Macy’s: The Retailer at the Forefront of a Technological Revolution

Within the last ten years, retail e-commerce sales as a percent of total retail sales has increased 183% [1]. As a result, many retailers are facing cannibalization of brick and mortar sales and rising inventory holding costs. Macy’s, one of the top department stores in the United States with 2015 sales of $27.1 billion [2], has been at the forefront of this trend and is using digital technology to address these challenges head-on.

The Macy’s Way

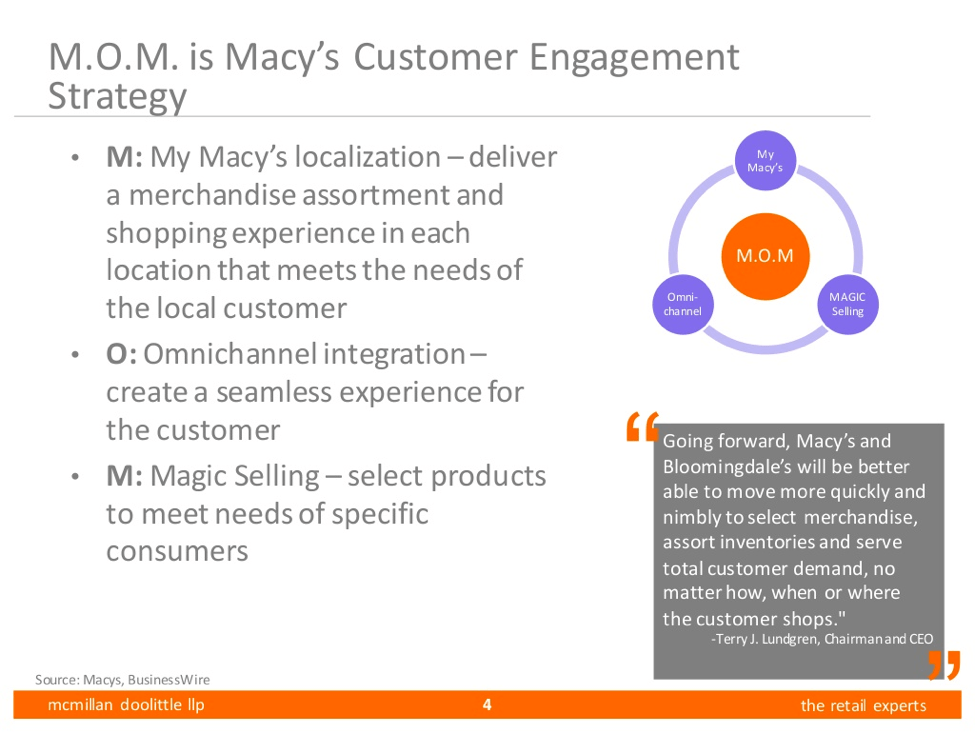

Macy’s takes pride in having a customer-centric business model. Thus, in the wake of the trend towards technology-based consumerism, the company quickly developed and launched a three-pronged customer engagement strategy [3], rooted in an evolving landscape of technological innovation.

Within five years of the 2010 launch of the strategy, Macy’s funneled $2 billion [4] worth of investment in technology and e-commerce to maximize its impact. Since initiating this digital transformation, Macy’s profit margin has grown 257.2%, far outpacing many of its top competitors [5]

The success of the Macy’s digital transformation can be attributed to two key shifts in its business and operating models:

I. Adopting a bricks-and-clicks omnichannel strategy

Since the launch of the macys.com website in 1997 [6], Macy’s online sales have grown to represent roughly 18% of total sales [7], In order to maximize the online shopping experience and offset the cannibalization of instore sales, Macy’s has embraced a technologically innovate, bricks-and-clicks hybrid strategy that enables customers to shop whenever, wherever, and however they choose.

