The Ethereum Project: the World 3.0

The Blockchain is a technology that is expected to be as disruptive as the Internet or the electricity. It is widely known as the technology supporting the digital currency Bitcoin, but its usage goes far beyond crypto-currencies; in fact, based on the Blockchain technology The Ethereum Project provides developers with a smart contract platform to re-imagine and re-design the world’s most fundamental interactions [1].

What is the Blockchain?

“Blockchain is a peer-to-peer distributed ledger technology for a new generation of transactional applications that establishes trust, accountability and transparency while streamlining business processes. Think of it as an operating system for interactions.” — Jim Zemlin, Executive Director, Linux Foundation

In other words, the Blockchain is a distributed public ledger recording all the transactions made in the network. This shared infrastructure can move value and ownership of property around. It’s a decentralized data infrastructure on which applications such as Bitcoin are built and run [2] [3]. Thanks to the open architecture of the blockchain technology, many applications are being developed; one of them is The Ethereum Project [4].

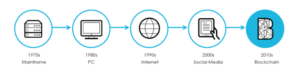

The last disruptive innovations

Ethereum, the smart contract platform.

While the digital currency Bitcoin is limited to financial transactions, Ethereum can cover different types of transactions using its smart contract platform. Smart contracts enable the exchange of money, property, shares, or anything of value in a transparent, conflict-free way, while avoiding the need for a third party to clear the transaction. More importantly smart contracts are autonomous; once a contract is specified and running, no additional human action is ever needed, the platform automatically enforces the terms of the contract [5]. Smart contracts are decentralized thanks to the blockchain and are therefore no longer stored on one central database, thus providing the security benefits of such shared infrastructure [5]. As a result, this technology eliminates the counterparty risk and therefore dramatically diminishes transaction costs by getting rid of middlemen.

A wide range of applications.

Financial instruments such as insurance contracts, stocks, pension rights, or derivatives can be translated into smart contracts readable and automatically enforced by the platform. Ethereum smart contracts can be created to represent ownership of financial securities. For example, companies like WeiFund are already using Ethereum to provide a decentralized crowd-funding service for investors and entrepreneurs [6].

Physical assets like commodities or real estate can be linked to their owners and traded using Ethereum. For example, Digix has launched the next generation digital gold exchange platform where its community can trade gold directly, bypassing banks [7]. Other companies like Rexmls are applying the same logic to real estate with one of the first decentralized real-estate platforms, making the transfer of real estate titles as easy as sending a text message [8].

Combining the Internet of Things with the Ethereum platform opens the door to securely rent apartments or compatible smart objects, like autonomous cars, without intermediaries such as Airbnb or Uber. Further, Ethereum will enable machine-to-machine transaction at scale; hyper-interconnected smart objects will have the ability to request and communicate information as well as process transactions with each other. For example, a fridge could order more yogurts to the convenience store and process the payment without any human interaction [9].

Beyond nations…

Beyond the transfer of value, Ethereum could be used as a platform for new forms of organizations that include, but are not limited to, incorporated companies, decentralized autonomous organizations, decentralized corporate organizations, and non-governmental organizations.

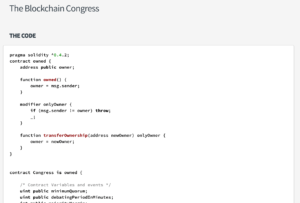

Example of the code for a Ethereum smart contract: The Blockchain Congress

Recently Ethereum was used to create a decentralized autonomous organization “The DAO”. This was an organization living in the cloud, with no tie to any particular nation, whose ownership was distributed among its shareholders. Ether (ETH), a native digital currency equivalent to the Bitcoin on the Ethereum ecosystem, was used to fund and start the organization [10]; one Ether equals one voting right. Theoretically, voting rights could be assigned not only to humans but also to machines. In a way “The DAO” governance system could be seen as an independent legal system based on a set of smart contracts; therefore, the organization could not be influenced by external forces such as corporate lobbies or governments. Ethereum eliminates the need for trust between parties as well as the need for a centralized entity coordinating these parties. Since the trust has been shifted onto the technology, people can coordinate themselves, in a trustless and decentralized manner without having to rely on any third party organizations such as corporations or public institutions.

Even though the Ethereum Project is in its infancy stage, it represents one of the most exciting applications of the blockchain technology to date. Should your car have the same voting right as you when it comes to planning your city’s next road infrastructure?

(774 words)

[1] De Filippi, P. (2014b). “Tomorrow’s Apps Will Come From Brilliant (And Risky) Bitcoin Code”. Wired at http://www.wired.com/2014/03/decentralized-applications-built-bitcoin-great-except-whos-responsible-outcomes/, accessed November 2016.

[2] James Schneider, The Goldman Sachs Group, Inc, “Profiles in Innovation Blockchain, Putting Theory into Practice”, P3. http://www.the-blockchain.com/docs/Goldman-Sachs-report-Blockchain-Putting-Theory-into-Practice.pdf, accessed November 2016.

