How can Axa manage the risks of climate change in the insurance industry?

The frequency and severity of natural catastrophes and extreme events have radically increased, causing important economic and human losses. What can insurance companies do?

The traditional way for insurers to calculate premiums for Property Damage Liability Insurance Coverage is through the use of statistics and historical models. The risk analyzed for the premium calculations comes from considering probable loss, frequency, and severity of claims that are expected to happen in the future. In the past there had been a high stability on climate impact in insured property, however, weather-related losses have increased nearly fourfold in the United States since 1980 leading to $560 billion in insured losses from 1980 to 2015[1]. The main causes have been prolonged droughts, hurricanes, floods and severe storms directly impacted by climate change. The overall cost of the risks associated with climate change has been estimated at 5% global GDP.[2]

Exhibit 1: Number of Natural Disasters in the United States 1980- First Half 2016[3]

A challenge brought on by climate change to insurers is that historical data is not as reliable as it used to be. Climate change is causing natural disasters to be more frequent and have an increased severity. Since insurers are the ones who are taking the risk generated by climate change, there are two options they can apply into their business model to mitigate this risk.

The simplest option is to include the climate change variable into their premium calculation models, which would in return increase the premium they are currently charging. This proposal brings up two main problems:

- How do we calculate the additional premium insurance companies are supposed to charge?

- How are the clients going to handle a larger price in their insurance premiums?

One of the problems with pricing is that currently, it is not possible to use climate-change models directly as inputs into the pricing model, mainly because the models are highly variable and have failed to accurately predict the impact of climate change. The other problem is that in the short-term premium costs are driven by supply and demand and do not clearly represent in many cases the long-term risks. If we were to add these costs to our premiums we would lose a lot of business to competitors who have not yet included this variable into their models.

Adding problems to the model, one of the main losses come from hurricanes. If we want to use historical data to predict the impact of climate change, we have a very small amount of data to work with. Hurricane observation equipment did not exist before the satellite era, which is relatively recent compared to the data insurers tend to use for their calculations.

To deal the issues that climate change has generated in its operations, Axa has started generating several strategies to mitigate these problems[4]:

- Using all their data to raise awareness of the issue to both governments and companies

- Providing services and advice to clients on how they can protect themselves to minimize climate-related risks. Pointing out how potential damage can be reduced by more prudent land use, stronger building codes, and better planning

- Helping developing countries adapt to climate change or invest in renewable energy

- Strong focus on growing green insurance

- Implementing rules on clients where failure to implement risk management activities may lead to lawsuits

- Implementation of weather-indexed based insurance[5]

- Essential for developing countries with a big agricultural weather risk and an underdeveloped insurance industry. This insurance allows them to have an agricultural business despite the inherent weather risk

- Generating allowances in their financial statements for losses that come directly from climate change issues

- Partnership with NGO “Care” to help vulnerable populations better prepare to deal with climate risks[6]

- Total cost generated by natural disasters is greatly increased by the time it takes for governments or organizations to take action

Currently, the insurance industry is mainly focused on mitigating the risks generated by climate change but they are still, in the end, absorbing all the potential monetary losses when this mitigation is not achieved.

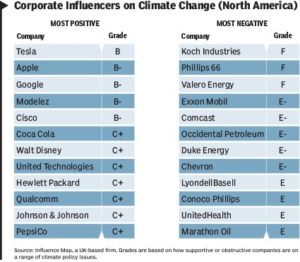

I think Axa should be focusing on transferring the costs they are incurring to the responsible parties for this increased cost and continue implementing and improving their mitigation strategies. They should concentrate on reaching a consensus with regulators to pass the cost to companies that do not comply with green efforts. This could be achieved by implementing a surcharge on the insurance premiums of companies or individuals who do not comply with a green policy. This way the companies are monetarily incentivized to reduce their carbon emissions and pollution which are the main causes of climate change. One such way would be to establish a premium surcharge based on the Corporate Influencers on Climate Change score created by UK-based firm InfluenceMap[7]. Using this information in a similar way rating agencies rate bonds emitted by companies.

Exhibit 2: Corporate Influencers on Climate Change (Influence Map)[8]

Axa should also continue to proactively increase insurance costs in areas that are prone to natural disasters to discourage both companies and consumers from building or living in such areas. (Word Count: 862)

[1] http://www.naic.org/cipr_topics/topic_climate_risk_disclosure.htm

[2] https://cdn.axa.com/www-axa-com%2F1b503ed0-104e-4fe1-9b4f-cf6ea62844ae_axa_and_climaterisks_2014.pdf page 2,CARE page 9

[3] http://www.iii.org/graph-archive/96278, Source: © 2016 Munich Re, NatCatSERVICE. As of July 2016

[4] https://group.axa.com/en/about-us/axa-and-climate-change

[5] https://www.ifad.org/documents/10180/2a2cf0b9-3ff9-4875-90ab-3f37c2218a90

[6] http://www.carefrance.org/partenaires/entreprise-fondation/axa.htm

[7] http://influencemap.org/filter/List-of-Companies-and-Influencers

[8] http://ww2.cfo.com/risk-management/2016/03/hot-topic-climate-change-insurance/

Incorporating climate-change models in premium pricing is a fascinating concept. It appears as though climate change effects on insurance premiums are based on previous outcomes as opposed to current knowledge on the rate of climate change. This concept raises a few questions:

1) Should insurance companies begin to increase premiums to reflect climate change variables, will these models be dynamic to take into account ongoing changes in climate change?

2) Will climate change mitigation programs enacted throughout the world have an effect on insurance premiums, or will it remain outcome based?

3) What would the long-term effect of the climate-change variables be should there be a small number of highly impactful natural disaster events, even if overall climate change indicators are improving? What about the reverse, where climate change indicators are declining, but there haven’t been any large scale natural disasters? Will these indicators increase costs to customers?