In the Eye of The Storm: An Energy Giant´s View on Climate Change

Climate change is disrupting the supply chain of Oil & Gas companies located along the Gulf of Mexico, how is a major player adapting to the rising temperatures that it has allegedly helped foster?

“Exxon knew about climate change half a century ago. They deceived the public, misled their shareholders, and robbed humanity of a generation’s worth of time to reverse climate change.” [1]

#ExxonKnew?

ExxonMobil has been at the center of the debate on climate change for decades, and as the largest publicly traded international oil & gas company, Exxon is no stranger to controversy. The quote above is the headline to the exxonknew.org website, which centralizes the efforts from a group of environmentalist and officials that consider the company knew about the effects on climate change due to greenhouse gas emissions decades ago, proactively tried to steer away the public´s perception via lobbying and funding of alternate research, and are calling for action by the Government for Exxon to ultimately “be held accountable” [1].

Various Attorney Generals have launched probes into the matter, including 2016 investigations by the states of Los Angeles, New York and Massachusetts which have been inconclusive [2].

More Than Politics

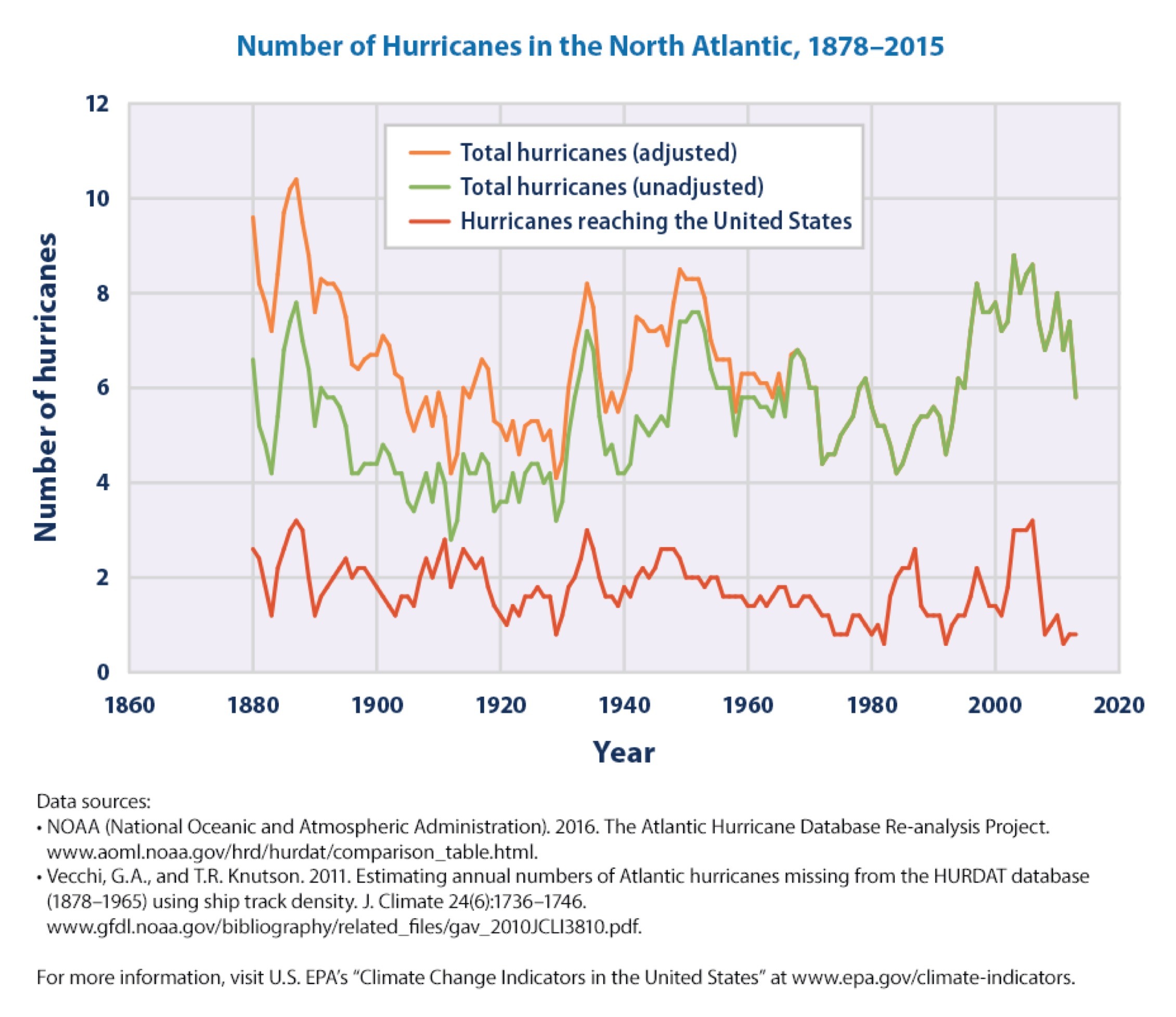

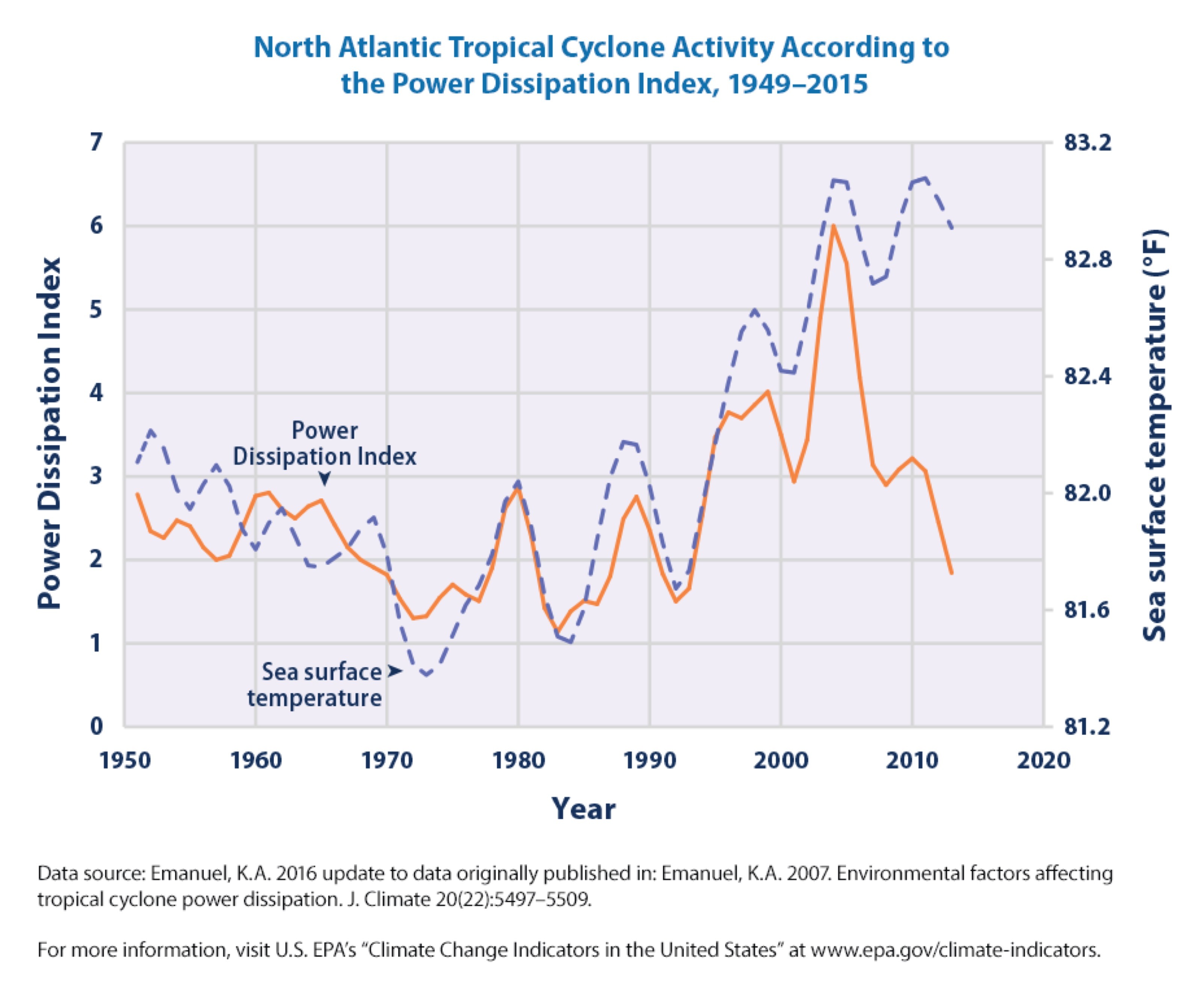

Aside from the political and media controversy, the climate change megatrend has other significant impacts for ExxonMobil´s complex worldwide supply chain. 2017 has given us many sobering reminders of the very real effects of climate change, with devastating impacts from Harvey, Irma and Maria along many states. The scientific community still debates whether the raising temperatures will make the storms more frequent or not [4], however there is general consensus that due to rising water temperatures, tropical storms are likely to become more powerful and rainier [5].

