Northern Sea Lanes: Melting Arctic Ice Creates Supply Chain Opportunity

Builders and operators of icebreakers stand to gain as international shipping firms increasingly utilize Arctic shipping routes in the face of global warming.

Climate change has traditionally been viewed through the lens of economic threat, but significant opportunities also exist. Steady reduction in polar ice due to increased temperatures has introduced drastically shorter shipping routes between Asia, Europe, and North America. As more shipping companies take advantage of these routes to shorten their supply chains, demand for polar infrastructure are increasing. Atomflot, a subsidiary company of Russia’s state-operated nuclear conglomerate Rusatom, operates nuclear powered icebreakers in these waters[1]. As traffic increases, Rusatom needs to expand their investment in new equipment to take full advantage of this positive aspect of global warming.

Figure 1: Arctic Shipping Routes[2]

Two of the primary shipping routes between Asia, Europe, and North American ports are the Suez Canal Route (SCR) and Panama Canal Route (PCR). The Northern Sea Route (NSR) is not a single route but a combination of passageways connecting Europe and Asia. The Northwest Passage (NWP) is a similar collection of routes in the Arctic waters north of Canada, shortening the trip for North American bound Asian and European ships[3]. Figure 1 depicts the northern sea routes, and Table 1 compares distances between major ports utilizing various sea routes.

| Departure Port | Destination Port | Traditional Dist (nm) | Northern Dist (nm) | Percent Shorter |

| Northwest Europe | Busan | Suez Canal: 10,827 | NSR: 7,248 | 33% |

| Hong Kong | Suez Canal: 9,753 | NSR: 8,399 | 14% | |

| Shanghai | Suez Canal: 10,532 | NSR: 7,688 | 27% | |

| New York | Busan | Panama Canal: 10,056 | NWP: 8,107 | 19% |

| Hong Kong | Panama Canal: 11,148 | NWP: 9,258 | 17% | |

| Shanghai | Panama Canal: 10,577 | NWP: 8,547 | 19% |

Table 1: Traditional and Northern Sea Route Distances Compared[4]

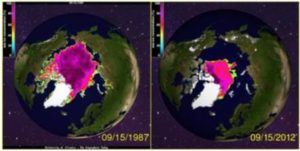

While shorter distances clearly show the benefit of northern routes, significant sea ice has traditionally prevented use. This is gradually changing. The Intergovernmental Panel on Climate Change (IPCC) has shown that sea ice coverage in polar regions has decreased at an average rate of 3.8% per decade since monitoring began in the mid-twentieth century. This reduction has been irregular in space and time, with 49% reductions in September compared to less than 2% reductions in March. As the rate that ice retreats in summer months and expands in

winter months changes, thickness of the ice is also affected. Average polar ice thickness has decreased by 1.8m in the same period as the 3.8% coverage decrease[5]. Experts mostly agree that polar ice will not fully disappear in this century, but the steady decrease in coverage and thickness allows for ice-breaker assisted transit. Demand for icebreakers is also assured by NSR regulation – Russia operates the Northern Sea Route Administration (NSRA), which forecasts ice coverage and mandates icebreaker escort for most vessels[6]. With their unique capabilities, Atomflot is poised to capture significant value from environmental and regulatory conditions. Demand for icebreakers already results in hour or day long waits to transit the NSR, which will continue to increase if demand for more icebreakers is not filled by Atomflot[7].

Figure 2: Sea Ice Coverage Change, September 1987-2012[8]

Atomflot currently operates four nuclear powered icebreakers, and in response to demand has ordered an additional three, all contracted to be operational by 2020[9]. Atomflot faces several other decisions and opportunities. The first relates to service life extension of existing icebreakers. The ships were designed for 100,000 hours of active icebreaking over 26 years, putting two of the existing ships up for retirement within a year of 2020’s new ships. Maintenance upgrades exist that have already extended one vessel’s life to 171,000 hours, with the possibility of 225,000 hours[10]. The significant investment of new ships will add no permanent capacity to the fleet without these upgrades, so Atomflot should extend the life of all existing ships to the greatest extent possible. Atomflot and the Russian government should also consider extending their market into the Northwest Passage, where ice is a greater threat to shipping than on the Northern Sea Route. By increasing capacity and expanding markets, Atomflot will create a mutually beneficial situation for themselves as well as shipping companies taking advantage of the shorter routes.

Completely reliable climate change predictions would make the number of new ships to build a straightforward analysis. Much subjectivity remains, forcing the question of what assumptions should Atomflot and similar companies make about the next hundred years? The opportunity window for profitable icebreaking operations exists between the present day and whenever rising temperatures result in permanent open waterways over the poles. Some experts put that as soon as 2060, at which point large capital investments in icebreakers would be useless[11]. Regardless of the specifics, trends in climate change show that anyone involved in international shipping will see significant impact to their supply chains in coming years.

Word Count: 792

[1] Rosatom Group, “The Nuclear Icebreaker Fleet,” http://www.rosatom.ru/en/rosatom-group/the-nuclear-icebreaker-fleet/, accessed November 2017.

[2] M. Humpert and A. Raspotnik, “The Future of Arctic Shipping,” October 11, 2012, Port Technology International, https://www.thearcticinstitute.org/future-arctic-shipping/,accessed November 2017.

[3] Orts Hansen et all, “Arctic Shipping – Commercial Opportunities and Challenges,” CBS Maritime, Copenhagen Business School, ISBN 978-87-93262-03-4, (January 2016), p.10.

[4] Ibid, p. 27-28

[5] Ibid, p.22.

[6] Ibid, p.12.

