Kroger: Sensors, Coming to Aisle Near You

Century-old grocery giant Kroger reinvigorates customer loyalty, operational efficiency and earnings by connecting customers, cashiers and Cap’n Crunch.

Kroger, one of the world’s largest supermarket goliaths with $110 billion in annual sales, has nimbly embraced the Internet of Things (IoT) technology – with an eye for customer promise fulfillment, workforce efficiency and profitability.[1]

At Check-Out: Time is Golden

As early as 2010, Kroger turned to IoT to solve its customers’ biggest pet peeve: the dreaded wait in check-out line. Launching the QueVision platform with one aim – to ensure that customers never have more than one shopper ahead in the line, Kroger installed infrared sensors over store doors and cash registers. These devices counted customers entering the store and leaving points-of-sale, and fed managers real-time data to on how many shoppers were in the store at any given second.[2] With just a few clicks, managers could leverage back-end software to predict when long lines would happen, calculate the magic number of registers and allocate cashiers before a pile-up began, looking as far out as 30 minutes.[3] Instead of staff communication via hand-held devices, wait times were projected on a screen, where everyone including customers, could see wait times. QueVision (deployed in over 2,300 stores) has since slashed average shopper wait time by 88%, from four minutes to 26 seconds.[4] Customers reported higher satisfaction with shorter lines and likelihood to return. Shoppers even reported a 24% improvement in cashier friendliness, a critical contributor to shopping experience and loyalty. QueVision boosted the bottom line too. By running historical data through algorithms to project what to expect on specific days of the week or month and gaining flexibility to schedule shifts and move cashiers to the floor for other tasks, Kroger increased productivity of its 431,000-strong employee base.[1][2]

Exhibit 1: Kroger QueVision Platform

In the Store: From Carvel to Cap’n Crunch

In 2015, Kroger expanded its IoT infrastructure onto the floor to tackle another problem: cold good spoilage due to temperature spikes in frozen and refrigerated cases. Spikes could be attributed to a handful of factors, including malfunctioning compressors, extended defrost cycles, bad door seals and human error, such as a shopper leaving the door open. To combat this, Kroger equipped frozen and refrigerated cases with water-proof, humidity-proof sensors that tracked temperatures every 30 minutes and sent automatic alerts to managers and facility engineers when the case started to fail. Much like QueVision, the temperature monitoring platform yielded labor cost savings. Associates, no longer needed to check thermometers manually twice a day, were freed up for alternate tasks. It reduced cost of goods sold, as fewer products went bad and had to be thrown out.[5] More importantly, it enabled Kroger to deliver on customer promise of food safety. Perishables like cheese stored even at two or three degrees warmer could go bad by the time shoppers took them home – an event whose became far less likely with the new technology.

Kroger did not stop at the frozen aisles. It rolled out electronic shelf-edge displays for dry goods. These “smart” tags fit onto the front-edge of merchandise shelves or racks – right where the purchasing decision is made. Kroger displayed video images of price tags. These displays could be altered with just a few key strokes in the back-office or at Cincinnati headquarter.[6] By enabling more dynamic price and promotion-setting, they enhanced operational agility to respond quickly to changing market conditions and offer more competitive prices to drive purchases.[7] Like the earlier IoT innovations, the displays freed up stock clerks to turn their attention to customer service. Previously, given tens of thousands of SKUs, a typical Kroger store took more than two weeks to completely re-price by hand. With “smart” shelf displays, associates could now offer customers directions, assist product selection and boost customer satisfaction in the process.[6]