Figure 1. EPA tracking of number of hurricanes in the North Atlantic

Figure 1. EPA tracking of number of hurricanes in the North Atlantic

Figure 2. EPA tracking of Power Dissipation Index – a measure of hurricane strength and sea surface temperature

Figure 2. EPA tracking of Power Dissipation Index – a measure of hurricane strength and sea surface temperature

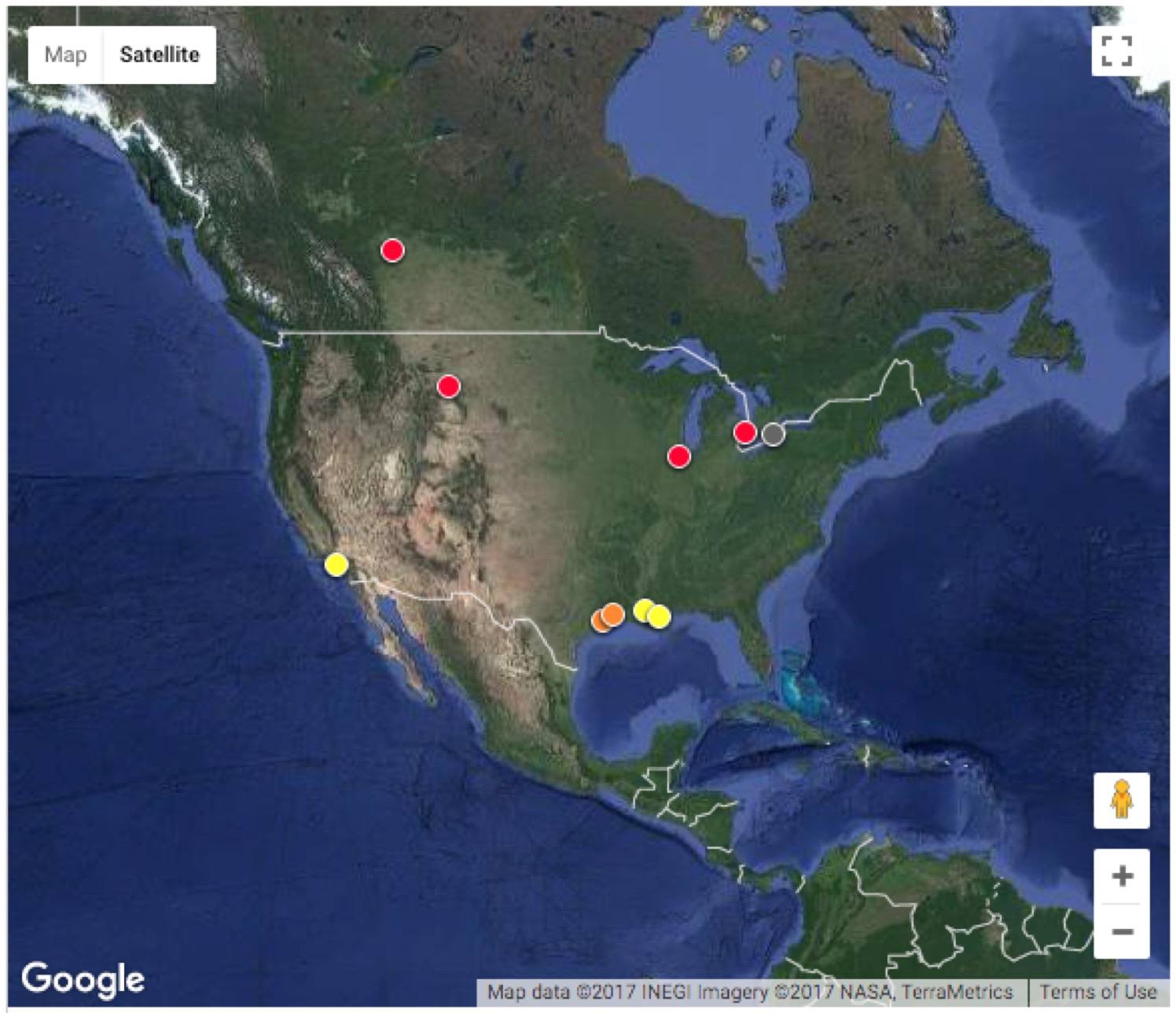

ExxonMobil holds many productive assets, namely refineries and blending plants, in the Gulf of Mexico [3]. The company´s Baytown, Texas, refinery, the second largest in the country, and its Beaumont, Texas, large-scale petrochemical complex took damages during Harvey, and remained shut down, along with various others, taking 23% of the U.S. refining capacity offline for several days. Supply chain disruptions have also come from the Gulf´s ports, the gateway to the Company´s worldwide exports of its refined products; these ports and the related commercial activity collapse in the aftermath of the tropical storms. Port Houston, one of America’s largest seaports, as an example, remained closed for more than a week after Harvey made landfall [9].