[3] IBM Website, http://www.ibm.com/blockchain/, accessed in November 2016.

[4] Ethereum Website, www.ethereum.org, accessed in November 2016.

[5] Jeroen van Oerle, Patrick Lemmens, “Distributed ledger technology for the financial industry, blockchain administration 3.0”, P7, https://www.robeco.com/images/201605-distributed-ledger-technology-for-the-financial-industry.pdf, accessed in November 2016.

[6] WeiFund Website, http://weifund.io/, accessed in November 2016.

[7] Digix Global Website, https://www.dgx.io/, accessed in November 2016.

[8] REX, The Global MLS, http://www.rexmls.com/, accessed in November 2016.

[9] Chris Curran, PWC, “Blockchain and smart contract automation: Introduction and forecast”, P3, http://www.pwc.com/us/en/technology-forecast/blockchain/introduction.html, accessed November 2016.

[10] Christoph Jentzsch, “Decentralized Autonomous Organization to Automate Governance”, https://download.slock.it/public/DAO/WhitePaper.pdf, accessed November 2016.

Thanks for the interesting post!

Who manages the Ethereum Project if it is so decentralized? When companies want to implement the Project to develop these smart contracts, who do they contact, what is the process of setting up such a service, and how does the Ethereum Project generate revenue?

While I understand how the blockchain promotes transparency, there will be – and already have been – abuses of this system to do things like drug or sex trafficking. The applications you mentioned seem promising, but I’m wondering what kinds of use cases you think the Ethereum Project needs to focus on now, in order to increase its market penetration?

Whoa. It’s taking me a few minutes to wrap my head around this! Very intriguing topic – thanks for sharing. My knee-jerk reaction to this is a bit negative and skeptical. When I read phrases like “eliminates the need for trust between parties” and understanding that this is completely untraceable leads me to the inevitable question of illegal activity. Now most new technologies can and will be taken advantage of to commit crimes, but I do think the benefits of such a system should vastly outweigh the associated costs of expected crime. I’m not sure what the balance is for something like Ethereum, but I hope the creators are taking that serious.

On the positive side, this seems to open the floodgates to seamless transactions that should be easy, but never are – which is awesome. I have to wonder, however, if the nuanced and situational interpretation and enforcement that comes along with contract law can be properly enforced autonomously. I’m not an attorney, but I can imagine this challenge is very real and quite a hurdle for the technology.

But do let me know when I can put my name in for a yogurt-ordering refrigerator.

Hey, thanks for the interesting post. I’m still in the process of completely understanding blockchain technology, but it seems like it has some incredible promise. I can think of a lot of examples from my career thus far in which having a centralized ledger would have been valuable. For example, maintaining a capitalization table for ownership of a private company can be tricky. If there are multiple different investors in a business, all with different types of shares, as well as employees of the company with different stock option plans and vesting schedules it can get confusing as to who owns what percentage of the company. Typically one of the lead investors is in charge of documenting and maintaining a master cap table that serves as the official reference for all others. Being able to make this a central ledger, as opposed to an excel document owned by one group, could be a better system.

As you mentioned in your post, it seems like a shame that the most prominent use case for blockchain technology thus far – Bitcoin – has had so many issues. From the high profile hacking and fraud at the Mt. Gox Bitcoin exchange to the legendary volatility of the currency, I don’t think that Bitcoin is a very good ambassador for blockchain technology in general. I’m certainly not rushing to tie my savings up in the new currency…

Thanks for sharing a real-life example of how blockchain can be valuable, Jordan!

Jordan – your point about cap table management is a pretty interesting one (and actually is the basis for Nasdaq’s “Linq” project: http://www.coindesk.com/hands-on-with-linq-nasdaqs-private-markets-blockchain-project/). However, one issue I’ve had with a lot of the blockchain startups out there is that for most of these transactions, trust is already built in. As a result, there isn’t really any reason why the ledger needs to be decentralized – you could have the issuer maintain a single record of share ownership. Putting “blockchain” in your pitch deck does help get you a meeting with VCs though….

Blockchain is a fascinating technology, although I am skeptic about labeling it as the last disruptive technology in 2010s. It is an ingenious way to promote transparency and enable cross-border transactions without getting human involved. Having an all-mighty algorithm to govern all the transaction does concern me, especially in today’s world where cybersecurity is such a sensitive topic. Do you know how the company you mentioned in the post enforce the contract if one party breaks it? What happens when there is a dispute? Who is the authority to settle the dispute?

Thanks for this! I find this blockchain technology so confusing, it’s so hard to get my head around what’s actually going on. I don’t understand if there is no third party, who is enforcing a contract or chasing the party who hasn’t stuck to the agreement? Am I going to be held accountable by Blockchain lawyers? and if so, if the system has to fall back on a human to enforce it’s terms then isn’t it in effect using a third party anyway?