Mayo Clinic: A Digital Prescription

While most hospitals are slow to adopt technology, the Mayo Clinic has made strides to implement digital supply chain tools that have saved costs while improving patient outcomes.

U.S. hospital systems have seen better days. Since late 2015, hospitals have seen both declines in volume and price growth below inflation, causing financial deterioration [1]. Further, with upcoming payment reforms triggered by the Affordable Care Act and pressure from insurers, hospital systems are increasingly concerned with cutting costs without impacting patient outcomes [2]. Even the Mayo Clinic, known for being one of the best hospitals in the U.S., is not exempt: its latest financial report in 2016 showed five-year lows in operating income and margin [3, 4].

The supply chain, which accounts for 30-40% of a hospital’s operating budget, is a natural place to start [5]. Hospitals deal with expiring drugs, blood, and other date sensitive supplies, and many hospital systems still use low technology methods of inventory management that lead to oversupply or shortages [2]. For hospitals, a backlog of supplies doesn’t just mean lost potential profits – it could mean expensive emergency refills, or worse, serious consequences to patients. As a result, hospitals are sometimes forced to choose between overstocking inventories or putting patients at risk [6].

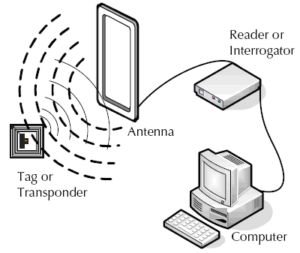

Fortunately, digital supply chain technologies offer an opportunity for these hospitals to reduce costs while potentially improving outcomes. For example, radio-frequency identification (RFID) technology, which uses computer chips that emit radio waves to digitally tracking medical equipment and supplies, has been proven effective in both lowering costs and improving patient outcomes [5]. RFID technology reduces the time staff members spend tracking down medical equipment and helps them easily locate misplaced equipment [7]. Further, the data generated using RFID can be coupled with advanced analytics to optimize inventory management. One study estimated that U.S. hospitals could save $23 billion through data analytics, optimization, and automation [8].

RFID Technology

While implementing these technologies seems almost obvious, hospitals are painfully slow in adopting technology. A recent survey conducted by Cardinal Health suggests 78% of providers are manually counting inventory somewhere in their supply chain, and only 17% have implemented an automated technology system to track inventory in real-time [9]. Barriers to adoption are familiar in healthcare: upfront costs, security concerns, and fear of risking private patient information (especially with low-quality RFID tags) [10].

Despite these barriers, Mayo Clinic has been at the forefront of digital supply chain technology. Mayo Clinic initiated its RFID project in 2013 (fully implemented by 2015) [7]. Additionally, Mayo Clinic has partnered with aptitude LLC to handle sourcing, contracting and analytics, allowing them to leverage data from its digital supply chain to monitor supply chain performance, engage in direct contracting with suppliers, and optimize for the most competitively priced suppliers [11]. Recently, Mayo Clinic implemented Reveal – a tool giving suppliers real-time visibility of inventory levels for each line-item, thereby helping suppliers know when a product is running low on inventory [12]. Because of their efforts, Mayo Clinic’s savings through supply chain innovations was estimated to be $163 million in 2015 alone, and they have been ranked in the top 3 for Gartner’s “Healthcare Supply Chain Top 25” rankings for the past five years [12, 13].

As Mayo Clinic looks longer term, they have committed to adopting more of these digital supply chain technologies. As Bruce Mairose, Vice Chair of Operations at Mayo Clinic, put it, “Reveal is the first phase of a series of multiphase tools that we believe will transform the healthcare supply chain” [14]. Indeed, as new digital technologies reach cost effectiveness and improve patient outcomes, Mayo Clinic will have to focus on staying ahead of the curve to maintain their competitive advantage.

To that end, I have two recommendations for the organization. First, for the short-term, Mayo Clinic should explore the digital technologies that remain to be implemented, such as 3D printing. While Mayo Clinic currently uses 3D printing for surgical procedures, they have not explored the use of 3D printing to replace certain parts of their supply chain (e.g., by printing a complex medical supply instead of purchasing). Another area to explore is electronic medical records (EMR) in the supply chain process – knowing what supplies a patient will need before he/she even arrives. My second recommendation, geared towards the longer-term, is to prepare for a world of value-based care (i.e., paying for successfully treating patients rather than for volume of services). With the rise of value-based care, it will be especially imperative that providers such as Mayo Clinic track costs at the patient level, and having their digital supply chain technologies integrated with EMR technology will be key.

