Volkswagen Hits the Road with the Adoption of 3D Printing

Volkswagen is leading the pack in integrating additive manufacturing into its production process. But is this technology scalable? Can it ever materially impact VW's bottom line?

In 2017, the world’s automakers spent a combined $1.1 billion on additive manufacturing (“AM”), a transformative approach to industrial production which utilizes innovative resources such as 3D printing to automate the manufacturing process. By 2028, that figure is estimated to reach $12.6 billion, implying a compound annual growth rate of 25% [1]. What is driving this increased investment? Will the proliferation of AM ultimately transform the way cars are manufactured?

Recent Trends in the Automotive Industry

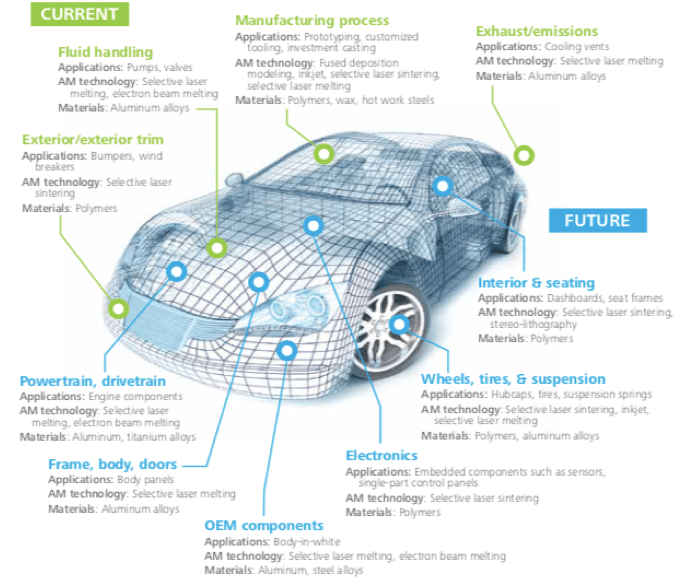

Over the last several years, automotive manufacturers have seen increased demand for improved fuel economy, the use of lighter weight materials, and stricter emission regulations, all of which have contributed to higher costs [2]. On the manufacturing side, there are over 6,000 to 8,000 different parts in each new vehicle, and that number is rising as customers expect more personalization options [3]. For context, the cost of materials and direct labor account for a combined 68% of the cost of manufacturing a car [4]. With new car prices forecasted to remain flat in most global markets for the foreseeable future, automotive original equipment manufacturers (OEMs) have been desperately seeking new ways to cut costs while still remaining competitive and profitable [5]. Enter AM, which was initially used for prototyping and small batch production; however, recent technological advancements have led to mass production capability [1]. The figure below provides a non-exhaustive overview of which parts are currently manufactured using AM and which parts may potentially be in the future [6].

Figure 1: Deloitte University Press [6]

Figure 1: Deloitte University Press [6]

Volkswagen Forges Ahead

Volkswagen (“VW”) is the world’s largest automotive manufacturer, with over 10 million vehicles sold globally in 2017 [11]. The company is no stranger to AM; as a pioneer of the use of AM technology among automakers, Volkswagen debuted 3D printing at one of its manufacturing plants in Portugal in 2014 [7]. By 2017, the company was using seven 3D printers to mass produce more than 1,000 parts each year, cutting production costs on those parts by upwards of 97% [8].

In September 2018, Hewlett-Packard (“HP”) announced a groundbreaking metallic 3D printing technology which is 50 times more productive than other 3D printing techniques, delivering lower cost and higher quality products [9]. One day later, VW announced that it, in collaboration with HP and auto supplier GKN Powder Metallurgy, would be the first auto manufacturer to use the HP Metal Jet process, with the goal of producing 100,000 metal units per year using this technology in 2-3 years [10]. Key parts to be produced include highly customized tailgate lettering, gear knobs, and keys with personalized lettering for customers (see Figure 3 below) [10].

Figure 2: HP’s Metal Jet 3D Printers [12] Figure 3: Sample VW Part Using AM [12]

Figure 2: HP’s Metal Jet 3D Printers [12] Figure 3: Sample VW Part Using AM [12]

Compelling Case for Scale?

While VW management has set short-term goals to incorporate this groundbreaking technology, the longer-term scale benefits remain to be seen. 100,000 units is a commendable goal in the short term, but it represents less than .0001% of the parts going into VW vehicles on an annual basis. Additionally, the parts produced by AM are niche accessories which are largely separate from the “meat” of the production process. Management even concedes, “Complete vehicle will probably not be manufactured by a 3D printer any time soon, but the number and size of parts from the 3D printer will increase significantly.” [3].

In the long-run, AM could represent a significant cost-out opportunity for VW and its peers. However, in its current state as a fringe technology, and without concrete plans at the management level to scale meaningfully in the medium-term, there is no evidence to support the idea that VW’s bottom line will be materially impacted by the use of AM.

