Morgan Stanley’s Attempt to Capitalize on Climate Change

Capital providers such as Morgan Stanley are uniquely positioned at the intersection of organizations most impacted by climate change and organizations aspiring to change current climate change trends

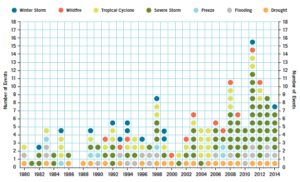

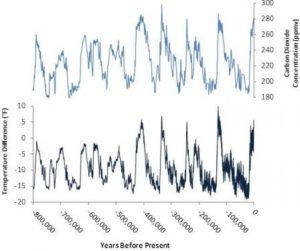

According to the EPA, “Carbon dioxide (“C02”) is the primary greenhouse gas that is contributing to recent climate change”. Trends show significant increases in C02 levels (see Figure 1) caused by human activities such as fossil fuel burning have increased Earth’s surface temperature1. As the Earth’s surface temperature has increased, many climate shifts such as dwindling ice cover, rising sea levels, ocean acidification, and weather extremes (see Figure 2) have occurred2. This has caused a dynamic across many industries where companies are looking for ways to either adapt to changing conditions or mitigate them (e.g. emissions reductions)3. For example, scarcity of water availability is threatening to reduce yields within agricultural production and increased surface temperatures have increased energy demand for business cooling solutions4.

Figure 1 – Historical CO2 concentration (top) and Antarctic temperature (bottom) Estimates1

Figure 2 – Billion-Dollar Disaster Event Types by Year (CPI-Adjusted)2

In recent years, the conversation about climate change responsibility and impact has centered around governments, non-profit organizations, and corporations that are directly impacted by or directly impact climate change. Responsibility for addressing climate change should be everyone’s responsibility especially those that can facilitate change across many companies and industries. To make a real impact, companies that are less directly exposed to climate change can embrace finding solutions that combat climate change trends, not just companies who have a large carbon footprint (e.g. energy businesses such as Chevron and ExxonMobil5) or companies whose businesses are negatively impacted by climate change (e.g. ski area operators6). One company that has begun to increase its involvement in battling climate change alongside its clients is Morgan Stanley.

Morgan Stanley is a large finance organization focused on advisory and capital markets business. At the surface, Morgan Stanley isn’t among the first corporations that comes to mind when thinking about climate change. However, Morgan Stanley’s serves in a financial and capital markets advisory role for the largest companies across every major industry. Long-standing clients across industries will be directly impacted by climate change and its associated regulatory changes, which creates an opportunity for Morgan Stanley to innovate creative solutions that will allow its clients to pursue business initiatives that will adapt to and mitigate climate change. In addition, being at the center of markets exposes Morgan Stanley to drastic changes in capital markets (equities, commodities) that are caused by events caused by climate change (e.g. natural disasters, changing food production, water availability, etc.). As the center of capital markets, Morgan Stanley, and other large capital providers, are uniquely positioned to lead the climate change conversation.

Recently, Morgan Stanley’s CEO, James Gorman, has seen an opportunity to use the company’s platform as a critical private capital provider to roll out initiatives that have begun to change the conversation. In November 2013, Morgan Stanley started the Institute for Sustainable Investing with a goal of reaching $10 billion in client assets invested for social and environmental impact within five years7. In addition, Morgan Stanley has been active in issuing and facilitating the issuance of so called “Green Bonds” that are used to fund environmentally beneficial projects. According to former Treasury Secretary Hank Paulson, the market for these securities has grown to $42 billion in 2015, up approximately 280% from 20148. A highly publicized example of a Green Bond occurred earlier this year when Apple raised a $1.5 billion to improve energy efficiency throughout their supply chain and innovate more sustainable materials into their products and processes9.

In June 2015, Morgan Stanley issued its own corporate Green Bond10, which ultimately helped finance seven different projects promoting the development of renewable energy and energy efficiency. Several of Morgan Stanley’s Green Bond transactions have included notable industry landmarks, including the first-ever corporate Green Bond and the first-ever U.S. university green bond11. These actions contributed to Morgan Stanley winning an Achievement in Corporate Social Responsibility Award last year12.

