When the Success of Digital Transformation is a Matter of Life and Death

Whether Cepheid, the first-mover in the point of care diagnostics market, can solve the challenge of connectivity will not only affect the company’s ability to improve patient outcomes but also determine its fate in an increasingly competitive landscape.

Developing countries are increasingly investing in “leapfrog” technologies that bypass conventional, more expensive, or less efficient infrastructure and systems to accelerate development. In healthcare, point of care (POC) devices, which allow a patient to receive a test result when she interacts with a provider, are democratizing access to diagnostics. Cepheid holds a significant competitive advantage in this market with its GeneXpert System. However, GeneXpert’s success hinges not on the technology’s performance but rather on Cepheid’s ability to solve connectivity.

First-Mover Advantage

Cepheid is a molecular diagnostics company specializing in manufacturing scaled-down automated devices that replace complex, manual laboratory procedures. [1] Arguably its most disruptive technology is the GeneXpert, a diagnostic platform that provides rapid results near or at the POC across an extensive test menu. In the global health context, the first widely used GeneXpert test was a tuberculosis assay, which was targeted to patients with multi-drug resistant tuberculosis or HIV-associated tuberculosis.

Figure 3: GeneXpert in GX I, GX II, GX IV, and GX XVI modules.

Since being endorsed for widespread adoption by the World Health Organization in 2010, the technology has proven effective in improving TB care in highly decentralized settings in sub-Saharan Africa and India, where weak infrastructure – poor roads, fragile cold chain, understaffed primary healthcare facilities – limits access to traditional laboratory-based services. [2],[3] In 2015, GeneXpert’s test menu expanded to include an Ebola Assay, which could have helped curb the outbreak in West Africa had it come to market sooner. [4] In June 2016, the WHO approved the HIV Qualitative Assay, which is used to test HIV-infected infants for whom immediate diagnosis and treatment are critical. [5]

In short, this leapfrog technology is a game-changer in delivering patient impact.

Connectivity as Cepheid’s Achilles’ Heel

Ministries of Health have embraced GeneXpert, and POC technology broadly, with open arms. But in pursuit of harnessing big data for better health outcomes, they’re increasingly demanding improved device connectivity, which enables aggregation, analysis, and management of testing data for enhanced patient linkage to care, remote device monitoring, supply chain optimization, and national program performance tracking. [6]

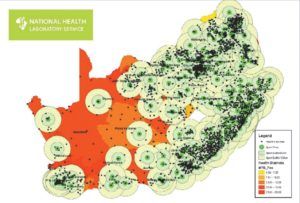

Cepheid did not design GeneXpert with inbuilt connectivity. In response, partners have developed independent solutions, such as the cloud-based GxAlert and server-based XpertSMS, and certain countries have built homegrown systems. South Africa, for example, successfully interfaced its fleet of nearly 300 GeneXpert devices with its national laboratory information management system. [7]

Figure 2: GeneXpert Network in South Africa

In 2015, Cepheid began piloting Remote Xpert, a proprietary connectivity solution. This represents a significant opportunity for Cepheid’s business model, as an integrated solution would allow the company to capture value currently claimed by partners that offer complementary software or devices. Importantly, GeneXpert is no longer the only POC technology on the market; the pipeline is rich, and several competitors whose devices have inbuilt connectivity are nipping at Cepheid’s heels. [8] If Cepheid proves out Remote Xpert, Ministries will likely allocate resources to expand their GeneXpert fleets rather than invest in alternative devices.

However, from an operating model perspective, a proprietary connectivity solution presents significant challenges. Historically, Cepheid has relied largely on distributors to troubleshoot device issues and breakdowns. The possibility of owning the diagnostic system from end-to-end – diagnosis, data aggregation, device monitoring, commodity management – means Cepheid must now consider the extent to which it should directly manage in-country service and maintenance architecture. Greater Cepheid presence on the ground could improve performance of a GeneXpert fleet, as current distributors often do not provide high-quality or timely service, but the upfront capital investment and ongoing costs required to manage networks in every country would be substantial.

Cepheid’s Next Move

Despite the costs associated with changing its operating model in-country, Cepheid should expedite development of its proprietary connectivity solution and move forward with establishing a stronger on-the-ground presence with the ultimate goal of capturing POC market share, as volume drives profit in this market.

Investment in proprietary connectivity and strengthened in-country service and maintenance networks would…

- …raise barriers to entry for competitors. Cepheid has a significant head-start on the competition, as robust GeneXpert fleets exist across many countries. By going all-in on connectivity and in-country architecture, Cepheid can raise barriers to entry, as smaller diagnostic companies cannot afford comparable investments.

- …make switching decisions costly for customers. A well-functioning end-to-end solution will disincentivize Ministries from considering deployment of other POC systems and rather encourage further investment in GeneXpert.

- …lay the groundwork for future technology deployment. In Q3 2017, Cepheid intends to release the GeneXpert Omni. [9] The first device truly designed for use at the last mile, Omni is entirely ruggedized; it weighs one kilogram, is battery-operated, and can survive harsh conditions. Its success will be contingent on service and maintenance architecture provided in-country.