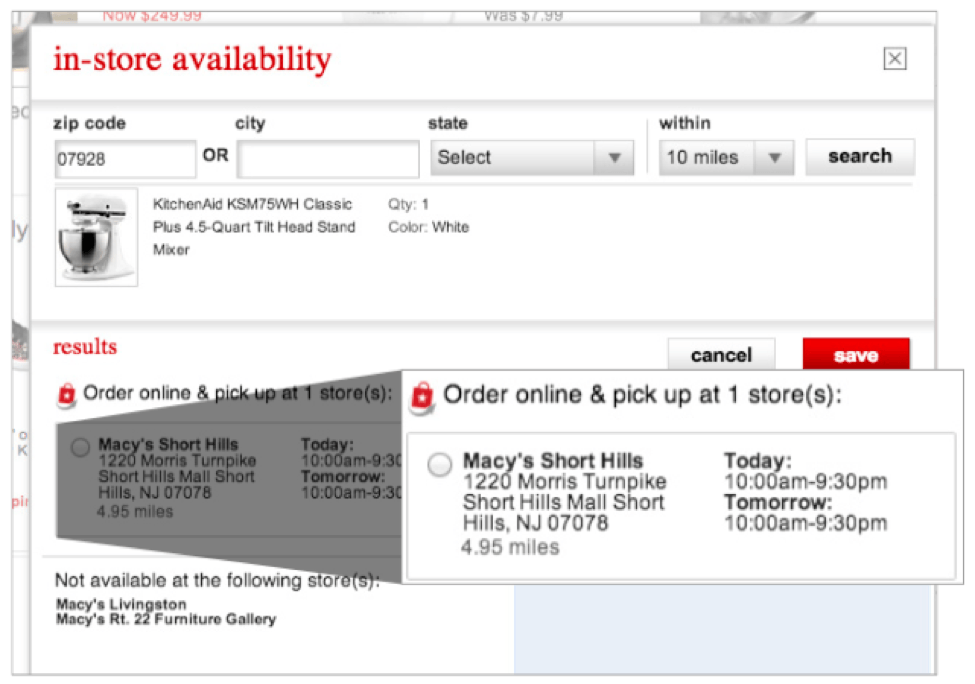

In 2011, the company stayed ahead of the competition by adopting Radio Frequency Identification Technology (RFID) [8]. Through RFID, Macy’s grants tablet-equipped sales associates and online shoppers a comprehensive view of all available inventory business-wide, helping fulfill the “buy anywhere, fulfill anywhere” omnichannel vision [8]. The inventory visibility offered through RFID also allows Macy’s to employ a “Pick to the Last Unit” strategy, whereby every item available for purchase instore can be easily located and delivered to the customer [9]. This optimized inventory management has resulted in an estimated $1 billion reduction of instore inventory [10]. Macy’s has also incorporated a “click and collect” functionality to its website, allowing omnichannel customers to order merchandise online and pick it up in a nearby store [8].

Coupled with the RFID technology, this functionality enables customers to browse and order based on inventory availability at specific stores. Once in the stores for pickup, omnichannel consumers are incentivized to shop instore through promotions [11] and, on average, end up spending approximately 125% of their intended online order [12]. Omnichannel customers have five times the customer lifetime value of single-channel customers [5].

To facilitate the omnichannel vision, Macy’s consolidated its merchandising and marketing businesses into one cohesive unit and invested in a number of strategically-located direct-to-consumer distribution centers, including a 1.3 million center completed in 2015 in Tulsa, OK [13].

II. Digitizing the instore shopping experience

In addition to digitally luring technology-based shoppers into physical stores, Macy’s has created a robust suite of digital tools to keep these shoppers in stores longer.

⎯ Macy’s On Call – Macy’s has teamed with the IBM Watson team to develop an artificial intelligence-powered shopping assistant. Still in its pilot stage, Macy’s On Call will allow customers to input questions about specific brands, departments, and services and facilities within a particular store [14].

⎯ Smart Pay – To allow for a more efficient checkout process, Macy’s has implemented one-touch-pay technologies such as PayPal, ApplePay, and the Macy’s Wallet mobile app so that customers can easily scan and checkout items [8].

