Care.com: a two sided marketplace for all your care needs

Care.com's 16.5 Million member base provides huge networks effects for caregivers and families

The Company:

Care.com is an online marketplace that connects babysitters, nannies, caregivers and dog walkers with families seeking these services. Their mission is to “to improve the lives of families and caregivers by helping them connect in a reliable and easy way…In providing families a comprehensive marketplace for care, we are building the largest destination for quality caregivers to find fulfilling employment and career opportunities globally.”

As of December 2014, Care.com has 14.1 million members in 16 different countries (7.9M families and 6.2M caregivers), this is up 46% annually; revenue is $116.7M, up 43% annually. The website lists current members at 16.5M. In addition to providing a service marketplace, care.com also operates Citrus Lane and Big Tent which offer child merchandise and a platform for parenting groups and forums respectively.

Value Creation:

Care.com creates value for the families by providing them with safe, reliable and convenient access to care for their loved ones. They can specify specific times and requirements (such as driving and language), read reviews and see background checks. Families are guaranteed a response within 3 days. Value is created for caregivers by providing them with a flexible way to find a job that fits their schedule and financial needs without having to know someone in the neighborhood or be recommended by a friend. In addition, it creates value by allowing for payment and nanny tax services through the website.

Value Capture:

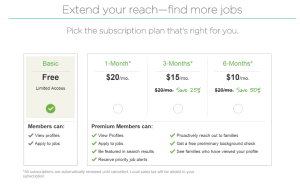

Care.com captures value is several ways: first, similar to the LinkedIn model, Caregivers can subscribe to an upgrade that provides additional benefits such as (in the case of the caregiver) free preliminary background checks, ability to filter job searches, proactively reach out to families and receive priority status for jobs (see below).

In addition, you can elect to do a background check of varying degrees for a $9-$59 one-time charge. Care.com captures value from the families through a subscription model as well. Care.com also captures value through its products via its Citrus Lane platform

Network Effects:

Care.com benefits primarily from indirect network effects. These are created in several ways:

- As a two sided marketplace, care.com creates increased value from having more families and more caregivers available to each other. As each group has more options there is more flexibly and optionality to choose something that fits ones schedule and requirements (similar to Uber) and more people will be willing to use the platform.

- com also benefits from what is perhaps economies of scope as families will seek a broader array of services. For example, a family initially seeking a babysitter might consider using the platform for a dog walker or someone to run occasional errands. These economies of scope could enhance the network effects by attracting more and more members on both sides of the platform.

Scalability:

Care.com is uniquely poised to scale since the caregiver marketplace is so fragmented. Think about it, they’re not going up again the “mob-like” incumbent cab companies the same way Uber is, they are going against (at best) localized competition for tutoring and nursing homes, and practically non-existent established competition for babysitting services. At the same time, care.com estimates their target market to be ~42M households in the US alone – leaving them with an additional ¾ of the market to tackle. If care.com can capitalize on some sort of social network component the way dating apps such as hinge (that recommend friends of friends to mitigate the creep factor) have, it will completely undermine the need to the existing model of finding babysitters and other caregivers. The main risk to their business model is likely the willingness to “go offline” once a family has an established (group of) caregiver(s) and bypass care.com’s main source of value capture.

Dani, great post! I believe you have touched the key points about Care.com success. In addition I would add that are two main attributes of the business model that would allow Care.com keep growing. First, given the nature of the business, I believe there is a high willingness to pay, given that the service is focused on your “most loved ones”, and this emotional connection could be translated into higher WTP. Second, the population is aging and the overall potential market will keep growing!

I wonder if they can keep quality consistent while scaling. Even with background checks and vetting/education, I would hesitate to use this service on the off chance of someone harming my sick grandmother or child. It definitely isn’t something I would use as lightly as I do Uber so I do think they have a tougher path than Uber does. Your suggestion of a social network component is something that would alleviate some anxiety though.

Also I think their operation of Citrus Lane and Big Tent is a great tactic to lock-in long term loyal customers and build up barriers to entry for new entrants.

Dani, it’s an honor to give you your first heart.

Excellent post. As we discussed in class today, all of these successful platforms have at least one competitor in the market. Is there a comprehensive care provider that competes with Care.com? Competing platforms have been developed to focus on one aspect of Care.com customer value proposition. Do you see that as a threat? Or, is the major barrier to Care.com’s long-term success and sustainability people going off platform after establishing a relationship?

In my opinion the main issue for Care.com is quality. creating a critical mass is crucial for direct and indirect network effects but if the quality of the provided care won’t be up to the clients expectations they would start leaving the platform and won’t be active users who provide positive WOM.

Care.com neet to focus on ensuring the quality of professionals on their network to make sure the network develops and grows.