Munich Re – mitigating risk in an uncertain climate

As one of the largest re-insurers in the world with circa 43,000 employees across the globe and over EUR 50bn premium income in 2015[i], Munich Re has felt the repercussions of climate change on its business model. The company has managed built a solid basis for future business success by diversifying its business across property/casualty (P/C) vs. life/health (L/H) insurance markets, and several geographies (US, Europe, Asia). More importantly, however, Munich Re has become a thought leader in innovative risk modeling for natural catastrophes and product offerings on the P/C side of the business.

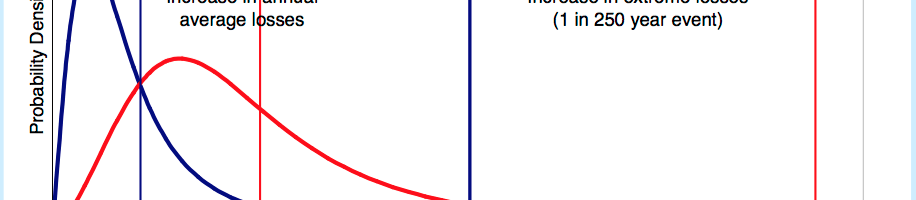

Re-insurance companies are affected by climate change, because of the increased probability of high impact natural catastrophes and thus increasing direct costs via higher damages. Pricing for re-insurance is heavily reliant on knowledge of these exact probabilities. Research suggests that climate change is shifting the probability distributions of natural catastrophes, such as hurricanes, blizzards, etc. to the right[ii], increasing the cost for re-insurers. However, data implies that probability distributions of disasters occurring are also getting more skewed[iii], i.e. showing fat tails, please see below[iv].

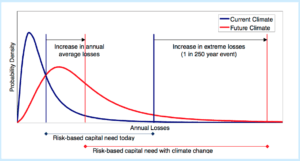

These developments make underwriting increasingly difficult for re-insurance companies. An easy example of the egregious impact of even the slightest change in weather patterns for hurricanes highlights the challenges climate change imposes on this industry: a change of 5-10% in wind speed during hurricane season will lead to damages amounting to roughly 0.13% of total US GDP[v]. Similarly, in a worst case scenario assuming a change in average temperature by 3-4 degrees Celsius, damages caused by natural catastrophes (e.g. flooding) would quadruple in the UK[vi]. Munich Re outlines its expectations for the average damage caused by several natural catastrophes[vii]:

Rising Value at Risk numbers have a direct impact on Solvency ratios imposed by regulators and thus on profit margins of the entire industry. For instance, a single Atlantic Hurricane disaster, as outlined above, would wipe out 20 % off the solvency ratio which as of 2015 stood at a comfortable 302%, please see exhibit below[viii]. This impact is more powerful than a 30% drop in equity capital markets and a negative FX effect of 20% combined which illustrates the dramatic impact of climate change on the re-insurance business model, as well as the need to innovation.

There are several levers to address this challenge:

- First of all, re-insurance companies need to find superior investment solutions to add investment income as a buffer in high loss years. This has been particularly difficult during the recent low yield environment. Munich Re with its in-house asset management company MEAG has increasingly switched its investment exposure to alternative investments, such as renewable energy and infrastructure which offer attractive characteristics, such as long durations, stable (often government regulated) cash flows matching their long-dated liabilities, and relatively high yields. However, the low yield environment has impacted several other industries, especially pension and sovereign wealth funds in similar ways, such that the competition for alternative investments has most recently driven up valuations, thus providing increasingly limited yield upside for Munich Re.

- In addition to that, Munich Re has outsourced parts of its tail risks to the capital market via so called ‘cat bonds’ (catastrophe bonds). These bonds allow Munich Re to better manage specific risks. Once a niche market, cat bonds have become increasingly popular for a whole range of risks. However, cat bonds introduce a certain risk for cannibalization in the re-insurance industry. Munich Re is slightly mitigating this risk by positioning itself on both sides of the Cat Bond market, issuing bonds for both clients and its own book, which further diversifies its revenues[ix]:

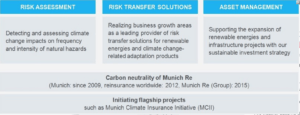

- Most importantly, however, Munich Re has been at the forefront of climate change research, building a climate change research center, a world class NatCat Service database for its clients, and started offering insurance solutions for renewable energy insurance coverage, crop failure insurance[x], etc.

NGOs, such as Ceres, have ranked Munich Re among the top 3 re-insurance companies[xi] in 2014regarding adherence to ESG criteria and it has received substantial external recognition for its continued efforts as a responsible investor and thought leader on climate change solutions.

