Water, Sanitation and Agriculture in Ethiopia and Tanzania

Investing in food and water in two East African countries.

Agriculture in Ethiopia and its Relevance to Resiliency

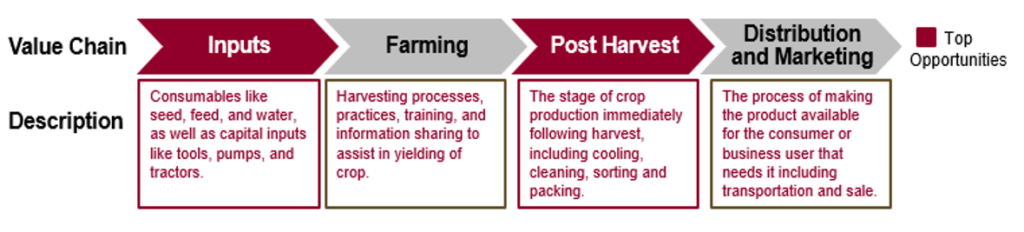

Agriculture remains the dominant sector in Ethiopia’s economy and an important source of economic growth. The sector accounts for 39% of Ethiopia’s gross domestic product, 73% of employment for the population, and 80% of export earnings[i]. Given the economy’s reliance on agriculture, climate related shocks pose a huge threat to the economy, employment rates, food security, and poverty reduction efforts. Thus, investing in the development of the agricultural sector is of critical importance to building resiliency and addressing urban sprawl in Ethiopia. In order to understand the systemic constraints of agriculture development, our team met with experts across the agricultural value chain (see Table 1 for illustration of value chain) to identify market inefficiencies and opportunities for the public and private sector to work together to jointly improve the sector. We identified the biggest opportunities are in inputs and post-harvest.

Table 1: Illustration of Agriculture Value Chain

Development Opportunities in Agricultural Inputs

Ethiopia’s agricultural sector is dominated by smallholder farming with low productivity. In order to improve productivity, we believe input focused public and private partnerships within fertilizer, irrigation, and seed can ensure sustainability and structural transformation of the sector.

Currently, fertilizer makes up a large element of Ethiopia’s balance of payments[ii] and farmers do not yet have access to advanced soil mapping data to realize benefits from optimal application of fertilizer. While the fertilizer industry is controlled by the public sector (government monopoly), we see an opportunity for the private sector to support domestic fertilizer production by investing capital in infrastructure construction, logistics services and distribution, maintenance, marketing, and capacity building to reduce the need of fertilizer imports. For example, the private sector can invest in projects like Morocco’s Office Cherifien des Phosphates (OCP) deal to build a $3.7 billion fertilizer production plant in Ethiopia. Private capital is needed to raise debt and equity, at a 20% IRR for equity investors, in order to begin construction at the end of 2018.[iii]

Many rural farming communities lack water infrastructure and farmers do not have access to capital to invest in technologies like solar powered pumps and irrigation systems to enhance productivity. The private sector has considerable expertise in product development and deployment to invest in projects that provide solar powered pumps and drip water irrigation systems to farmers through microfinance innovations. For example, the private sector can establish projects similar to Netafim, an Israeli company and world leader in smart irrigation for sustainable agriculture, that has taken on a major $200M irrigation project to provide the Ethiopian government’s sugar company with end-to-end irrigation solutions on 7,000 hectares of land[iv].

Limited crop and seed improvements have also contributed to the vulnerability of Ethiopia’s agricultural economy. The lack of seed producers supplying quality seed relative to the quantity demanded, limits farmers from delivering consistent quantity and quality crops to private food processing companies. Thus, there is an opportunity for the private sector to invest capital in the development of private seed enterprises to produce, distribute, and promote consistent and productive seed to farmers. For example, the private sector can replicate partnerships like Diageo’s Meta Abo Brewery, which partners with thousands of wheat and barley farmers in Ethiopia to provide a comprehensive package of inputs including improved seed and credit access[v].

Development Opportunities in Agricultural Post Harvest

We identified two opportunities in post-harvest: agricultural storage and agro-processing. There is currently a large deficit in storage capacity in both dry crops and cold chain. This gap is estimated to be 2.7M metric tons of storage capacity to 2027, is acknowledged by both the public and private sectors, and must be addressed to achieve the agricultural production goals in the Ethiopian Growth and Transformation Plan II. Therefore, there is an opportunity to create a third-party logistics and storage business that builds storage capacity in strategic locations and charges rental and transport fees to commercial producers selling their agricultural products to off-takers. Further in the future, there may be an opportunity to act as a crop aggregator, purchasing agricultural products from the fragmented network of farmers, controlling for quality, and selling to large agricultural processors.

Ethiopia is also attractive for investment in agro-processing. The country is heavily dependent on foreign currency reserves to pay for its balance-of-payment deficit, and the government has prioritized export-focused development. Agro-processing fits this bill, as Ethiopia has a strategic geographical location close to the processed food-importing markets of the Persian Gulf and East Asia. Further, Ethiopia has a comparative advantage in the production of high-quality agricultural products, such as tef, sesame, and honey. Development of agro-processing capacity could occur either within or outside an industrial park, and there are discussions of established agro-industrial parks in the country.

