The impact of climate change on Saint-Gobain’s supply chain

Saint-Gobain’s manufacturing plants have to be included in the company’s overall environmental strategy to hedge against the risks created by climate change. Here we discuss a couple of ideas to manage these risks.

Saint-Gobain is a $42B revenue French multinational corporation that develops, produces, and distributes glass, polymer, and ceramic materials. Its product portfolio can be divided into three families: Flat glass (for buildings and cars), High-Performance Materials (plastics, ceramics, and textiles), and Construction Product (pipes, acoustic and thermal insulation, roofing, flooring, and wall facing solutions). Adding to this portfolio an activity of building material distribution and you get an organization whose economic prospects will be unavoidably impacted by climate change. First and foremost, the main market Saint-Gobain operates in (building materials) has been increasingly concerned with energy efficiency since the first oil crisis in 1973 [1]. Over the past 20 years, this trend has been accelerating and is likely to keep doing so in the coming decades. Second, the production of glass and ceramic, two major businesses for Saint-Gobain, require substantial amounts of energy, whose consumption can only be optimized so much. Finally, Saint-Gobain relies on the supply of raw materials such as clean water, sand, and minerals to manufacture its products, whose extraction and distribution might be impacted by climate change in the long run.

What is Saint-Gobain doing?

1. Staying aligned with and being active about global actions against climate change

Generally speaking, Saint-Gobain focuses its strategy on sustainable construction [2] and is always trying to penetrate new markets based on sustainability [3]. Besides, it is among the 1,200 non-state actors that signed the Paris Pledge for Action on Climate Change. Being an active member of environmentally friendly networks and quickly integrating sustainable recommendations into its strategy enables Saint-Gobain to anticipate major trends and regulations that pertain to climate change.

2. Monitoring and communicating its impact on the environment

Saint-Gobain closely monitors and publicly communicates at the group level key environmental metrics such as energy consumption, raw material and production waste, GHG emissions, and water consumption and discharge. It also performed a comprehensive and rigorous Life Cycle Assessment on most of its products and solutions to gauge the impact over time of its sustainable measures on the company’s footprint.

3. Taking proactive measures to anticipate future regulations

Besides targeting the market of energy-efficient building materials and keeping track of its environmental footprint, Saint-Gobain proactively sets ambitious goals for itself. For example, a new internal carbon pricing strategy was implemented on January 1, 2016 to achieve the goal of reducing its carbon emissions by a factor of 4 by 2040, compared to its 2010 level.

What other steps can Saint-Gobain take?

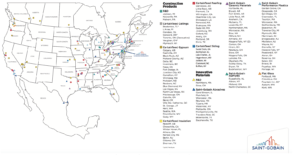

One aspect of its supply chain that Saint-Gobain seems to have overlooked so far relates to its manufacturing base. Saint-Gobain operates hundreds of production plants all over the world. We show in figure 1 the example of North America with its 138 Saint-Gobain plants.

Figure 1: Saint-Gobain in the U.S. and Canada 2017

By the nature of the products they manufacture, some of these plants consume a substantial amount of energy, which creates a major risk for the company. Figure 2 is a snapshot of the process used by Saint-Gobain to produce flat glass.

Figure 2: Snapshot of the float process for the production of flat glass

To address this concern, Saint-Gobain should invest in renewable energy capacity to hedge against the risk of energy becoming the main cost driver for its products. In the short term, the company should prioritize the plants to be supplied with clean energy based on the following criteria:

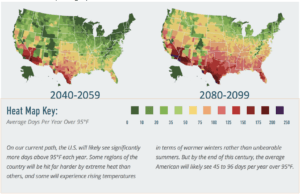

- The plant is located in an area that is likely to face extreme temperature increases, straining regional generation and transmission capacity and driving up costs of electricity. Figure 3 gives an idea of where these areas are.

- The plant is energy-hungry. For instance, plants that belong to the Flat Glass and Ceramic Material divisions should be looked into (see Fig. 1).

- The plant is currently running on a carbon-intensive fuel. Some plants wouldn’t fall within this category, such as the ones that run on hydroelectric power in the Niagara Falls area (see Fig. 1).

Figure 3: Prediction of US regions that will experience extreme heat in the next 20-40 and 60-80 years [5]

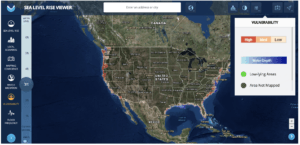

Another long-term concern for Saint-Gobain’s supply chain is the expected increase in sea level and coastal storm damage. An increase in sea level of three feet by 2050-2070 [6] would make several coastal regions where Saint-Gobain’s plants operate highly vulnerable, as shown in figure 4.

Figure 4: Map of North America for a sea level rise of 3 feet compared to the current sea level [7]

Currently, in the US, Saint-Gobain owns about 20 plants in these vulnerable areas. Hence, the company should proactively evaluate the risk of maintaining some of its manufacturing base near coasts.

In the same vein, it would be interesting to study the impact of sea level rise on the supply of raw material that Saint-Gobain uses for their products such as minerals and rare-earth.

(746 words)

[1] A. H. Rosenfeld and D. Hafemeister, Energy-efficient Buildings, Scientific American, Vol. 258, No. 4 (APRIL 1988), pp. 78-87

[2] https://www.saint-gobain.com/en/group/strategy

[3] C. Laszlo, Sustainable Value, Problems of sustainable Development, Vol. 3, No. 2, pp. 25-29, 2008

[4] Saint-Gobain 2016 Annual Report.

[5] K. Gordon, Risky Business: The Economic Risks of Climate Change in the United States, Risky Business Project, June 2014.

[6] W. V. Sweet et al., Global and regional sea level rise scenarios for the united states, NOAA Technical Report NOS CO-OPS 083 ed., January 2017.