A 3D Printed Heart

Some questions remain for me about Mayo Clinic’s digital supply chain: what is the role of a distributor (such as Owens & Minor) in influencing hospitals to adopt digital technologies? Is Mayo Clinic organization set up in a way that enables them to test and implement new digital supply chain technologies better than their competitors?

Word count: 795

[1] Goldsmith, J., “How U.S. Hospitals and Health Systems Can Reverse Their Sliding Financial Performance,” Harvard Business Review (October 2017)

[2] Chao, L., “Hospitals Take High-Tech Approach to Supply Chain,” The Wall Street Journal, October 2015, https://www.wsj.com/articles/hospitals-take-high-tech-approach-to-supply-chain-1445353371, accessed November 2017

[3] U.S. News, “Mayo Clinic,” https://health.usnews.com/best-hospitals/area/mn/mayo-clinic-6610451, accessed November 2017

[4] Reilly, M., “’Growth mode’ sandbags Mayo Clinic profits,” Bizjournals, February 2017, https://www.bizjournals.com/twincities/news/2017/02/27/growth-mode-sandbags-mayo-clinic-profits.html, accessed November 2017

[5] Coustasse, A., S. Tomblin, C. Slack, “Impact of Radio-Frequency Identification (RFID) Technologies on the Hospital Supply Chain: A Literature Review,” Perspect Health Inf Manag., October 2013, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3797551/, accessed November 2017

[6] Kelle, P., J. Woosley, H. Schneider, “Pharmaceutical supply chain specifics and inventory solutions for a hospital case,” Operations Research for Health Care, July 2012, [URL], accessed November 2017

[7] Pasupathy, K. and T. Hellmich, “How RFID Technology Improves Hospital Care,” Harvard Business Review (December 2015)

[8] Henderson, J., “Supply chain improvements could save US hospitals $9.9mn, says new study,” Supply Chain Digital, September 2017, http://www.supplychaindigital.com/scm/supply-chain-improvements-could-save-us-hospitals-99mn-says-new-study, accessed November 2017

[9] “Survey Finds Hospital Staff Report Better Supply Chain Management Leads to Better Quality of Care and Supports Patient Safety,” press release, http://ir.cardinalhealth.com/news/press-release-details/2017/Survey-Finds-Hospital-Staff-Report-Better-Supply-Chain-Management-Leads-to-Better-Quality-of-Care-and-Supports-Patient-Safety/default.aspx, accessed November 2017

[10] Coustasse, A., B. Cunningham, S. Deslich, E. Willson, P. Meadows, “Benefits and Barriers of Implementation and Utilization of Radio-Frequency Identification (RFID) Systems in Transfusion Medicine,” Perspect Health Inf Manag., July 2015, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4558481/, accessed November 2017

[11] PRNewswire, “Upper Midwest Consolidated Services Center partners with aptitude LLC for direct contracting,” April 2016, https://www.prnewswire.com/news-releases/upper-midwest-consolidated-services-center-partners-with-aptitude-llc-for-direct-contracting-300251212.html, accessed November 2017

[12] Gartner, “Gartner Announces Rankings of Its 2016 Healthcare Supply Chain Top 25,” November 2016, https://www.gartner.com/newsroom/id/3516418, accessed November 2017

[13] O’Daffer, E., S. Meyer, L. Callinan, A. Stevens, “The Healthcare Supply Chain Top 25 for 2015,” Gartner, November 2015, https://www.gartner.com/doc/3169736/healthcare-supply-chain-top-, accessed November 2017

[14] Speed, V., “Healthcare Logistics: Filling a New Prescription for Supply Chain Improvement,” Inbound Logistics, July 2016, http://www.inboundlogistics.com/cms/article/healthcare-logistics-filling-a-new-prescription-for-supply-chain-improvement/, accessed November 2017