Finally, there is an opportunity to leverage the Zero Liquid Discharge (ZLD) strategy being implemented in the Ethiopian Industrial Parks for private investment in the water and sanitation space. As part of the development of the industrial cities, Ethiopia has pledged that the facilities will be waste-neutral, with treated water offered to the businesses for industrial purposes at a set tariff. The ZLD facilities will be competitively bid; as such, there is an opportunity to invest in the construction and operation of plants or the provision of systems and parts.

The public sector has three main levers to encourage private investment in water, sanitation, and agriculture: market opening, implementation of incentives, and further public investment in enabling infrastructure. Many segments of the agricultural market are closed to private investment. By opening (not necessarily deregulating) the fertilizer market, for example, Ethiopia could encourage investment and production that will enable its farmers to be more productive. Ethiopia could also utilize incentives, such as credit guarantees, land cost waivers, and tax breaks, to encourage investment in storage infrastructure and agro-processing capacity.

Finally, enabling infrastructure – both hard infrastructure such as transport links and soft infrastructure, such as capacity building – would improve the fundamental characteristics of the country and make it a more attractive location for the development of export industries. A more extensive road and rail network would attract agricultural investments because it would allow processors to more economically transport inputs and products for export. There are also early-stage projects evaluating the feasibility of building a network of cold-chain storage facilities along the newly developed Addis-Ababa – Djibouti railway.

Further, investors in the agriculture space should consider how they may look to other sectors to increase the value of their projects. For example, there are opportunities for agriculture in solid waste, where agricultural waste can be processed into livestock feed, and sanitation, with wastewater serving as a potential source of fertilizer. The real estate sector is a potential source of partners for developing storage infrastructure, especially as warehouses and distribution centers are built in urban areas. In ICT, the ability to connect millions of farmers through Ethiopia’s mobile network is highly relevant for the agricultural sector.

Water and Sanitation in Dar Es Salaam and its Relevance to Resiliency

Improvements in sanitation and water access in Dar es Salaam are desperately needed. In terms of sanitation, 90% of the population lacks access to a centralized sewerage system and 70% lives in unplanned communities with poor access to decentralized sanitation facilities. In terms of water, while 85% of the population has some form of water access, only 8% have access via household connections. Lack of space and unplanned settlements complicate efforts for sewerage systems and water pipe infrastructure.

This has direct relevance for city resiliency. A robust water and sanitation infrastructure will reduce the risk of public health shocks. Each year, for instance, there are cholera outbreaks, with over 33,000 cases reported between August 2015-January 2018[vi], resulting from poor sanitary conditions and contaminated water supplies. Outbreaks such as these and other health conditions reduce the aggregate level and sustainability of economic development, thereby exposing a greater number of individuals to economic shocks. This is exacerbated by the unequal costs imposed by a poor sanitation and water infrastructure, as those off grid pay more than those on grid (up to ten times the price for water)[vii].

Development Opportunities in Sanitation

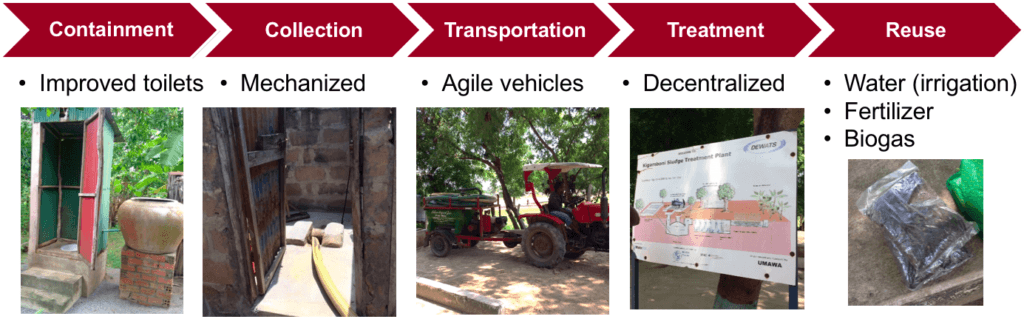

We identified a $50M investment opportunity in decentralized fecal sludge management systems for the 70% who are unserved by sanitation facilities. Such a system would provide containment, collection, transportation, treatment, and reuse of human waste (reflected in Table 2). Within containment, unsanitary facilities such as unlined pit latrines, which can lead to public health issues by contaminating groundwater, would be replaced by improved toilet systems. Within collection, the manual process of dumping waste into streets and rivers would be replaced by a mechanized system that would safely collect waste into a sealed container. The container would then be transported to a decentralized treatment plant by using small, agile vehicles that can navigate the narrow, unplanned streets that are typical of these communities. Finally, decentralized facilities using biological treatment processes, which are scalable and inexpensive, would be used to treat the waste and convert it into reusable products including water for irrigation, fertilizer, and biogas.