While Morgan Stanley and other businesses have made strides in creating opportunities for businesses focused on solving climate change issues and for investors focused on generating social profit as well as financial returns, there remains a large gap in funding for the projects necessary to shift us to a low-carbon infrastructure. Capital providers like Morgan Stanley as well as peer finance organizations will need to increasingly generate opportunities to match investors seeking to support environmentally friendly causes with those companies that can execute projects against those goals. In closing, I wanted to leave you with one question about the role of for-profit, private capital providers like Morgan Stanley. Does Morgan Stanley not only have a responsibility to create programs like the Institute for Sustainable Investment but also to self-select out of traditionally profitable parts of its business that help fund projects that work against solving climate change issues?

Word Count: 785 words

1 EPA – Climate Change Science. 2016. Causes of Climate Change. [ONLINE] Available at: https://www.epa.gov/climate-change-science/causes-climate-change. [Accessed 4 November 2016].

2 Harvard Business School Business & Environment Initiative. 2016. Climate Change & Business. [ONLINE] Available at: http://www.hbs.edu/environment/resources/climate-change-101/Pages/Climate%20Change%20and%20Business.pdf. [Accessed 4 November 2016].

3 Harvard Business School Business & Environment. 2016. CLIMATE CHANGE 101 – Responding to Climate Change. [ONLINE] Available at: http://www.hbs.edu/environment/resources/climate-change-101/Pages/responding-to-climate-change.aspx. [Accessed 4 November 2016].

4 Dave Grossman (Green Light Group), Jeff Erikson (SustainAbility); Neeyati Patel (UNEP). 2013. GEO-5 for Business – Impacts of a Changing Environment on the Corporate Sector. [ONLINE] Available at: http://web.unep.org/geo/sites/unep.org.geo/files/documents/geo5_for_business.pdf. [Accessed 4 November 2016].

5 Heede, R, 2014. Tracing anthropogenic carbon dioxide and methane emissions to fossil fuel and cement producers, 1854–2010. Climatic Change, Volume 122, Issue 1, p 229–241.

6 Scott, D, 2006. Climate change adaptation in the ski industry. Mitigation and Adaptation Strategies for Global Change, 2 December 2006.

7 Morgan Stanley. 2013. Morgan Stanley Establishes Institute for Sustainable Investing . [ONLINE] Available at: http://www.morganstanley.com/press-releases/morgan-stanley-establishes-institute-for-sustainable-investing_a2ea84d4-931a-4ae3-8dbd-c42f3a50cce0. [Accessed 04 November 2016].

8 Paulson, H, 2016. How to Raise Trillions for Green Investments. The New York Times, 20 September 2016.

9 Mike Cherney. 2016. Now You Can Own A Green Bond From Apple – MoneyBeat – WSJ . [ONLINE] Available at: http://blogs.wsj.com/moneybeat/2016/02/16/now-you-can-own-a-green-bond-from-apple/. [Accessed 04 November 2016].

10 Morgan Stanley. 2015. Morgan Stanley Green Bond Program . [ONLINE] Available at: http://www.morganstanley.com/articles/green-bond-program. [Accessed 04 November 2016].

11 Morgan Stanley. 2015. Morgan Stanley Extends Commitment to Sustainable Investing with Its Inaugural Green Bond . [ONLINE] Available at: http://www.morganstanley.com/press-releases/0e12646f-4334-4152-a308-2ef86a3affe3.html. [Accessed 04 November 2016].

12 Snowden, C, 2015. Achievement in CSR Award: Morgan Stanley. Euromoney., 8 September 2015. p1.

Extremely interesting read! You make a great point about involving all companies, not just those with GHG emission-heavy operations, in the climate change conversation. Morgan Stanley is in a unique position as a client-facing company with impact across a wide variety of industries and geographies. Utilizing these connections to help its clients lessen their impact on climate change will not only help the environment, but it provides both profitable business opportunities and good press for Morgan Stanley. The company could also take advantage of the Institute for Sustainable Investing by partnering with other firms in the environmental impact space in order to (i) source sustainable projects that have been quality checked; (ii) combine capital to mitigate risks and diversify holdings; and (iii) expand its reach into this field in order to set a positive example for other financial institutions. Green Bonds are also an excellent way to become involved in the climate change conversation, but pose some risks. The market currently does not have a clear definition of what “green” is, creating a lack of standardization and transparency. Any company in any industry can issue a Green Bond for projects ranging from renewable energy to nuclear power plants. Perhaps Morgan Stanley could take the lead on initiating these conversations around Green Bonds. However, I agree that Morgan Stanley should continue to both push itself and its clients to respond to climate change in a sustainable manner through innovative financial instruments.

