Redefining an Oil Giant

With hydrocarbons heading for the door, will Shell's bet on natural gas carry it into the future, or is this only the first step of a larger transformation?

We’re all aware of the rapid growth of solar and wind power generation over the last decade1. The shift towards renewable energy sources must continue if CO2 limits are to be achieved2. Yet, for Shell, it’s not so much the source of the energy which is troubling, it’s the form that energy comes in.

A Business Under Siege

Climate change effects all aspects of Shell’s business, particularly its strategic direction. Although energy demand is projected to grow 48% from 2012 to 2040, political pressures could shift the energy mix towards lower carbon fuels3. Although not legally binding, COP21 targets are ambitious and meeting them will necessitate a reduction in hydrocarbon use globally. In addition, any sort of carbon pricing scheme will reduce demand for hydrocarbons4. These combined pressures directly threaten the very existence of Shell and other oil & gas producers.

Manning the Battle Stations

Shell has taken a multi-pronged approach to addressing climate change with initiatives aimed at cleaning up its operations and investing in clean technology5. However, the biggest strategic decision Shell has made has been to shift its portfolio away from crude oil towards natural gas. Although the proportion of revenue from natural gas has been increasing for many years, the recent acquisition of BG creates a step change in the important of natural gas to Shell as reported by the WSJ, “the combination would nearly double Shell’s production of liquefied natural gas within two years, and turn it into the world’s largest marketer of the fuel by the end of the decade.”6

A Way Out

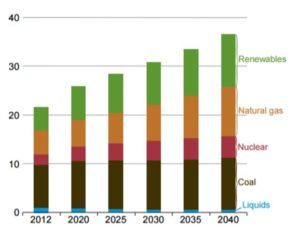

This is an effective short term strategy for Shell. Natural gas is primarily used for generating electricity, a space within which it competes with coal3. Decarbonizing the power generation industry is one of the easiest ways to meet CO2 targets, and since natural gas has half the carbon intensity of coal, replacing coal-fired power plants with efficient gas-fired plants can be part of a solution7. Figure 1 shows forecast demand for electricity, with natural gas and renewables providing the growth while other fuels stay flat. Crude oil, on the other hand, is primarily used in the transportation industry3. Decarbonization of the transportation sector has started, with electric vehicles starting to gain a foothold. That will put pressure on crude oil demand while simultaneously raising demand for electricity. In the short term, natural gas is well positioned to play a key role in fighting climate change.

The Long Game

Of course, the IPCC has called for net zero emissions of CO2 by the end of the century which means that, barring large scale carbon capture and storage deployment, natural gas production must ultimately decline8. It’s not obvious how the world will achieve that target, but what is quite clear is that a very large proportion of global energy will be supplied by wind and solar generation in the future. Those technologies naturally produce electricity and economic activities that can take advantage of that form of energy will have an advantage. Total electrification will be the defining industrial trend of the 21st century.

What Next?

Shell has several transferrable competencies which it can apply to the electrical supply chain. Management of long term capital intensive projects can as easily describe an electrical generation and transmission system as it can an oil field and pipeline network. Commodity trading, health and safety, and research and development are all activities that can be transplanted wholesale into the electricity space. But if Shell has any hope of surviving that transition, they need to take steps now to build up their technical expertise in a new electrical world.

(611 Words)

1 U.S. Energy Information Administration, “Short Term Energy Outlook,” October 2016 [https://www.eia.gov/forecasts/steo/pdf/steo_full.pdf]

2 IPCC, “Special Report on Renewable Energy Sources and Climate Change Mitigation,” 2011 [https://www.ipcc.ch/pdf/special-reports/srren/SRREN_FD_SPM_final.pdf]

3 U.S. Energy Information Administration, “International Energy Outlook 2016,” May 2016 [https://www.eia.gov/forecasts/ieo/pdf/0484(2016).pdf]

4 Bruvoll, Annegrete, and Bodil Merethe Larsen. “Greenhouse gas emissions in Norway: do carbon taxes work?.” Energy policy 32.4 (2004): 493-505.

5 Royal Dutch Shell. “Sustainability.” http://www.shell.com/sustainability/environment/climate-change.html, accessed November 2016.

6 Kent, S. “BG Deal Caps Shell’s Big Gas Bet.” The Wall Street Journal Jan 27 2016 [http://www.wsj.com/articles/shell-shareholders-back-bg-deal-1453899225]

7 U.S. Energy Information Administration. “Frequently Asked Questions.” https://www.eia.gov/tools/faqs/faq.cfm?id=73&t=11

8 IPCC, “Climate Change 2014 Synthesis Report Summary for Policymakers,” 2014

[https://www.ipcc.ch/pdf/assessment-report/ar5/syr/AR5_SYR_FINAL_SPM.pdf]

Great post and concise summary. I appreciate your acknowledgement of the long game, and the understanding that natural gas is not the foolproof solution to the carbon emission problem.

That being said, I am incredibly bullish on natural gas as an energy source. While it might not be the end all be all, it is overtaking coal fired power plants as the primary provider of electricity. The adoption of natural gas power also paves the path for other forms of sustainable energy, and in that respect serves as a leading indicator for cleaner energy sources in the future.

I want to include one of my favorite graphs recently published by the U.S. Energy Information Administration. Note natural gas overtaking coal in 2016 as the leading fuel for power generation! http://www.eia.gov/todayinenergy/detail.php?id=25392