SolarCity: Harnessing the Power of the Sun to Drive Customer Value

SolarCity's business and operating models come together to drive down the cost of clean energy

Introduction

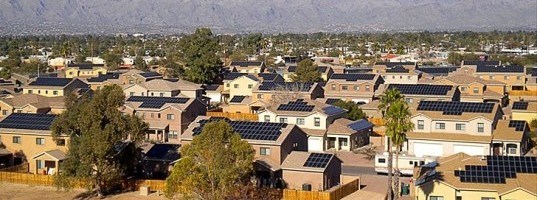

SolarCity is the largest U.S. installer of solar energy systems with over 300,000 residential and commercial customers and operations across 19 states. SolarCity’s value proposition is to provide its customers clean energy with no upfront cost at a lower $/kWh price than they are currently paying their utility. The majority of SolarCity’s customers enter into 20-year contracts with SolarCity to purchase the electricity generated by their solar energy system on an ongoing basis just like they are currently paying their utility bill. SolarCity is unique among solar installers as being a fully integrated solar company which is responsible for everything from production of the solar modules to sourcing financing to installation and ongoing monitoring. Through this integration, SolarCity is able to insure the quality of the end customer experience and realize cost reduction opportunities along the entire solar value chain. The alignment of the business model of providing electricity to customer at below utility rates with the vertically integrated operating model has allowed SolarCity to be the market leader in the distributed generation solar industry.

SolarCity Cumulative Customer Growth

Business Model

SolarCity’s business model is based around the value proposition of providing customers clean electricity at a cost lower than they are currently paying their utility and at no upfront cost. SolarCity is able to do this by having its customer enter into 20-year contracts to purchase the electricity generated by its solar energy systems, which creates a 20 year stream of cash flows. SolarCity sells a portion of the future customer cash flows as well as the tax benefits associated with the solar energy systems to investors which provide an upfront payment which is used to fund the cost of the system itself; SolarCity retains the rest of the cash flows largely as profits given lack of feedstock costs in solar. SolarCity was the first major company to popularize the “solar lease” business model which eliminated the $10K – $20K upfront cost of systems which was a major barrier limiting the adoption of solar energy. This business model made it easy and simple for customers to have solar panels as SolarCity handled everything for the customer from installation to monitoring to monetization of the various tax incentives. The introduction of the “solar lease” business model by SolarCity and its competitors has driven an exponential growth in distribution generation solar, especially in the residential markets, resulting not only cost savings by customers but also substantial environmental benefits in the form of foregone carbon emissions.

SolarCity Customer Value Proposition

Operating Model

SolarCity’s operating model is based on developing efficiency through scale and vertical integration in order to offer the customer a price of electricity that is lower than the retail utility price. To effectively grow the existing business as well as expand into additional states, SolarCity must offer a $/kWh which is lower than the utility to make the customer value proposition attractive. In order to offer the lowest price to the end customer and insure quality of service, SolarCity has chosen to have a vertically integrated operating model which allows it to find cost efficiencies all along the value chain.

SolarCity’s Vertically Integrated Model

To insure adequate supply of panels as well as capture value from the continued decline of polysilicon prices, SolarCity acquired Silevo, a solar panel technology company, in 2014 and has begun to construct a 1GW manufacturing facility. SolarCity made this move to insure the growth of its business was not constrained by the operating limitations of foreign suppliers. Additionally, over the past few years, SolarCity has improved its time of installation from up to two days to install a system to now being able to complete two installations in a single day. This have been enabled by both process efficiencies such as building internal systems to insure trucks are fully packed with the all the necessary components as well as technological improvements like the rail-free mounting systems which SolarCity acquired. By improving the efficiency of its teams, SolarCity is able to get more operating leverage out of its operations centers and installation staff and lower costs. Finally, as SolarCity has continued to scale, it has lowered its cost of financing allowing it to sell less of its customer cash flows to fund the upfront cost of the system and retain more profits.

SolarCity Average Total Cost Per Watt Over Time

The operating model of SolarCity was chosen to be able to find cost efficiencies and economies of scale in all aspects of the value chain, from the equipment itself to the cost of financing to the cost of installation. This allows SolarCity to offer rates to customers which are both below that of the utility and other competitors that don’t have vertical integration. As of result of this advantage, SolarCity is able to continue to drive its business model growing contracts and led to the Company’s strong operational performance.