Charting Volkswagen’s Path Forward

For VW and its competitors who are serious about integrating AM into their manufacturing process and benefitting from the increased scale and dramatically reduced costs, partnerships with leading AM technology companies are crucial. In particular, targeted research partnerships with these companies are crucial – rather than seeking to apply the newest AM technologies to its manufacturing process, VW should work with its technology partners to specifically design solutions tailored to auto manufacturing. This approach would speed innovation and adoption and ultimately generate value for VW and its shareholders through decreased lead times, increased efficiency, and higher profitability.

As VW contends with these decisions, several questions remain. Can AM ever scale to a point where it will materially impact these companies’ bottom line? If so, what will be the impact of increased AM adoption on VW’s and other manufacturers’ workforce? Finally, as the automotive production process continues to shift to a build-to-order model, can AM be adaptive enough to suit customers’ increasing desires for personalized solutions?

(Word Count: 781)

Sources:

[1] Wright, Ian. “Automotive Additive Manufacturing Market to Reach $5.3 Billion by 2023.” Engineering.com, 6 July 2018, www.engineering.com/AdvancedManufacturing/ArticleID/17238/Automotive-Additive-Manufacturing-Market-to-Reach-53-Billion-by-2023.aspx, accessed November 2018.

[2] Weber, Austin. “Lightweighting Is Top Priority for Automotive Industry.” Assembly, 7 June 2018, https://www.assemblymag.com/articles/94341-lightweighting-is-top-priority-for-automotive-industry, accessed November 2018.

[3] Ready for Mass Production: Volkswagen Uses the Latest 3D Printing Process for Production. Volkswagen AG, 11 Sept. 2018, media.vw.com/en-us/releases/1072, accessed November 2018.

[4] “Car Production Cost Breakdown as of 2015, by Segment.” Statista, www.statista.com/statistics/744910/cost-breakdown-of-car-production-by-segment/, accessed November 2018.

[5] The Road to 2020 and beyond: What’s Driving the Global Automotive Industry? McKinsey & Co. , Sept. 2013, www.mckinsey.com/~/media/mckinsey/dotcom/client_service/ Automotive and Assembly/PDFs/McK_The_road_to_2020_and_beyond. ashx, accessed November 2018.

[6] Giffi, Craig A., et al. 3D Opportunity for the Automotive Industry. Deloitte, 19 May 2014, www2.deloitte.com/insights/us/en/focus/3d-opportunity/additive-manufacturing-3d-opportunity-in-automotive.html, accessed November 2018.

[7] 3D Printing Continues Making Inroads in Auto Industry. National Law Review, 13 Sept. 2018, www.natlawreview.com/article/3d-printing-continues-making-inroads-auto-industry, accessed November 2018.

[8] O’Connor, Daniel. Can You Jig It? 3D Printing inside Volkswagen Autoeuropa. TCT Magazine, 22 Feb. 2018, www.tctmagazine.com/can-you-jig-it-volkswagen-ultimaker-3d-printing/, accessed November 2018.

[9] HP Launches World’s Most Advanced Metals 3D Printing Technology for Mass Production to Accelerate 4th Industrial Revolution. The Hewlett-Packard Company, 10 Sept. 2018, press.ext.hp.com/us/en/press-releases/2018/hp-launches-worlds-most-advanced-metals-3d-printing-technology.html, accessed November 2018.

[10] Ready for Mass Production: Volkswagen Uses the Latest 3D Printing Process for Production. Volkswagen AG, 11 Sept. 2018, www.volkswagenag.com/en/news/2018/09/volkswagen_3d_printing.html, accessed November 2018.

[11] Porter, Sarah. Car Industry: Who’s the Biggest of Them All? BBC News, 14 Feb. 2018, www.bbc.com/news/business-43028005, accessed November 2018.

[12] Blain, Loz. HP Launches Metal Jet 3D Printing Technology for Mass Production. New Atlas, 13 Sept. 2018, www.newatlas.com/hp-metal-jet-3d-printing-production/56315/, accessed November 2018.

It is interesting to see how recent some of these Additive Manufacturing advancements are- truly an evolving technology. I think that while AM is a fringe technology for VW at the moment, there is clearly a commitment ($$$) to its implementation within the company, and potentially within the automotive industry. What I am more skeptical of is the ability for AM to customize / personalize a car part for a particular customer (e.g. build an ergonomic seat shaped specifically to a customer’s body shape). My skepticism here is derived from the sheer number and speed with which VW is producing vehicles. Spending even 15 minutes to print a customized seat could be too detrimental to the overall process flow. Great article!

Great article L 401! I agree with Svenardi that customization might disrupt the whole production process and might not be as effective as VW desired the technology to be. I would also add that customization of cars is not only shape/design, it is mainly by type of hardware used. So companies would typically tailor make their cars to cater for the needs of specific geographies and climates. For example, cars made for the gulf are manufactured in a way that they can tolerate very high temperatures. Where would AM fit in this customization?

