Progressive: The digitization drag race in car insurance

Digitization is shrinking risk pools and upending the traditional insurance model

Would you buy your health insurance from Apple or your home insurance from Amazon? A recent survey by Gartner found that almost half of British consumers would happily be insured by tech giants [1]. This is a foreboding sign in an industry where traditional operating models are being upended by the use of digital tools. The most agile insurers are investing in connected devices and data analytics to enable more accurate predictions of risky events, but as the cost of these technologies falls, so do barriers to entry. Progressive has capitalized on some (but not all) of the opportunities presented by digital innovation.

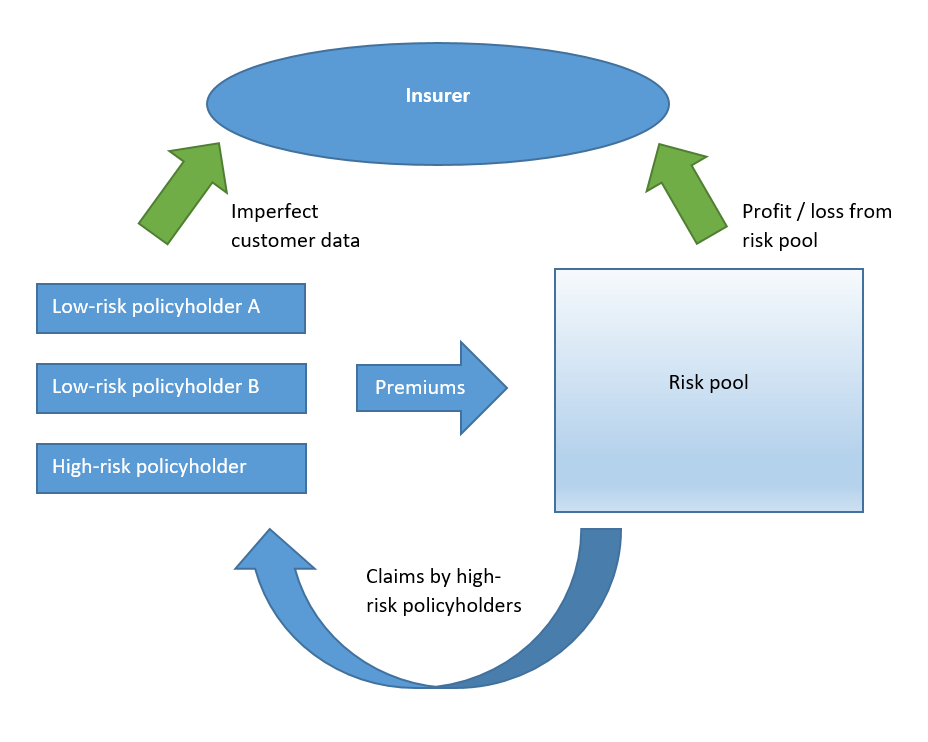

Insurance companies add value through their ability to quantify risk in the face of limited information, and to offer a price to eliminate policyholders’ potential financial losses [2]. Leading insurance companies therefore employ large teams of skilled actuaries (forecasting professionals) who analyze imperfect, generalized data to project likely claims and therefore set premiums. The traditional model relies on a plentiful supply of individuals subject to varying degrees of risk: the premiums paid by low-risk customers (who don’t later claim) cover the cost of the eventual claims of the high-risk customers and leave some profit for the insurer, once all receipts are aggregated into a ‘risk pool’.

The challenge

Improvements in data collection and data analysis will shrink traditional risk pools in the car insurance industry by up to $54bn, according to a recent report by Morgan Stanley and the Boston Consulting Group [3]. Devices such as smart-watches, in-home networked sensors and GPS trackers allow firms to remotely monitor people, homes and cars respectively. Applying data analytics tools, companies can draw granular insights from the data collected to better segregate according to risk, and to encourage risky customers to change their behavior [4]. In both instances claims should fall, and more detailed data allows insurers to more easily select and serve only the best low-risk customers.

The urgency to adapt the traditional insurance model to one using connected devices and data analytics is strong – those who do it best can offer the lowest premiums to low risk customers and make predictable profits. Those who can’t are stuck with a deteriorating customer base of high-risk customers who can’t get their insurance elsewhere [4].