Thank you for your essay on such an important topic. I found it shocking to know that 78% of providers are manually counting inventory somewhere in their supply chain. I think Mayo Clinic is a frontier is moderinizing its supply chain. Firstly, information collection and transparency are key in optimising supply chain. Though a relative standard technology for many other industries´ supply chain, the adoptation of it serves as the foundation for a systematic way of managing in replacement of manual counting. I think the implementation of Reveal particularly encouraging. As supply chain is a function of system, lead time and behavior. The fact that Mayo clinic is sharing such inventory data to its suppliers are overcoming a traditional mindset and legacy behaviour. A truly efficient supply chain is one that do not only look at isolated benefit of each player but rather optimising the whole chain (e.g. Toyota). Therefore, personally I would encourage Mayo clinic to potentially form a JV with a technology company that looks at how the whole supply chain can be optimized, once the low hanging fruit of supply chain optimisation of its own organisation is achieved. Questions like “who is the best one in the chain to best forecast demand? What more can technology do to reduce lead time of the overall chain?” As Zara has formed a partnership with Toyota to implement Just-in-time management for fast fashion, can U.S. healthcare system form similar Partnership? Will U.S healthcare supply chain be one of JIT, led by Mayo Clinic? This will be my recommendation for its longer term focus.

It is indeed quite surprising to see the adoption of RFID in industries that rely on strong inventory management. It’s scary from the Healthcare perspective because ineffective inventory management can potentially put a patient life at risk. The Healthcare industry is in tremendous need to better manage their resources as cost of care continues to rise [1]. You’re right that operating margins of providers such as Mayo Clinic are strongly threatened (more than ever) and I believe the cost pressures will finally lead to adoption of important technologies such as RFID. We can finally see this happening in Retail.

The Retail industry has been talking about the RFID revolution since the early 2000s [2]. After nearly a decade, things are starting to materialize. Partly what has helped is the cost of RFID has significantly dropped from $1 in 2003 to roughly 10 cents today (at the basic level). And partly because retailers are suffering more than any point in time. I think what creates adoption is when select players embrace the technology and start showing results. For example, Macy’s adopted RFID a couple years ago and has seen results that easily justify the investment — inventory accuracy has improved from 63% to 95% and out-of-stocks have reduced by 50% [2]. In the airline industry, Delta was the first to adopt RFID and they’re also seeing promising results. The company plans to reduce lost baggage by 25% [3]. Other players such as United have followed suit.

I see a similar movement starting in Healthcare, but players like Mayo Clinic have to lead the way. The risk that firms like Mayo take and the results (we hope they achieve) will create the movement within the industry and eventually stabilize as a norm, improving the cost of care in our country.

[1] http://money.cnn.com/2016/09/16/news/economy/health-care-costs-rise-most-in-32years/index.html

[2] https://www.forbes.com/sites/barbarathau/2017/05/15/is-the-rfid-retail-revolution-finally-here-a-macys-case-study/#4f76a8d63294

[3] http://www.journalgazette.net/business/Delta-to-use-RFID-to-reduce-lost-luggage-14998731

One additional questions that I asked myself after reading the article is – Who should benefit from the cost reduction? Should it be the customer that has to be treated by an effectively run organization or the hospital? As Phil mentions hospitals are experiencing a decline in volumes and tougher competitions, therefore one way to gain a competitive advantage it to have an operating excellence and to pass its monetary value to the customer by reducing the prices.

I also think that RFID system should be implemented by the push from the drug manufacturers and not by the pull from hospitals, e.g. an RFID might be put in a mandatory fashion on each of drug packages that are delivered to the hospital. Namely drug companies are interested in 1) providing the better service 2) have an access to the usage data 3) reducing counterfeit that is a $200B loss [1], so they are already incentivized in doing so considering their scale and access to different players.

[1] https://www.strategyand.pwc.com/reports/counterfeit-pharmaceuticals

Thank you for a very interesting look at how Mayo Clinic is using technology to manage their inventory and improve their supply chain. This essay made me think about whether vendor managed inventory (which we saw implemented successfully in the Barilla case, and which is common in many retail supply chains today) would ever make sense in a hospital setting. In theory, both of the key benefits that we saw in the Barilla case (reduced inventory holding costs and reduced out of stocks) would also apply in a hospital setting if the suppliers took over responsibility for forecasting and scheduling deliveries. The addition of RFID technology would make this transition even easier, as suppliers would have full visibility on how much inventory remained at the hospital, and how much inventory was used each day. I can imagine hospitals being hesitant to make this change, as any resulting out of stocks could have a significant impact on patient outcomes, but if suppliers managed to prove an improved supply chain performance, this could be an interesting win-win-win for suppliers, hospitals, and patients.

Interesting topic and I liked your question about “Is Mayo Clinic organization set up in a way that enables them to test and implement new digital supply chain technologies better than their competitors”.

