GE Aviation: Soaring Apart From Competition with Data Analytics

GE Aviation's digital efforts enable strategic partnerships that generate value across the supply chain

Supply chains operating today need to be concerned about digitization. “The confluence of connectivity, big data and leaps in computing and software capabilities are disrupting old business models and enabling digital-savvy startups and other competitors to push into new markets”.1 GE Aviation is specifically concerned about digitization as a means to differentiate themselves from competitors by creating new value for their customers, especially in a climate of rising fuel costs and high fixed costs associated with aging fleets. “Smart, connected products dramatically expand opportunities for product differentiation, moving competition away from price alone. Knowing how customers actually use the products enhances a company’s ability to segment customers, customize products, set prices to better capture value, and extend value-added services”.2

Along with differentiation from competitors, the insights generated from the new wave of data coming from GE’s engines can increase their power within the aviation ecosystem, especially relative to their customers. “GE’s analysis of fuel-use data, for example, allowed the Italian airline Alitalia to identify changes to its flight procedures, such as the position of wing flaps during landing, that reduced fuel use. GE’s deep relationship with the airlines serves to improve differentiation with them while improving its clout with airframe manufacturers”.2 Moving forward, GE can work with airlines as a partner, in an effort to reduce overall cost and deliver value to the end customers. “In technology intensive and global competitive markets like aviation and aerospace adaptation of the coopetition strategy is often only one, possible way of survival and development.”3

In the short-term GE Aviation has focused on acquiring the talent necessary to support expanded digital capabilities. In 2012, at the start off their digital journey, GE acquired Austin Digital, a company with a “proprietary suite of tools to analyze digital flight data and other operational data to improve safety and efficiency for operators.”4 This move acted as an accelerator for GE’s digital development. John Gough, leader of GE Aviation’s Fuel and Carbon Solutions believes that “Austin Digital’s data frames and analytical capabilities will help his team find answers in minutes to hours, as opposed to a “longer” time previously”.5

Looking forward, GE has focused on forming strategic partnerships with airlines. One of the first partners GE formed was with Qantas Airlines. “Data scientists, engineers and software designers from Qantas and GE will analyze some of the 10 billion data points produced by the aviation sector annually to help the carrier cut fuel costs and carbon emissions”.6 This partnership has moved beyond data sharing, pilots from Qantas have collaborated with GE Aviation to develop an application called FlightPulse. “FlightPulse is the first fully commercialized product to be developed with mobile services from GE’s Predix platform and uses recorded aircraft data and analytics to enable pilots to securely access their individual operational efficiency metrics and trends. Information accessible on this platform helps them understand the operational efficiency of their flight”.7 The insights from applications such as FlightPulse have the potential to drastically reduce costs and emissions across the entire aviation ecosystem. “GE’s ‘Power of One Percent’ report estimated that the global commercial airline industry is spending about $179 billion annually on jet fuel. A one per cent cost reduction would save the global aviation sector around $30 billion over the next 15 years”.6

I believe one of the largest challenges facing GE is data security. In the short term, I think ensuring data collected is secure, and managing customer concerns around this issue will be imperative to continuing to form new strategic partnerships and harness the scale of available data from all GE’s engines. “As airline systems become more interconnected, the more vulnerable they become to a cyber-attack. ‘Airplanes themselves have never been more complex, never been more reliant on technology,’ says Jeff Schmidt, a pilot and CEO of JAS Global Advisors, a security consultancy for government and critical infrastructure firms. ‘Complexity is the enemy of security’”.8

GE Aviation must anticipate new regulations that will continue to solidify as the aviation industry becomes increasingly vulnerable to cyber-attacks. “FAA is working on standards for cyber-security, but for now they are using a process called ‘special conditions’ as the substitute until those requirements are formalized and complete”.8 GE Aviation should be actively engaging in discussion with the government as well as collaborators in the industry to ensure future regulations create security while leaving space for innovation.

As GE Aviation faces the task of ensuring data security, I’m left wondering how closed off should GE’s system be towards talking with other digital systems? A closed system reduces the risk of security breaches as well as acting as a forcing function to create long term customer loyalty with GE. However, is GE and their customers sacrificing future functionality and benefits by not considering a more hybrid approach?

(Word count 793)

References

- Goldberg, M. (2016, September 19). Getting Positioned For Digital Disruption. Aviation Week & Space Technology, p. 15.

- Porter, M. E. (2014, November). How Smart, Connected Products Are Transforming Competition. Harvard Business Review, 64–88.

