Sunrun: Confronting Solar Panel Import Tariffs

How should Sunrun respond to the impending threat of steep tariffs on imported solar panels?

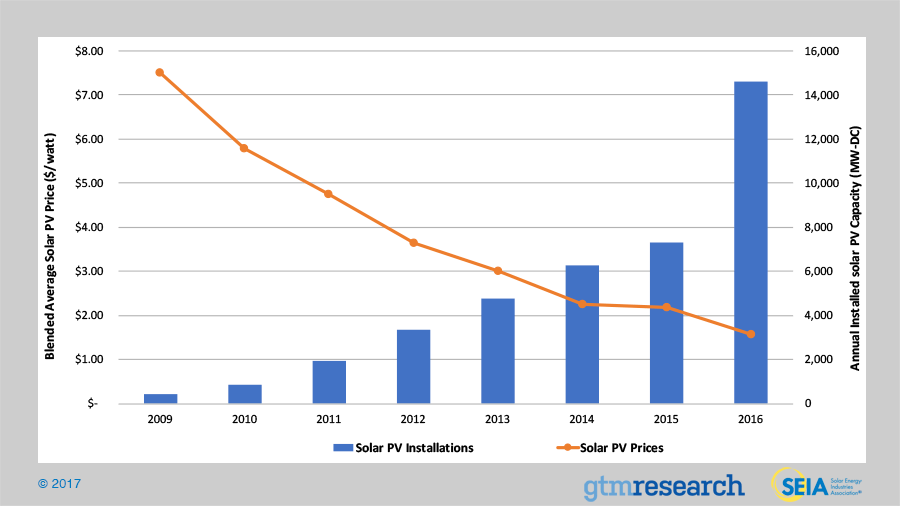

Average U.S. installation costs for solar photovoltaic (PV) cells have decreased by more than 70% since 2010, driven largely by lower solar panel prices (see Figure 1).

Figure 1: U.S. Solar PV Installations and Prices, 2009-2016

Source: Solar Energy Industries Association, “Solar Industry Data,” https://www.seia.org/solar-industry-data, accessed November 2017.

SPV Market Research estimates that approximately 95% of cells and panels sold in the U.S. in 2016 were made abroad, mostly in China, Malaysia, and the Philippines. [1] Sunrun, a San Francisco-based residential rooftop solar company, has benefitted immensely from these reduced input prices, which have helped make rooftop solar a worthwhile investment for homeowners in many parts of the country. However, in September 2017, the United States International Trade Commission (ITC) issued a unanimous ruling that U.S. solar panel manufacturers Suniva and SolarWorld are being injured by increased solar panel imports. [2] The Trump Administration must decide by January 2018 whether to impose some combination of tariffs, import licensing fees, minimum prices, and quotas on foreign solar panels entering the U.S. to grant domestic manufacturers relief under Section 201 of the 1974 Trade Act. [3]

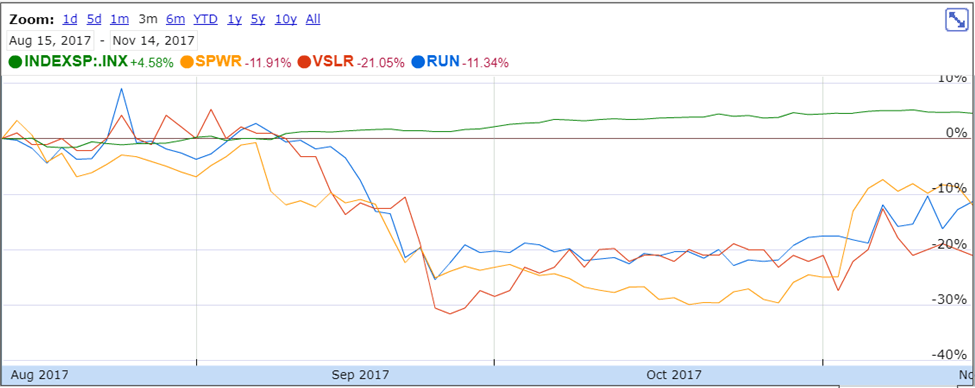

Sunrun, which purchases most of its solar panels from Singapore, South Korea, and Canada, is rightly concerned about the implications of potential import tariffs on its core business. [4] Because U.S. solar panel manufacturing capacity is so limited, these trade remedies are likely to result in much higher input costs for Sunrun, ultimately yielding lower residential consumer demand as well as downward margin pressure. Although Greentech Media Research believes that residential PV projects are less sensitive to import tariffs than utility-scale PV projects, [5] investors are clearly concerned about the effect of protectionist trade policies on the bottom lines of residential solar companies: share prices for Sunrun (RUN) and competitors Vivint Solar (VSLR) and SunPower (SPWR) were all down more than 10% from their pre-ITC ruling prices as of November 14, 2017 (see Figure 2).