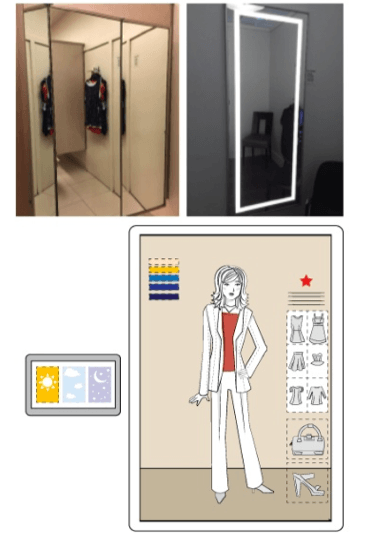

⎯ Smart Fitting Rooms – Through smartphones and company-provided tablets, customers can try on items without having to leave the dressing room. Customers can browse, locate and request items by size on their Macy’s mobile app and sales associates can deliver those items directly to the fitting room through a wall chute [15].

⎯ “Virtually Dress Up” with the Magic Mirror – A newer feature of the smart fitting room is the magic mirror. The 72-inch mirror allows customers to superimpose different clothing options on their reflections [16]. The multi-touch mirror surface allows customers to swap various articles and sizes of clothing with a few simple swipes [16].

⎯ Visual Search – Through the visual search application, shoppers can upload images of items from their smartphones and search for similar items in the Macy’s catalog.

⎯ Promotions and Advertising – In 2014, the company installed 4,000 iBeacon devices in its 786 stores [17]. The devices send personalized ads to the smartphones of consumers in and around physical stores. The Macy’s Wallet mobile app also provides users with easy access to loyalty programs and instore/online promotions.

The Road Ahead

While these investments have spurred double-digit digital sales growth, this growth showed signs of slowing in Q1 2016 [18]. In an effort to reverse this trend, Macy’s should consider ramping up its personalized omnichannel strategy through the use of social media. Using facebook profiles and pinterest boards, Macy’s can potentially replace the iBeacon technology and create more targeted advertising campaigns for individual shoppers. Similarly, Macy’s could incorporate a social component on its mobile app to allow users to create profiles that showcase specific Macy’s products. The exchange of outfit ideas, for example, can increase word-of-mouth advertising, thus reducing overall marketing costs.

Word Count: 796

References:

1. http://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf, accessed Nov 2016

2. Macy’s 2016 factbook: file:///Users/kamoy/Downloads/2016%20Fact%20Book%20(1).pdf

3. https://www.macysinc.com/macys/m.o.m.-strategies/default.aspx, accessed Nov.2016

4. https://www.l2inc.com/the-future-of-retail-looks-like-macys-not-amazon/2015/blog, accessed Nov 2016

5. https://centricdigital.com/blog/digital-trends/how-macys-implemented-a-successful-omnichannel-approach/, accessed Nov 2016

6. http://money.cnn.com/1998/06/26/companies/macys/, accessed Nov 2016

7. http://fortune.com/2016/04/01/department-stores-ecommerce/, accessed Nov 2016

8. http://www.businesswire.com/news/home/20140915005587/en/Macy%E2%80%99s-Outlines-Developments-Omnichannel-Strategy-Technology, accessed Nov 2016

9. http://www.rfidjournal.com/articles/view?13990, accessed Nov 2016

10. http://www.tycoretailsolutions.com/Pages/ArticleDetail.aspx?ItemId=697, accessed Nov 2016

11. http://www.macys.com/ce/splash/buy-online-pickup-in-store/index, accessed Nov 2016

12. http://www.mediapost.com/publications/article/238471/macys-adds-visual-search-image-recognition-to-mo.html, accessed Nov 2016

13. http://www.businesswire.com/news/home/20131217006140/en/Macy%E2%80%99s-Build-Major-Fulfillment-Center-Tulsa-County, accessed nNv 2016

14. http://www.forbes.com/sites/rachelarthur/2016/07/20/macys-teams-with-ibm-watson-for-ai-powered-mobile-shopping-assistant/#5995ae8f7395, accessed Nov 2016

