Ready to become an energy prosumer?

A Swiss utility embarks on the disruptive journey of turning its consumers into “prosumers” (active participants to the energy system) with the help of digital technologies.

A centuries old contract

The universal access to an uninterrupted power supply has been an indisputable social right in modern Europe. While we were going on with our normal consumption patterns, our power suppliers were working to seamlessly fulfill our predominantly1 inflexible power demand. This “back-stage” balancing relied on high investments in grid infrastructure and (relatively) flexible generation facilities. Given the monopolistic nature of the power provision business, integrated energy utilities were in turn allowed to pass these investments through the regulated tariff, thus charging us for our inflexibility [1].

Hit by a perfect storm

Over the past decade, two concurrent phenomena have started to increasingly challenge this historical agreement: the growing penetration of renewable generation and the market liberalization:

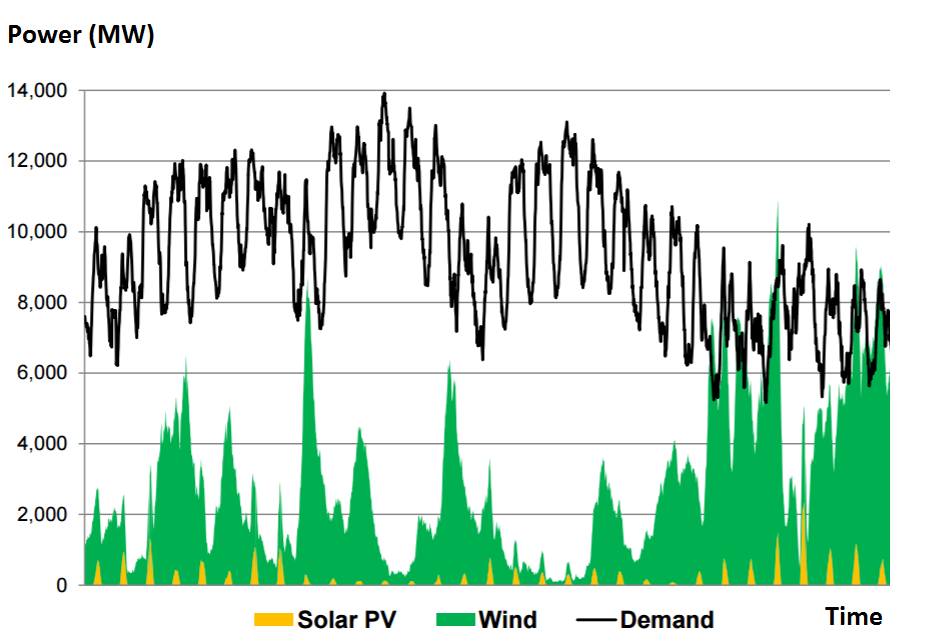

- The intermittent, unpredictable and often distributed nature of renewable generation is significantly increasing the volatility of power supply, thus challenging its capability to match demand. Even highly flexible gas-fired plants [2] find it difficult to keep up with wind speed and sunshine variability

- The trend towards market liberalization and unbundling of vertically integrated utilities is making it more difficult for utilities to defend high power prices. By 2015, 53% of Swiss consumers eligible for free-market access (>100MWh/year) had decided to switch to free-market energy purchases [3]

The digital lifeboat

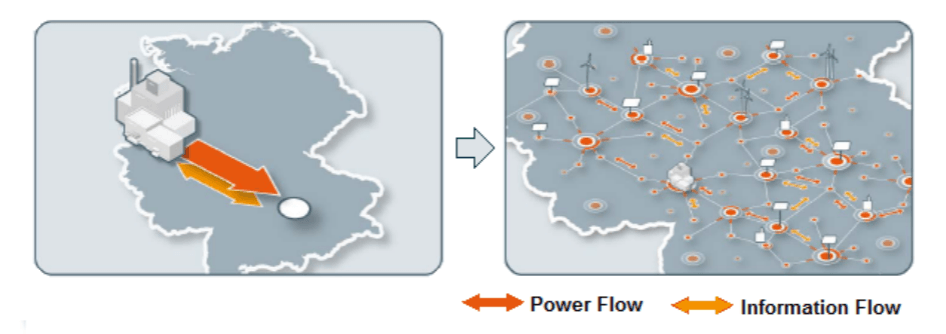

While the above phenomena are exacerbating the need for DSI (Demand Side Integration), it is the rampant development of digital technologies that is providing utilities with tools to address these issues, by enabling a smart grid. In a smart grid, an electric system able to host two-way power and information transfers between a high number of grid participants [5], consumers can receive real-time pricing information in order to modulate their demand in a way that optimizes their own cost-convenience function. While a universal smart grid is still a visionary concept, both utilities and new energy players have started to invest in this direction.