- …establish a strong foundation for future infectious disease outbreaks. GeneXpert’s test menu will expand to further serve established markets and respond to emerging infectious disease crises. [10],[11] Getting connectivity and supporting infrastructure right today could pay huge dividends in the future.

Figure 4: GeneXpert Omni

[799 words]

[1] “Healthcare Impact, The GeneXpert System makes a big impact,” 2015, http://www.cepheid.com/en/healthcare-impact-uk, accessed November 16, 2016.

[2] World Health Organization, Rapid Implementation of the Xpert MTB/RIF Diagnostic Test: Technical and Operational ‘How-to’ Practical Considerations, (Geneva: WHO, 2011).

[3] N. Raizada, K.S. Sachdeva, A. Sreenivas, B. Vadera, R.S. Gupta, et al., “Feasibility of Decentralised Deployment of Xpert MTB/RIF Test at Lower Level of Health System in India,” 2014, PLoS One 9(2): e89301.

[4] Pinsky BA, Sahoo MK, Sandlund J, Kleman M, Kulkarni M, Grufman P, et al., “Analytical Performance Characteristics of the Cepheid GeneXpert Ebola Assay for the Detection of Ebola Virus,” 2015, PLoS One 10(11): e0142216.

[5] Cepheid, “Cepheid Announces World Health Organization Prequalification of Xpert HIV-1 Qualitative Test: Broadens Access to Critical Diagnostic Results for Infants Born with HIV,” June 15, 2016, http://www.prnewswire.com/news-releases/cepheid-announces-world-health-organization-prequalification-of-xpert-hiv-1-qualitative-test-300284806.html, accessed November 16, 2015.

[6] J. Cowan, C. Michel, I. Manhica, C. Mutaquiha, C. Monivo, D. Saize, J. Beste, J. Creswell, A.J. Codlin, S. Gloyd, “Remote monitoring of Xpert® MTB/RIF testing in Mozambique: results of programmatic implementation of GxAlert,” International Journal of Tuberculosis and Lung Disease, 2016, (20)3:335-341.

[7] Wendy S. Stevens, Brad Cunningham, Naseem Cassim, Natasha Gous, and Lesley E. Scott, “Cloud-Based Surveillance, Connectivity and Distribution of the GeneXpert Analyzers for Diagnosis of Tuberculosis (TB) and Multiple-Drug-Resistant TB in South Africa,” in Molecular Microbiology: Diagnostic Principles and Practice, 3rd Edition, Ed. by David H. Pershing, et al., (Washington, D.C.: ASM Press: 2016).

[8] UNITAID, HIV/AIDS Diagnostics Technology Landscape, 5th Edition, October 2015 (Geneva: World Health Organization, 2015).

[9] Cepheid, “World’s First ‘Go-Anywhere’ Molecular Diagnostic System Unveiled at AACC: GeneXpert Omni Sets New Standard for Molecular Point of Care Testing,” July 28, 2015, http://ir.cepheid.com/releasedetail.cfm?releaseid=924107, accessed November 16, 2016.

[10] Cepheid, “Cepheid Targets Development of a Point of Care HIV Viral Load Test From a Few Drops of Blood,” September 8, 2016, http://www.prnewswire.com/news-releases/cepheid-targets-development-of-a-point-of-care-hiv-viral-load-test-from-a-few-drops-of-blood-300324397.html, accessed November 16, 2016.

[11] Mark D. Perkins and Mark Kessel, “What Ebola tells us about outbreak diagnostic readiness,” May 2015, Nature Biotechnology 33(5).

Photo Sources

[Photo 1: Cover Photo] Centers for Disease Control and Prevention, “Ebola (Ebola Virus Disease),” June 22, 2016, https://www.cdc.gov/vhf/ebola/, accessed November 17, 2016.

[Figure 1 Photo] Cepheid, “The New GeneXpert System: New Systems. Same game-changing performance,” 2016, http://www.cepheid.com/administrator/components/com_productcatalog/library-files/8434a8549f97588671a798cf4ab581db-GeneXpert-Brochure-0112-09.pdf, accessed November 17, 2016.

[Figure 2 Photo] Stevens, et. al, “Cloud-Based Surveillance.”

[Figure 3 Photo] Cepheid, “Cepheid Announces.”

Thank you for educating us on digital innovation pushing healthcare improvement.

Reading through this, I could not help but linking this leapfrog with the direct to mobile infrastructure choice in Africa short-cutting the physical land phone network as developed in Europe and North America. A reminder that it often makes sense to think differently a catch-up strategy from a new growth strategy.

I was also pleased to see competition growing in the sector which is likely to push devices’ unit price down thus providing more impact.

Lastly I agree with you that raising barriers to entry, stickiness, cross-connectivity could be a good way to grow Cepheid/Danaher profit pool. They could also look at different funding model potentially monetizing the maintenance, per diagnostic cost or evolution of devices.

Brittany, this is a really interesting company and problem that I had never heard of before. Companies throughout the medical device market are struggling with how to enter the medical device monitoring market and help customers aggregate / use the data created from their products. The additional challenges created by operating primarily in developing markets with potentially limited communications infrastructure make this an even more difficult issue.