Garmin – Getting lost in the changing navigation maze

A look back at the rise and fall of Garmin, formerly the world’s leading producer of automotive navigation systems.

Mobile phones are “the kind of commodity business we would like to avoid.”

Min Kao, CEO of Garmin, in 2003

In the 2-3 decades since the beginning of the era of digitalization, trends have not been a straight line of disruptions, but rather a zig-zag of misguided trends, disrupted disruptors, and out-of-nowhere innovations.

Garmin Ltd – originally named ProNav – was a market leader in GPS technology, and went public in late 2000. Its mobile, GPS-enabled devices were sold globally, including for military use.

Navigation systems became increasingly wide-spread – including consumer facing, disrupting the industry for physical maps, and use cases increased. As a consequence, Garmin saw it’s best era in the first decade of the millenium, and increased it’s stock price by roughly 2x in 2007 alone, in particular driven by GPS devices for vehicles from cars, boats and planes.

What could have been better for a company focused on navigation then the beginning of the mobile era?

But Garmin was not prepared for the arrival of the smartphone. Instead of leading the way helping people navigate the streets both when driving and walking, Garmin continued the focus on sales of standalone GPS hardware devices, which declined in sales between 2007 and 2013.

It is not that Garmin didn’t see smartphones coming. But the leadership massively underestimated the threat, regarding mobile phones as a commodity that will not achieve sufficient capabilities in mapping and navigation. The same leaders that created the vision for the need for global navigation using satellites were unable to foresee the power of handheld, every day devices equipped with navigation software.

While competitors TomTom and NavTaq sold quickly in a rapidly deteriorating market, Garmin’s stock plunged by more than 80% within 12 months.

Garmin’s products suffered the fate of digital cameras, portable music players and many more, and was absorbed into the smartphone. Google – followed by Apple and yahoo – quickly set out to dominate the GPS market by investing heavily into mapping the world, and providing superior user experience for navigation. As the billion dollar tech company saw mapping as a central platform to control, Garmin had little fighting chance against a service offered for free and under less pressure to monetize.

The “Garminfone” was launched in 2009 in collaboration with Asus, and received decent reviews. Nevertheless, it remained a footnote of history, despite heavy investment. The cell phone line was eliminated in 2010 after six models.

In the meantime, the innovation in the maps market happened elsewhere. In 2013, Google acquired Waze for almost $1B, a startup that created a community to improve navigation for users.

Garmin survived largely due to its diversification, and non-automotive sources of revenue, such as navigation for professional outdoor athletes, for boats, aviation and the military. At a time when every other driver uses a navigation system at all times, this system is almost never not installed on a smartphone.

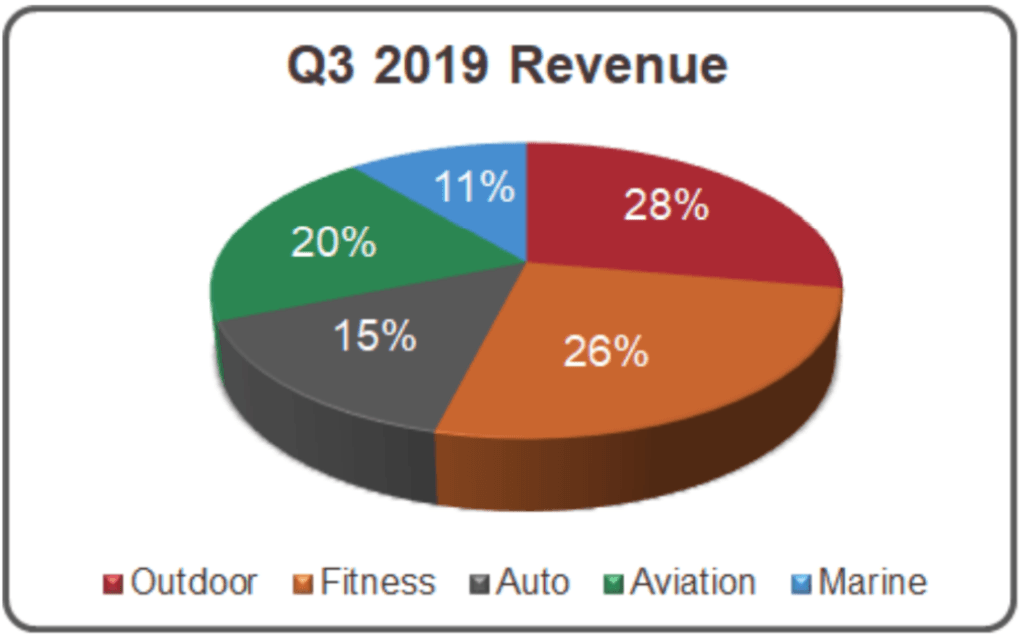

Fast forward to today, Garmin is staging a comeback. The company is approaching it’s 2007 peak market value, and has been consistently growing since at least 2016. Growth originates from a diversified portfolio, in particular in the Aviation and Fitness segments. At the same time, Automotive has declined consistently over time, to 15% in Q3 of 2019.

Looking back, Garmin is undeniably a loser of the digital revolution. As automotive navigation systems became common, the company did not have the vision to foresee that the standalone devices’ boom will be rather short lived. Within years, they faced a fight against billion-dollar technology startups that offered competitive software for free on hardware with much superior technology.

