Miami is going to sink… and the Latin Americans are going to pay for it

Make no bones about it, Miami is going to sink. Ocean levels are rising globally at an increasing rate due to global warming, and Miami’s low-elevation geography makes it especially vulnerable. The question is not if, but when (1). And the most recent data suggests that it may be sooner than you think (2). Despite this new data, Miami housing prices have continued to rise (2) and multi-billion construction projects are going ahead full steam (1), due in part to an influx in Latin American buyers looking for safe haven investments (3).

How can real estate be booming when it’s all going to be underwater soon enough? Perhaps because Miami insiders, including real estate developers and government officials, appear to be downplaying the issue (3). Indeed, many are incentivized to kick the can down the road – as long as naïve buyers are buying, developers can keep developing, and the government can collect property taxes on inflated valuations.

Somebody help…

The local government has begun to take action, however. In 2010, the Miami-Dade county commission joined with other counties to form the Southwest Florida Regional Change Climate Compact (“SFRCCC”). The stated purpose of the compact is to take action to address “the vulnerability of the Southeast Florida region to the impacts of climate change” (4). The SFRCCC produced a Regional Climate Action Plan (“RCAP”) to address these changes. One of the significant planned changes in the RCAP was “to reduce greenhouse gas emissions.” Additionally, the RCAP has identified areas which are “uniquely vulnerable to climate impacts, including sea level rise, to serve as a planning tool and encourage technical assistance and funding opportunities.”

The SFRCCC also produced a report which analyzed the impact of a sea-level rise on some of the uniquely vulnerable areas, one of which is Miami. The report identifies significant risks to infrastructure when the sea level rises even a few feet. One example is the Turkey Point Nuclear Power Plant, which is located partially below sea level. The report states that the potential impact of a sea rise is unknown (5). Others have speculated that far more infrastructure is at risk in addition to Turkey Point, including the county’s sewer systems and fresh water supply (1).

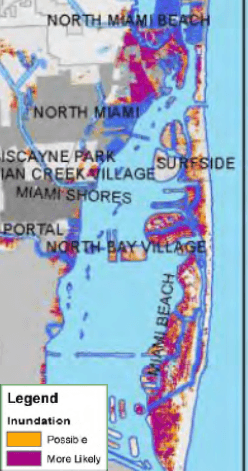

The report also analyzed the impact that rising seas would have on residential areas. The conclusion was that even a 3-foot rise in seas, which even the conservative forecasts preferred by the SFRCCC acknowledge will occur in the next 50-75 years, will expose significant portions of Miami and Miami Beach to flooding (see purple shading in below graphic) (5).

Yet, the expected real estate losses due to this flooding is conspicuously missing from the report. Despite listing dollar figures for other parts of Southeast Florida, the Commission was unable to report a figure for Miami (5). The county’s tax assessor however listed the combined real estate value at $250 billion (6).

After acknowledging these risks, the SFRCCC also presents 110 action proposals in the report, noting that potential damage to the broader Southeast Florida region could reach into the trillions of dollars (5). Certainly, their efforts to identify the risks and make recommendations represent a positive step forward. Whether the recommendations will result in successful implementation, especially given the billions of funding required, remains to be seen.

Pulling the wool over?

One area in which the SFRCCC seems to not be doing enough is communication. For those who don’t read the 181-page report and instead navigate to the FAQs on the SFRCCC website, it would seem that there is no cause for concern. In addressing the implications of sea level rise on the property market, the site blithely states that “Southeast Florida’s property market continues to be one of the strongest in the U.S.. Each and every day, local governments in South Florida are joining forces to plan and invest in adaptive infrastructure to manage the threats of gradual sea level rise” (7). The website also claims that Miami faces no unique threat due to rising seas, despite evidence that its low-elevation geography makes it and the surrounding area at unusual risk (8).

The mixed messages that the SFRCCC is putting forth is contributing to the general indifference to sea level rise risk that Miami insiders display. This apathy allows for developers to keep developing, and Latin American buyers to continue buying, potentially unaware of the significant risks they are undertaking. The SFRCCC and the Miami-Dade county government need to publicly acknowledge the risks that are ahead for their city. This will be politically unpopular, as it will mean lower real estate values and lower tax revenues. But to pull the wool over the eyes of the naive, while Latin American buyers hold the bag, is deceptive and wrong.

