Philips: Lightbulb maker or healthcare internet of things (IOT) pioneer?

Most people associate Philips with internet-connected LED lightbulbs you can control with your smart phone. Few know that the company is connecting millions of medical devices and driving adoption of the internet of things (IOT) in hospitals and outpatient settings. Students of TOM and disruptive technologies will want to read on to learn more!

The problem: Healthcare costs are becoming unsustainable

It is estimated that by 2020, half of the US population will have a chronic illness, and US healthcare spending will reach $4.5 trillion.1 Medicare analysis suggests that each year, $17 billion is spent on expenses related to preventable hospital readmissions.2 Such readmissions are primarily due to chronic conditions. Healthcare payers and providers are scrambling to find solutions. New legislation has prompted a shift to fee-for-value vs. fee-for-service care delivery models in an attempt to mitigate costs. Can the healthcare internet of things (IOT) help cut costs and deliver value for patients, hospitals and payers?

Philips’ eureka moment: Addressing a market opportunity

Operating model shift: Creating value

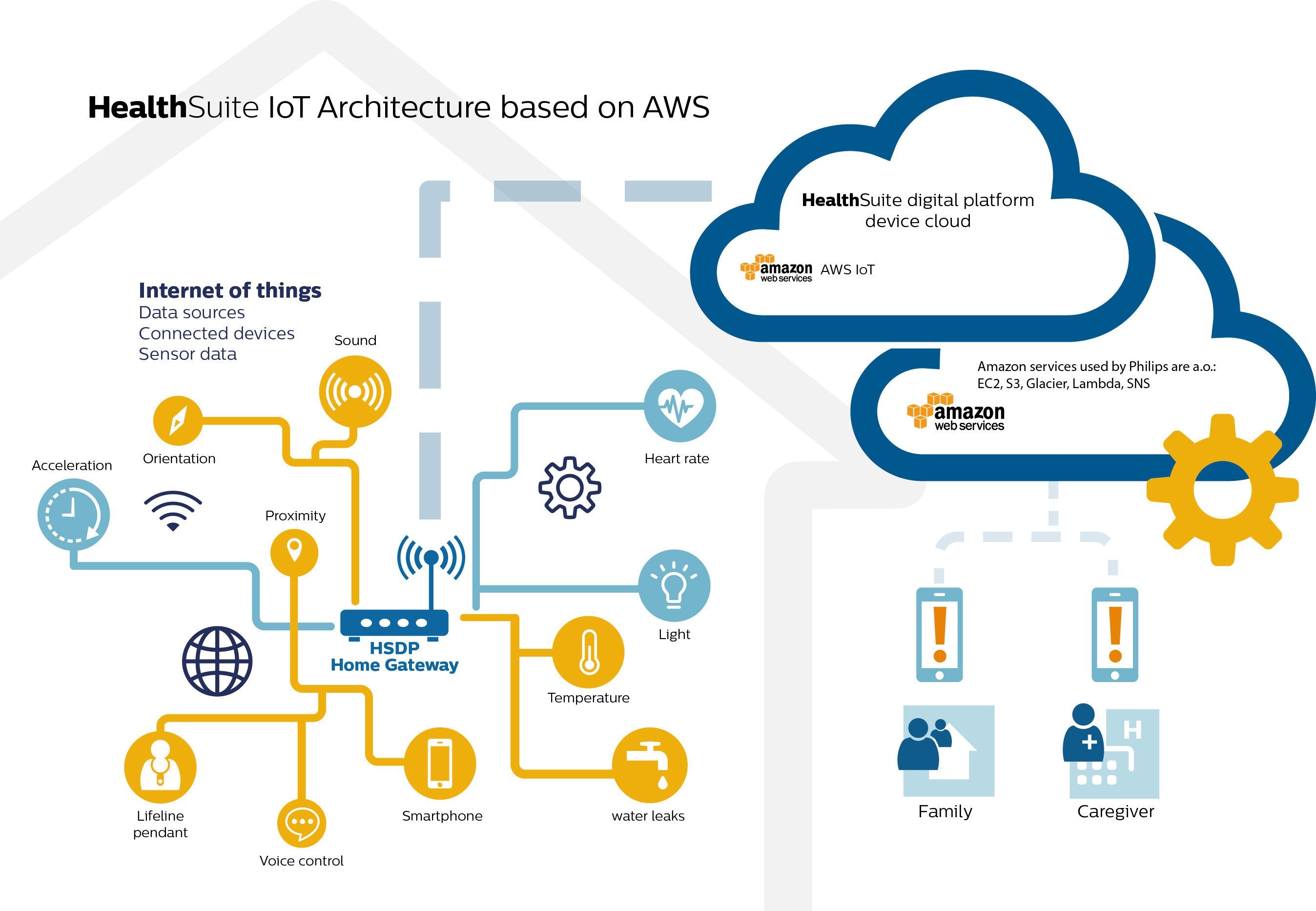

Philips recognized that healthcare systems are optimized to manage acute care, and are being overwhelmed by patients receiving chronic care. It decided to leverage its clinical expertise in providing medical devices and sensors to hospitals, and focus on how the IOT can be applied to drive prevention of hospital admissions, and enable continuous patient care outside of the hospital.3 Philips already had a massive installed base of medical hardware that generated data on >190 million patients per year.4 In January 2014, it developed a platform called HealthSuite, which connects services, capabilities and hardware, and makes this data available via a simple mobile app cleared by the Food and Drug Administration (FDA).5 With HealthSuite, Philips’ value-add is no longer just hardware – it is data that delivers actionable insights to healthcare providers and patients.