The core value propositions of Garmin were GPS-enabled hardware, as well as customer-facing navigation software. I believe that Garmin would have had a shot at success by seeing those two key competencies as separate bets.

What if it had been Garmin, not Google, that sent cars to streets worldwide in order to map and take pictures of every corner of the world? What if Garmin had created a world class navigation app and aggressively distributed it on Android and iOS devices? An aggressive market grab could have stopped the operation system providers from going after the market themselves – just like Spotify to a large part prevailed in the music industry.

What if the company had focused entirely on owning GPS and location-tracking components within hardware of all types and from all manufacturers?

The Garmin FoneBoth of those ways would have been hard, but more promising than competing in the much bigger fight for smartphone supremacy – a fight that exceeded Garmin’s core value proposition.

—–

Sources:

Company quarterly reports: https://www.garmin.com/en-US/investors/earnings/

http://allthingsd.com/20120612/how-garmin-failed-to-see-the-iphone-threat/ (Webarchive here:https://web.archive.org/web/20120715075043/http://allthingsd.com/20120612/how-garmin-failed-to-see-the-iphone-threat/)

https://www.technologyreview.com/s/511786/a-shrinking-garmin-navigates-the-smartphone-storm/

https://www8.garmin.com/aboutGarmin/invRelations/reports/2019_Q3_Earnings_Call_Webcast_Slides.pdf

https://www.wired.com/2010/04/t-mobile-garmin-announce-new-android-phone/

Fascinating post! I wish we had insight into some of the conversations going on in the executive meetings at Garmin in the late 2000’s. Was it a lack of foresight that prevented Garmin from capitalizing on their early lead in navigation? Or did the executives consider the possibilities you posed (dominating either the hardware or software space) but executed poorly?

I see a recurrent trend in our class’s blog posts that incumbents that do not adequately consider competitive threats from digitally-enabled companies end up losing. I am surprised though that in this case, Garmin is able to stage a comeback as you mentioned, as most other companies that fail to innovate in the digital world end up becoming obsolete. This does speak to the importance of diversification as well. I wonder what changes Garmin might make now in their strategy going forward so that they do not fall behind again.

Great post! This reminds me a lot of the Nokia case that we did in class and in particular where we discussed how FUJI re-invented themselves through diversification. It would be interesting to hear Garmin’s leadership discuss whether this was architectural vs component innovation and how/if that would have changed their response. In addition to the alternative options you wrote about, I wonder if there could have been a successful partnering strategy with the large operating system providers to build the software together so they would have remained the owner of navigation without having to invest in application building.

Thanks Bastian, very exciting post! Although I completely agree that Garmin lost the opportunity to maintain a leadership position on the industry of digital maps, I would not classify Garmin as a loser of the digital revolution. Although the company drastically lost value, it was able to recover by focusing on other areas. As you highlight in the article, the aviation and fitness segments has allowed the company to boost its revenues. From 2012 to 2018, the company has been able to increase year by year its revenues. The potential of the business is reflected in the value of its stock, which has increased from 37 USD (Jan 2016) to 96 USD (Jan 2020). The introduction of new technologies and features such as a golf watch with special sensors and preloaded courses, or digitization of marine marine mapping. For me, Nokia is a looser of the digital era, but Garmin is not a loser, since it was able to adapt its business and deliver good results.

Thanks Bastian – super interesting post! I actually looked at Garmin when I was working on Fitbit acquisition at Google CorpDev. You are spot on in terms of Garmin’s diversitied business units and recent growth more coming from fitness / wearables – as consumers needs are shifting away from single-purpose tracker (Fitbit’s stock plunge) to more functionality (Garmin & Apple Watch). I wonder whether they could leverage their strength in hardware to build something interesting for wearbles, potentially the next gen computing platform. However, software / content econosystem strategy (build / partner / buy) needs to be fleshed out as it’s increasinly more about a blended hardware + software offering for optimal user experience.

Your question around “What if it had been Garmin, not Google, that sent cars to streets worldwide in order to map and take pictures of every corner of the world?” is thought-provoking. Mapping requires inherently different capabilities which I’m not sure Garmin possessed at that time. But I am curious if they had foreseen the shift from GPS device to app and had leveraged their wide distribution of hardware at that time to crowdsource mapping info, how would the landscape look like today.

Great article! It is very interesting to see how “smartphone” changed not only the cellphone industry but also adjacent ones. I think Garmin is clearly a victim of the rapid innovation of smartphone which was hard to imagine back in late ’00s. I wonder, however, Garmin would have ever become a winner in the revolution even if they have the right leadership and willingness to change. I think Garmin made great success in niche market as a small player. Its coming back strategy also focuses on niche markets as a small player. For some companies, scaling or revolutionizing might not fit after all, I guess.

Interesting article. I wonder if Garmin can repeat its unfortunate story of failure in auto segment with their dominance in fitness now. It seems that Apple Watch is going to win the competition for sophisticated users by leveraging iOS as a platform for the apps and tight integration with their phones, not saying about healthcare tracking where Apple may win just because of the scale. Moreover, Garmin fitness trackers are also attacked from the low-end of the spectrum with much more cheaper Fitbits, etc. Further, I’d say that outdoor segment may also face a threat from ever-increasing quality of other smartphone-navigators and trackers.