Figure 3. – Location of ExxonMobil´s USA and Canada Refineries [3]

Figure 3. – Location of ExxonMobil´s USA and Canada Refineries [3]

The Road Ahead

The company has already taken some steps to mitigate the impact. The most visible one was integrating a comprehensive business continuity plan (BCP) into their Operations Integrity Management System (OIMS) that addresses disruptions on the Gulf Coast facilities on various grounds, including natural disasters, oil spills, and hazmat situations, among others [12].

The full plan can be reviewed at the SCAA (Spill Control Association of America) [12]; it incorporates chapters on alternative routes of supply from other plants from across the globe, which impacts cost but ensures reliable supply to its customers. It also has a chapter on preemptive safety stock increases in warehouses and distribution centers, as well as in other country´s distribution operations which are triggered prior to the “hurricane season”, and are well-measured to last for a significant disruption. In another chapter, the plan also encompasses manufacturing operations that use the Company´s own base-oils as raw materials, and defines alternative manufacturing recipes for refined products using non-U.S. base oils as an alternative for U.S. supply chain disruptions. Finally, the plan also considers alternate suppliers and long-term backup contracts to procure finished products or raw materials from third parties as a potential fallback plan.

Further to the company´s current actions, a recommendation would be made on investing on developing different refineries in other geographies, or regions of the country, that might be less subject to the impact of rising temperatures and rising strength of storms. The company announced a $20Bn plan to strengthen its refining assets along the gulf coast; the plan, which runs through 2020, will add extra capacity at 11 sites, the reason they argue is that the zone is strategically advantageous to reap the benefits of cheap shale oil available in the region [13]. However, the question remains on whether from this major megatrend on climate change, holding all the productive assets in a region so susceptible to natural phenomena is the right answer.

Finally, we have reviewed at large the adaptation measures that Exxon can take to accommodate to climate change; the larger question, particularly in Exxon´s alleged position as the world´s second largest pollutant emitter in the sector – responsible by some accounts for 3.2% of the world’s total fossil fuel emissions from 1751-2010 [14], is what could they do to reduce its own contribution to climate change?

(Word count: 791)

[1] 350.org, “#ExxonKnew”, http://exxonknew.org, accessed November 2017.

[2] The Washington Free Beacon, “Memo Shows Secret Coordination Effort Against ExxonMobil by Climate Activists, Rockefeller Fund”, http://freebeacon.com/issues/memo-shows-secret-coordination-effort-exxonmobil-climate-activists-rockefeller-fund/, accessed on November 2017.

[3] Oil Change International, “Refinery Report”, http://refineryreport.org/nucomp.php?id=7107, accessed on November 2017

[4] MIT Center for Global Change Science, “CGCS NEWS IN THE NEWS: Hurricanes Could Be Stronger- and More Frequent”, http://cgcs.mit.edu/news-hurricanes-could-be-stronger-and-more-frequent, accessed on November 2017

[5] EPA, “Climate Change Indicators: Tropical Cyclone Activity”, https://www.epa.gov/climate-indicators/climate-change-indicators-tropical-cyclone-activity, accessed on November 2017

[6] Climate Central, “Hurricanes Likely to Get Stronger & More Frequent: Study”, http://www.climatecentral.org/news/study-projects-more-frequent-and-stronger-hurricanes-worldwide-16204, accessed on November 2017

[7] The Washington Post, “ExxonMobil refineries are damaged in Hurricane Harvey, releasing hazardous pollutants”, https://www.washingtonpost.com/news/energy-environment/wp/2017/08/29/exxonmobil-refineries-damaged-in-hurricane-harvey-releasing-hazardous-pollutants/?utm_term=.1adfbeda60dc , accessed on November 2017

[8] Reuters, “Factbox: U.S. Gulf Coast energy infrastructure shut due to Harvey”, https://www.reuters.com/article/us-storm-harvey-oil-factbox/factbox-u-s-gulf-coast-energy-infrastructure-shut-due-to-harvey-idUSKCN1BG2Y8, accessed on November 2017

[9] USA Today, “Houston port reopens cargo terminals while waterways access remains limited”, https://www.usatoday.com/story/money/2017/09/01/houston-port-reopens-cargo-terminals-business/625479001/, accessed on November 2017

[10] Hydrocarbons Technology, “Top 10 large oil refineries”, http://www.hydrocarbons-technology.com/features/feature-top-ten-largest-oil-refineries-world/, accessed on November 2017

[11] Singapore Business, “ExxonMobil unveils expanded Jurong lubricant plant”, http://www.straitstimes.com/business/exxonmobil-unveils-expanded-jurong-lubricant-plant, accessed on November 2017.