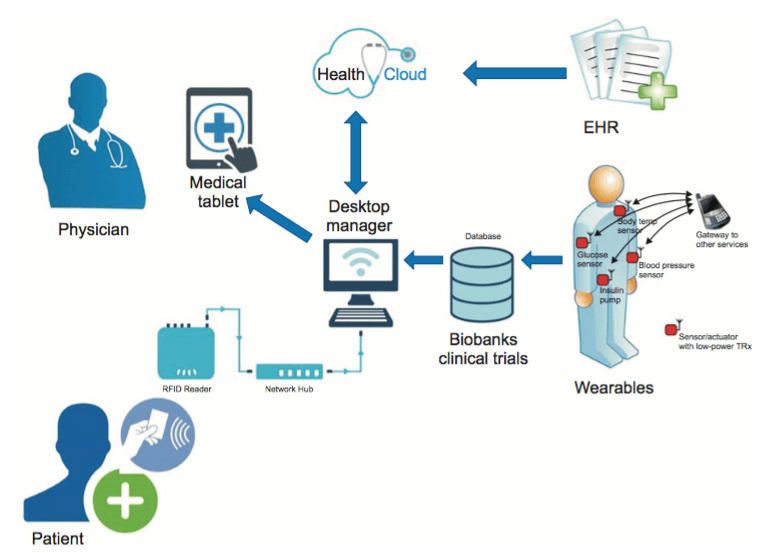

Exhibit 1: Schematic of how the healthcare internet of things might theoretically be structured in a hospital setting.14

Business model shift: Capturing value

Philips traditionally provided hardware (e.g. heart rate monitors) sold for an upfront cost. Its new platform is delivered as a subscription with bolt-on consulting services that facilitate integration, adoption and maintenance. Philips has captured value by extending its product to a service in addition to hardware. By working closely with customers and building partnerships with key innovation centers eager to adopt new technologies that reduce healthcare costs, Philips has also introduced switching costs for its hardware products.6,7

Exhibit 2: Philips has partnered with third parties such as Amazon and SalesForce to avoid investing in areas such as web services infrastructure, where it does not have operational or business expertise.7

A high impact case study: Treating Chronic Obstructive Pulmonary Disease (COPD)

COPD is the third leading cause of death in the US, and a significant burden on the healthcare system.1 It is a complex condition, and often results in expensive hospital re-admissions: exactly the kind of condition increasing overall healthcare costs. Using its HealthSuite platform and a prototype wearable sensor, Philips demonstrated that COPD patients can be effectively monitored and managed remotely.5,8,9 In a similar pilot project, the cost of patient care and hospitalizations was reduced by 27% and 45%, respectively.6

https://youtube.com/watch?v=8QpUUC6gh4g

Exhibit 3: The Philips COPD sensor in practice

A path forward: Overcoming operating and business model hiccups

1) Demonstrate the value of healthcare IOT with hard data

In order to drive adoption of its platform, Philips needs to demonstrate the long-term value it delivers. While many pilot studies are ongoing, data on the impact of healthcare IOT is scarce.10,11 Providing additional data across common diseases will help drive adoption beyond pilot centers.