In my opinion, Munich Re’s message to shareholders and customers alike would profit from an additional commitment on the product side: phasing out underwriting for carbon intensive industries. However, this sector continues to be profitable and Munich Re Syndicate Limited is actually one of the market leaders in the overall energy underwriting business[xii]. In my opinion, this conflicts with the overall message to shareholders. In its mission statement to customers and capital market participants alike, Munich Re puts carbon neutrality front and center in its business model[xiii].

In my opinion, the company will be truly able to claim this when phasing out oil and gas underwriting in addition to its other very successful climate change initiatives. (880 words)

[i] See https://www.munichre.com/us/property-casualty/about-us/mr/portrait/index.html

[ii] Heck et al. (2006), as cited in Stern, Nicholas (2007), The Economics of Climate Change: The Stern Review, p. 15; available from: http://webarchive.nationalarchives.gov.uk/20100407010852/http://www.hm-treasury.gov.uk/d/Chapter_5_Costs_Of_Climate_Change_In_Developed_Countries.pdf

[iii] See Association of British Insurers (2005a): ‘Financial risks of climate change’, London: Association of British Insurers, available from http://www.abi.org.uk/flooding; as cited in Stern, Nicholas (2007), The Economics of Climate Change: The Stern Review, p. 15; available from http://webarchive.nationalarchives.gov.uk/20100407010852/http://www.hm-treasury.gov.uk/d/Chapter_5_Costs_Of_Climate_Change_In_Developed_Countries.pdf

[iv] Ibid.

[v] See Stern, Nicholas (2007), The Economics of Climate Change: The Stern Review, p. 1; available from http://webarchive.nationalarchives.gov.uk/20100407010852/http://www.hm-treasury.gov.uk/d/Chapter_5_Costs_Of_Climate_Change_In_Developed_Countries.pdf

[vi] Ibid.

[vii] See Munich Re, 2016, p. 126: https://www.munichre.com/site/corporate/get/documents_E-90938998/mr/assetpool.shared/Documents/0_Corporate%20Website/_Financial%20Reports/2016/Annual%20Report%202015/302-08843_en.pdf

[viii] See Munich Re, 2016, p. 35: https://www.munichre.com/site/corporate/get/documents_E1513219753/mr/assetpool.shared/Documents/0_Corporate%20Website/5_Investor%20Relations/Publications/Presentations/Presentation-Investor-Relations-MunichRe-en.pdf

[ix] See Munich Re, 2016, p. 42: https://www.munichre.com/site/corporate/get/documents_E1513219753/mr/assetpool.shared/Documents/0_Corporate%20Website/5_Investor%20Relations/Publications/Presentations/Presentation-Investor-Relations-MunichRe-en.pdf

[x] See https://www.munichre.com/corporate-responsibility/en/responsibility/corporate-responsibility-in-business/sustainable-solutions/index.html

[xi] See https://www.ceres.org/press/press-releases/first-of-its-kind-report-ranks-u.s.-insurance-companies-on-climate-change-responses

[xii] See https://www.munichre.com/syndicate457/business-solutions/underwriting/energy/index.html

[xiii] See https://www.munichre.com/en/group/focus/climate-change/mission-and-vision/mission/index.html

JM – I like the points you bring up that (i) climate change adds risk to the world and (ii) makes underwriting more difficult because of increased tail risk specifically. Tail risks are tougher to robustly price, and given the regulatory requirements for VaR, this could make the business model tougher going forward.

I actually see a few tailwinds for reinsurers here, given my own post was about an insurer (Allstate):

1) Insurers are facing the same problem, so they are more likely to buy reinsurance. To the extent reinsuers get more comfortable with pricing the increased tail risks associated with climate change, this is an opportunity

2) In general, more risk is good for the insurance industry in a world of risk-averse individuals. More risk = more value able to be provided to the end consumer

It’s a positive sign that Munich Re has invested in a climate change research center. Climate change is a risk that is difficult to underwrite, so building this capability could be a strong differentiator for the business.

RYR – thank you for your comment. I do agree that we are likely to see a snowballing effect from insurance companies’ demand for reinsurance cover. However, in the case of Munich Re, I would argue that the effect will likely be less severe compared to single line reinsurance companies.

1) Munich Re has a very diversified business with several direct insurance lines in their company portfolio (ERGO as a direct insurer, for instance). If they were at some point to decide that reinsurance is not a profitable business anymore (for instance, because new business underwriting cannot manage to capture underlying probabilities anymore), Munich Re among all reinsurers should be best equipped to deal with the potential loss in revenue from its reinsurance business in my opinion.

2) Given the current growth in the market for cat bonds, I would argue that we might see an end to the reinsurance industry at some point if cat bonds cannibalize the reinsurance business model. In an extreme low yield environment where investors are constantly scrambling for higher yielding investments, cat bonds could become an attractive fixed income investment opportunity for investors seeking diversified exposure for their portfolios. Munich Re is already helping companies issue these cat bonds, which could become a future revenue source as a replacement for classical reinsurance business. I am really curious to see if the capital market will at some point become the reinsurer of tomorrow!