Figure 2: Share Prices for Sunrun and Selected Competitors vs. S&P 500, Aug. 15-Nov. 14, 2017

Source: Google Finance, https://finance.google.com/finance?q=NASDAQ%3ARUN&ei=OHILWtn6E5K2e7uuh_gD, accessed November 14, 2017.

Sunrun has responded by advance-purchasing some panels at current tariff-free rates. [6] Chris Ummerle, a member of the Sunrun strategic sourcing team addressing this threat, explained that Sunrun has also discussed guaranteed supply arrangements with some manufacturers. [7] Indeed, CEO Lynn Jurich recently confirmed that Sunrun has insulated “a good portion of next year” from a potential tariff or other trade action. [8] There are clear costs to this strategy, however: Reuters found that feverish buying activity has caused solar panel spot prices to increase by as much as 20% recently, [9] and carrying costs for this inventory could be significant for companies accustomed to managing their stockpiles judiciously. More generally, because the final form of any potential trade remedy is unknown, it is difficult for Sunrun and others to forecast their post-2017 cost structures. This pricing uncertainty makes forecasting customer demand – and thus determining how much inventory to pre-purchase – problematic.

In the medium term, Ummerle explained that Sunrun is exploring deeper strategic partnerships with some of its solar panel suppliers. [10] However, Sunrun’s competitors are likely pursuing similar arrangements, and many panel manufacturers have been understandably reluctant to make commitments in advance of the Trump Administration’s ruling. [11] Sunrun could also give its panel suppliers fixed volume commitments in exchange for unit cost savings, but the risks of being saddled with excess inventory loom large. Ummerle’s group is also conducting sensitivity analyses based on various tariff durations, looking to past steel and solar trade cases for guidance. [12]

Moving forward, Sunrun should take additional measures to prepare for an adverse trade ruling. First, management must rigorously consider the full cost of capital in determining whether to stockpile inventory – and if it does, where and how much. One industry analyst noted that depending on where its warehouses are located, a company might have to take ownership of pre-purchased inventory and pay taxes in California even if the panels are eventually used on an East Coast project. [13] Given that a ruling is now less than sixty days away, though, additional stockpiling efforts must be carefully considered.

Sunrun should also consider actively supporting (or perhaps even backing financially) the development of online marketplaces that increase transparency between manufacturers and developers/installers. If properly constructed and sufficiently inclusive, such marketplaces could give Sunrun real-time indications of market trends and enable their purchasing department to make more informed decisions. Finally, Sunrun should conduct further comprehensive risk assessments of its solar panel supply chain. By modeling its current vulnerability to a range of potential worst-case scenarios (additional trade disputes, key manufacturer bankruptcies, shipping strikes, etc.), Sunrun will likely identify more opportunities to improve its supply chain’s long-term robustness.

Of course, with so much uncertainty, many questions remain. Some foreign solar panel manufacturers are considering opening (or purchasing existing) manufacturing operations in the U.S. to circumvent possible trade restrictions. [14] Does it make sense for Sunrun to incentivize one or more manufacturers to move production to the U.S. to ensure surety of supply, either through long-term contracts or a formal partnership? What are the most important tradeoffs for Sunrun to consider?

Word Count: 793 words

Sources:

[1] Nichola Groom, “Prospect of Trump tariff casts pall over U.S. solar industry,” Reuters, July 25, 2017, https://www.reuters.com/article/us-usa-trade-solar-insight/prospect-of-trump-tariff-casts-pall-over-u-s-solar-industry-idUSKBN1AA0BI, accessed November 2017.

[2] Krysti Shallenberger, “Updated: ITC finds injury to US solar manufacturers, sending tariff decision to Trump,” Utility Dive, September 22, 2017, https://www.utilitydive.com/news/updated-itc-finds-injury-to-us-solar-manufacturers-sending-tariff-decisio/505602/, accessed November 2017.

[3] Christian Roselund, “The clock ticks: ITC turns Section 201 over to President Trump,” PV Magazine, November 13, 2017, https://pv-magazine-usa.com/2017/11/13/the-clock-ticks-itc-turns-section-201-over-to-president-trump/, accessed November 2017.

[4] Josh Siegel, “Thriving solar industry braces for Trump’s decision on tariffs,” Washington Examiner, September 20, 2017, http://www.washingtonexaminer.com/thriving-solar-industry-braces-for-trumps-decision-on-tariffs/article/2634976, accessed November 2017.

[5] Cory Honeyman, “Suniva and SolarWorld Trade Dispute Could Halt Two-Thirds of US Solar Installations Through 2022,” Greentech Media, June 26, 2017, https://www.greentechmedia.com/articles/read/suniva-dispute-could-halt-two-thirds-of-us-solar-installations#gs.=5jdthg, accessed November 2017.

