GE Digital: One Size Fits None

“The data economy for the industrial world has arrived, and GE is in a unique position to lead it.” – Jeff Immelt [1]

Why does Digitalization matter?

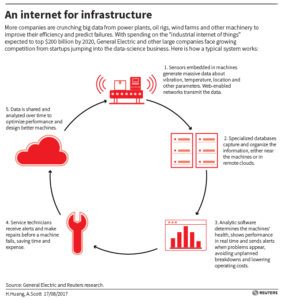

Digitalization and the era of big data have the potential to transform industrial giants of the past and create a step-wise change in industrial productivity. While this trend will certainly impact GE’s customer base, perhaps more interesting in the short-term is its potential impact on GE’s own service supply chains.

In its various business units from Aviation, to Power & Water, to Oil & Gas, GE often enters Contract Service Agreements (CSAs) with its hardware customers. In this model, customers pay a flat annual fee to have their equipment serviced and maintained by GE. Lowering the cost to serve immediately impacts the bottom line, and downtime is expensive (as GE often pays penalties if a customer cannot operate).

Done correctly, predictive analytics presents a massive opportunity to cut contract service supply chain costs by facilitating a move from calendar-based maintenance to condition-based and predictive maintenance. For example, if a power plant operator can measure performance indicators and predict a critical part failure, GE can proactively stage the required inventory, schedule maintenance in advance, reduce costly emergency outages, and avoid a scramble for long-lead-time parts production and skilled maintenance labor. The operator can also fine-tune operating parameters to match conditions, minimizing fuel consumption, emissions, and machine wear-and-tear.

What is GE doing about it?

GE’s top executives (including Jeff Immelt, who recently stepped down as GE’s CEO, and John Flannery, now at the helm) recognized this trend early on and set a vision for GE to transform itself from an industrial manufacturer to a software and analytics company. To this end, in 2015 GE created a new business unit called GE Digital to house a software center and global IT capabilities [2]. The focus to-date has been on creating “Predix” – a software platform for creating applications for the Industrial Internet of Things [3].

It’s easy to see why GE took this centralized approach to creating digital capabilities. The idea was to perfect a centralized software platform, then quickly roll it out at scale across multiple business units, creating savings in their own service supply chains as well as a competitive advantage in selling new machines.

How has this strategy panned out so far?

Unfortunately for GE, not very well. GE Digital has not delivered the revenue investors wanted, despite high levels of capital spending ($2.1 billion invested in Predix and its applications over 2015 – 2017), and has essentially nothing to show for its ongoing efforts. In an uncharacteristic move, GE announced it was taking a “two month time out” in May and June of this year as a sort of emergency-surgery approach to get Predix back on track. [4]

Time out? Why did this happen?

At the heart of the matter, centralization in a single business unit divorced the software from the hardware it attempted to serve. Rather than focus on specific, value-add applications, engineers initially wasted time trying to build data centers, before shifting course in 2016 toward creating applications for specific machines.

Additionally, GE historically developed unique coding languages for systems within different GE businesses, which made it next-to-impossible to integrate them into a one-size-fits-all platform à la Predix. In an effort to grow quickly, GE Digital also made a series of dubious strategic acquisitions, including Meridium and ServiceMax, which only introduced more code that had to be converted to run on Predix. [4].

What now?

Flannery is quickly realizing the mistakes and money-black-hole that have defined GE Digital so far. In an earnings call on November 13th, Flannery announced he is cutting spending plans by $400 million in 2018, and focusing on a few products. [5]

But this is insufficient. To salvage the potential a digital platform can provide, GE Digital should be disbanded as a business unit entirely, and a SWAT-team approach should be taken from inside individual business units. Teams should tackle a couple of specific platforms, with large installed bases and relatively standardized models (e.g. the aeroderivative LM2500 engine in Oil and Gas, and the H-series gas turbine in Power and Water would seem logical choices).

God-willing, a successful model could later be scaled in other businesses and potentially centralized, but going for scale at this point just means burning more cash for no reward. This approach would also better align incentives, as the software development teams would actually share the supply chains and P&L’s of the products they’re attempting to impact.