[7] https://coast.noaa.gov/slr/

You raise interesting points, and I like how action-oriented this is in providing a prioritization of plants to be examined for.

However, I’m not quite whether the first category of prioritization should be plants where increasing temperatures drive up regional generation and transmission costs. While I don’t disagree with the phenomenon you describe (you may have come across this source already http://iopscience.iop.org/article/10.1088/1748-9326/11/11/114008/pdf), it’s probably not the most urgent in the short-term. For example, the rising cost of generation v. the cost savings promised by renewables is probably a more compelling driver to contract for non-fossil fuel capacity and favors taking care of prioritized categories two and three (energy intensive and carbon-intense fuels). By the time St-Gobain does this, it will likely have already tackled category number one as well.

Separately – as you cite, the impact of a rise in sea levels isn’t something that contracting for greener energy can directly counter – might there be a strategy where St-Gobain looks at manufacturing footprint consolidation and relocation, so that they move away from coastal exposure and reduce logistics cost? While the current plant network is likely optimized for shorter, regional distribution, we could also imagine that the company partners with lower-emission logistics providers and reduces its overall plant count to force energy efficiencies.

Eric, I thought your post was very interesting and insightful. I agree with your proposed measures around investing in renewable energy capacity to minimize the risk of increasing cost due to increasing energy consumption for manufacturing.

However, I think that there’s room for Saint-Gobin to take a look at its end-to-end supply chain when addressing sustainability issues and the impact of climate change. Specifically, the company could leverage its relationship and important position with its suppliers of raw materials, such as water, sand, and minerals. Saint-Gobin could create incentives for its suppliers to evaluate and report on how their practices impact the environment. It could also commit to purchasing a certain amount of its raw materials from providers that operate above a certain threshold when it comes to practices that may contribute to climate change. Overall, I believe there’s an opportunity to take more holistic view of the sustainability problem, particularly given that the extraction and distribution of water, sand, and minerals are largely impactful for the environment.

There are a variety of risks from climate change, and physical risks from severe weather related disasters are one of them. I agree with your point that Saint-Gobain should move away from locations that are highly exposed to severe weather in the long-term. But because of the heavy capital investment and time needed for this change, it should focus on developing technical capabilities to help mitigate the potential risks from such disasters in the short term.

Today the government, environmental agencies, as well as construction/infrastructure companies are prioritizing global climate change sustainability initiatives. I think Saint-Gobain should collaborate with these stakeholders to gain support to develop innovative solutions that reduces the environmental impact of buildings throughout their entire life cycle, from the raw materials to the end-product. I really like Saint-Gobain’s promoting dialogue with the public, and it should continue to lead and educate customers on their initiatives.

I also think because Saint-Goban heavily depends on raw materials like water, sand, and minerals, it should develop sophisticated tools to track down energy data for each of its products and increase visibility of real-time energy use to identify and improve areas where energy inefficiencies occur.

As with any company that utilizes natural resources on a large scale, I can imagine that there is significant push and pull between implementing the energy efficient production methods that customers desire and the costs to do so. My main concern for Saint Gobain is around the ability to maintain its customer relationships, and contract in a way that customers understand the attribution of increased costs to their climate change efforts. While many customers are increasingly demanding a clean and sustainable supply chain, not all of them are, and implementing these efficiencies requires transforming the entire manufacturing process and cost structure. Increased costs could affect not just those who are willing to pay a higher price for energy efficiency, but also those who simply seek the lowest cost manufacturer.

Is the Company effectively communicating with its customers the changes it is making around climate change? Is the Company working with governments to apply manufacturing standards across its competitors, so that it does not put itself at a disadvantage?

Eric,

I enjoyed hearing your perspectives on how Saint-Gobain is combating climate change.

Given the company’s reliance on raw materials – such as clean water, sand and minerals – which are directly impacted by global warming, the topic you picked is imperative for the company to sort out. The dual-approach you propose in terms of short-term and long-term strategies feels as though it is an effective formula for management to take to address their risks.

I wholeheartedly agree with your suggestion that management should, in the short-term, focus on plans that are in areas which are scarce on the raw materials the company needs. Although effective in the short-term, I agree with your view that they will also need to implement some long-term measures. Evaluating whether they should maintain manufacturing bases near the coasts would be a good course of action for management to purse. To de-risk their business in the long-term, I believe that they should seriously consider selling off some of their manufacturing assets if they are able to do so without too much disruption in the business.

With that said, I believe that if they look to sell off those risky manufacturing bases on coastal cities, they should try and be one of the first movers with this de-risking strategy for a few reasons.

1) If they move quickly, they maximize the number of alternatives for what they can do with their manufacturing assets if they conclude that they present too great of a long-term risk due to their coastal location.

2) The longer the wait, the more of a risk they will be and the less attractive of an asset it will be to external parties of interest.

It will be interesting to watch how this company proceeds in the coming years. Thanks for a great read.

Best,

Triston

After reading this post, and looking up more facts, I’m very impressed by Saint-Gobain’s commitment to reducing environmental impact, as well as energy security, the latter of which has a stronger economic motive. Similar to IKEA case (where wood was so central to IKEA’s business), energy consumption is also core to SGO’s business. Unlike some of the issues raised by other posts (e.g. vehicle emission standards) where regulation seems harsher, energy consumption by building materials companies seem to be less regulated as of now. SGO is right in taking proactive measures instead of waiting for regulations to catch up. I also really like Eric’s priority list for where to implement alternative energy first. The only question I have is that, the footprint that fit the criteria is still small, compared to SGO’s entire production footprint. The rest of the geographies might lack economic motivation to transition to renewable energy, absent of government policies.