15. https://www.bloomberg.com/news/articles/2015-08-18/macy-s-tests-chutes-tablets-in-dressing-rooms-to-repel-amazon, accessed Nov 2016

16. https://www.cnet.com/news/macys-mirror-lets-your-reflection-try-on-clothes/, accessed Nov 2016

17. https://www.washingtonpost.com/news/business/wp/2014/09/25/is-the-new-technology-at-macys-our-first-glimpse-of-the-future-of-retail/, accessed Nov 2016

18. http://risnews.edgl.com/retail-news/Macy-s-Continues-Tech-Investment-Despite-Slumping-Sales105548, accessed Nov 2016

Thank you for the wonderful post Kimmy! While many of the digital initiatives Macy’s has deployed in-store have improved and digitised elements of the customer experience, I have concerns and questions about if Macy’s encountered accompanying challenges in their operating model through implementing these changes? Did these lead to measurable uplift in revenue or did customers just see them as ‘gimmicky’? I would imagine the investments required for ‘smart fitting rooms’ and ‘magic mirrors’ are substantial and my concern would be the financial viability of these investments and the ROI of them in the long run? As mentioned in the Forbes article below, retailers across the world are investing billions in the ‘Internet of Things’ but will they pay off? [1]

1 – http://www.forbes.com/sites/barbarathau/2016/11/18/retailers-are-spending-billions-on-the-internet-of-things-but-will-it-pay-off/#e42d72f79fec

Thanks for a great post! I’m also curious about the operational impacts of these initiatives. With over 150,000 employees, what was the implementation plan for this digital overhaul in all of its stores? Additionally, I recently read that Amazon is expected to surpass Macy’s as the largest apparel in the US next year through initiatives such as launching its own private label brands [1]. I’m curious to know how Macy’s plans to react to this threat. With the recent decision to close over 100 stores, are more store closures in sight for Macy’s? [2]

[1] http://www.businessinsider.com/amazon-becomes-the-biggest-clothing-retailer-in-the-us-2016-10

[2] http://money.cnn.com/2016/08/11/investing/macys-closes-100-stores/

When I think of Macy’s, I definitely don’t think of a technologically savvy company so I was very interested to read your post about the initiatives they have put in place to optimize their e-commerce platform and customer experience. From your post, it appears as though Macy’s is taking all the right steps in order to build out their digital capabilities – in particular, I was impressed by their early adoption of the RFID inventory management system and their partnership with IBM Watson for “Macy’s On Call.” However, are these initiatives enough to keep the company afloat in the near term? Technology investments are notoriously difficult monetize and have long payback periods so my question is how will Macy’s balance their obligations to shareholders to maximize profits in the short-term? I admire Macy’s focus on the long-term growth prospect of the company, but with activist investors knocking at the door, are they going to be able to implement and invest in these initiatives to the degree they will need to in order for them to be successful [1]? Furthermore, as SHK pointed out, Macy’s in the process of closing 100 stores which frees up capital that could be re-invested into their technology initiatives. It will be interesting to see if Macy’s chooses to double-down on their digital platform, as they scale back on their retail footprint.

[1] http://www.wsj.com/articles/starboard-takes-stake-in-macys-wants-real-estate-spun-off-1436976717

Omnichannel strategy has been a hot topic among many retailers nowadays when digitalization is in the forefront of business development. As one of the biggest retailers in a giant market, embracing this trend is inevitable for Macy’s. I am one of biggest supporter for this move even though I am fully aware of the cons of the move such as high up front investment on infrastructure and staff training. Macy’s was named the Mobile Retailer of the year in 2014 and its share price saw a great gains right after its big success in digital revolution so I strongly believe this is the way to go. In fact, Macy’s has to continously try to stay in leader position of this revolution to really leverage its brick and mortar successful model.

Reference:

https://centricdigital.com/blog/digital-trends/how-macys-implemented-a-successful-omnichannel-approach/