Otis – From Mechanical to Digital Innovation

Otis is poising itself to disrupt the elevator service industry with its IoT strategy

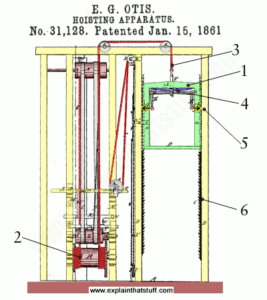

Elisha Otis didn’t invent the elevator; he invented the elevator brake in 1852 [1]. This invention, however, was far more important. It transformed skyscrapers from a dream to a practical reality. Otis was at the forefront of mechanical technology in the 19th century, and now it is at the forefront of digital technology.

Research and Development at Otis

Today, Otis rakes in $12 billion in revenue and is the world leader in elevator installation and maintenance with a market share of 10% [2][3]. In this highly competitive industry, it is important for Otis to have strict controls on its costs. To do so Otis has made several digital innovations to its elevators. “On a year-to-year basis ….the investment in R&D and IT together is 40%-50% more. It is a considerable amount of money that the leadership has dedicated to the transformation and digitalization strategy” says Marcus Galafassi, VP of Information Technology and CIO at Otis [4]. Most of this spend targets the maintenance and servicing sector.

Targeting the Service Component

Otis’ service contracts form a significant part of its profits. An analyst from William, Blair and Company estimates it to be 65% of the profit [5]. These profits take a significant hit when there are unscheduled callbacks. To put it into perspective, Otis has 2 million service contract elevators transporting 2 billion people daily with only 30,000 service technicians worldwide [6]. This amounts to 60 millions hours servicing elevators yearly [7]. The median pay for 2015 was $39 per hour for elevator service technicians. Assuming a conservative $25 for worldwide average pay, leads to a net spend of $1.5 billion [8]. For a company with revenues of $12 billion and operating profits of $2.5 billion this is a significant cost [2].

Before the IoT Revolution

Service contracts for elevators have shifted from being dominated by the manufacturer, to a marketplace of specialized service companies as well as manufacturers. Generally the contract period is for five years and the contract is tailored to the elevator type, age and pattern of use. Each tailored contract would include regular monthly servicing and a few hours of free unscheduled calls. Contracts are structured based on performance and hence the costs of unscheduled calls are borne by the service company [9]. Any unscheduled call would completely disrupt the scheduling of technicians, not only adding man-hours but also increasing variability and consequently a low labor utilization.

Otis Remote Elevator Monitoring

Otis, in tying up with Microsoft and AT&T, has installed Remote Elevator Monitoring (REM) in 300,000 of its 2 million elevators [4]. It has installed several sensors on these elevators, which collect hundreds of various data points. For example some of these data points are “how far has the elevator travelled over its lifetime” or “what is its braking deceleration” [4][10].

In case the server (located in the building itself) detects a breakdown, an automated response is sent to Otis’ 24-hour communications center and a service technician is dispatched [10]. Within the operating model, this removes the time lag from the cumbersome process of the building manager recognizing the problem, diagnosing it and contacting an Otis call center.

REM is even more powerful in its ability to aggregate and analyze data from thousands of elevators and then predict failures [10]. The numerous sensors installed in each of Otis’s elevators will send data to a centralized Otis server. The server uses historical data points that preceded the breakdown of elevator parts, to predict when future breakdowns will occur. The key here is that Otis is able to use data from all its REM elevators across the world. In this manner a technician can be dispatched even before failure, in a departure from Otis’ prior operating model. The benefits are twofold. Firstly there is no downtime of the elevator. Secondly Otis is better able to plan the schedule of its technicians thus increasing labor utilization and reducing labor costs.

What More?

Otis can take further steps to enhance its operational efficiency.

While other elevator companies would be following similar IOT strategies, Otis should target elevators of other manufacturers. Otis can use its data from its initial 300,000 REM elevators as a head start to offer cheaper service contracts.

Otis also has the opportunity and ability to disrupt the service technician labor market. Instead of keeping technicians on its payroll, it can “Uberify” the technician market. This would reduce Otis’ fixed cost and also allow service technicians to work on their own schedule. By using predictive analytics, Otis should aim to perfectly match service technician demand with supply. In doing so Otis will need to be mindful in its allocation of value to landlords, service technicians and itself, making sure that all constituents benefits.