Progressive

Progressive, founded in 1937, has a track record of innovation, including drive-in claims and the first installment payment plans [5]. More recently, the company has sought to capitalize on connected devices and data analytics trends through Snapshot, its driver quality assessment program. Using telematics (the long-distance communication of driving data) Progressive awards discounts of up to 30% off the generic premium rate to Snapshot users who drive carefully. This prospect was enough to entice a large number of customers, who paid $2.6bn in premiums through Snapshot in 2014 [6], or around 15% of Progressive’s total business.

However, more remains to be done if Progressive is to take full advantage of digital innovation in insurance. As Simon Douglas of AA Insurance observes: “the winners in the insurance market will be the ones that have got the data insights that others don’t have” [7]. Insurers are increasingly looking for such data insights in unconventional places. For example, a pilot scheme by Aviva, a British insurer, found that a customer’s online behavior and spending habits were equally effective health risk indicators to medical examinations [1]. Progressive must be cognizant that as connected devices become cheaper and more widely available, barriers to entry fall and traditional benefits of scale are being eroded. The company must maintain an operating model that fosters the collection and analysis of a wide range of data to gain insights beyond what smaller competitors can achieve. This could be done with a product innovation process involving a wide funnel of novel data inputs, which are then intelligently narrowed in stages to arrive at the most meaningful predictive risk indicators.

Privacy and trust

Despite greater acceptance of personal data-sharing, especially by younger generations, privacy and trust remain an important consideration for policyholders; Allianz is spending $500m to build its own private cloud, to avoid entrusting its data to third parties [1]. Insurers like Progressive must ensure they use an operating model that has robust controls on the transfer and use of customer information, enabling differentiation on data privacy as well as price [8].

Driving change, for now

Progressive’s Snapshot program challenges the traditional insurance model of segmentation of customers into broad risk pools, instead gaining specific insights that enable lower pricing for its least risky customers. The program is revolutionary and reflective of a wider trend made possible by low cost connected devices and powerful data analytics. While taking steps to mitigate privacy concerns, Progressive must continue to creatively develop best-in-class data insights if it is to maintain its position in the market.

(800 words)

Sources:

[1] “Risk and reward” Economist (March 2016), accessed 17 November 2016, available here

[2] “Insurance” The Concise Encyclopedia of Economics, accessed 16 November 2016, available here

[3] “Evolution and revolution in a digital world” Morgan Stanley, The Boston Consulting Group September 2014, accessed 16 November 2016, available here

[4] “Car insurers find tracking devices are a tough sell” Wall Street Journal, January 2016, accessed 17 November 2016, available here

[5] “History” Progressive homepage, accessed 17 November 2016, available here

[6] “How’s my driving? The insurer knows” The New York Times Blogs, June 2015, accessed 16 November 2016, available here

[7] “Insurers mine customers’ finance records to set premiums” Financial Times, July 2014, accessed 17 November 2016, available here

[8] “Big Data, Privacy and the Familiar Solutions” Lenard, T. and Rubin, P., Journal of Law, Economics & Policy, Spring 2015, available here

As you noted, one challenge Progressive will face as it moves forward will be the ability to transform massive amounts of data (both that which is collects through Snapshot, as well as that which it can scrape from other sources) into actionable insight. Doing so will require a very different kind of employee than it has traditionally hired. Insurance companies will now have to compete with a whole host of new companies (big tech, etc.) to attract talent. As it has built up Snapshot, how has Progressive addressed the talent gap? I would be curious to know how it markets its own employment opportunities vis-a-vis its competition in tech, and if this competition has changed anything within Progressive’s own operations.

I really like your idea of data privacy as an opportunity for differentiation for Progressive, as well. As a consumer, I certainly hope that insurance companies will compete in this regard, rather than using collected data as a profit-generating mechanism. Data privacy policies are going to be something that we as consumers need to become increasingly aware and critical of!

Michael,

Thank you very much for your insightful post. Outside of the data privacy issues, I also wonder if the insurance model might be eroded if risk is priced too perfectly? For example, if premiums decline for the least risky customers, is it not likely that premiums will increase for more risky customers or customers that do not want to share their personal data in order for the insurance companies to retain revenue levels? At some point, do riskier drivers then decide it is not worth purchasing insurance because the premiums don’t make sense vs. potential damage to their cars (or, alternatively, do they move to competitors)? This is a very interesting topic – thank you very much for writing about it.