Under Armour Wants Your Data

Under Armour invested nearly $1B in a venture to create and grow an online health and fitness ecosystem through applications and wearable technology. Will this improve their business and operating models?

Business and Organizational Model Opportunities

Under Armour is a sports apparel and equipment company aimed to create value for consumers by delivering on their mission, “To make all athletes better through passion, design and the relentless pursuit of innovation.”[1] The company generates revenue through selling their apparel and equipment across several channels ranging from online to sporting goods retail stores.

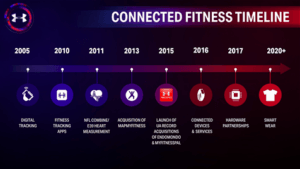

Embracing digital innovation as a means to sell more apparel and equipment, Under Armour is seizing the opportunity to create an online community through its Connected Fitness platforms. Through acquisitions of health and fitness platforms such as MapMyFitness, Under Armour owns four apps that allow consumers to track activity, sleep, workouts and nutrition. One of these apps, UA Record, acts as a health dashboard connected to the company’s wearable technology product, Health Box, which was developed in partnership with HTC.[2] Health Box consists of a heart rate monitor, a body weight and body fat percentage scale, and a fitness band measuring sleep and activity.[3] The data gathered by these apps and wearable technologies uploads to Under Armour’s Connected Fitness platform to create value to the consumers by allowing them to track their fitness and health.

To build the capacity to monetize the value created for the consumer, Under Armour altered its organizational model. After the acquisition of MapMyFitness, Under Armour stood up a digital headquarters consisting of “engineers, data scientists, designers, and product innovators in digital health, fitness, and sports.”[4] This has allowed the company to innovate in the application of software develop and data analytics.

Operating Model Opportunities

Under Armour’s apparel operating model consists of hiring low-cost manufacturing partners around the world. Their digital operating model consists of acquiring and integrating technology companies into their digital headquarters to improve software, while partnering with HTC to build and improve hard ware. These models support five growth drivers – Digital Technology, Women’s Wear, Direct to Consumer, Footwear, and Global Expansion – to deliver their mission to their customers.[5] Currently, Under Armour has 190 million users on its Connected Fitness platforms.[6] To support their business model, CEO, Kevin Plank “envisions all of those users, and their metrics, as a big data engine to drive everything from product development to merchandising to marketing.”[7] This provides an opportunity to shorten the feedback loop from consumer to product development teams, and quickly improve products based on customer wants and needs. Under Armour has already leveraged this advantage in their product development cycle. Data from MapMyFitness identified the average run distance, and aided in the development of a shoe tailored for the average jogging distance, 3.1 miles.[8]

Moving Forward

For this investment in wearable technology and connected health platforms to pay off, Under Armour should find a method for the platforms to generate sales. An example could be the app suggesting to the user to buy new shoes or apparel based on the number of miles logged. The platform could then redirect the consumer to products that meet the athlete’s profile.

To gain salience amongst consumers, a health and fitness app needs to be as least cumbersome as possible. Under Armour can achieve this in two ways. First, they must find a way to consolidate their digital platforms into the most robust experience possible with the least amount of effort required by the consumer. Second, Under Armour should develop improved wearable technologies requiring less user interaction. This may take some time to develop non-invasive technologies, but this will be crucial to gain access to data to improve their product cycle feedback loop.

The main challenge and threat Under Armour faces is the role of Apple in the wearable technology market. In partnering with Nike, the Apple Watch Nike+ is improving in functionality to the original Apple Watch and interacts with the Nike+ run app community. How fast can Under Armour move to beat this ominous partnership? (799 words)

The main challenge and threat Under Armour faces is the role of Apple in the wearable technology market. In partnering with Nike, the Apple Watch Nike+ is improving in functionality to the original Apple Watch and interacts with the Nike+ run app community. How fast can Under Armour move to beat this ominous partnership? (799 words)

[1] http://www.uabiz.com/company/mission.cfm. Accessed November 16, 2016.

[2] Foster, Tom. “Kevin Plank is Betting Almost $1 Billion That Under Armour Can Beat Nike.” Inc. http://www.inc.com/magazine/201602/tom-foster/kevin-plank-under-armour-spending-1-billion-to-beat-nike.html. Accessed November 16th, 2016.

[3] https://www.underarmour.com/en-us/healthbox. Accessed November 16, 2016.

[4] “Kevin Plank – Chairman, CEO and President, Under Armour Inc.” Boardroom Insiders Profiles: n/a. San Francisco: Boardroom Insiders, Inc. (Mar 13, 2015).

http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1668322808?accountid=11311 Database: ABI/INFORM Collection, accessed November 15,2016.

[5] Kaminski, Bryan. Under Armour Company Presentation. Harvard Business School, Boston, MA. November 3rd, 2016.

[6] Kaminski, Bryan. Under Armour Company Presentation. Harvard Business School, Boston, MA. November 3rd, 2016.

[7] Foster, Tom. “Kevin Plank is Betting Almost $1 Billion That Under Armour Can Beat Nike.” Inc. http://www.inc.com/magazine/201602/tom-foster/kevin-plank-under-armour-spending-1-billion-to-beat-nike.html. Accessed November 16th, 2016.

[8] Foster, Tom. “Kevin Plank is Betting Almost $1 Billion That Under Armour Can Beat Nike.” Inc. http://www.inc.com/magazine/201602/tom-foster/kevin-plank-under-armour-spending-1-billion-to-beat-nike.html. Accessed November 16th, 2016.

Cover Image: https://www.underarmour.com/en-us/healthbox Accessed November 17th, 2016.

Digital Growth Strategy Image: Seth McNew, “150 Millions Reasons to Bet on Under Armour’s Connected Fitness Growth.” http://www.fool.com/investing/general/2015/12/22/15-billion-reasons-to-bet-on-under-armours-connect.aspx Accessed November 17th, 2016.

It will be very interesting to see how the data that Under Armour allows them to target their marketing in an extremely customizable manner based on the data they’re receiving for each athlete. As UA competes with Nike on these new digital platforms, I think it will be critical for UA to differentiate its products from that of Nike and stays true to its brand image of the underdog. In a sense, the fact that they’re going up against the Nike/Apple superteam validates that underdog position in the market. So perhaps they can play that message up to the younger demographics who might view Nike as being overly established and thus more of their father’s (or at least their older brother’s) athletic apparel company.

Wow, this competition for the online business in sports goods between Nike and Under Armour is very interesting.

However, it seems like they are taking different approaches.

At first sight, it seems like Under Armour is acquiring companies already established in both software and hardware to gain market share.

Then, on the other hand, Nike is either developing the technology in-house or making partnerships for products like the Apple watch.

It seems that it will be a race of who can achieve the largest market share and can connect these technologies to their core products.

Soon we might be seeing as you mention in your post, suggestions for products given our weight/height/BMI and exercise activities.

This means that Under Armour will have to invest in merging these applications together (MyFitnessPal, Endomondo, etc.).

Or, finding synergies between all the applications and how they can better suit their business.

Right now, Under Armour should focus on acquiring the largest number of customers in their applications and look for a revenue model later.

Once they have achieved a large customer base they can look for strategies to monetize by maybe offering bundled products.

Next, they should use their better data from the apps to better develop products that match their customer base.

This will be very interesting to follow in the future, as we also need to consider additional competitors (Adidas, New Balance, etc.)

One would expect this will lead to better products and better apps as they better match physical products with technology.