Hunting for Methane Molecules: Hot on the Trail of Fugitive Emissions

Natural gas is the world’s cleanest burning fossil fuel, or so we are told. But leaked methane traps 100 times more heat in the atmosphere than carbon dioxide, so how clean can it really be?

Nearly ten years after the beginning of the “Shale Revolution,” the battle lines in the fracking debate are drawn. Environmentalists point to pollution, noise, water usage, and a host of other ills, while advocates point to a reduced dependency on foreign oil among other benefits. Many in the industry have embraced natural gas as the fossil fuel of the future: cleaner than coal and oil, it cannot be spilled into the nation’s oceans nor does its extraction reshape mountaintops and hillsides.

Southwestern Energy: An Example for Its Peers

But is natural gas truly cleaner if the effects of the methane that leaks from the nation’s wells, gathering lines, compressor stations, and pipelines are taken into consideration? Some critics assert that natural gas producers have enriched themselves and their shareholders while hiding the commodity’s negative consequences for the atmosphere in plain (but odorless) sight. One company, however, is intent on changing the status quo. Southwestern Energy, the nation’s third-largest gas producer, has decided that if natural gas is to have a future in the United States, producers must address fugitive emissions, or the methane that escapes from wells and pipelines on its way to the end user. As the owner of some 9.8 billion cubic feet of proven reserves and the operator of almost 7,000 wells nationwide, the Company’s efforts, if successful, could significantly impact the way the energy industry thinks about climate change and environmental compliance. [1]

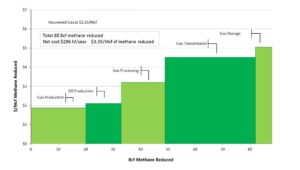

Southwestern has dedicated significant resources to finding methane leaks. In 2014, it led the creation of ONE Future, a coalition of energy companies who have committed resources to developing new technology solutions to challenges associated with natural gas. ONE Future has released studies illustrating the economics of leak detection and repair (LDAR) programs, which oil and gas operators have long resisted implementing under the argument that they are too expensive. [2] (See Exhibit 1)

Exhibit 1: National Marginal Abatement Cost (MAC) by Energy Industry Segment

The effort is not entirely selfless. Southwestern has an interest in ensuring the continued relevance of natural gas, as Mark Boling, an executive vice president at Southwestern, explains, “Natural gas is the bridge to a low-carbon future, but if it’s a rickety bridge that leaks methane, why would you take that bridge?” [3]

The Economics of Compliance

Indeed, the Environmental Protection Agency (EPA) feels the same way. In early 2016, the EPA approved sweeping regulations aimed at curbing fugitive methane emissions. These new rules represent the first direct regulation of methane as a greenhouse gas, and once fully implemented, will have an acute impact on the operations and economics of natural gas producers. [4] Known collectively as Quad Oa, they require well and pipeline operators to conduct quarterly inspections on their wells, pipelines, and compressors. The personnel, training, equipment, and technology required to comply will challenge the current business models and practices of both producers and pipeline companies, especially given the tight profit margins of a low commodity price environment.

It Depends on Your Assumptions

The EPA suggests that these regulations will have a net economic benefit to the operators given that the methane that would have otherwise leaked into the atmosphere will be now sold to end users. However, that calculus is based on natural gas prices that are no longer realistic. In late 2014, prices peaked near $5.00/mcf, whereas they are currently hovering around $2.80/mcf. [5] Natural gas companies simply do not produce as profitably, leaving little excess cash available to pay for inspectors and their equipment.

