The Art Market Shuns Digitalization, But Can It Survive?

Is Digitization A Challenge or an Opportunity For The Art Market? Only Time Will Tell

From a commercial standpoint, the art world thrives on the inefficiency of the market. The art economy, valued at nearly $50 billion, has for centuries been largely informal, unregulated and opaque which has led many players to be resistant to digitization and technological innovation.

A man holds his hand up while bidding on a work of art inside the auction house Christie’s during the Post-War and contemporary Art sale November 15, 2006 in New York City.

While art museums and institutions have made impressive leaps to adopt innovations to engage with audiences and a strong digital presence, traditional art-market gatekeepers, particularly galleries and auction houses, have been slow to adopt the digitization of databases that contain information about prices, details of art work characteristics, provenance, and records of previous sales. “The art market does not conform to the Efficient Market Hypothesis (EMH). It is an imperfect and assymetrical place in which prices fail to reflect all published and unpublished data. The assumptions that the irrational trades or art-market players are cancelled out by traditional abritrageurs (Shleifer 1999), that prices instantaneously adjust to available information (Hagstrom 2001) and that indices capture all economic activity do not apply. Even the weak form of EMH fails to represent art-market activity.”[1]

Digitization nonetheless is improving the art market in fundamental ways. First, it is forcing a business that has been greatly secretive and complex to be more transparent. “The availability of a plethora of art market e-data has rendered a market that is usually seen as secretive and lacking in disclosure much more transparent. Moreover, digitization has created innumerable possibilities for research on the relationship between information access and social practice in the art world.”[2] For example, today you can track the price histories of a work of art through time as it exchanged hands from buyer to buyer. Secondly, art market data’s wider availability has been essential in supporting the globalization and commercialization of art which has turned new art lovers into buyers and has encouraged growth in emerging markets beyond New York, London and Paris.

Art Basel Fair

Instagram in particular has been central as a platform supporting the art market’s move towards the web. “Instagram has emerged as a more democratic platform for art, offering unparalleled access to those whose pockets are not as deep as their enthusiasm for art. It also allows serious collectors and critics to discover and evaluate art without bias. In a sense the platform strips away reputation and fanfare, instead forcing artists to connect with people in a visually engaging and innovative way.The mobility of Instagram also makes it perfect for the hyper-connected lifestyle of the 21st century. An artist can instantaneously share their work from the convenience of their smartphone. No longer do critics and collectors have to physically visit a gallery to view a masterpiece. Most importantly to the artist, instant feedback and critique is provided in the form of “likes” and comments.”[3]

An HBS Case Study on Paddle8, one of the most prominent start ups trying to “disrupt” the art market by partnering with galleries to offer works for sale on their website, questioned whether online art marketplaces such as this could make art more accessible to a larger audience. “The question is: will this succeed in the context of the art market where exclusive access is a prime driver of value?”[4] In 2013, “Prospero”, the culture blog of The Economist echoed the same concerns. “The notion of an open art market—noble as it may be—seems a long way off. It is hard to imagine that the internet could dislodge art galleries and institutions from their exalted status, sustained, to some extent, by exclusivity and elitism.”[5]

Paddle8 Homepage

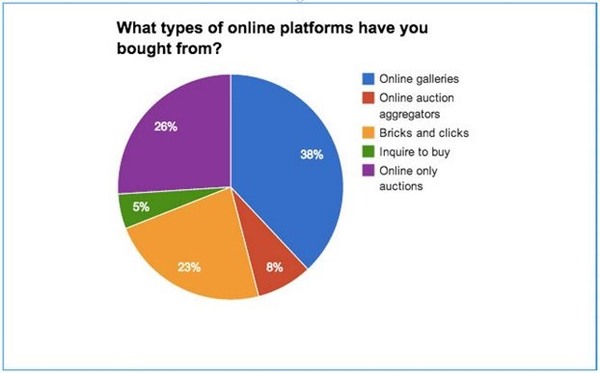

Source: Artnet.com

While television, film, music and publishing have been forced to reimagine their business models in the digital age, the art market has until recently been invulnerable to the rise of e-commerce but this will only change in the future. Indeed, in 2015, online art sales account for only seven percent of all global art and antiques sales by value. But it is undeniable that online sales are a fast-growing section with sales of art online were estimated conservatively to have reached $4.7 billion, up seven percent year on year, and accounting for seven percent of all global art and antiques sales by value. [6]

Word Count: 799

[1] Robertson, Iain. “An Inefficient Market.” Understanding Art Markets: inside the World of Art and Business, Routledge, New York, NY, 2015.

[2] Arora, P., & Vermeylen, F. (2013). “Art markets”, in R. Towse and C. Hanke (eds)

Handbook of the Digital Creative Economy Cultural Economics, Edward Elgar, Cheltenham, UK, 2013.

[3] Davies, Simon. “How Instagram Is Revolutionizing the Art Market.” How Instagram Is Revolutionizing the Art Market, Sept. 2015, tech.co/instagram-revolutionizing-art-market-2015-12.

[4] Khaire, Mukti. “Paddle8: Painting a New Picture of the Art Market.” Harvard Business School Case 812-047, October 2011. (Revised September 2014.)

[5] “Out with the Old, in with the New.” The Economist, The Economist Newspaper, 2013, www.economist.com/blogs/prospero/2013/01/art-market-online.

[6] McAndrew, Clare. TEFAF Art Market Report 2016. Helvoirt, European Fine Art Foundation, 2016.

Such an interesting industry to think about digitization in. I think it will be particularly challenging to fully take advantage of the powers of digitization. So much of the success of artists depends on the state of curators, gallery owners and consumers. Will this really change the game? And, is it possible that the digitization of the art world actually hurts the industry? Sometimes it’s better to have asymmetric information and exclusivity in an industry.