Naraffar – 24×7, Unmanned,, Swedish convenience Store; Is customer self-service the new model in retail?

Have you ever felt the frustration of scrambling to the grocery store only to find that its shut? Or had to suffer through long lines at the postal depot to collect your Amazon delivery that you weren’t home in time for? Unstaffed stores like Naraffar and 24×7 “click and collect” retail models are using tech to solve these very pain points.

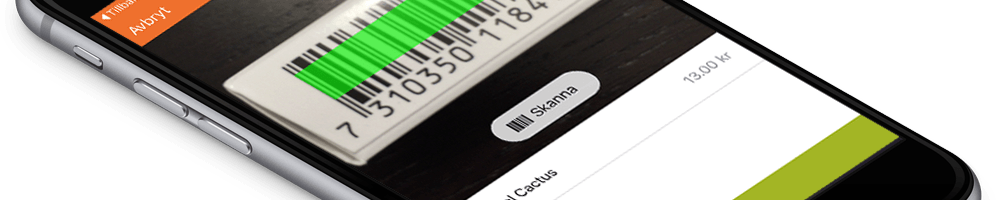

When Robert Ilijason, aged 39, had to drive 12.5 miles to find the nearest grocery store that was still open, he conceived the idea of Naraffar – a wholly unmanned, convenience store. Naraffar, located in the town of Viken, Sweden (population 4,200) is an employee-less, tech-enabled store that is open 24×7, 365 days a year. Customers unlock the door using the Naraffar smartphone app which provides them with a unique id number linked to their Bank ID. The customers then proceed to scan the individual items that they wish to buy and are charged monthly for their purchases, all through the Naraffar app. (Watch: Naraffar Video – https://www.youtube.com/watch?v=ShNL3oU4Mi0) In Ilijason’s mind, the value proposition of Naraffar lay in providing 24×7 convenience to remote towns like Viken by getting rid of the constraint of scarce and costly labor. While Naraffar has only been in operation for 10 months now, it does pose an interesting question about the growing trend of customer self-service in retail.

This trend is clearly evidenced by the “click and collect” boom in Europe. In this model, retailers enable customers to order and pay online and then pick up their purchase at one of several strategically-located, highly-accessible, 24×7 pick-up points. In 2015, the number of click and collect points in Europe grew by 20% to reach an estimated number of half a million. The UK by far has seen the most traction with ‘click & collect” with nearly a third of online revenues coming from this channel. Several brick-and-mortar retailers in the UK have successfully decoupled the buying and collection process to minimize costs and maximize customer convenience. The supermarket ASDA has over 600 collection points across the UK located in operating ASDA stores, Tube stations, public parks and gas stations.  These collection points, which are accessible 24×7, consist of temperature-controlled “intelligent” lockers which customers can unlock using a QR code given at the time of purchase. Similarly, Waitrose has installed “chilled”, unmanned lockers at Tube stations and Gatwick Airport (so that travelers returning from a trip can just pick up pre-ordered groceries as they exit the airport).

These collection points, which are accessible 24×7, consist of temperature-controlled “intelligent” lockers which customers can unlock using a QR code given at the time of purchase. Similarly, Waitrose has installed “chilled”, unmanned lockers at Tube stations and Gatwick Airport (so that travelers returning from a trip can just pick up pre-ordered groceries as they exit the airport).

So let’s break it down. Why are these models working?

Firstly, the collection model solves many of the inefficiencies that exist within the current doorstep delivery model for online retail. It increases customer flexibility by shortening delivery time. ASDA for example offers same day pick up after 4 pm for customers that order before noon. This is invaluable for perishable and last-minute buys such as groceries. Moreover, from the seller standpoint, it takes away the high cost associated with last-mile logistics. Oftentimes for goods ordered online, customers aren’t home when the delivery arrives and the parcel needs to be either returned to a central depot or redelivered later. It is estimated that the direct cost to retailers of failed first time deliveries is over $1 billion per year in the UK alone.

The cost and convenience implications for a more direct model like Naraffar are also huge. For a traditional retail/grocery store labor costs form 10-20% of the cost bar. The absence of labor cost allows for retailers to expand into less dense areas and keep stores open in low-demand hours. Having said that however, this model is also more capital intensive. It requires significant investments in software and infrastructure such as POS and “temperature controlled lockers” which does pose a challenge to rampant network expansion.

Another significant challenge is security. Naraffar has employed some interesting mechanisms to deal with security issues. In addition to allocating a bank-linked, unique identifying number to each customer, the store is equipped with over 6 surveillance cameras. A state-of-the-art alarm system guards against break-ins and notifies the owner if the main door is open for longer than 8 seconds. While these may be effective deterrents in a small Swedish town the scalability of this model in larger cities and different markets is a question mark.

Slower adoption of technology, especially in rural areas, and a lower quality retail experience from lack of human interaction, pose additional hurdles. However, all-in-all, as smartphone penetration increases, the growth of this model seems inevitable.