Despite widespread wailing and gnashing of teeth from much of the industry, Southwestern is embracing the new regulatory environment. [6] The Company began to experiment with various LDAR programs and technologies as early as 2013, purchasing forward-looking infrared (FLIR) cameras in order to conduct inspections of its wells and gathering lines. In three years, the Company has succeeded in driving down inspection costs to $400 annually for a well and $2,000 for a compressor station. At $2.25/mcf gas prices, that saves $150 of gas every year at each well and $2200 worth of gas every ear at each compressor station. [7]

Technology is the Way Forward

The regulatory urgency to mitigate fugitive emissions has resulted in a wave of innovation in the fields of gas detection and monitoring. Startups like Multi-Sensor Scientific and Rebellion Photonics have secured venture funding and have begun to commercialize in situ leak detection technologies, potentially eliminating the need for inspections altogether. Southwestern should build on the progress it has made by continuing to invest in new technologies, as they represent progress towards helping the industry mitigate the climate threat posed by fugitive methane emissions while allowing natural gas producers to economically produce and sell natural gas, which is truly the most pragmatic fossil fuel for the near future.

(794 words)

Sources:

[1] Southwestern Energy, 2015 Annual Report (Houston: Southwestern Energy, 2015), p. 7.

[2] ICF International, “Economic Analysis of Methane Emission Reduction Potential from Natural Gas Systems,” Fairfax, Virginia. May 2016.

[3] Krauss, Clifford. “Future of Natural Gas Hinges on Staunching Methane Leaks.” New York Times, July 11, 2016. http://www.nytimes.com/2016/07/12/business/energy-environment/future-of-natural-gas-hinges-on-stanching-methane-leaks.html

[4] “A New Slew of Oil and Gas Regulations: What You Need to Know.” Vinson & Elkins, New York, NY. May 18, 2016.

[5] NYMEX Natural Gas Prices. http://www.nasdaq.com/markets/natural-gas.aspx?timeframe=5y. Accessed 3 November 2016.

[6] Comeskey, Rachel D. and Snow, Corinne. “Additional Legal Challenges to EPA’s New Methane Emissions Regulations.” Climate Change Blog. Vinson & Elkins. http://www.velaw.com/Blogs/Climate-Change-Blog/Additional-Legal-Challenges-to-EPA-s-New-Methane-Emissions-Regulations/. Accessed November 2016.

[7] Interview with Southwestern Energy Health, Safety, and Environmental (HSE) executive. August 2016.

Exhibits & Photos:

Exhibit 1: ICF International, p. 25.

Cover Photo: Krauss, p.1.

Fascinating article on Southwestern Energy and how they are leading the natural gas space in new methods of fugitive emissions detection. Southwestern Energy demonstrates how long-term thinking can prod corporations to embrace sustainability initiatives. As you noted, the EPA is taking a closer look at natural gas production and is imposing more stringent regulatory requirements. Because of their foresight, Southwestern Energy will have a head start against its peers on compliance.

One concern that I have is natural gas producers exiting the space entirely over fears of not being able to profitably meet compliance costs. However, as new technology is developed the costs of adoption will likely continue to decrease. Additionally, if natural gas prices increase for a sustained period of time it could draw companies back into the sector.

Sam, this is a very well written and thoughtful piece. As the third largest producer, Southwestern has every incentive to avoid addressing the issues laid out in the post. Southwestern could be complacent, and argue that if the number 1 producer is not operating in a sustainable manner, then why should they? Understandably, this approach is short-sighted and it is admirable that Southwestern has decided to address the issues and to spearhead the ONE Future initiative. I agree with you that “the effort is not entirely selfless” but acknowledging the changes and understanding the impacts of fugitive emissions is far more selfless than denying their existence. Hopefully more “startups like Multi-Sensor Scientific and Rebellion Photonics ” emerge who can truly make this energy source sustainable and responsible.

Sam, this is an excellent example of using a challenge and turning it into an opportunity. I have had the chance to work in upstream oil and gas but I knew that there are inefficiencies involved in the refining and collecting processes. What I did not know that methane has a much more detrimental effect on the atmosphere than CO2. It is totally understandable that there will be some benefit involved for SW Energy before it would go ahead and do this project. Based on the numbers, it seems that the investment is already making a lot of sense and once prices of gas go up, the investment will more than justify itself.

Natural gas does present a cleaner alternative but it seems that other producers have battened down the hatches for this storm. This makes me think that ultimately climate change will be more affected by what these companies do in the good times when the money is flowing. If they can be forward thinking enough to invest in technologies when they have the money to do it, they will be able to fruitfully use them when times become tough.