- Klimas, P. (2014). MULTIFACETED NATURE OF COOPETITION INSIDE AN AVIATION SUPPLY CHAIN – THE CASE OF THE AVIATION VALLEY. Journal of Economics and Management, 96-119.

- Drake, T. (2012, August 1). GE Aviation Acquires Austin Digital. Retrieved from Avionics : http://www.aviationtoday.com/2012/08/01/ge-aviation-acquires-austin-digital/

- Tegtmeier, L. A. (2012, December 17). GE, Boeing At Work On Next-Gen Digital Data Getting Smarter. Aviation Week & Space Technology, 174(45), 1. Retrieved from Aviation Week & Space Technology.

- Connolly, B. (2016, October 7). Qantas tapping data to improve flight efficiency. CIO (13284045), 1.

- Driskill, M. (2017, October). QANTAS, GE AVIATION DEVELOP NEW FLIGHT DATA APP. Asian Aviation Magazine, 12.

- Jaeger, J. (2015, November). Managing Cyber-Risk in the Aviation Industry. ERM & INTERNAL CONTROLS, 44-45.

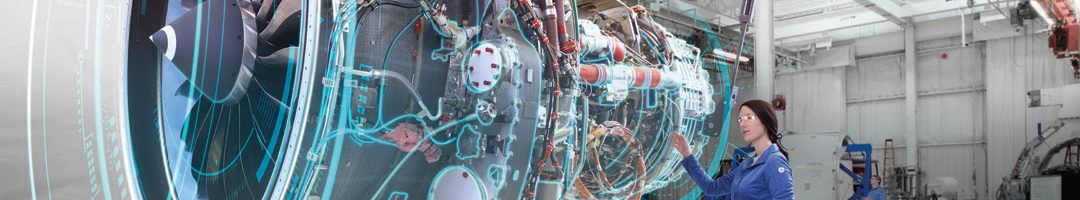

Cover Photo

- Aviator. (2017, October 17). GE Aviation and Teradata Form Strategic Partnership to Bridge the Gap Between Aviation Operations and Business. Retrieved from Aviator: http://newsroom.aviator.aero/ge-aviation-and-teradata-form-strategic-partnership-to-bridge-the-gap-between-aviation-operations-and-business/

Thanks for the great post! You raise a very valid concern surrounding the tradeoff between future functionality and benefits when considering a closed off digitalized communication system. The reality is though, that in the current digital age, companies must proactively consider potential cybersecurity threats. As indicated by a PWC study, cybersecurity attacks have been increasing over the last few years and there is little indication that attempts to hack into our highly-utilized information systems (including airline controls) will cease. [1] As a result, I would argue that GE should lean more towards closed-off (and ideally end-to-end encrypted) systems. If GE shows in good faith that it is trying to adjust to the realities of digitalization and protect its consumers, customers may actually feel more inclined towards loyalty and partnership with GE.

[1] PWC. “The Global State of Information Security Survey 2018.” PwC, 18 Oct. 2017, http://www.pwc.com/us/en/cybersecurity/information-security-survey.html.

Great post! I tend to agree with you and HeidiRozensUncleHoward. In most cases, I believe that a closed loop system is better. Data can always be aggregated and submitted to the appropriate parties. Similar discussions are taking place with regards to cyber security and the oil and gas industry. As with aviation, the oil and gas industry is also seeking to optimize its processes through digitization. However, the industry faces similar threats as it moves in this direction. See the article below that raises some great points on this.

https://www.forbes.com/sites/forbestechcouncil/2017/04/03/cyber-security-risks-to-be-aware-of-in-the-oil-and-gas-industries/#3fbd29a93f0a

In my previous role, we ultimately came to the conclusion that some data was harmless and could either be aggregated or transmitted directly to collaborators. Data like pressures, temperatures, vibration, etc. are relatively harmless. As long as these systems are separate from the controls to the actual operation (as is described in the article above), I believe the benefits exceed the risks. In conclusion, I think asking what data are we sharing and is the system truly isolated from other critical controls is key.

Fascinating article—I had not considered that there was an ability to leverage engine data in such a way to capture additional revenue opportunities with airline partners through such ongoing engagement! A key question that strikes me is which organization actually owns and receives the data on an ongoing basis, given that the engines are presumably purchased outright by the airline. It would be interesting to understand how GE would therefore be affected by marketing / pricing their data analytics services to the airline.

Cybersecurity is certainly a huge concern and one that should be carefully thought through as there are significant reputation risks on both sides. I believe that a closed, modular system is absolutely necessary in the event of an in-flight cyber attack so as not to compromise other flight operations in an emergency situation. Segregation of key systems and processes in any organization is always a good consideration.