There are certainly risks to this approach. Are the organizational competencies required for software development simply too different from the industrial business units’ traditional skills to get results? Would there be reputational impacts?

Possibly. But what we know is that what we have now is not working, and GE Digital needs a Hail Mary. Fast.

—

[Word count: 785]

Sources:

[1] General Electric. (2015). General Electric 2015 Annual Report. https://www.ge.com/ar2015/letter/

[2] Associated Press. (2015, September 14). General Electric Forms GE Digital Unit. Retrieved November 15, 2017, from http://www.chicagotribune.com/news/sns-bc-us–general-electric-ge-digital-20150914-story.html

[3] Woods, D. (2016, October 01). What Is GE Predix Really Building? Retrieved November 15, 2017, from https://www.forbes.com/sites/danwoods/2016/09/28/what-is-ge-predix-really-building/#38a602e83c5b

[4] Scott, A. (2017, August 30). GE Shifts Strategy, Financial Targets for Digital Business After Missteps. Retrieved November 15, 2017, from https://www.reuters.com/article/us-ge-digital-outlook-insight/ge-shifts-strategy-financial-targets-for-digital-business-after-missteps-idUSKCN1B80CB

[5] Lohr, S. (2017, November 13). G.E. Rolls Back the Breadth of Its Ambitions. Retrieved November 15, 2017, from https://www.nytimes.com/2017/11/13/business/ge-dividend-flannery.html?login=email

Reading this essay made me think of Clay Christensen’s “Innovator’s Dilemma” that explores how an established company can still disrupt and innovate while maintaining it’s core business that is serving as a stable cash cow. While all things digital and AI are hailed as the next revolution and a lucrative business opportunity, there are very few players, if any, currently making money in this sector. Unfortunately for GE, this reality means that the company needs to keep heavily investing in the near future without any meaningful return. However, since hardware is becoming commoditized in vast majority of industries, GE likely has to pursue value-added software and digital offerings to stay relevant.

I think the most promising approach to tackle this challenge is to identify a business unit within GE that has mostly maximized it’s hardware advancements (e.g., wind turbines, etc.) and partner with established customers for the product to co-develop advanced predictive software that will provide additional value for the end user. Since GE as an OEM is often removed from the actual use / operation of the equipment (besides their maintenance contracts mentioned in the essay), I think it is critical for them to partner with equipment operator to identify additional opportunities for improvement. This surgical approach would focus of identifying and delivering concrete value for customers, as opposed to developing a single “fit all” platform, making it easier to monetize these products in the near term. Later, GE could distill and aggregate lessons learned from these individual AI endeavors, if it makes sense to generalize digital / AI offerings across multiple products.

Building on Alona’s very interesting comment around the strategic necessity for historical hardware companies such as GE to pursue value-added software and digital offerings to stay relevant, I think GE clearly followed the incorrect implementation approach of a “full roll-out at once” vs. a more considerate approach of “first nail it, then scale it”. Digital offerings and software are obviously not at the historical core of a more-than-a-century-old hardware manufacturing company and respective digital capabilities need to be carefully yet quickly build up internally to capitalize on the future profit pool arising from data analysis and predictive maintenance.

Regarding the organizational set-up of digital offerings & related IT systems, I do agree with GE’s current approach of an envisioned cross-business unit IT platform such as Predix given the eventual required data analysis capability will be fairly similar across applications and main differences will be in the technological integration. Hence, I would advocate for a two-step approach: i) expand and refine Predix’ flexibility to have the potential to incorporate a variety of GE’s IT systems and ii) in the short-to-mid-term focus on the particular digital applications in a specific set of BUs to gain experience and develop a learning curve around monetization of digital offerings. This is also aligned with GE CEO Flannery’s latest announcement of a “sharpened focus of GE’s digital operations […] to prioritise what the company works on and the investment needed to achieve the best results for customers and shareholder”. [1]

________________

[1] Crooks, E., “John Flannery sends cost-cutting signal at GE with shake-up,” Financial Times (Oct 8, 2017)