Redefining how WeWork

How WeWork is creating the office space of the 21st century by leveraging design, community and technology to deliver superior value to startups.

Introduction

WeWork is a fast-growing startup that provides shared working space to companies, non-profits and individuals. Founded in New York in 2010 by Adam Neumann and Miguel McKelvey, it has grown to 82 offices in 18 cities, 35,000 members and 200m+ of revenue while staying profitable. It is set to adapt the working space to the 21st century, by creating a business model that takes into consideration the different needs of its stakeholders and developing an underlying operating model that supports it.

The Business Model

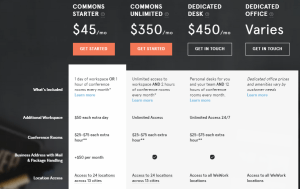

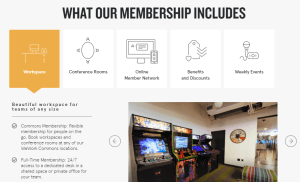

WeWork leases office space from landlords and real estate brokers – through long-term contracts –, works with developers to refurbish the space, and, finally, offers small parts of the space along with some added perks to tenants on a short-term basis. It has a tiered pricing that allows different customers – from freelancers to large companies – to benefit from its offering, depending on their needs and willingness to pay (Figs. 1 and 2).

Fig. 1 – WeWork pricing (source: www.wework.com) Fig. 2 – WeWork offering (source: www.wework.com)

WeWork is able to satisfy both startups and its landlords by providing flexibility to the former (charging monthly rates) and certainty to the latter (long-term contracts). However, since it is a fixed cost business, to succeed it needs to keep utilization of its offices high. This is especially hard because startups have risky business models which may lead them to scale out of WeWork or fail – in which case they may stop being WeWork customers – which is why the operating model is so important.

Operating model

The operating model of WeWork is based on 3 main pillars: office space and design; community; technology and complementary services.

Office space and design

It all starts with office space. WeWork has a dedicated team which leverages software to look for undervalued office space that they believe could be a good place for startups. Besides that, it uses historical real estate price data from its existing offices to establish long-term relationships with real estate brokers and show prospective lessors that WeWork has consistently increased the value of its offices and surrounding areas and get cheaper rates. WeWork also has a team of architects and interior designers who have a streamlined process and accumulated knowledge that allows them to assess and quickly redesign new offices to create a startup friendly environment. They create a mix of diverse working spaces to fit different people’s needs (small offices, big open-spaces, meeting corners, conference rooms) and social areas (common areas, bars, arcade machines, foosball, etc.) where people can meet each other on a more relaxed environment, all with a design developed to foster creativity and adapted to the local community context (e.g.: http://fortune.com/2015/03/05/wework-utopian-vision/).

Community

Community is perhaps the biggest focus of WeWork. Both founders have experience with its power – Neumann grew in a kibutz in Israel and McKelvey was raised in a five-mother collection in Oregon – and soon realized that it could be their advantage. To achieve this goal, they have created an office space that fosters creativity and human interaction, hired community managers and gave them considerable power in the organization, created a social program (including parties, retreats and happy hours) that members rave about and have fostered diversity within the community (Fig. 3). This creates not only a sense of belonging, but also business opportunities for its members – both startups and big companies which have been increasingly interested in having people in WeWork offices.

Fig. 3 – Diversity of tenants 2014 (source: http://www.forbes.com/sites/alexkonrad/2014/11/05/the-rise-of-wework/2/)

Technology and complementary services

Since the onset, WeWork has leveraged technology to provide its tenants the most seamless experience possible. From making its IT infrastructure (e.g. broadband, printers, conference rooms’ equipment) easy to use, to creating internal tools (e.g. internal social network), it has consistently used technology to make the lives of its tenants easier. As WeWork grew, it started to take a more holistic approach to solve the needs of startups and created partnerships with other companies to provide additional services and perks which solve their key pain points – from HR and health insurance, to cloud hosting, legal services and payment processing.

Conclusion

WeWork’s operating model allows them to get office space at a lower cost and deliver superior value to its customers through its unique community, superior office space design and complementary service offering. This allows them not only to acquire customers fast (having >80% utilization by the launch date in some offices) but also to have very loyal WeWork members (even after they leave the workspace). This creates significant network effects, hence mitigating WeWork’s business model risks. It’s true that due to its hefty valuation, exposure to economic downturns and current lack of direct competition, it’s not clear whether WeWork will succeed, but I think that, as long as it can keep its operating model while growing, it will redefine how we work.

References

[2] http://www.businessinsider.com/the-founding-story-of-wework-2015-10

[3] http://www.theawl.com/2015/05/where-will-wework

[5] http://www.wsj.com/articles/wework-now-a-5-billion-real-estate-sartup-1418690163

[7] http://www.forbes.com/sites/alexkonrad/2014/11/05/the-rise-of-wework/

[8] http://www.businessinsider.com/weworks-bets-on-welive-2015-10

[9] http://therealdeal.com/issues_articles/the-world-according-to-wework/

[10] http://nocamels.com/2015/01/wework-building-startup-community-by-transforming-office-space/

[13] http://fortune.com/2015/03/05/wework-utopian-vision/

[14] WeWork presentation at HBS on November, 4th

WeWork is such a fascinating company, Andre! Thanks for your post. I was surprised to learn that they lease their office space. It seems that WeWork could capture a lot of value by owning their properties. Admittedly, it would be capital intensive at the beginning, but in growing urban centers WeWork essentially holds a monopoly on startup real estate.

On a personal note, I used to work in a WeWork space in Manhattan. Although the shared communal space was wonderful, it was often challenging to find a quiet area to focus. It was also difficult (and expensive) to find conference room space. To fix each of those issues, WeWork would have to decrease the high office space utilization rates you mentioned. I wonder if WeWork is focusing on capturing tech clients who wouldn’t require as much quiet/conference room space as other industries (e.g., client services).

Really interesting post, Andre! I also spent some time working in a WeWork space in Manhattan. Based on my experience, it sounds like you nailed its story.

WeWork is a cool-feeling place – I don’t know if any space better captures the 2010s tech startup zeitgeist – but from what I saw, its value proposition really falls apart if it can’t provide some sort of community. As Sophia noted, common spaces were in high demand, and most desks were in open workspaces where it was difficult to hold long phone calls.

For a tech startup with very limited resources, WeWork’s closest competition seems to be founders’ apartments. (Or, if we’re going for a true tech founding myth, founders’ garages.) The WeWork space provides a bit more legitimacy in the eyes of customers/clients/collaborators, but it seems that the community there is really what should convince small outfits to pay rent. Established communities also seem to be WeWork’s first mover advantage, given that it probably wouldn’t be particularly difficult for new entrants to borrow their model.

Given the downsides to the open and shared workplace setup, it seems that in order to succeed going forward, WeWork will have to be very thoughtful about how it provides, allocates, and prices private and semiprivate spaces for meetings and calls. Were you able to get a sense of whether (and how) its approach to these spaces has changed through its rapid recent growth?