Unlocking accessibility to the stock market, even for the visually impaired

Looking to to democratize access to financial markets, Robinhood has disrupted the online brokerage industry with its cool designed, easy to use and free mobile trading platform.

According to Joseph Schumpeter creative destruction is the “process through which something new brings about the demise of whatever existed before it” Creative destruction replaces the old with the new and destabilizes established economic relations, incentivizing innovation and therefore economic growth. [1] The problem arises when the wave of creative destruction, in fact, brings more destruction than creation. Today, the confluence of globalization and technology is continuously making the gap between the rich and the poor greater. In reaction to such situation, social entrepreneurs and new businesses have arisen, looking to bridge this gap through innovation and technology. I called them the Robin Hoods of ideas and business. Among them is Robinhood, the mobile platform, founded by two Stanford graduates after the Occupy Wall Street movement, whose sole mission is to democratize access to the financial markets. [2]

The stock market is one of the best available tools that exist today for individual wealth creation. But only 10% of the adult population in the US directly owns shares. [3] Robinhood looks to democratize access to the financial markets by inspiring and empowering more people to invest in stocks with the help of technology, and by capitalizing on the vast, largely untapped market of millennial investors, which they believe can help shrink the gap between the “haves” and the “have nots” and lead to a healthier, more robust global economy. [2] Robinhood aspires to achieve this ambitious goal through an app-based stock brokerage that offers commission free trading and by helping investors learn to invest without the dizzying additional futures or price tags of current traditional discount online brokerage firms like Ameritrade. A zero-commission and easy to use stock-trading platform presents a serious value proposition for millennials and young investors.

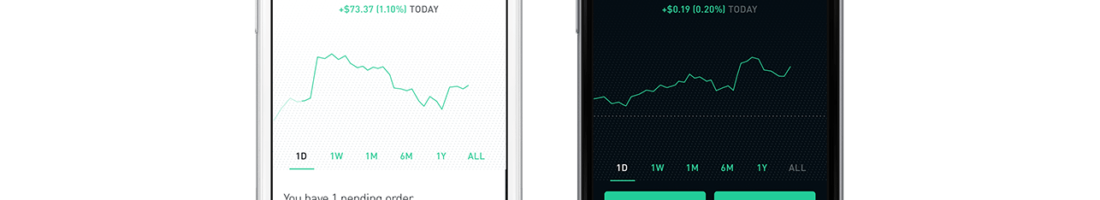

But how does Robinhood achieve this objective and deliver such an ambitious value proposition? Steve Jobs once said “good design isn´t just how something looks and feels but how it works” [4] Robinhood has internalize and owned this mentality. The platform´s nice and clean design simplifies the investment process and makes the user experience simpler and more gratifying. The interface is simple and tactile, giving people the sense that when they open the app, they are holding their money right in their hands. The company was able to put a very complex design under a very simple product and make it free. In order to accomplish this, the company was built from the ground up as efficient as possible by keeping its cost structure extremely lean: no physical locations, a small staff, no massive public relations campaigns and only one platform to maintain, passing the savings along to the costumers. Robinhood makes money by collecting interest from margin accounts, which is like a loan that lets people have more money to trade with, and by generating interest from costumers´ unused cash balances. Such a successful and innovative operating model, which allows the company to deliver its value proposition is probably the reason why in 2015 it raised $50 million in funding from a diverse set of venture capitalists like Google Ventures, and won an Apple Design Award, the first fintech app to do so.

Robinhood is now the fastest-growing brokerage in history, with more than $3 billion in trading volumes. According to the company. Its almost 1 million customers have saved some $70 million in trading commissions. [5] Some of it success may be to the fact that the established discount brokers haven´t budgeted for 15 years and badly need some fresh competition. In recent years, only institutional investors have been able to benefit from advancements in technology, while the average citizen, has seen no cost saving whatsoever. Robinhood is able to bridge solve this issue due to his unique competitive advantage of a free and mobile-first lower head cost with no branches or ads. It keeps the company ahead of competitors who have to constantly deal with high fixed costs and regulatory roadblocks. It won´t be easy for any competitor or new entrant to catch cup as long as Robinhood keeps this competitive advantage locked tight.

Going forward, the company is working to reach a broader market of consumers. For example, in May of this year, the company teamed up with LightHouse for the Blind to develop a feature the allows the Robinhood platform to be entirely accessible for people with visual disabilities. The company is also looking for strategic partnerships with developers, letting them build its functionality into already existing products like StockTwits and Quantopian, which could revolutionize trading. [6] It also plans to include educational tips and insights about investing. And finally, it´s eyeing international expansion where Mexico can be a huge potential market as stock market penetration is considerable low and current per-trade fees can reach over $50. [7]

792 words

[1] Schumpeter, Joseph A. (1994) [1942]. Capitalism, Socialism and Democracy. London: Routledge. pp. 82–83.