2) Drive adoption among all stakeholders

While its primary customers are hospitals and health networks, Philips cannot forget its key stakeholder: patients. Patients are end users of Philips’ apps, and will have a direct influence on their uptake via their interaction with healthcare providers. Based on ratings of Philips’ apps in the Google and Apple app stores (~2.5/5 stars), there is work to be done to enhance the patient experience.12,13

Privacy and interoperability: Serious but not insurmountable issues

Critics of healthcare IOT point to privacy concerns or data inter-operability hurdles.14,15 Most large health systems use electronic health records.14 Healthcare IOT broadens the dataset stored, but the security risks it introduces are not new. Additionally, Philips designed its platform in an open format so that other players can leverage and extend its capabilities. 8 There are risks to the adoption of any new technology. Healthcare IOT, however, can cut costs and deliver significant value for patients, hospitals, payers. In an environment where healthcare costs are becoming unsustainable, aren’t these risks acceptable?

(Word Count: 712)

Sources

- Quelch, J. A. & Rodriguez, M. L. Philips Healthcare: Marketing the HealthSuite Digital Platform. Harvard Bus. Sch. Case Study (2015).

- The IoT Is Coming To Healthcare. Available at: http://www.forbes.com/sites/jonmarkman/2016/09/15/the-iot-is-coming-to-healthcare/#6dbcdc227503. (Accessed: 16th November 2016)

- Tas, J. Connections that will Transform the Future of Healthcare | Jeroen Tas. 1–5 (2016).

- Sullivan, M. Salesforce and Philips partner in ambitious health data venture | VentureBeat | Business | by Mark Sullivan. Available at: http://venturebeat.com/2014/06/26/salesforce-com-and-philips-partner-in-ambitious-health-data-venture/. (Accessed: 16th November 2016)

- Changing the life of patients, together! | Lucien Engelen | Pulse | LinkedIn. Available at: https://www.linkedin.com/pulse/20141013143013-19886490-changing-the-life-of-patients-together. (Accessed: 16th November 2016)

- Banner Health achieves 27 percent cost savings through joint pilot telehealth program with Philips. 3–5 (2016). Available at: http://www.prnewswire.com/news-releases/banner-health-achieves-27-pe…-through-joint-pilot-telehealth-program-with-philips-300076268.html. (Accessed: 16th November 2016)

- Shipilov, A. A Better Way to Manage Corporate Alliances. Harv. Bus. Rev. (2014).

- PORTER, M. E. & HEPPELMANN, J. E. How Smart, Connected Products Are Transforming Companies. Harv. Bus. Rev. 93, 96–114 (2015).

- Open a world of cloud- based collaborative care. 1–6 (2016). Available at: http://www.usa.philips.com/healthcare/innovation/about-health-suite/applications-health-suite. (Accessed: 16th November 2016)

- Gastelurrutia, P. et al. Wearable vest for pulmonary congestion tracking and prognosis in heart failure: A pilot study. Int. J. Cardiol. 215, 77–79 (2016).

- Hentschel, M. A., Haaksma, M. L. & van de Belt, T. H. Wearable technology for the elderly: Underutilized solutions. Eur. Geriatr. Med. 7, 9–11 (2016).

- Philips HealthSuite health app on the App Store. Available at: https://itunes.apple.com/us/app/philips-healthsuite-health/id1018192035?mt=8. (Accessed: 16th November 2016)

- Philips HealthSuite Health app – Android Apps on Google Play. Available at: https://play.google.com/store/apps/details?id=com.philips.moonshot&hl=en. (Accessed: 16th November 2016)

- Dimitrov, D. V. Medical Internet of Things and Big Data in Healthcare. 22, 156–163 (2016).

- Monitor: The language of the internet of things | The Economist. Available at: http://www.economist.com/news/technology-quarterly/21615067-more-and-more-devices-are-becoming-connected-will-they-speak-same. (Accessed: 15th November 2016)

- Header image source: Image source: http://www.usa.philips.com/healthcare/innovation/about-health-suite

Very interesting article on Philips’ move into the healthcare IoT space. I think you correctly highlighted under “A path forward” bullet (2), that one of the primary difficulties in this space is patient adoption. Philips could have the best technology in the world, but if patients refuse to use that technology then it won’t matter. I would be interested to hear your thoughts on how Philips can focus on designing products that drive patient adoption, and how Philips can work with healthcare providers to get them to explain the benefits to patients.

I would imagine that a large number, if not the majority, of the patients that Philips is focusing on are in the 65+ category, and may be adverse to utilizing new technologies. How do you think Philips will be able to drive adoption of COPD monitoring technology in the 65+ category among non-tech savvy users?