BKW Energie AG, one of the three major energy utilities in Switzerland has decided to gradually transition to an energy services business model [7], by turning its consumers into active market participants, with a number of dedicated initiatives:

- PowerFlex: Designed in collaboration with ENERnoc, an established US DSI developer [8], PowerFlex acts as a broker for power consumers on the balancing energy market. The platform monitors power prices and sends customized real-time production adjustment suggestions to the K-Boxes installed at each consumer’s facility, thus allowing them to monetize their flexibility

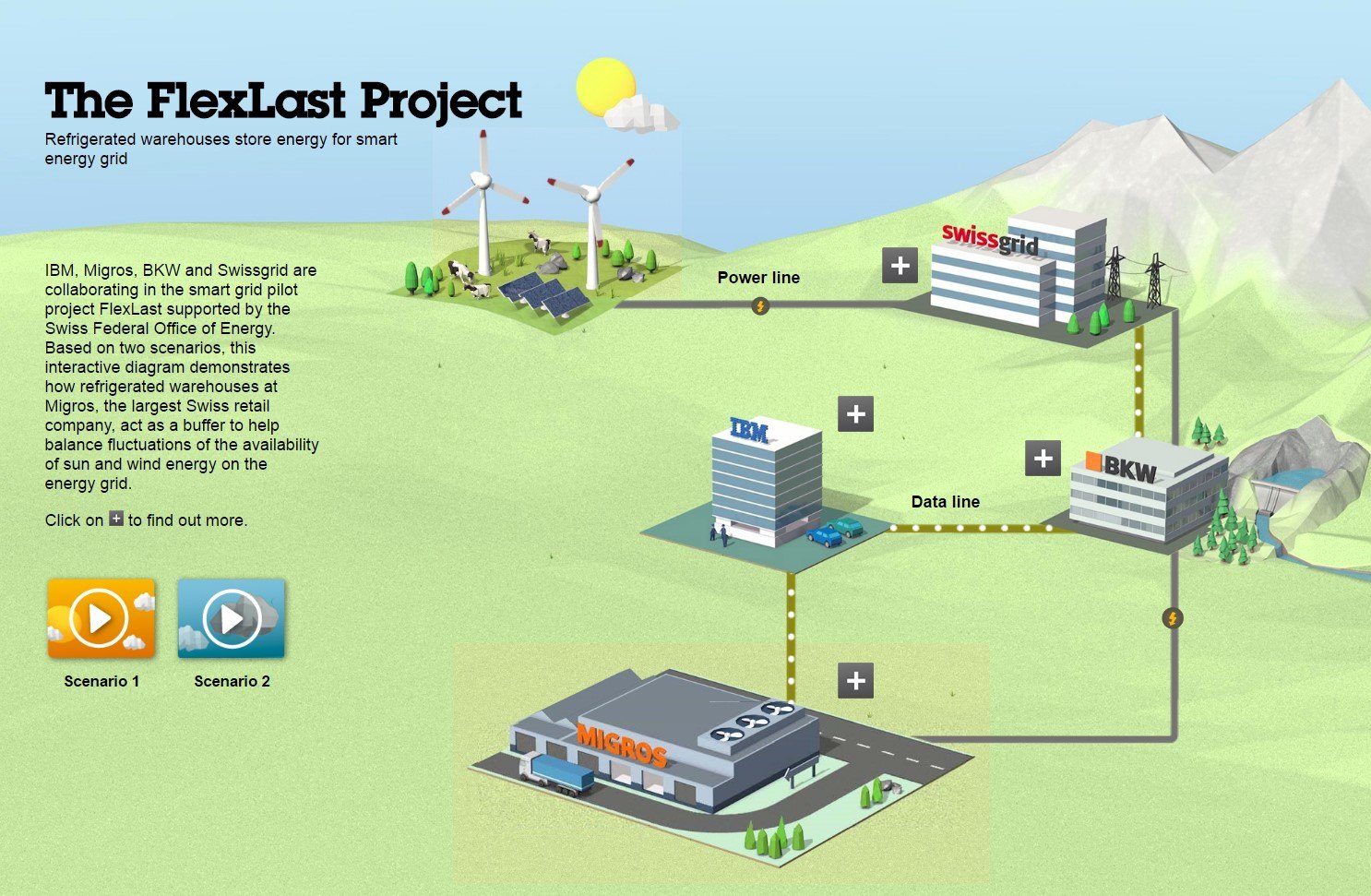

- FlexLast: Beyond dynamic consumption, FlexLast enables inertial consumers, such as commercial refrigerators to act as buffers for the energy grid, by storing energy at excess generation, to then consume it in times of shortage. The project was piloted in collaboration with IBM (whose European research headquarters are based in Zurich), MIGROS (one of the main Swiss retailers) and the national grid operator SwissGrid [10]

FlexLast operating model – animation available at [11]

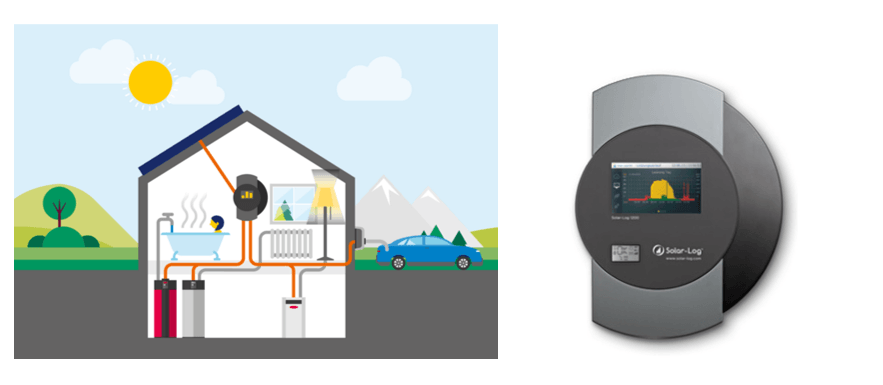

- Home Energy: As Swiss consumers increasingly turn into PV producers, BKW is providing them with an intelligent way to manage their own generation and consumption behaviors. This is done through a central controller that dictates the way solar power is distributed in between home appliances (including electric cars), stored or sold to the grid.

In 2015, BKW has reported a 34% growth in revenues from energy services (incl., but not limited to the ones listed above), from 320 to 430 CHFM [8], partially offsetting the decay of their traditional business. However, the actual success of these business models is still highly uncertain, given both adoption and profitability challenges. Potential “side effects”, such as net increases in energy consumption are not excluded either [10]. I think the company should focus on the following areas:

- Proving commercial feasibility of the solutions, and customer’s willingness to pay, given the very small share of energy costs in Swiss consumers’ budgets

- Aggressively campaigning DSI’s contribution to the transition to clean energy, given Swiss citizens’ environmental awareness and drive

- Fostering their existing relations with the (still regulated) consumers (it is a lot easier to convert an existing customer, than one you’ve already lost)

- Strategically managing their R&D activities, as well as acquisitions and partnerships in a way that mitigates their dependency on technology players

While its new journey has just begun, I strongly believe BKW’s decision to embrace the energy transition is setting it up to become one of Europe’s future leaders in energy services.

1 Exceptions existed for large industrial consumers, and mostly outside Europe

Word count: 777

[1] Swiss Federal Electricity Commission (ElCom), “Kostenrechnung für die Tarife 2015”, 2015, https://www.elcom.admin.ch/dam/elcom/de/dokumente/2014/06/wegleitung_zur_kostenrechnungfuertarife2015.pdf.download.pdf/wegleitung_zur_kostenrechnungfuertarife2015.pdf, accessed November 18, 2016.

[2] APS Panel on Public Affairs Committee on Energy & Environment, “Integrating Renewable Electricity on the Grid”, 2010, American Physical Society, https://www.aps.org/policy/reports/popa-reports/upload/integratingelec.pdf, accessed November 18, 2016.

[3] Swiss Federal Electricity Commission ElCom, “Entwicklung der Wechselrate im Strommarkt”, 2014, https://www.newsd.admin.ch/newsd/message/attachments/37360.pdf, accessed November 18, 2016.

[4] SBC Energy Institute, “Electricity Storage”, 2013, http://www.sbcenergyinstitute.com/_/media/Files/SBC%20Energy%20Institute/SBC%20Energy%20Institute_Electricity_Storage%20Factbook_vf1.pdf, accessed November 18, 2016.