[2] https://robinhood.com/company/

[3] Hong Kong Exchanges and Clearing Limited, Retail Investors Survey 2011 (Hong Kong: Hong Kong Exchanges and Clearing, 2012), and Tom Holland, “Alibaba’s Plan to Stuff Board Hardly in Investors’ Interests,” cited in Raymond Siu Yeung Chan and John Kong Shan Ho, “Should Listed Companies Be Allowed to Adopt Dual-Class Share Structure in Hong Kong?” p. 175

[4] “The Steve Jobs Nobody Knew”. Rolling Stone. 2016-02-24.

[5] https://techcrunch.com/2015/10/26/free-stock-trading-app/

[6] “Unlocking Accessibility to the Stock Market”. http://blog.robinhood.com/news/2016/5/19/unlocking-accessibility-to-the-stock-market

[7] “Zero-Fee Stock Trading App Robinhood Nabs $50M From NEA To Go Global”. TechCrunch. AOL. 7 May 2015.

Thanks for the great article Chanti! I was already aware of Loyal3 (https://www.loyal3.com), but this is my first introduction to RobinHood. I always enjoy learning about disrupting companies that contradict “truths” that have been otherwise accepted for decades, such as commission-based stock trading.

I did find it interesting that RobinHood still has to charge fees on security sales, which are mandated by the U.S. Securities & Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). See https://support.robinhood.com/hc/en-us/articles/208650436-Fees-on-Robinhood-

Also, RobinHood plans to make money by encouraging margin accounts, which generate interest income for RobinHood. If RobinHood’s mission is to introduce investing to millennials, I question their strategy of promoting margin trading. When trading on margin, you need to additionally obtain returns to cover your margin costs, which can range from 5-10%. This might not be the best lesson for a new investor…

To that end, I think the positioning of Loyal3 is better. Loyal3’s customers are public companies who realize that customer loyalty can be increased with share ownership. Also, to keep costs down, Loyal3 bundles its entire trade orders into 1 order per day. On the downside, this doesn’t provide much price discovery to its investor customers, but on the upside, this bundle trading keeps transaction costs down.

It will be very interesting to see how these disrupting “free” brokerages will continue to impact large financial institutions.

Great article Chanti. As a current Robinhood user, I agree with with the sentiment in the comment by HCL that Robinhood’s mission to “democratize” trading might be more harmful than helpful. As you mentioned the Robinhood app really got it right when came to app design. The app is super clean and easy to use; It is definitely app that attract millennials. However, I worry that they’ve made it *too* easy to trade. Since there are zero-cost involved there is a lot less analyzing that goes one before a trade. To wit: https://www.reddit.com/r/RobinHood/. Browsing this popular reddit one can find numerous posts touting bio-tech/pharma stocks replete with app screen shots showing great growth, and many novice traders eagerly taking on those positions. Often times these stocks experience a precipitous fall in price shortly after ala the pump-and-dump schemes of the eighties. I worry that Robinhood may be providing too much access due to its pricing structure.

I’m also curious how the free trades are a defensible business strategy. Can a major discount broker do the same thing for a while and put Robinhood out of business?

Really interesting post I love Robinhood and what they are doing. The idea of a low margin brokerage business with an elite online platform is a game changer for the industry as banks are refusing to lower trading fees to the discounted brokerage model. The one issue I have with Robinhood is the customer service, which as you mentioned is kept very lean. The main issue with this is that when a trade related issue happens it is a big big deal, especially when it is your life savings on the line and its a large amount. Getting a discounted broker on the phone is notoriously tough and Robinhood is no exception, and to get someone at a senior level who actually carries enough weight to get the problem fixed is an even harder tasks, with heavy weight times and poor feedback and response times from an over worked often underpaid staff.

This is fantastic! I really enjoyed your point on the importance of visual aesthetics. I don’t think enough people in retail finance realize how importance it is to look and feel accessible in order to mitigate customer’s concerns about getting involved in the risk of the stock market. I think it is important that more Americans get involved in investing at least a part of their own money in the markets– maybe the platform of RobinHood could be used for the inbound marketing we’ve learned about by including more education on investing personal finances. I also really like, as you say, that individuals are finally benefiting from technology that institutions have been using. I hope there become cheaper ways for RobinHood to show individual traders how past strategies have worked and why and how to adjust their future plans.