JM – great post! I thought you highlighted very well the negative impacts that climate change poses to MunichRe’s business model and their efforts to mitigate these effects. I also totally agree with RYR’s comment above that the reinsurance and insurance industries are fairly lucky in that the risk of climate change could actually be a significant driver of future business opportunities, but like every business, they will be forced to adapt to the new warming world.

You’re right that more uncertainty in underwriting models will increase the risk of losses to the insurer, but climate change will also provide a unique increased opportunity for insurers to write increased coverages and extract higher premiums on existing policies (e.g. flood or hurricane risk in coastal areas) or expand entire new lines of business that may arise as climate change threatens businesses and consumers in new ways and they seek to be covered for these risks.

I also thought your point about the growing catastrophe bond market was interesting and validated some trends I observed in my pre-MBA job. I was investing in early-stage financial services businesses and came across several entrepreneurs pitching innovative new structures for insurers and reinsurers to manage, price, and trade risk, including cat bonds and other insurance-linked securities. While risk might be increasing, these new securities provide insurers with the opportunity to diversify their balance sheets by selling all or parts of the risk that they underwrite to investors, allowing the industry to grow in a less capital-consumptive manner, giving reinsurers and insurers some relief on their capital cushions and the room to write more premiums.

Thank you for sharing. Like the above posters, I also think this is an interesting topic.

I was curious first and foremost about how Munich Re will take a principal position given the uncertainty that exists in modeling changes in hurricane frequency.[1] Should they trust their own propriety models or try to disentangle the scientific literature that exists on the topic?

Also, I was wondering whether the strategy of refusing to underwrite carbon intense technologies will have an effect beyond better aligning their mission statement with their actions? Would you draw a distinction between a coal extraction operation vs. a natural gas exploration, where natural gas is much less carbon intense than coal?[2] Given that our society will continue to be powered by fossil fuels for the foreseeable future, I am wondering if blanket rejection of carbon-based technology is a feasible path forward.

[1] https://www.wunderground.com/climate/hurricanes-and-climate-change

[2] https://www.eia.gov/tools/faqs/faq.cfm?id=73&t=11

Thank you for your answer and the valuable links. I totally agree regarding the distinction between oil/coal extraction on the one side and natural gas exploration on the other side. Given that many countries are also phasing out nuclear energy at the moment (many of them as a reaction to the Fukushima catastrophe), we need to make concerted efforts to find energy alternatives which are capable of keeping up with rising energy demands.

On the other hand, I am a firm believer in consistent messaging at all costs: if we want to meaningfully incentivize renewable energy research, we as a society need to go all in and focus all our efforts on finding a solution to the looming energy crisis asap. Phasing out oil and gas (i.e. any carbon intensive energy source) will only become attractive to the market when the cost of oil and gas exploration becomes unsustainable and renewable energy as an alternative gets enough support (research funding, tariff subsidies, etc.) to sway the market equation in its favor. Refusing to underwrite these industries would increase direct insurance premiums and thus make the oil and gas industry incrementally less profitable. I do agree that insurance costs by themselves will never be the main driver for total oil and gas profitability. However, many little increments may accumulate and make a difference over time. If any re-insurance company could do it, though, it would be the market leader – Munich Re.

Thanks for the great post! I was also interested by the impact of climate change on the insurance/reinsurance industry and I was particularly intrigued by the issue of forecasting and pricing future risk. At an operational level, insurance/reinsurance companies use historical data and risk analyses to assess, price and underwrite new insurance policies. [1] However, climate change is forcing these players to re-evaluate their approach as the increasing number of weather-related catastrophes make current weather pattern forecasts irrelevant. The company I looked at, Allianz, is purchasing global data sets and flood maps to leverage its expertise in risk modeling to create new rapid flood maps that can be deployed in real time, immediately after a disaster takes place, which helps assess the impact of a flood in a more timely manner. [2] You mentioned that Munich Re is also investing in its forecasting capabilities and had built a climate change research center and a world class NatCat Service database for its clients. Have you come across any data that quantifies how the new research / risk assessment models developed as a result of these improved databases is helping mitigate tail risk caused by more frequent instances of natural catastrophes? My hypothesis is that private sector efforts driven by the insurance/reinsurance companies may be limited and that larger scale government partnerships may be needed to ensure that companies are deploying the most scientifically accurate models to assess risk in the future.

[1] Dave Grossman, United Nations Environmental Program, “Impacts of the Changing Environment on the Corporate Sector”, 2013, http://web.unep.org/geo/sites/unep.org.geo/files/documents/geo5_for_business.pdf, accessed November 2016.

[2] Allianz Life Insurance Company, “Sustainability Strategy”, https://www.allianz.com/en/sustainability-2014/sustainability_report_2014/sustainability_strategy/climate_change_strategy.html/, accessed November 2016.