[5] Math H.J. Bollen, “The Smart Grid: Adapting the Power System to New Challenges”, 2011, Morgan & Claypool Publishers.

[6] E-Energy, “Smart Grid made in Germany”, Symposion zur Themen der Normung und Standardisierung, Berlin, 2010.

[7] BKW Group, “Annual Report 2015”, 2015, https://bkw-portal-static.s3.amazonaws.com/Webcontent/bkw.ch/fileadmin/user_upload/4_Ueber_BKW/Downloadcenter/UEber_BKW_Gruppe/Geschaeftsbericht_2015_en.pdf, accessed November 18, 2016.

[8] ENERNOC, “The World Leader in Energy Intelligence Software”, 2016, https://www.enernoc.com/, accessed November 18, 2016.

[9] Christophe Bossel, “BKW’s Experience with Demand Side Integration”, 2015, http://www.irgc.org/wp-content/uploads/sites/4/2015/09/Bossel-Demand-Response-2015.pdf, accessed November 18, 2016.

[10] Heather Clancy, “IBM, Migros Test How Freezer Loads Could Balance the Grid”, 2014, http://www.forbes.com/sites/heatherclancy/2014/02/04/ibm-migros-test-how-freezer-loads-could-balance-the-grid/#2e191d2703f2, accessed November 18, 2016.

[11] IBM, “The FlexLast Project”, https://www.zurich.ibm.com/flexlast/infographic_en/, accessed November 18, 2016.

[12] BKW, “Home Energy”, https://www.bkw.ch/de/privatkunden/home-energy/#c10100, accessed November 18, 2016.

Corina, fascinating article on the transition to smart grids and the decentralization of control away from traditional utilities into the hands of consumers. The connection you make between historic customer inflexibility and the ability of utilities to pass the associated costs on to consumers leads me to wonder how companies targeting individual consumers for participation in the smart grid educate their customers. If I am required to purchase and/or install some sort of control node of command mechanism at my residence or office, how do I become convinced that this is going to worth the upfront cost? Are there immediate cost savings, or do I see a long payback period (i.e. as in the case of residential solar), or is it some combination of cost savings and tax credits? I think that the future for smart grids is bright, but I wonder about the consumer (or prosumer as you say) education and awareness process.

Very interesting, Corina! I wonder whether this effort can be further pushed by the evolution in battery technology. As we all know, consumers tend to be lazier than we’d like (recycling being a proxy). Therefore, could these solutions only work when battery technology evolves and can be coupled with software that basically does the thinking & acting in behalf of the consumer? I would feel much more optimistic if you think we can either do it without batteries or with today’s battery technology.

Great article, Corina!

Love the examples you explained to show the recent trends on the utilities market – in my opinion one of the few industries were the last decades have shown only marginal innovations in grid networks and grid technologies.

I fully agree with your implications and the roadblocks for a full adoption of the new innovations by the market. Having worked for one of the major energy provider in Europe, I have seen how difficult it is to roll-out new innovations or to educate customers in a market which is almost purely driven by price competitiveness. For instance, although Germans consider themselves very eco-friendly and demand clean energy, only 2% of the consumers are actually willing to pay a small premium over the standard tariff for a green tariff. Thus I agree that the largest hurdle will be in customers’ willingness to pay and if governments will decide to subsidize certain new trends.

Interesting article Corina! I find the concept quite innovative particularly in light of how the energy industry is looking more towards decentralizing power grids. It appears as if the Swiss market is showing an appetite to experiment with these new models, but my concern is whether, even if it proves successful in Switzerland, it is a representative sample that can be replicated in more energy intensive economies. With it’s small size and relatively low energy consumption (per capita) compared to GDP, Switzerland can afford such experiments and the underlying subsidies that they entail. Until a major energy consumer (think US, China, Germany) takes a bold step in this direction, I’m not sure it will gain traction (although I hope it does!)

Very interesting article. In California, decentralization initially caused large rate increases since there was little real competition. Now, however, the power struggle between utilities and consumers is becoming heated as more and more consumers install solar. Some of the major issues in California are related to paying for the access to the grid and net metering rules. The threats of changing state regulations add another level of uncertainty for the industry. With increasing utiliy prices and increasing uncertainty, my parents finally jumped in and installed solar last year to ensure that they would grandfathered in case the laws change. https://www.technologyreview.com/s/546156/california-decides-the-future-for-solar-is-net-metering/ , http://www.latimes.com/business/la-fi-rooftop-solar-power-20160128-story.html