The question then remains – what will the impact of this be on employment in developed markets? Retail sales in the US alone provide ~5 million jobs. How well are we equipped to absorb the displacement of a significant part of the workforce? While it may seem like self-service retail is paving the way to better economics and higher consumer convenience what we need to really ask ourselves is, at what cost?

Word Count: 760

Endnotes:

- http://www.digitaltrends.com/cool-tech/sweden-app-enabled-automated-store/

- http://gizmodo.com/theres-smartphone-powered-store-in-sweden-with-no-human-1761930134

- Deloitte Industry Report – “TMT predictions, 2015”

- https://www.theguardian.com/money/2015/jun/20/online-shopping-click-collect-deliveries

- https://www.retail-week.com/sectors/grocery/asda-unveils-full-details-of-24/7-click-and-collect-pod-trial/5075195.article

- http://www.retailanalysis.igd.com/Hub.aspx?id=23&tid=3&nid=13908

- http://www.cityam.com/1413548291/waitrose-trials-chilled-click-and-collect-lockers

- Forbes – 2010 Benchmark Breakdown: Key Metrics on 25 industries

- United States Bureau of Labor Statistics (http://www.bls.gov/ooh/sales/retail-sales-workers.htm)

Tarunika – thanks for the post. Few thoughts came to mind while reading. I completely agree that there are considerable security concerns inherent in the Naraffar model, particularly around shoplifting. Perhaps the costs generated by theft, especially in low-priced environments such as a convenience store, are still relatively light compared to staffing needs – but it certainly raises concerns if one were to consider other applications of this model. My second thought revolved around inventory and stocking. Perhaps a self-service model would allow an owner to reduce the cost of idle employee time spent at register, but the shelves would still need to be stocked, spills would still need to be mopped, etc. I would imagine that these tasks would certainly incur significant labor costs. And, I’d imagine that these costs may be even more significant for a click and collect model under which parcels are likely hand-compiled. To that extent, is convenience and extended hours the true upside of these models vs. reduced labor costs?

Great post, Tarunika! This model for grocery shopping makes me think of remote south-asian villages and how such stores would be life-changing in many developing markets. Unfortunately, credit card penetration in such areas is extremely low, while in some places, there is also an absence of reliable internet/electricity. I wonder if Naraffar can think of ways to expand to such places. One idea that comes to mind is for them to partner with local mom and pop shops so that up-and-starting is not so capital intensive and they also have trial-ability. Regardless, I am keen on observing the future journey of Naraffar.

This is awesome. Such a great example of how a small operational change can drive differentiation. I bet people have a much higher basket size here given the pain of payment is delayed and separated from the purchase itself – it feels like free food.

I completely agree on scalability issues. Like any chain of stores, this business would benefit from density of locations in order to cut procurement and distribution costs. However, larger cities are more likely to already have a late-night convenience store open, in which case the hours of operation differentiation become less applicable. With higher volumes and many people cycling in an out at all times, the security becomes much harder to enforce. You will have unregistered people slipping in through the same open doors who then have free reign to take as much food as they want with no way to track them. On the other hand, the lower cost delivery model could be used to pass some savings through to the customer, which would add pricing differentiation and drive traffic.

As we have all seen in self checkout lanes in existing grocery stores, the technology can get pretty finicky. Luckily, there is always a human there as a backup. I could see this model frustrating many customers who have no recourse when their app malfunctions and have now wasted a trip.

However, if this business model were scaled upward, I assume they would have a skeleton crew staffing the store just to handle these issues and the ones Patrick brought up. There is both an experiential and a security benefit to even having one or two people greeting at the front of the store, and spreading that cost over much larger stores in bigger markets would be negligible.

I am sure all of these issues are solvable, but whether or not they are solvable while maintaining the customer experience is unclear.

Thank you Tarunika for a fascinating read on the unmanned grocery store concept! I think it’s particularly interesting that Naraffar came about in a very rural Swedish town, when I would generally associate tech-enabled concepts with large cities.

Similar to Patrick, I would have a few concerns as to how “unmanned” stores like Naraffar can be. Aside from stocking and clean up, patrons might face technical issues with the scanning of items, or have questions on merchandise. Not providing in person or mobile-enabled support for these issues could lead to customer dissatisfaction. Additionally, reviewing hours of security footage whenever inventory is missing could be a very costly endeavor from a labor perspective.

That said, I believe there is a place for unmanned convenience stores, as a supplement to traditional grocery stores. After watching the video linked in the article, it seems like business is largely done either after grocery stores have closed at night or before they have opened in the mornings. Moreover, the I would guess that business at these stores would likely be one-off purchases of snacks or missing essential items such as a jar of baby food, and not a household’s weekly grocery purchases. As long as the revenue from these purchases offsets the large capital expenditures for a tech-enabled store, I think these concepts could have great success.

Great concept and entertaining article Tarunika!

I love the idea and I would use it all the time, as I did when I was leaving in front of a 24/7 megastore. The issue that I have for this is actually what would happen when you move out of a little Swedish town where everyone knows everyone to Stockholm where people would be less inhibited to do wrong. Additionally, how would this concept be exported to other countries that are less prone to shoplifting than Sweden?