SolarCity IPO Day – Management Team, Board of Directors and (Most Importantly) Investment Bankers

Sources:

- Conversations with research analysts and company management over period from 2011 – 2013

- SolarCity November 2015 Investor Presentation; http://files.shareholder.com/downloads/AMDA-14LQRE/1126115827x0x830612/1A32ABBC-4024-44B9-8F81-1B5BD77DD00B/2015.11_SCTY_Investor_Presentation.pdf

- SolarCity Form S-1; http://www.sec.gov/Archives/edgar/data/1408356/000119312513399788/d554071ds1a.htm

- SolarCity 2014 10-K;http://www.sec.gov/Archives/edgar/data/1408356/000156459015000897/scty-10k_20141231.htm

- Wesoff, Eric. “SolarCity Acquires Zep Solar for $158 Million” GreentechMedia. 09 Oct 2013. http://www.greentechmedia.com/articles/read/SolarCity-Acquires-Zep-Solar-For-158-Million

- Musk, Elon, Rive, Peter and Lyndon Rive. “Solar at Scale”. 16 Jun 2014. http://blog.solarcity.com/silevo

- Gross, Daniel. “The Miracle of SolarCity” Slate. Jun 2015. http://www.slate.com/articles/business/the_juice/2015/07/solarcity_the_company_didn_t_invent_the_solar_panel_but_it_invented_something.html

Kevin,

Very interesting company and I find it fascinating how they have found an innovative way to remove the single largest obstacle for the customer – the upfront cost of installation – from the equation. My question is as follows – my understanding is that these businesses would find it difficult to exist without the significant government subsidies and/or credits that exist to support solar energy. Has SolarCity done anything in its operating model to address this key weakness in its operating model?

Sorry, the last line should read:

Has SolarCity done anything in its operating model to address this key weakness in its business model?

Mason,

One of the biggest things currently in the industry is the reduction of the investment tax credit from 30% to 10% at the end of 2016, which as you correctly noted would significantly effect the company’s profitability as it must sell more of its cash flows to fund the upfront capital investment of the solar energy system. A bigger driver of the cost reduction target for 2017 is driven by this desire to make sure the economics for the business still look attractive if the ITC really does go down to 10%. This comes in the form of not only operational improvements, but also lower the cost of capital for the business through use of securitizations as well as aggregation facilities of cash flows.

The real problem the Company needs to figure out to make the equation work is how to lower the cost of customer acquisition, which is still quite high. The belief is that as solar become more prevalent, it will be easier and easier to sell as people can literally see it in the neighborhood. SolarCity has had an interesting partnership with Tesla (given Elon Musk connection), where they try to sell SolarCity solar energy systems to Tesla purchasers as buying an electric car basically shifts fuel costs to electricity costs and the best way to reduce your electricity costs is with solar energy.

The combination of reductions in cost from process improvements, a lower cost of capital, and lower CAC is really the Company’s strategy to cope with the reduction in the ITC. SolarCity is a great business with a 30% ITC but it is still a very good business with a 10% ITC.

You laid out clearly how residential rooftop solar can be cost-competitive with retail utility rates, so I think you showed how that business model operates. I think an important part of SolarCity’s operating model is the financing component, as SolarCity’s principal value-add prior to the vertical integration moves you discussed is providing financing for customers. That financing depends upon the availability of the capital to support lower cost financing. Additionally, SolarCity has significant cost (and rising in recent years) of customer acquisition. As the graph above illustrates, the cost of sales has been steadily increasing since 2013 ($0.45/Watt to $0.64 in 2015). This portion of the operating model seems out of sync with the business model of continuing to drive lower solar costs for customers.

SolarCity clearly has a great model for encouraging adoption, but I wonder how prepared they are for infrastructure maintenance and upgrades? Commercial solar panels function at relatively low conversion efficiency at the moment, so I would want to know if they plan to upgrade panels as improvements emerge or settle for the lower efficiency. Also, in the 20-year time horizon, panels do require costly maintenance, are these costs built in to the futures that are sold to investors?