Ultimately, as it has been since 1852, Otis ultimately must consistently be innovating. (798 words)

[1] National Inventors Hall of Fame

http://www.invent.org/honor/inductees/inductee-detail/?IID=115

[2] UTC Annual Report 2015

http://2015ar.utc.com/assets/pdf/UTC_AR15_Annual_Report.pdf

[3] IBISWorld Industry Report Elevator Installation and Service in the US – Chrystalleni Stivaros

[4] Network World Interview with Marcus Galafassi VP of Information Technology and CIO at Otis Elevator

[5] Otis Elevator Is Keeping Up By Going Digital – Hartford Courant – Stephen Singer

http://www.courant.com/business/hc-otis-technology-20160520-story.html

[6]AT&T Press Release April 25, 2016

http://about.att.com/story/att_and_otis_collaborate_on_internet_of_things_solutions.html

[7] IOT Connectivity Solutions Industry News

http://www.iotconnectivitysolutions.com/news/2016/04/24/8351490.htm

[8] Bureau of Labor Statistics – Elevator Installer and Repairer

http://www.bls.gov/ooh/construction-and-extraction/mobile/elevator-installers-and-repairers.htm

[9] Facilities Net Interview with Glenn Rodenheiser, Director of Service Sales and National Accounts with Schindler Elevator Corporation

[10] Otis Remote Elevator Monitoring

http://www.otis.com/site/us/Pages/REMElevatorMonitoring.aspx

I found your description of the future of remote elevator monitoring to be quite interesting. It will require Otis to pivot more into being a data-centric company rather than just an equipment-centric company. I also imagine the possibility to predict elevators failures to be relatively accurate, so I see a real value add in this area.

On a different note, it is surprising to hear that there is a large amount of research and development money being spent in the elevator industry. I would have never guessed! One of the few innovations I have noticed recently is the use of destination dispatching for elevator lobbies (http://otis.com/site/us/OT_DL_Documents/OT_DL_DownloadCenter/Product%20Information%20-%20Compass%C2%AE/Compass%20Brochure.pdf). The elevators where I worked in Chile had this system where it tells users which elevator to take after punching in the desired floor number. It grouped users with other people going to the same floor and was quite effective in reducing elevator travel time.

Who knew plain old vanilla elevators could be at forefront of IoT?! It turns out there are 12+ million elevators transporting 1 billion people every day worldwide, so market opportunity is massive… especially for predictive maintenance, as you noted. Otis’s competitor thyssenkrupp entered the market with similar platform called MAX, which captures key metrics such as motor temperature, shaft alignment, cab speed and door functioning to predict maintenance needs. They’ve taken digitization one step further, by leveraging Microsoft HoloLens and Skype technologies to give their technicians remote assistance – they can see what on-site technicians are seeing and give real-time advice on complex matters and cut the average length of their service calls. By reducing frequency and shortening service visits, reducing maintenance costs and improving elevator uptime, early movers like Otis and thyssenkrupp are nicely positioned to ride up a larger share of this $44B revenue market.

https://blogs.microsoft.com/iot/2016/09/15/microsoft-azue-iot-suite-and-hololens-enable-revolutionary-solutions-for-thyssenkrupp-elevator/

Great article Shiv! Really interesting how technology creates an opportunity to improve a part of the business model (providing service), to the point that it becomes a competitive advantage.

I had one concern about the suggestion that Otis should ‘uber-ify’ the technician market in order to optimise supply.

As we noted during the Uber case in class, one problem is that Uber drivers are able to sign up for Lyft/Ola/competitors. They are not tied to a single company. If Otis were to go down this route and change their technicians from employees to contractors, does that not lower barriers to entry for competitors?

In this specific case, given the highly skilled nature of the elevator technician ($39/hour median pay as you noted), is it not wiser to keep them on the payroll and give them a significant switching cost to leaving Otis?

Nevertheless, I believe Otis can still use the uber concept by matching supply and demand for unscheduled calls. However, this should be controlled centrally within the company, and not decentralised with contracted technicians.

Thank you for the great article!

Although Otis seems to be moving the right direction, I am quite skeptical about the company’s ability to collect and process the amount of data, in order to come up with key conclusions. More precisely, this sounds like a very high investment, which makes me question if it will ever payback.

On the contrary, once the above is resolved. this is indeed an amazing revolution for even more data mining, which could potentially assist Otis to better cater specific customers (e.g. specific details on usage of elevators). Using this, Otis can better design the elevators to proactively fight common defects.