everyone to be ‘out and about’. People are longing for the in-person and social experience. With multiple physical competitors forced into the online world, they would become omni-channel and flexible for customers. If Peloton remains online, it remains at-risk. If it moves to studios, it needs cash!

Great article! Thanks for posting! I agree with your sentiments around diversifying the product portfolio. It seems to me that Peloton users loves their bikes, but COVID-19 likely just pushed forward demand without necessarily expanding the pie. I could see many users renew their membership subscriptions because they’ve developed a behavior pattern of using the bike, but I would expect a demand drop after the pandemic ends when many users return to their habits from before the virus or seek more outdoor recreational activities. This is where new product offerings could be very valuable. I wonder if Peloton could create a regular bike and introduce biking communities across cities as people begin going outside more often. This may hurt margins, but diversify revenue streams to help the business build a greater sense of community among existing users. Coordinating this with a social feature on the platform could be a digital strategy to sell complementary products.

Additionally, your point around other sessions such as yoga or fitness groups to expand the subscription value could be interesting and scales very well, but I’m not sure this would be a unique offering relative to many YouTube channels or studios who have been broadcasting online during the crisis. How might Peloton uniquely add value to these offerings relative to competitors? Again, it seems that more outdoor and active products could temporarily reduce demand in the short-term and many people considering a purchase in the next year might hurt sales over the next year by having front-loaded during the pandemic. I’m curious what the implications are for Peloton’s manufacturing forecasts because of their vertically integrated approach.

Will be interesting to see how they respond, and whether the disruptions to competitors in the ClassPass/SoulCycle space will have a significant impact on Peloton’s business.

Thank you for the post! I have been following this stock for a while. It’s super interesting how investors are viewing this stock as the defensive play during he pandemic, similar to Zoom and TDOC. I think PTON can increase their user retention rate by lowering the price of their hardware. For example, they can introduce wearable devices, such as hand bands. These wearable devices will make sure the users stay engaged with their app.