Round Down: John Deere Brings Machine Vision to Precision Agriculture

In 2017, the world's largest tractor company spent $305M to acquire a startup that distinguishes lettuce from pigweed. As a result, US farmers are freeing themselves from Monsanto's Roundup. Is John Deere's machine learning approach the future of ag tech?

Source: James Vincent, “John Deere Is Buying an AI Startup to Help Teach Its Tractors How to Farm,” The Verge, September 7, 2017,

https://www.theverge.com/2017/9/7/16267962/automated-farming-john-deere-buys-blue-river-technology, accessed November 2018

“Take one man and put him on a tractor, and we can do the work of 8 to 10 people.” – Clint Bigham, Blue River client [1]

With global food demand slated to increase up to 98% by 2050 [2], farming yield en route to drop 2-3% due to climate change [3], and a superweed crisis emerging in response to reliance on a narrow range of herbicides [4], the agriculture industry faces an unprecedented need for innovation. Recent years have seen a spate of consolidation and investment, with a record $10.1B pouring into agricultural technology (“ag-tech”) startups in 2017. Last year also featured a bumper crop of acquisitions, including purchases of farm software company Granular by DowDuPont for $300M and agricultural robotics startup Blue River by Deere & Company for $305M. [5]

These acquisitions typify two dominant trends in the farming industry: continuing progress in “precision agriculture”, the use of sensors and algorithms to manage site-specific crop and soil variability [6], and the emerging space of agricultural machine learning. The latter industry is expected to grow 23.2% year-over-year through 2023, concentrated in crop monitoring, robotics, irrigation, and farm drones. [7] With data availability multiplying 1000-fold in the past two decades and software reaping concomitant performance improvements, machine learning investment over the next decade will prove not merely beneficial but indispensable to agricultural companies’ survival. [8]

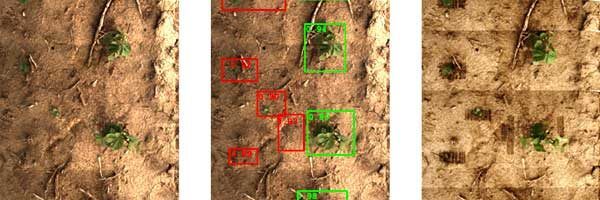

Deere & Company, the world’s largest farm equipment manufacturer with $29.7B in 2017 revenues [9], is an established leader in precision agriculture and innovator in autonomous navigation. The company’s pioneering AutoTrac™ guidance system, together with competitors, is used in 60-70% of U.S. farm acreage [10]. The Blue River acquisition enhances Deere’s technological portfolio, enabling its tractors to identify specific crops and weeds using the same deep learning algorithms underlying facial recognition [11]. Now used in lettuce production with 10% US adoption, Blue River’s software replaces the current standard of broad-based Roundup sprays, made costlier and less effective by herbicide-resistant “super-pests”, with micro-sprays the size of postage stamps. Technology director Willy Pell claims that the successor for cotton will reduce herbicide usage by 90%. Soybean- and corn-specific products, as well as harvesting and seed-planting products that incorporate soil type and crop size, are currently under development. [12]

Blue River Technology, “See & Spray – Blue River Technology’s Precision Weed Control Machine,” YouTube,

published August 23, 2017, https://www.youtube.com/watch?v=-YCa8RntsRE, accessed November 2018.

Looking forward, ag-tech machine learning presents an especially attractive opportunity for large firms because of the scale of data required. Today’s algorithms require tens or hundreds of thousands of training images [13] to achieve competence, further multiplied by crop and geographical variation. Deere thus enjoys a rare competitive advantage by using the same field data that informs its farmers’ chemical regimens to enhance its product lines. This feedback loop will enable Deere to create a defensible IP moat and reinforce its autonomous navigation offerings, where costly false negatives (e.g. disregarding safety hazards) and weather variability remain serious challenges. [14]

Over the next decade, Deere must capitalize on its reach and culture of innovation to preserve its advantage among equipment manufacturers and the broader agriculture industry. Diversifying its current precision-agriculture lineup with further robotics investments will allow the company to offer a cohesive product suite, delivering unparalleled crop yield and cost savings. Deere has recently moved in this direction, integrating with ag-drone data platform provider Agribotix [15] and drone analytics startup Sentera [16], whose AgVault utilizes high-resolution imagery live in the field. [17] Deere also stands to reap continuing rewards from collaborations with academia, where it has sponsored and licensed past research. [18]

Finally, Deere must embrace Blue River CEO Jorge Heraud’s vision to move “from the field level to the plant level…[using] machine learning to help smart machines detect, identify, and make management decisions about every single plant”. [19] Generalizability remains the grand dream of machine learning; Deere’s scale and diversity present a unique opportunity to thrive by contributing to its realization. A decade from now, Deere may not need to customize software per-crop – given sufficient training and algorithmic advances, its systems could not only generalize across observed data, but also infer the spaces in between.

As rising demand, declining yield, burgeoning investment, and data proliferation make continued development inevitable, investors and companies must ask: which innovation segment will dominate? Double-digit growth looks set to continue on all fronts [20], but a single breakthrough, whether in machine vision or microbiology, could transform minor players into multibillion-dollar juggernauts. Additionally, which companies will lead the charge, and which regions will see the greatest change? Large firms have thus far maintained their advantage through acquisitions, but growth investors such as Softbank, whose globally oriented Vision Fund recently poured $160M into Zymergen, are redrawing the competitive map. In the ag-tech industry, as with the farms it promises to revitalize, the direction has long been clear, but “the devil is in the data”. [21]

(778 words)

Source: Randall Munroe, “Here to Help”, XKCD, https://xkcd.com/1831/, accessed November 2018.