(word count = 785)

Sources:

- Orrin H Pilkey, Linda Pilkey-Jarvis and Keith C Pilkey, The Guardian, 14 Mar 2016

- Weiss and Overpeck, 2010

- Robert Meyer, “How Climate Change Is Fueling the Miami Real Estate Boom,” Bloomberg October 20, 2014 — 11:51 AM EDT

- org: 1-page flyer

- org: “Unified Sea Level Rise Projection: Southeast Florida.” October 2015.

- Pedro Garcia. Press release: “Miami-Dade property values reach record heights”

- http://www.southeastfloridaclimatecompact.org/news/press-hub/

- michael d. lemonick. “Florida Counties Band Together To Ready for Warming’s Effects.” 12 JAN 2012. E360.yale.edu.

It is a shame that SFRCCC is not being explicit about this issue. Having lived in Miami before, I have seen how real estate has developed fast and been advertised aggressivelly to attract more investors as if this was a great investment. Nothing is ever mentioned about future implications and consumers will very likely realize this soon and probably regret their decisions. I wonder if US Gov shouldn’t be more active in rolling out policies accross the country to 1. increase awareness to the issue 2. educate population so they can make conscious decisions and 3. actually act on trying to minimize this impact (such as Holland does in their boarders). Legislators are key influencers and ignoring the issue is the worst path for all of us.

I agree with Dan, the first step to solving this problem is to admit that there is one and talk about it. People need the information in an easily digestible way so they can understand the risks when buying a home or building a business in Miami. However just knowing about a problem will not solve it. Miami should look to other cities who are facing similar issues of sinking and see how they are addressing the problem. The most famous example is of course Venice. The world has known that Venice is sinking for a long time and now they are finally acting on it. There is a large public works project to create gates to help be a barrier to the incoming water all around the city (http://www.businessinsider.com/venice-sinking-mose-system-italy-2012-4?op=1/#e-city-has-been-working-on-a-plan-since-the-great-flood-of-1966-2). This gating system is like the use of levees that cities like New Orleans use. While it is not a perfect solution, it helps to solve the sinking cities (at least for now). However, these gates are expensive. I think there should be some sort of tax break for developers who help to put in these gates or a tax on the new real estate to help pay for them. The people of Miami need to work together to save their city.

Like Monica, I lived in Miami and saw how Miami real estate was aggressively marketed to foreign investors (usually Latin American) looking to protect their money from instability and inflation elsewhere. I think there are three factors behind the lack of dialogue in Miami and other vulnerable markets regarding the likely long term impact of rising sea levels on property:

– It is a long term problem; buyers in 2016 are unconcerned what their neighborhood will look like in 2070

– There exists a sense of fatalism compounded by poor understanding of key data and little faith in scientific forecasts

– People assume, perhaps unrealistically, that society will “figure it out”, or “cross that bridge when we get to it”

Thanks for posting this excellent analysis!

You pointed out an important link between climate change awareness and the denseness of climate change reports. Philanthropists worried about climate change should consider hiring advertising firms to translate these academic studies (181 page reports) and create materials that are succinct and easy to understand.

One of the reasons for subdued concern about the sinking of Miami must be the common belief that if cities are sinking, we will have much bigger problems than just the value of our properties. I think most people believe that others will solve this problem and they will never have to worry about it.

You make some great points. But, from the perspective of Miami leaders and politicians, it does not make economic sense in the short term to dissuade foreign investment in real estate, when said investment contributes tremendously to jobs, tourism, and more. As Blaine mentioned, these foreign investors are thinking more short-term, whereas the impact of climate change on the cost is relatively longer-term, so it is likely something they are not investigating when performing due diligence. In addition, Miami is “hot’ – literally and figuratively – both of which are beneficial to Miami. In an ironic way, warmer weather in Miami due to climate change actually helps Miami businesses. As is widely known, tourism and vacationing is Miami’s bread and butter. So, increasing temperatures actually boost the city’s main industries. From the figurative angle, Miami is an attractive destination for vacationers in the U.S. and elsewhere given its close proximity to Latin America and no-frills, quick flights from major traveling hubs, like New York, into its two major international airports – Miami International and Ft. Lauderdale. Given these benefits, Miami’s leaders have little incentive to provide all the relevant information on climate change as it relates to Miami. And, international investors don’t see a major obstacle in investing now in the short-term, because the effects of climate change on Miami may boost their businesses – a nearsighted yet economically feasible calculus.

As Latin American, I grew up going to Miami every summer both to shop and to visit my family. I also fall in the statistic of latinos buying properties in Miami, as my relatives held some properties in Florida as investments. As a result, I agree with you that many Latin Americans see this great city as a great place to invest in real state. It is important to mention that this tendency is not just because; political instability and currency devaluation have forced Latin Americans to seek new horizons for their investments.

