Farfetch: Tackling the Online Luxury Fashion Market

Farfetch prides itself on being the only online luxury fashion platform at scale. Leading up to its IPO in 2018, it has amassed impressive growth and continues to do so till today in the large USD 300 billion luxury fashion industry. Started by Jose Neves, Farfetch now has two million active users in 190 countries engaging with 500 brands and 700 boutiques. Brands include the likes of Chanel and Saint Laurent, whilst boutiques include high-end retailers such as Harrods and Harvey Nichols.

So how have they become so successful?

By creating value:

Strong network effects– On the supply side, they offer traditional brick-and-mortar boutiques a strong online presence that they typically lack (or poorly execute on) and access to a large number of customers. They also give brands more access to the younger generations (millennials and gen-z) who increasingly prefer to shop online. On the demand side, consumers are offered a wide but curated selection of goods from the best brands, superior customer service (i.e. data-driven marketing, logistics, care), convenience, and an element of discovery (thrifting through pages to find hidden gems). The more users that join, the more brands that sign up, and vice-versa.

Rapid distribution systems– Farfetch is known for its quick deliveries in certain major geographies, including London and New York. They operate same-day deliveries in 19 cities. They also offer returns at no charge for customers.

Well-known brand– Farfetch has become a common name in the industry for both brands and consumers of luxury fashion. They are synonymous with luxury, selective, reliable, customer-centric, fast, etc.

Hunger for innovation– The platform continues to innovate on both sides of the platform to remain relevant. On the supplier side, they offer platform solutions the help brands develop full end-to-end digital experiences, which include opening digital stores or setting up WeChat stores. On the demand side, they recently launched Second Life, an initiative where users can sell back second-hand goods to Farfetch for credit to use on the website. This was done to appeal towards the trend of buying sustainably.

By capturing value:

Effective monetization– Farfetch monetizes the platform on the supply side by charging the brands a total of 25% on the sale of each good, with added 8% if retailers wish to outsource order fulfillment to Farfetch. Over 70% of the company’s revenue comes from the sales commission.

Right target market– Farfetch has been able to attract a strong customer segment of young men and women that spend an average order size of 550-650 USD consistently.

How have they scaled?

Solid partnerships– They have strong relationships with the brands and boutiques they showcase on their website. Not only do they provide value-added solutions for their partners but they engage in collaborative seminars, creating a community feel around the network. More importantly, they have locked in 98% of their retailers with exclusivity contracts.

Impressive technology system– Farfetch operates a business model where they do not have to own any inventory. Instead they have an efficient back-end technology system that sources the desired product from around the world and makes arrangements with the respective retailer / brand to complete the order. Despite growing so quickly, they have also been able to keep up with front-end technology needs in dealing with superior user experience.

Is it sustainable?

Given the reasons mentioned above – exclusive partnerships, strong brand image, network effects, innovation, effective distribution, etc. – this business model is sustainable. There are, however, some concerns.

- By going through Farfetch, brands and boutiques are giving up a level of control and datathat could prove useful to them. It is possible that at some point these shops develop their own capabilities in this space to once again go direct to consumer. It is uncertain though if the stores will be able to replicate the technological prowess of Farfetch.

- Multi-homing may be a risk. I assume users shop across multiple online fashion sites, including Net-a-Porter / Mr. Porter. I have yet to see what Farfetch has down to increase customer stickiness. Perhaps they could look into more effective loyalty schemes.

- Amazonhas announced they will enter the luxury fashion segment. Given their size and distribution network they pose a significant threat – however I believe Farfetch can still rely on their trusted, upscale image.

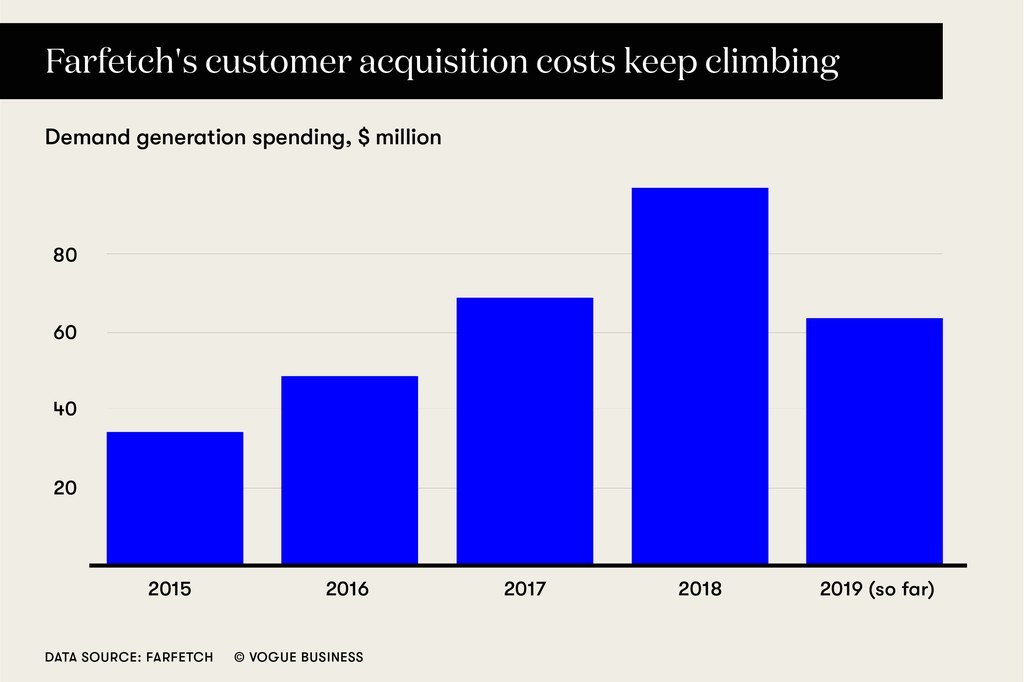

- Customer acquisition costs are rising(refer to figure one). Now that they need to keep adding brands to propel user growth, this can become costly and they will need to find solutions to organically obtain users.

Figure One: Customer Acquisition Costs Rising

World Count: 755.

Sources:

- https://www.forbes.com/sites/pamdanziger/2018/03/20/digital-luxury-fashion-marketplace-farfetch-is-on-a-roll-to-an-ipo/#2b7151a89723

- https://aboutfarfetch.com/about/farfetch-platform-solutions/

- http://lumosbusiness.com/business-model-canvas-farfetch/

- https://qz.com/1781553/amazon-said-to-be-launching-new-luxury-fashion-platform/

- Farfetch 2019 Annual Report

Great article!

I think the concerns you mentioned are very valid. Regarding data, I wonder if Farfetch can support brands on its website by providing them analytical reports regarding user behavior on the platform, things like click-rate on items, browsing, etc. (the brands will only be able to see behavior around their own brand, and high-level aggregate data on other generic user behaviors). By providing these reports, Farfetch would’ve created a value-add service that will make the relationship with brands stickier and that could potentially make brands prefer this platform over other (maybe reducing brand multi-homing).

Farfetch could also use data to reduce customer multi-homing. As you mentioned, they could create a loyalty program and fuel with personalized and target product recommendations and discounts. This will also help improve the customer experience and increase retention.