[7] Ibid, p.28.

[8] Ibid, p.23.

[9] Rosatom Group, “The Nuclear Icebreaker Fleet,” http://www.rosatom.ru/en/rosatom-group/the-nuclear-icebreaker-fleet/, accessed November 2017.

[10] “Atomflot: Russia needs to build more icebreakers due to increased Arctic shipping,” February 16, 2017, The Arctic with Support of the Russia Geographical Society, http://arctic.ru/infrastructure/20170216/553706.html, accessed November 2017.

[11] Jugal Patel and Henry Fountain, “As Arctic Ice Vanishes, New Shipping Routes Open,” The New York Times, May 3, 2017, https://www.nytimes.com/interactive/2017/05/03/science/earth/ arctic-shipping.html, accessed November 2017.

A fascinating article and well researched article. Recognising that climate change overall is a huge issue overall, it’s refreshing to hear a case for some of the accompanying opportunities.

One thought that struck me is that it might not be just the pace of climate change (and so reduction in ice levels) that Rusatom needs to plan for uncertainty around – if demand rises for shipping via northern routes, then presumably: a). New competitors could enter the market (e.g. large freight companies might procure their own icebreakers), and b). Transport ship design might adapt so that, for example, large freight ships are fitted with their own icebreakers, negating the need for Rusatom’s service offer.

With this in mind, I wonder whether it might make sense for companies like Rusatom to begin thinking about R&D/joint ventures with large shipbuilders, while they still have a comparative advantage in the icebreaking field?

A very interesting perspective on a truly large opportunity created by the negative effects of climate change. I agree that Atomflot is in a good position to create a strong position in this market and extract value from what is likely to be a product in high demand.

One thing that Atomflot should consider is how to protect themselves from negative public backlash and/or regulation preventing them from using these routes. Given that a large capital investment that is required it is very important to ensure that the company clearly accounts for the potential risks of some countries banning shipments through these routes and/or placing severe restrictions. I think by having an open dialogue with key stakeholders before making a large capital investment the company may be able to get reasonable guarantees that de-risks their investments in the future.

Overall the 15-30% reduction in distance opens up a large opportunity to greatly reduce shipping costs. This will be an exciting space to keep watching.

Dillon, this is a very thought-provoking perspective.

I believe that it will be very difficult for Atomflot to invest in new ships for any period longer than 30-years. The key uncertainties that Atomflot will likely face are 1) Changes in regulatory environment that reduces demand for ice-breakers 2) Barriers to tapping new shipping routes e.g., due to regulations 3) Freeing up of capacity as jobs can probably be done faster as polar ice thickness starts to decrease 4) Decrease in demand as ships are able to clear their own passageway through additional fixtures / new desgins

Within the 30-year time period, there are probably ways for Atomflot to manage these uncertainties. Given their current positioning, it seems likely that Russian regulations will continue to support their operations, justifying investment in new ships that cater to the demand in the Northern Sea. Atomflot should also consider expanding its operations to other shipping routes and the best way to lock-in some demand certainty is to partner with the local authority.

This is a very interesting space to watch, especially with mega ships that will be ready by late 2019. I’m curious to see how the introduction of larger vessels on these shipping routes will impact the demand for Atomflot’s services.

This is really interesting and a perspective on climate change that I had not previously considered. Perhaps less commercial, I can’t help but think of the geo-political implications of such a port emerging. It is no secret that the Suez and Panama canals are of utmost importance to Western economies, and the US government has gone to great lengths to preserve these routes (http://www.nytimes.com/1989/10/08/world/failed-coup-bush-team-noriega-special-report-panama-crisis-disarray-hindered.html?pagewanted=all). Given that, Ruastom would likely need to weigh broader political factors along with climate ones to determine the long-term feasibility of such projects.

It is truly intriguing to see opportunities rather than threats brought by global warming.

Shorter shipping routes via the northern sea lanes certainly present promises of lower cost and faster delivery for global supply chain. However, not all type of goods are suitable for these shipping routes. For instance, some commodities may be damaged or otherwise negatively impacted by the extremely low temperature during part of the northern sea lanes.

In addition, companies also need to consider the reputational risks associated with exploiting the northern sea lanes. Driven by rising consumer advocacy towards environmental preservation, many companies, especially the largest ones, today have made commitment to operate their business in a sustainable, traceable and transparent manner. Such companies face risks of upsetting and even losing their end customers by projecting an image of exploiting earth as they ship their products through a shipping route created as a result of global warming. As they are often the most important customers of shipping companies, whom in term are customers of Atomflot, the future demand for northern sea lanes may be more volatile than current expectation.

Really interesting article on how climate change can create supply chain opportunities and cost savings. In addition, I like RM’s analysis of how the shipping companies might respond to the opportunity. When considering the assumptions that Atomflot should make about the next hundred years, three potential challenges should be addressed.

1) Similarly to nuclear power plants, is the cost of decommissioning the nuclear-powered icebreakers incorporated in the analysis, as this might affect the viability of Atomflot’s business plan? This is especially true as there isn’t currently a viable long-term solution to the storage of nuclear waste in place.

2) Will the introduction of drone ships affect the way shipping companies view sea routes to the detriment of the North Sea route?

3) How trade restrictions, such as the current one between the European Union and Russia [1], will affect the relationship between EU companies and Atomflot?

[1] INTA. “Russia’s and the EU’s sanctions: economic and trade effects, compliance and the way forward”. http://www.europarl.europa.eu/RegData/etudes/STUD/2017/603847/EXPO_STU(2017)603847_EN.pdf. Accessed on December 1st, 2017.