[1] Blue River Technology, “See & Spray – Blue River Technology’s Precision Weed Control Machine,” YouTube, published August 23, 2017, https://www.youtube.com/watch?v=-YCa8RntsRE, accessed November 2018.

[2] Maarten Elferink and Florian Schierhorn, “Global Demand for Food Is Rising. Can We Meet It?” Harvard Business Review, April 7, 2016, https://hbr.org/2016/04/global-demand-for-food-is-rising-can-we-meet-it, accessed November 2018.

[3] David Reid, “UN Report Shows Climate Change Effect on Farming,” September 17, 2018, https://www.cnbc.com/2018/09/17/un-report-shows-climate-change-effect-on-farming.html, accessed November 2018.

[4] Union of Concerned Scientists, “The Rise of Superweeds—and What to Do About It,” https://www.ucsusa.org/food_and_agriculture/our-failing-food-system/industrial-agriculture/the-rise-of-superweeds.html, accessed November 2018.

[5] Reuters, “Global Ag Tech Startup Investments Rise 29 Percent in 2017,” March 6, 2018, https://www.reuters.com/article/agriculture-tech-investment-idUSL2N1QO1PW, accessed November 2018.

[6] Tom Meersman, “Precision Agriculture Becomes Mainstream in Minnesota,” Star Tribune, http://www.startribune.com/precision-agriculture-gps-robots-drones-are-new-minn-farmhands/259320921/, accessed November 2018.

[7] Prescient & Strategic Intelligence, “AI Market in Agriculture Size, Global Industry Report, 2023.” https://www.psmarketresearch.com/market-analysis/artificial-intelligence-in-agriculture-market, accessed November 2018.

[8] Erik Brynjolfsson and Andrew McAfee, “What’s Driving the Machine Learning Explosion?” Harvard Business Review, July 1, 2017, https://hbr.org/2017/07/whats-driving-the-machine-learning-explosion, accessed November 2018.

[9] Statista, “Major Farm Machinery Manufacturers – Global Revenue 2017”, https://www.statista.com/statistics/461428/revenue-of-major-farm-machinery-manufacturers-worldwide/, accessed November 2018.

[10] The John Deere Journal, “John Deere Hands-Free Guidance System Continues Its Evolution,” March 29, 2016, https://johndeerejournal.com/2016/03/terry-picket-first-gps-unit/, accessed November 2018.

[11] James Vincent, “John Deere Is Buying an AI Startup to Help Teach Its Tractors How to Farm,” The Verge, September 7, 2017, https://www.theverge.com/2017/9/7/16267962/automated-farming-john-deere-buys-blue-river-technology, accessed November 2018.

[12] Tom Simonite, “Why John Deere Just Spent $305 Million on a Lettuce-Farming Robot,” Wired, September 7, 2017, https://www.wired.com/story/why-john-deere-just-spent-dollar305-million-on-a-lettuce-farming-robot/, accessed November 2018.

[13] James Vincent, “These Are Three of the Biggest Problems Facing Today’s AI,” The Verge, October 10, 2016, https://www.theverge.com/2016/10/10/13224930/ai-deep-learning-limitations-drawbacks, accessed November 2018.

[14] Dave Gershgorn, “After Trying to Build Self-Driving Tractors for More than 20 Years, John Deere Has Learned a Hard Truth about Autonomy,” Quartz, https://qz.com/1042343/after-trying-to-build-self-driving-tractors-for-more-than-20-years-john-deere-has-learned-a-hard-truth-about-autonomy/, accessed November 2018.

[15] Jason Reagan, “Agricultural Drone Provider Inks Major Deal with John Deere, ” DRONELIFE (blog), January 4, 2018, https://dronelife.com/2018/01/04/agricultural-drone-provider-inks-major-deal-john-deere/, accessed November 2018.

[16] Cision, “Sentera Announces Series A Funding,” September 5, 2018, https://www.prnewswire.com/news-releases/sentera-announces-series-a-funding-300707562.html, accessed November 2018.

[17] Sentera, “About Sentera,” https://sentera.com/johndeere/, accessed November 2018.

[18] The John Deere Journal, “John Deere Hands-Free Guidance System Continues Its Evolution,” March 29, 2016, https://johndeerejournal.com/2016/03/terry-picket-first-gps-unit/, accessed November 2018.

[19] John Deere US, “Deere Acquisition of Blue River Technology,” https://www.deere.com/en/our-company/news-and-announcements/news-releases/2017/corporate/2017sep06-blue-river-technology/, accessed November 2018.

[20] Prescient & Strategic Intelligence, “AI Market in Agriculture Size, Global Industry Report, 2023.” https://www.psmarketresearch.com/market-analysis/artificial-intelligence-in-agriculture-market, accessed November 2018.

[21] Arama Kukutai and Spencer Maughan, “How The AgTech Investment Boom Will Create A Wave Of Agriculture Unicorns,” Forbes, https://www.forbes.com/sites/outofasia/2018/01/16/how-the-agtech-investment-boom-will-create-a-wave-of-agriculture-unicorns/, accessed November 2018.

I completely agree with you that the “devil is in the data”. In this case, the availability of training data is the key element to success. Thus, I believe John Deere is much more set up for success than any other start-ups because of its unique access to create training data through its machines. This is a prime example of training data being a barrier to entry. Deere’s machines are already used by farmers; there is no additional work to do for adoption.

In other cases, start-ups can get access to data through signing exclusive contracts from data providers, or through creating the data themselves (e.g., deploying field teams or cameras/drones to create picture data). However, for agriculture, you need data across large spans of land, and Deere is uniquely positioned to take advantage of it.

However, a question remains on whether Deere should monetize this simply by selling the rights to the data, and focus on their core competency of machines, or whether they should develop new capabilities for machine learning.