Self-selecting out of industries that do not align with environmentalism sounds nice on paper, but probably wouldn’t translate well into a business strategy. Morgan Stanley has a fiduciary duty to its clients, and is not being paid to be an eco-friendly firm, so this would be in contradiction with many of their existing contracts. There are financial for-profit companies, however, that invest with an eye towards sustainability. For example, it’s in the best interest of a life or health insurance company to appear health/environment/sustainability conscious. For a health insurer, investing in a green bond is doubly beneficial – it portrays them as responsible investors and offers attractive returns.

Interesting post! I often think about the trade-offs that financial services company must make as they assess potential investments. On the one hand, companies like Morgan Stanley have a fiduciary responsibility to operate in the best interests of their shareholders (which often equates to maximizing profits), but many would argue that these companies also have a responsibility as corporate citizens to help prevent climate change. As you say, ideally they can find a way to do both by investing in companies that have sustainability mandates but that also generate strong returns.

Another example of a financial services company managing these challenges that may interest you is the Royal Bank of Canada. RBC has made significant efforts to operate more sustainability and has focused most of their efforts on water. This initiative is called the Clear Blue Project (http://www.rbc.com/community-sustainability/environment/rbc-blue-water/). However, despite receiving commendation for these efforts, RBC has also been the target of significant backlash due to investments they’ve made in the oil sands in Alberta. The Rainforest Action Network has led the charge against RBC and used some pretty extreme (and quite unethical, in my point of view) efforts to get their point across (http://www.macleans.ca/society/life/a-hostile-climate/). Financial services firms have a unique opportunity to drive change as both investors and as major organizations in their own right. With that said, there is certainly no simple solution!

Ryan – This is a great post. I like how you are highlighting a company that is finding ways to make positive impact to address climate change. I am impressed by the green bonds that Morgan Stanley issued. Morgan Stanley is going a step further than simply reducing their carbon footprint and publishing the results. The company is finding ways to support projects that will help reduce our dependence that do not provide environmental benefits. Because Morgan Stanley has such a strong reputation in the financial services industry, other banks and finance firms will likely follow the Morgan Stanley’s lead. Additionally, I appreciate how this post gives me a better understanding of the size of the market for green bonds. I was surprised that the market for these bonds was greater than $40 billion in 2015. I believe that there is still room for this market to grow and expand. Morgan Stanley and other banks could use this industry to drive their own growth as they struggle to find ways to increase revenue year over year.

Great post! It touches the topic of impact investing in environmental causes. I think there are increasing number of investors who are willing to trade off some returns for social causes especially in enviromental related issues which affect everyone one the planet. The impact investing industry is also growing tremendously, but still, it is only 60 billion AUM out of 11 trillion dollars private investment management industry. (https://thegiin.org/impact-investing/need-to-know/) I think, the challenge here for attracting more private capital, is two-fold – how to demonstrate returns and how to measure these environmental-related results post investment. Interestingly, on average the past impact investments are generating roughly 7-8% return which is completely isolated from stock market while having an impact. Nevertheless, in order to grow this industry, we need large global players like Morgan Stanley to help promote, increase awareness, and more importantly, to provide a platform as said in this article to improve access for investors both large and small to participate in environmental initiatives that impact us on a daily basis.

Thank you so much for bringing up a product innovation that arises from the need to mitigate the effects of global warming and actually seems to be effective in a market economy.

At this point, it is essential to make capital available to the innovators to come up with ways to reduce the adverse effect of our economy on the planet; and Morgan Stanley, as a very large financial institution, is in a unique position to be able to provide that capital.

I could not agree more with the last question you brought up – any institution that claims to be genuinely interested in *solving* the climate change problem we are facing should not be doing something with one hand and messing up with the other one, i.e. funding projects that are environmentally conscious and projects that are the culprits of the problem at the same time.

Though, given the tough competition in the industry and what the company stands for, it is only fair to assume that this initiative is only one to boost brand name, PR, and employee morale rather than to solve the core problem. However, since it adds a net value to the solution of the problem, I would also argue that what the company is currently doing is much better than that its peers do and should be supported.