Wells Fargo: Banking in the Digital Age

Retail banking today is largely viewed as one of the most traditional service industries. With significant investments in branch locations, ATMs, and customer service representatives, banks continue to struggle with high operating costs and disappointingly low customer experience levels. To address these issues, banks have been moving towards digital technologies to improve the customer experience. As a consequence, the consumer has moved online, allowing banks to shutter branches and cut costs. Much work is yet to be done to fully digitize the banking industry, but Wells Fargo is one of the companies leading the field in implementing advanced digital solutions for customers. By building some of the earliest and most comprehensive mobile platforms and investing in emerging financial technology companies, Wells Fargo is positioning itself to be a bank of the future.

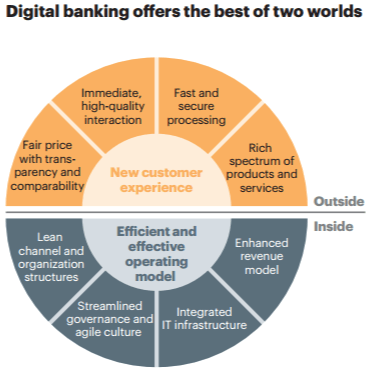

Benefits of digital banking [1]

Mobile banking has been a significant trend affecting the retail banking industry. In 2009, 18% of mobile phone owners reportedly used mobile banking, and this number has grown to 51% of mobile phone owners in 2016. To capitalize on the capabilities of the smartphone and penetrate this increasingly popular customer channel, Wells Fargo introduced its retail mobile banking app in 2012. The company also accompanied this tool with additional resources like SMS-triggered alerts and notifications. These resources have created convenience for customers by allowing them to manage accounts, transact, and explore products without having to visit the branch or even a computer. [2] [3]

In addition to creating one of the first mobile banking apps, Wells Fargo has embraced more advanced technology and digitization by investing in six innovation labs and a Startup Accelerator. Rather than seeking a high return on the technologies developed through these programs, the bank is building relationships with entrepreneurs and engineers whose technologies can someday be used in the Wells Fargo digital infrastructure. One example of a startup the bank has supported is EyeVerify, a participant in the bank’s accelerator program since 2014. Wells Fargo announced in early 2016 that it plans to roll out an eye-scan biometric security technology to its corporate customers to ensure secure sign-in on mobile apps. While there are some doubts and limitations surrounding this specific technology, the bank has been a pioneer of integrating innovative features to its digital interfaces to stay on the cutting edge of mobile technology. [4] [5]

The move towards digital banking has allowed banks to decrease their physical branch footprint, leading to operational efficiencies. From a high of 100,000 bank branches in 2009, the number of retail bank branches in the U.S. has dropped year over year, with some of the largest contributors being Bank of America and Chase. Since 2012, Bank of America has slashed 15% of its branches, and Chase has shrunk 9%. Through the 2009-14 period, Bank of America alone benefited from cost savings of $4 billion from shrinking the size of the branch network. Wells Fargo’s branch count has remained more stable as compared to its competitors but has declined nonetheless from 2012 to 2016 at a rate of 2% per year. [6] [7]

While Wells Fargo has continued to improve customer experience and decrease its branch footprint as a result of mobile technologies, the company can do more to advance its mobile offerings and keep up with customer demands as they increasingly move their transactions online.

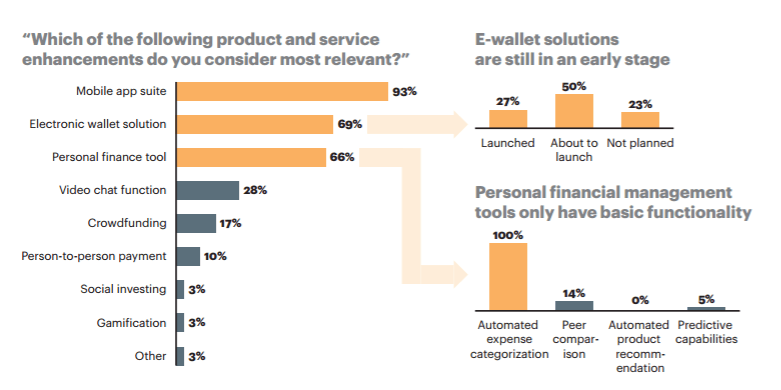

As demonstrated in the graph above, most banks and fintech companies have been focusing on building mobile app suites, electronic wallet solutions, and personal finance tools. Going forward, Wells Fargo and other banks should shift their focus to more advanced digital consumer solutions. Examples include:

- Peer-comparison capabilities for financial products

- Automated product recommendations on the mobile app

- Video chat functions to interact with bank staff remotely, and

- Peer-to-peer payments

By investing in these technologies, Wells Fargo would be reacting swiftly to changes in the customer journey: a move away from in-person advisors to online chatrooms and review sites that grade products and services, a personalized customer experience that does not involve traveling into a physical retail establishment, and the social element of payments that current banking apps do not facilitate. If Wells Fargo is able to successfully launch these products that address customers’ digital behaviors, the bank will improve its customer experience and differentiate itself from less tech-savvy competitors. [1]

In sum, Wells Fargo is ahead of the curve in its adoption of digital technologies to improve the customer experience. With its strategic investments in high-potential startups and technologies, the bank is well-positioned to outpace competitors, whose customer experience significantly lags behind other industries that have already revolutionized their digital platforms. As Wells Fargo continues to invest in its digital future, the company is living up to its customer promise of “Together we’ll go far.”

[796 words]

[1] “Banking in a Digital World.” AT Kearney and Efma, 2013. https://www.atkearney.com/documents/10192/3054333/Banking+in+a+Digital+World.pdf/91231b20-788e-41a1-a429-3f926834c2b0

[2] “Mobile Banking Strategy: 4 Best Practices to Follow.” Centric Digital, April 2016. https://centricdigital.com/blog/digital-trends/mobile-banking-strategy-best-practices/

[3] “Going Far with the Wells Fargo Mobile Banking App.” Centric Digital, May 2016. https://centricdigital.com/blog/digital-strategy/going-far-with-the-wells-fargo-mobile-banking-app/

[4] “Why Wells Fargo Keeps Adding To Its Innovation Initiatives.” Penny Crosman, American Banker. July 2015. http://www.americanbanker.com/news/bank-technology/why-wells-fargo-keeps-adding-to-its-innovation-initiatives-1075682-1.html

[5] “Wells Fargo to Verify Customers through Eye Prints.” Kim Nash, Wall Street Journal, April 2016. http://blogs.wsj.com/cio/2016/04/26/wells-fargo-to-verify-customers-through-eye-prints/

[6] “Scandal may speed up Wells Fargo branch closures.” Matt Egan, CNN, October 2016. http://money.cnn.com/2016/10/21/investing/wells-fargo-branch-closures-fake-accounts/

[7] “Bank Branches in U.S. Decline to Lowest Level since 2005.” Saabira Chaudhuri & Emily Glazer, Wall Street Journal, September 2014. http://www.wsj.com/articles/bank-branches-in-u-s-decline-to-lowest-level-since-2005-1412026235

Interesting that online banking has led to so many retail bank closings. Moving more and more banking services online will probably only increase this trend as you mention, through things like face to face chat with employees for things like basic questions and banking services. I think a great new online banking trend is the proliferation of personal finance tools. This is really helpful for things like budgeting and tracking spending by category. If Wells Fargo can develop an app that lets you plug in your budget and then the app tracks how much you are spending in each category and whether you are above or below budget for a given period, that would be extremely useful.

Alex, thank you for a very interesting post. I agree with you, digital technology in banking can improve the banking experience in many aspects. My only concern is if reducing face-to-face interactions in the banking experience, can end up negatively affecting the bank’s value proposition. This could play out especially in situations when a client needs to make a financial decision in which the level of understanding is very low. Thoughts?