What’s Next: Cold Chain Industry Leadership

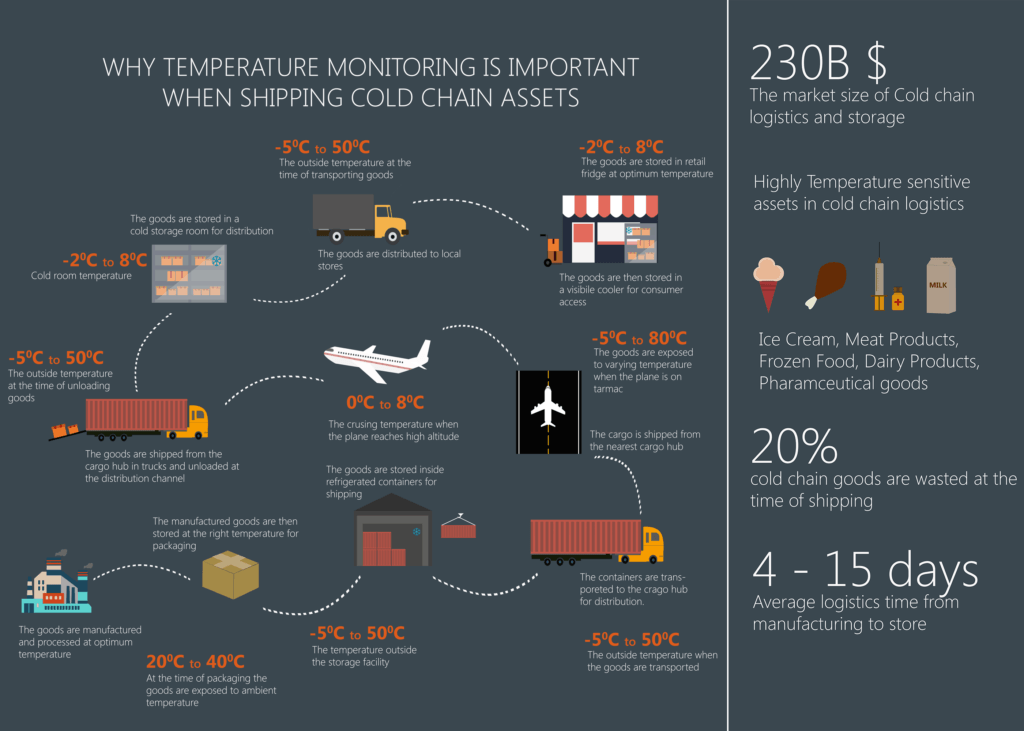

According to the FDA, 1 in 6 Americans gets sick from foodborne diseases annually. Temperature fluctuations during the long journey from production to store-shelf, is a key culprit.[8] Amidst this public health burden, Food Safety Modernization Act (FSMA), signed in 2011, requires temperature-sensitive, perishable “cold chain” foods carriers and shippers to collect, report and keep records for all transport. For instance, fleet managers can install sensors to trigger auto-alerts for temperature fluctuations. If the system doesn’t auto-correct, it alerts the supplier who replaces bad goods. Truck managers leverage IoT fleet management tools to optimize routes and ensure on-time delivery of new goods.[9] FSMA has disappointingly endured numerous extensions (now out to 2020), as vendors delay putting up requisite investments (e.g. sensor-equipped reefers, connectivity).[8] Just as IKEA exercised market leadership by demanding sustainability standards among suppliers, Kroger – the largest U.S. chain with 2,778 supermarkets in 35 states, is well-poised to push vendors throughout the grocery supply chain to improve food safety for customers and extract value by reducing spoilage – a potentially large sum given 4-15% in-transit loss for fresh produce and meats globally. [1][10] Will Kroger deliver?

Exhibit 2: Cold Chain Logistics – Temperature Monitoring[11]

[Word Count: 798]

[1] “Kroger 2015 Fact Book,” Kroger (2015), http://ir.kroger.com/Cache/1500086312.PDF?O=PDF&T=&Y=&D=&FID=1500086312&iid=4004136, accessed November 2016.

[2] McLaughlin, Laurianne. “Kroger Solves Top Customer Issue: Long Lines,” InformationWeek (Apr. 2, 2014), http://www.informationweek.com/strategic-cio/executive-insights-and-innovation/kroger-solves-top-customer-issue-long-lines/d/d-id/1141541, accessed November 2016.

[3] Taylor, Kate, “Kroger is building the grocery store of the future,” Business Insider (Nov. 8, 2015), http://www.businessinsider.com/krogers-grocery-store-of-the-future-2015-11, accessed November 2016.

[4] “Microsoft vision for IoT, and what it could mean for retail,” Microsoft Corporate Blogs (May 7, 2015), http://blogs.microsoft.com/iot/2015/05/07/the-microsoft-vision-for-iot-and-what-it-could-mean-for-retail/, accessed November 2016.