When I am reading the essay, I thought about what we learned on leading changes in an organization. Some concerns the hospital staff have might be a temporal decrease in efficiency of adapting new system, lack of training, overly fear about the security concern. What we learned in lead course on leading changes definitely applies here on how Mayo clinic could roll out the change effectively.

However, apart from the hospital itself and its supplier, I am thinking that government could also play a positive role here. Healthcare as a basic needs for every single person in the country and it is to the society’s benefits to reduce healthcare cost. I am wondering if Government could provide subsidy or tax back if hospital implements supply chain digitization.

One more party involved here I think is the government’s role in technology adaption.

Thank you for a great article, Phil! I 100% agree with your suggestion that Mayo Clinic should look to further advance its technology and invest in improving its supply-chain practices. Mayo Clinic has for quite some time now been regarded as among the very best hospitals in the country (currently ranked #1 in the United States by US News & World Report) largely due to their forward-thinking and incredible entrepreneurial spirit. They are often the first to integrate the newest technologies/treatments and often produce the strongest of clinical outcomes.

What bothers me is that so many other American hospitals don’t follow suit when it comes to technology practices. In my experience, as a physician-in-training, I have observed several healthcare providers look to Mayo Clinic for direction on how to improve their own respective practice of medicine. The medical community relies heavily on the Mayo Clinic for new research, new protocols, revolutionary ways to interact with patient, etc. which in turn generate a more effective delivery of care. We often implement or attempt to implement their recommended findings into our medical procedures and protocols fairly quickly.

However, when it comes to medical technology, for some reason, it seems that hospitals take a long time, as you have pointed out, to integrate new devices, instruments, or software until they have been well-proven in the market for several years. Perhaps this is due to the administrators unwillingness to take risks, perhaps it is the physicians who don’t feel comfortable with new tech, or maybe it’s because insurance companies make it difficult for reimbursement of new technologies/3D equipment.

Regardless, I think that for our healthcare system to continue to digitize as best as possible, we need to create an environment that better fosters medical innovation. Device companies and medical technology developers need to know that there is a broader market for early-adopters out there that goes beyond just the Mayo Clinic and a few others. Therefore, I would also recommend that the Mayo Clinic invest some of its endowment in existing or new medical device/technology companies. It can leverage its immense reputation to perhaps help these companies bring their technologies to other hospitals, while also maintaining a stake in their successes. As a society we need to find ways to align incentives for our patients, physicians, hospitals, and device companies to be most effective in the digitization of medicine.

As a very passionate person about healthcare, I researched the area of digitalization of the supply chains in hospitals and specifically in the Boston Children’s Hospital. With the advancements in technology, the dilemma does not need to be between overstocking inventories and putting patients at risk but rather which just in time inventory management system to implement in the hospital. This will enable the hospital to provide more customized services and products.

I do agree with you that 3D printing should be used to replace parts of the supply chain especially to enable customization of products that can enable a more comprehensive patient treatment. Internal 3D printing can pose a threat on the relationship between the hospitals, suppliers and distributors. I believe that it is the distributors’ interest to influence the advancements in the supply chain in order to be left in the game. Hospitals will be able to manage their levels of inventory and quality of products – maximizing efficiency and costs.

Great read Phil! The RFID technology sounds amazing and I’m sure can have equally large gains for smaller hospitals. I wonder what is preventing small hospitals from adopting this technology especially given the clear gains from implementing them. Is is possible that there is a very high up front cost to implementing this technology that deters hospitals? Or is it an organizational issue where hospitals that are less innovative than the Mayo clinic are less inclined to make such big changes to their operations?

I also wonder if they will be able to further integrate this digitized supply chain with their suppliers and other partners such as blood banks and laboratories. This seems especially pertinent for hospitals where the movement of products (such as blood or other critical hospital supplies) is highly time sensitive. I am looking forward to seeing how this technology further improves our hospitals, their bottom line, and the well being of their patients.

Very interesting article, Phil. I greatly enjoyed reading about the extent to which the Mayo Clinic has pioneered the path forward in terms of deploying advanced technology to revolutionize their inventory management, as well as their broader supply chain. The primary question this elicited in my mind is centered upon the extent to which their commitment to digitalization was motivated by a divergent strategic calculus from that which underpins the vast majority of other hospitals. Does the Mayo clinic benefit from a structurally induced longer term investment horizon compared to the rest of the hospital system?