[12] ExxonMobil, “Overview of ExxonMobil Emergency Response Processes”, http://www.scaa-spill.org/presentations/2015-annual-meeting/Overview%20of%20ExxonMobil%20Emergency%20Response%20Processes.pdf, accessed on November 2017

[13] ExxonMobil, “ExxonMobil Plans Investments of $20 Billion to Expand Manufacturing in U.S. Gulf Region”, http://news.exxonmobil.com/press-release/exxonmobil-plans-investments-20-billion-expand-manufacturing-us-gulf-region, accessed on November 2017

[14] Heede, R. Climatic Change (2014) 122: 229. https://doi.org/10.1007/s10584-013-0986-y

Very interesting read, particularly given how present Exxon has been on the global stage in the last year. When President Trump was still considering pulling out of the Paris agreement, Exxon and many other oil and gas industry players advocated for remaining in the agreement (https://www.bloomberg.com/news/articles/2017-05-31/exxon-conoco-back-paris-climate-deal-as-trump-weighs-pact-exit). An ironic 180 degree twist given the #Exxonknew scandal.

Exxon has admirably re-thought their supply chain and refinement process to adapt to natural hazards and disruptions. However, one can wonder: how long will their operating model remain relevant? Is there a natural expiration date to the oil and gas industry? If so, how much time does the SCAA buy them?

I’d answer the question about what Exxon can do about its contribution to climate change in short, by saying that the company probably doesn’t have too many incentives to change their contribution to climate change. According to the International Energy Agency, demand for fossil fuels will continue to increase in the next decades, especially in the next 10 years: https://www.iea.org/weo2017/#section-2

Given that ExxonMobil is still mostly focused on the international oil & gas business, I assume that they will try to reap these business opportunities. Given this perspective, I think that ExxonMobil could leverage its resources to at least maximise all efforts to limit emissions by installing filter systems and improving its energy efficiency. As Lynn pointed out, the clock is ticking for ExxonMobil and the company claims to already invest in renewable energy resources. When reading the essay, however, its supply chain efforts rather indicate that ExxonMobil is trying to protect its oil and gas business model against the impact of climate change.

Thanks for sharing your research on this interesting dichotomy – one of the world’s largest polluters now facing a threat to its own business model viability as a result. Please see below for my thoughts:

– One point on your verbiage on holding all the productive assets in the Gulf Coast region and the risk associated with this capital allocation: as Exxon is a vertically integrated oil major, it maintains operations across the oil and gas value chain (upstream acreage development, midstream transportation/storage of hydrocarbons, and downstream refining and sales/marketing of those hydrocarbons) and across the world. It is inherently one of the most diversified energy companies that exists, so I would not be immediately concerned that it is seeking to concentrate investment in the Gulf Coast. Furthermore, while $20bn is a large figure to invest in the Gulf Coast region in isolation, in the context of its total spend, I would imagine that this figure is not as significant contextually (for example, this is roughly equal to one year of XOM spending at current levels (which are depressed because of the oil market environment), and this $20bn initiative is likely to last several years. Assuming a 10 year program, this would be $2bn per year, or 10% of total annual spend at current levels (which are likely to increase when the market recovers – a large piece, but not concerning to me).

– One fun element of energy is that it tends to be a zero-sum game along the energy chain (unless oil prices are depressed, when everyone hurts). So, if we think about XOM (which owns all pieces of the value chain as I note above), a supply disruption in one area of the world (Gulf Coast) for one element of the supply chain (downstream refining) could actually prove to be a net-positive for XOM. For example, if a hurricane rocks the Gulf Coast, most likely oil and refined product supply will both be dampened, providing price support for oil. So, although XOM’s downstream operations may be hit by downtime and/or higher feedstock costs, its upstream and midstream operations in the U.S. may be able to sell at a higher price, therefore increasing revenue and margins for XOM and netting out the downstream losses. Though this is all speculation, I would be interested in knowing to what extent some of these supply disruptions caused by storms are helping XOM and therefore providing incentives for XOM management to continue to turn a blind eye.