[5] Kaneshige, Tom, “The Internet of Things now includes the grocery store’s frozen-food aisle,” CIO Magazine (Jul. 31, 2015), http://www.cio.com/article/2945732/cio100/the-internet-of-things-now-includes-the-grocery-stores-frozen-food-aisle.html, accessed November 2016.

[6] Coolidge, Alexander, “Kroger tests smart shelf technology,” USA Today (Oct. 2, 2015), http://www.cincinnati.com/story/money/2015/10/02/next-shelves-giving-cues-kroger/73218252/, accessed November 2016.

[7] P. Middleton, T. Kowslowski and A. Gupta, “Forecast Analysis: Internet of Things – Endpoints, Worldwide, 2015 Update,” Gartner (Dec. 15, 2015).

[8] “FDA Food Safety Modernization Act (FSMA”), U.S. Food & Drug Administration 2016), http://www.fda.gov/Food/GuidanceRegulation/FSMA/, accessed November 2016.

[9] Jones, Chad, “How the Internet of Things is Revolutionizing Food Logistics,” Food Logistics (Apr. 2014), http://www.foodlogistics.com/article/11366603/food-and-more-for-thought-how-the-internet-of-things-is-revolutionizing-food-logistics, accessed November 2016.

[10] R. Jedermann, M. Nicometo, I. Uysal and W. Lang, “Reducing food losses by intelligent food logistics,” Phil. Trans. R. Soc. A

(2014) 372: 20130302, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4006167/pdf/rsta20130302.pdf.

[11] “Why Temperature Monitoring is Important When Shipping Cold Chain Assets,” Nimble Wireless (2016), http://www.coldchainhub.org/cold-chain-logistics/, accessed November 2016.

A great post, and a very interesting use of IoT to optimise operations! I just wonder about cost concerns, especially considering the lack of implementation in the cold chain channel.

I would think that the price of sensors, and the price of creating portable powering systems, is probably the key barrier to your suggestion being implemented.

However, I would argue, that it is just a matter of time before such solutions become economically viable – as the cost of sensors falls dramatically – the average price of iot sensors is projected to fall from $0.60 in 2014 to $0.38 in 2020. [1]

[1] https://www.theatlas.com/charts/BJsmCFAl

Great article, thanks for sharing. I find it extremely impressive that their QueVision technology led to not only reduced wait times, but also resulted in cost savings. It says a lot about how technology and automation can create create efficiencies for the labor force. Kroger is currently testing two other automated checkout systems: Advantage Checkout, which is able to scan multiple items at once, and also Scan-Bag-Go, which allows customers to scan items as they shop. [1] Although they are both big investments, the potential benefits in terms of long-term savings and customer satisfaction are significant.

To your point about the perishable “cold chain”, I see this as an opportunity for Kroger. Since one of the biggest issues with grocery delivery services today is the low quality of the perishable items at delivery, I think Kroger could apply its in-store technology for perishables to a delivery fleet for perishables and enter the grocery delivery industry with a significant competitive advantage.

[1] Retail Leader, “Kroger Tests New Scanning Technology.” http://www.retailleader.com/top-story-tech___logistics-kroger_tests_new_scanning_technology-119.html, accessed November 2016.

Very interesting article! They are clearly making a lot of great investments to improve the customer experience in-store and out of the store (with less spoiled food). My fear for Kroger is that their issue is not solved by improving the in-store experience, but rather competing with the rapid emergence of companies delivering groceries / meals. Amazon Fresh recently slashed its membership fee and is rapidly expanding into cities and at the same time you have companies such has BlueApron that deliver ingredients for meals. I read Kroger has launched online ordering with curbside pickup, but I wonder if that will be enough. A lot of restaurants are facing similar problems, with the demand for delivery driven by the millennials, these companies will have to face the reality of whether they will spend the money to build out the infrastructure and delivery capabilities or perhaps suffer market share loss. Hopefully some of the technology that could make delivery more feasible (autonomous cars and drones) comes soon enough for these companies to survive!