We have already passed “peak car”. More than 50% of the world’s population currently lives in cities. That number is projected to increase to 70% by 2030. In the future, passenger vehicles will largely be used for ride-sharing, not personal use. As a result, I don’t believe that personalization is an attractive medium-long term benefit of additive manufacturing to automotive OEMs. The more valuable benefits of the technology, in my opinion, are the reduction in capital expenditures and lead times associated with component design changes.

I agree with Thomas regarding the ride-sharing trend. However, there could still be a market for personalization depending on which target market VW would like to focus on i.e. VW could position its 3D-enabled cars as premium products that compete with brands such as Porsche, Bentley and Jaguar. I do believe that close research partnerships with AM technology companies will help VW speed up the implementation of this technology, enabling it to scale AM to cover current models of VW as well.

Thank you for the great article – super interesting topic!

On your questions; I agree with Thomas that AM has limited potential in car customisation. However, I believe AM has significant potential to be applied in other areas of the automotive industry.

Specifically, I believe that AM can also be used to create support tools for automotive production lines. This is not about using AM to produce the input parts as mentioned above, but instead about creating printed tools to support production and quality assurance on the factory floor. One case study of this I found stood out to me; Stratsys, a 3D printer manufacturer, helped to design a multi-functional tool to combine several production steps and check the quality of a taillight, via measurement, in one step [1]. While this is a simple application, it illustrates that the use of AM in the automotive industry should not be limited to producing input parts.

—

[1] Stratasys, “Five Ways 3D Printing is Transforming the Automotive Industry”, 2016, http://www.stratasys.com/resources/search/white-papers/transforming-auto-industry?resources=58ebc939-4384-4476-95c0-63055c5ee9af, accessed November 2018.

No doubt those huge HP metal printers are very expensive equipment. Scaling up this technology would require huge upfront capital investment. However, considering the fast pace this industry is evolving, is it smart for BMW to make a mega investment in 2018 printers if next year’s version will most likely be far superior? Like buying a laptop, after a couple of years you will buy a new one to keep up with the increased computing power. It seems hard to find the right trade off between investing for a long-term manufacturing facility vs retaining flexibility to go for the latest technology available. Maybe something like a car-leasing scheme could work — e.g. you return your printer back to HP every X years in exchange of the latest one available?

Wow, very interesting that they are investing so heavily into AM. I see that current consumer parts are more gimmicky personalized components. Do you think that someday, large portions of a car could be 3D printed? I would love to be able to buy a car that’s unique to my personal tastes without paying Ferrari or Lamborgini prices. Moreover, has AM been applied to aftermarket parts? I feel like inventory costs for replacement parts must be very expensive due to their unpredictable nature. Could we print those someday? It’d be amazing if someone could just print me a new bumper everytime I get into a car accident haha.

I see this a bit differently. To me, no doubt that ridesharing will become a larger share of car usage, and the cars used in this application will likely be standardized, meaning this portion of the category may not benefit from the personalization benefits afforded from 3D printing. Ridesharing and autonomous vehicles are still decades away from replacing all car usage, and individual car ownership will likely endure at least through the medium term, especially outside urban environments. For these customers, personalization may actually be a key differentiator and more in demand than before. The idea of personalized ergonomic seats or otherwise customer-specific parts is intriguing. While it may not make sense to install these products at the automotive factory, it may be possible to build these parts separately and install the parts at a dealer. Aftermarket, dealer-installed parts are already commonplace in the industry, and supplying more individual-specific pieces could be a real advantage for the brand with customers.

Colm brings up a good point about additive manufacturing being applied to tool construction — this is likely a relevant and useful application.

Interesting article and well-researched. I was intrigued by the discussion above on ride-sharing and the macro trends which might not necessitate customized car demands. However, it leads me to think if there is an opportunity to produce customized features for higher-end individuals using 3D printing for Volkwagon which is a more mass brand and what the cost-benefits of those would look like. It would require deeply engaging partnerships with consumers. VW can also potentially use AM in production processes to test different inputs on their assembly line vs just the output of the car parts.

Great article! One thing that I’m thinking about is how additive manufacturing may help VW prepare for another industry disruption–self-driving vehicles. As vehicles become more autonomous, will more of their parts be AM-friendly? This may be a way for VW to stay competitive as the industry advances. I also think that VW should consider manufacturing techniques that will help them create cheaper, higher-quality, more-customizable parts that don’t make sense to AM (e.g., I don’t believe that an axel would be cheaper to 3D print than manufacture in the traditional way.) I am struggling to see the value AM for customization purposes; when I think of customizing cars, I struggle to see how typically customizable things–like upholstery, exterior color, premium sound systems–could be created with AM. I am curious to learn more about how AM is used to customize cars. (Disclaimer: I’ve never owned or shopped for a car…)

Thank you for this – a very interesting topic and application of 3D Printing and additive manufacturing! I also question the validity of the argument that customisation can be the core focus of AM. I agree with Thomas below that with the overcrowding of urban spaces and the sharing economy, the future will involve different types of mobility versus just cars, as we know. We see the auto industry overall moving in this direction. I add that I think AM has a role to play in R&D especially as VM will need to continue to experiment with new products as it navigates a new world for the auto industry.