We predict that this opportunity would significantly improve the health of these communities while providing a highly profitable opportunity for investors. We estimate a $50M total capital requirement for the investment in 1,200 treatment facilities[1]. Based on interviews with BORDA and entrepreneurs who manage decentralized fecal sludge systems, we expect a payback period of 5 years and 50% operating margins.

Table 2: Overview of fecal sludge management recommendations

Development Opportunities in Water Supply

In drinking water treatment and distribution, we found attractive opportunities for private players to address the water supply issues in the city of Dar es Salaam. One such issue, which is not unique to Tanzania, is the leakage of clean water from the distribution network. An estimated 40% of clean, city-supplied water is lost due to both mechanical leakage (from corroding or damaged pipes) and commercial leakage (from illegal off-taking).

Private players can effectively identify and repair the system leakage, while also sharing in the increased sales for the municipal water authority, via a performance-based contract. In a simplified example, we utilized the water savings from comparable projects of 10% of the system’s capacity, which amounts to an additional 50,000 m3/day of water that can be sold to Dar es Salaam residents. At an official tariff of 1,000 Tanzanian shillings per m3, the project can generate incremental revenue of 50MM Tanzanian shillings per day, or approximately 8MM USD per year. This model is further supported by the reality of frequent water shortages and the 30% of the population that do not currently have access to city-provided water.

As a result of ineffective sanitation infrastructure, the 30% of residents that rely on underground aquifers for potable water are also subject to contamination from wastewater seepage. Private companies can provide technologies such as solar-powered pumps for deeper (cleaner) groundwater collection.

On the demand side, we find that non-residential customers utilize a significant portion of Dar es Salaam’s clean water supply. For the purposes of construction (e.g. concrete-making), agriculture (e.g. irrigation) and industrial cooling, water supply does not need to meet drinking water standards. We see an opportunity for a market for secondary water usage, selling treated wastewater to commercial customers at a lower price point than that of potable water.

The public sector can magnify the effects of private investment. Firstly, it can explore more flexible and innovative contract structures to allow private companies to earn a return on bettering the water and sanitation infrastructure. Secondly, it can enact and enforce legislation to prevent dumping of fecal sludge in unapproved places. This, in combination with continued education campaigns on the public health consequences of improper wastewater disposal, can lead to more demand for professionalized pit latrine emptying. Finally, the government can spearhead responsible wastewater management by utilizing distributed wastewater treatment systems, in addition to the by-products of treated wastewater, in its own facilities.

Taking a multi-sector approach further addresses the issues of water, sanitation and urban sprawl. Solid waste removal in informal neighborhoods clears drainage systems, reducing flooding, which in turn reduces cross-contamination of the stormwater, drinking water and sewerage systems. Additionally, the creation of affordable, dense housing enables economically viable connection of domestic utilities (both water and sewerage) at scale. In the transport sector, investment in planned inter-city roads can provide a right-of-way for buried water and sewerage lines, enable vacuum truck access to domestic pit latrines, and reduce congestion which complicates the transportation of fecal sludge to wastewater treatment facilities. Finally, the public sector can take advantage of improved telecommunication and mobile technology to share best practices regarding the handling of domestic sewage.

Endnote

[1] Assuming a population of 5M people in Dar es Salaam, 5 people per household, 70% of households requiring sewerage systems, 600 households served per facility, and $40K CAPEX required per facility.

References

[i] Agriculture Transformation Agency, (2016-17), Annual Report 2016-17, <http://www.ata.gov.et/download/annual-report-201617/?wpdmdl=2499>

[ii] Simtowe, Franklin. (2015). An Assessment of National Fertilizer Policies, Regulations and Standards for Ethiopia. <https://www.researchgate.net/profile/Franklin_Simtowe/publication/297161589_An_Assessment_of_National_Fertilizer_Policies_Regulations_ and_Standards_for_Ethiopia/links/56dd5a5608aed3a79eb2ab28/An-Assessment-of-National-Fertilizer-Policies-Regulations-and-Standards-for-Ethiopia.pdf>

[iii] Maasho, Aaron. (2016). Moroccos OCP and Ethiopia Sign Large Fertilizer Plant Deal. Reuters. <https://www.reuters.com/article/morocco-fertilizers-ethiopia/moroccos-ocp-and-ethiopia-sign-large-fertiliser-plant-deal-idUSL8N1DK0BR>

[iv] Author Unknown, (2016), Netafim project in Ethiopia financed to the tune of $200mm. Israeli Agriculture International Portal <http://www.israelagri.com/?CategoryID=460&ArticleID=1233>

[v] Author Unknown, (2015), Ethiopia: Growing our Partnerships with Barley Farmers, Diageo, <https://www.diageo.com/en/in-society/case-studies/ethiopia-growing-our-partnerships-with-barley-farmers/>

[vi] Author Unknown, (2018), Cholera – United Republic of Tanzania, World Health Organization, <http://www.who.int/csr/don/12-january-2018-cholera-tanzania/en/>

[vii] Feighery, J., (2017), In Cities, Water Security is a WASH issue, mWater, <https://medium.com/mwater-technology-for-water-and-health/in-cities-water-security-is-a-wash-issue-3c1d150d3ec5>