[6] Julian Spector, “Sunrun Aims to Prove Solar Installers Can Grow and Make a Profit at the Same Time,” Greentech Media, November 13, 2017, https://www.greentechmedia.com/articles/read/sunrun-aims-to-prove-solar-installers-can-grow-and-make-a-profit-at-the-sam#gs.4UyBkCs, accessed November 2017.

[7] Chris Ummerle, interview by author, San Francisco, CA, November 13, 2017.

[8] Spector, “Sunrun Aims to Prove Solar Installers Can Grow and Make a Profit at the Same Time,” Greentech Media, https://www.greentechmedia.com/articles/read/sunrun-aims-to-prove-solar-installers-can-grow-and-make-a-profit-at-the-sam#gs.4UyBkCs.

[9] Groom, “Prospect of Trump tariff casts pall over U.S. solar industry,” Reuters, https://www.reuters.com/article/us-usa-trade-solar-insight/prospect-of-trump-tariff-casts-pall-over-u-s-solar-industry-idUSKBN1AA0BI.

[10] Ummerle, interview by author.

[11] Julia Pyper and Julian Spector, “Foreign Solar Manufacturers Weigh Opening US Facilities as Tariff Decision Looms,” Greentech Media, September 20, 2017, https://www.greentechmedia.com/articles/read/foreign-solar-manufacturers-weigh-opening-us-facilities-trade-tariff-looms#gs.LfJ3pBA, accessed November 2017.

[12] Ummerle, interview by author.

[13] Katherine Tweed, “Marketplaces Are the Key to Managing Volatility in Solar,” Greentech Media, November 13, 2017, https://www.greentechmedia.com/articles/read/marketplaces-are-the-key-to-managing-volatility-in-solar#gs.MMT6UtQ, accessed November 2017.

[14] Pyper and Spector, “Foreign Solar Manufacturers Weigh Opening US Facilities as Tariff Decision Looms,” Greentech Media, https://www.greentechmedia.com/articles/read/foreign-solar-manufacturers-weigh-opening-us-facilities-trade-tariff-looms#gs.LfJ3pBA.

Mike, this is a really fascinating article. You did a great job explaining the problems facing each player (manufacturer, installation/service, customer) and their corresponding solutions. I think I am most curious to see how foreign (and domestic) manufacturers react. It will certainly take time to move production to the US, but it appears that our solar industry (volatile as it may be) is here to stay. Depending on the January decisions, there could be some real upside to “made in America” PV cells.

Mike — thanks for sharing information about this topic, I found it super fascinating but also pretty concerning at the same time. There seem to be broadly negative implications for US solar panel manufacturers and their competitiveness in the global marketplace, and I’m wondering how many years of market growth this will effectively set the solar power industry back.

I like your suggestion that Sunrun should consider incentivizing one of its manufacturing partners to establish domestic operations in the US, if that would allow solar cells and panels produced within those operations to be exempt from tariffs. Under the proposal, is it sufficient that the products are made in the US even if they are ultimately owned by a foreign corporation? Another thing I was wondering is whether Sunrun should consider taking it a step further toward vertical integration by purchasing a domestic solar panel manufacturer. It seems that this strategy could help to insulate them from political and regulatory risk. One financial consideration would be whether the purchase price and ongoing operating costs (in the higher manufacturing cost environment of the US) would be less than the cost of tariffs on top of its current supplier relationships.

Hey Mike, I think you’ve done a great job of clearly outlining the issues facing Sunrun and other solar panel companies that import their finished goods from manufacturing plants abroad. I agree with your point regarding the importance of considering the cost of capital in the determination of the worthiness of stockpiling inventory.

Another angle through which Sunrun and other companies could tackle this problem would involve the application of a legal lens. I wonder if they have considered investing capital in establishing plants domestically to which they could ship nearly-finished goods for final assembly domestically, and thereby avoid the tariffs that may be placed on finished goods. Although this is a bit of a loophole and I’m not a lawyer, if it works from a legal standpoint it could be an option worth considering relative to the alternative. It seems that in other situations this has resulted in reduced costs from the importer’s standpoint, at least in the short term. Consider the case of mosquito nets in sub-Saharan Africa. In some countries, tariffs were imposed on imported nets, but they were significantly higher for finished goods than work-in-progress [1]. This could be a less appealing alternative to the solution suggested by Karen above (incentivizing manufacturing partners to establish domestic operations in the US).

A more long-term approach through the same legal lens could entail increased lobbying efforts, especially if coordinated with competitors facing similar roadblocks.