I also like the name you chose for your article and I think it reflects the reality of the real state situation in Miami. According to an article published by the newspaper Miami Herald, In 2015 50% of South Florida real state buyers were from Latin America (See the following link for more details: https://www.miamire.com/docs/default-source/international-articles-and-advertisements/intl-article-2016-02-10-miami-herald.pdf?sfvrsn=2) Especially from Venezuela, supporting my previous point on political instability and currency devaluation influence. I would like to have read more about what other cities in similar flooding risk are doing. For instance, you could have compared what NYC is doing vs what Miami is doing. I also think that is very complex to ask our politicians to communicate something that will happen in 75 years, when we currently have many urgent matters to work on. I’m not saying is not important, I’m only stating that I understand the natural response to focus on what help them gain votes in the short term.

I visited Miami just a couple weeks ago and was amazed by the amount of ongoing construction as well as new buildings that seem to have been erected since my last trip to the area. I agree with some of the earlier comments about the Miami tourist industry benefiting from increased temperatures as well as the likely short-term nature of much of the foreign investments made in the city’s real estate. I’m also unsure if Miami’s residents and real estate owners would change their behavior even if the government stepped up to the plate and clearly communicated the consequences of rising sea levels, especially given the response (or lack-thereof) we saw when residents of Southern Florida were asked to leave their homes last month during what was at the time expected to be one of the most dangerous hurricanes in recent history (http://www.cnn.com/2016/10/06/us/hurricane-matthew-evacuations/). I expect the residents of Miami to continue taking risks regardless of government communication, but would definitely be curious to see how insurance companies react as the threat to property values becomes impossible to ignore; perhaps the day will come when these firms will refuse to offer coverage for certain areas of the city, which is one of the only scenarios in which I could see investment in the Miami coastline coming to a standstill.

Dan great effort in bringing to fore an important issue that has been on the back benches for long. It seems Florida has developed “Climate Resilience” to the impending flooding which is expected to wipe out $69 billion in Florida coastal property by 2030. I can understand the reluctance and affinity of the people of Florida to leave their homes and wanting to enjoy it while it lasts. In the same tune, I also see why the government hesitates towards “alarmist climate planning” as it may scare off banks, insurers and developers. Without an income tax the state of Florida relies on real estate taxes and tourism to survive. Yet it is inevitable that property and flood insurance will get too expensive and may even become unavailable. These economic downsides can easily be overturned if this is seen as an opportunity for Florida to step up and become a leader in acknowledging climate change and finding solutions – the likes of “Silicon Valley of Green”. I wonder in the face of government inaction, if the media and environmental groups can playing a substantive role in drawing attention to this issue but also if they are engaging the private sector to take the lead in investing “Silicon Valley of Green”. In the short run, possible solutions may include tax incentives and mortgage payment abatement periods to encourage property owner to upgrade their septic systems but from a preventive standpoint connecting property developers to climate scientists may help start the dialogue in circles where it counts.

Great article, Dan. I find it interesting that cities that will be most negatively impacted by climate change–coastal, and arid cities–do little to draw attention to the issue because of the short term economic impacts. In the case of Miami, Latin American’s who are investing in real estate will carry the financial burden of the collapsed real estate market. This article reminded me of how climate change will impact Dubai. Many scientists suggest that the United Arab Emirates (UAE) will be uninhabitable by 2090 or 2100, due to climate change. Ironically, Abu Dhabi, the capital city of UAE generates most of its revenues through oil, while oil consumption is a leading contributor to global warming. Dubai, the business capital of UAE, has made substantial investments in infrastructure to attract international businesses and real estate investors, even though the long term outlook does does not look promising. Additionally, due to the abundant oil supply, the city does not take steps to ensure energy efficient practices. As a result there is wide spread constant air conditioning across commercial and residential buildings during the summer month, and even an indoor ski slope in one of the malls!

Dan this is a fantastic piece! I have to say, I do feel a bit skeptical even though in general I completely embrace the data on climate change. I attended a science and technology high school where we were given articles to read such as “7 years until Manhattan is under water”. While I believe the threat of increased water levels is very much real, I am concerned about putting a timeline on these. 7 years have come and gone since that article, and Manhattan, while still fearful, is still above water.

I also really appreciated that you specifically noted who would be most impacted. Mainstream media often leaves this very important part of the story out.

Interesting, I can’t help thing what the prospects of rising sea levels are on other cities, namely my own town, London. Sea levels are rising but surely technology can keep up with the pace and something will be invented to come along to protect our coasts and riverbeds?