[1] https://www.wto.org/english/res_e/reser_e/ersd201714_e.pdf

You bring up a valid concern of the short-term strategy to build up materials inventory by stockpiling panels at the pre-tariff rate, which is the negative financial impact of both the spot rate increases (raising COGS) and the increased inventory carrying cost. Depending on how Sunrun is able to negotiate payment terms with its suppliers, this may have strong impacts in the immediate horizon on their net working capital. Given the market’s response across the solar industry, there may not be strong appetite for the additional debt or equity infusion that could be needed to absorb that net working capital impact. Another important aspect of the pending ruling will be the decision on NAFTA and how panel production/finishing that could occur over the border in Mexico at a lower cost than in the U.S. will be treated. Pending this decision, the decision on long-term contracts with suppliers, incentivizing them to open up shop domestically, or starting to manufacture locally themselves will have additional capital implications for Sunrun.

Mike – fascinating article, and what a great debate it has inspired! One piece that I was left wondering about, was the ability for Sunrun to invest in the specific panel technology that it is currently buying, and develop capabilities for in-house production. Is Sunrun’s gap in abilities that significant such that the company could never compete? Or, would it be enough for Sunrun to buy a progressive, American company for long-term company sustainability?

In addition, I wonder if Sunrun could replicate some of the strategic business decisions that other globalized businesses, like Pharmaceutical organizations have tested. For example, if Sunrun acquires a foreign panel producer, would Sunrun be able to transfer inventory across the border with a less-steep penalty than as two stand-alone entities? Finally, I think that it is important to have a critical lens about the ability of the current administration to execute on its promises. As I read in another classmate’s post, it is important to evaluate whether or not it is worth it for Sunrun to swallow the cost of investing in new technology, lobbying the government or other costly practices, if the administration is not able to follow through on their threats.

Mike, what an interesting article. The potential ruling is an example of a decision that may appear logical on the surface, but could have numerous drastic unintended consequences. This article had me thinking about the impact of other protectionist policies, particularly in the United States. In particular – whether protectionist policies impact domestic producers of ‘discretionary’ goods, or goods in new industries, more harshly than ‘staple’ goods. An analogy would be in the automotive industry – if prices on imports escalated to such a point that US-manufactured cars were cheaper in a relative sense, the consumer is unlikely to stop buying cars. For a relatively new industry, like the solar industry, that hasn’t reached critical mass, the impact of protectionist policies could be huge. As you eluded to – consumers may simply stop buying solar panels if the domestic price becomes too high.

Hey Mike, great write-up on a really pressing topic. I’d add that there’s another significant source of uncertainty in the residential solar market, namely, state-level net metering policies that have placed a significant damper on companies like Sunrun and SolarCity in recent years. If states continue to scale back the rate at which they offer to reimburse homeowners for generating power in the middle of the day, it could have an even greater negative impact on the residential solar industry. Combined with the tariffs, it could lead to a perfect storm that sinks these young companies. Additionally, from Sunrun’s perspective I think I might disagree with your point about increasing transparency in the supply chain, primarily because doing so could limit the spread that Sunrun captures between the manufacturer and residential customer (who would likely also have access to marketplace info), which in turn could further squeeze already tight margins.

Mike – thanks for the article! It is fascinating that physical production location – via tariffs and tax regulations – can impact the production costs, Sunrun’s margins and ultimately, end consumer demand. In other industries, I presume that increased costs due to trade regulations can be passed to the end consumer. However, given that the growth in solar adoption has been largely fueled by price decreases in panel costs, I am reticent to think that Sunrun will be able to push these costs downstream, as you allude to. If they do push costs downstream, I am concerned about what then happens to the expansion of the renewable energy industry, from an environmental perspective in the U.S. In such case, it appears that U.S. may be trading a commitment to environmental sustainability to fuel its increased domestic manufacturing adoption.

Fascinating read, Mike! Indeed, very interesting to see the working capital implications of stockpiling a large inventory in anticipation of trade tariffs. Further, given the pace with which PV technology is advancing, carrying a large inventory of PV cells may pose an obsolescence write-down risk to the company, further exacerbating the issue of tying up cash in inventory.

Mike: Extremely well-done! Such a thought-provoking article on a topic I knew nothing about…..

Reading your article, I was amazed about how many layers of complexity these potential restrictions have on Sunrun. Your analysis on stockpiling was especially eye-opening. Even though panels are going to be used on an East Coast project, the pre-purchased inventory will incur a tremendously high tax in California? I didn’t realize there was this level of complexity and so many costs and factors to manage….

There are a lot of parallels in your article to the TOM case we did with Fuyao glass. You mentioned opening manufacturing in the U.S. to avoid trade restrictions. Similarly in Fuyao, this was one of the key considerations that they were taking into effect when considering manufacturing in Tianjin vs. Ohio. But as we also learned from that case, there are SO many others factors to take into account. What is truly unfortunate for Sunrun is that they are faced with only SIXTY days to analyze their potential decisions!

Great post, Mike!