From Paper to Clicks: How RetailMeNot Changed How Shoppers Save

How one company brought savings into the digital age

The Rise of the Coupon

In addition to getting the world hooked on soda, Coca-Cola also got people hooked on savings by introducing the first coupon in 1887 [1]. Less than 30 years later, Coca-Cola was a major brand and had given away over 8.5 million free beverages through couponing. After seeing the success of this type of promotion in increasing sales and brand awareness, paper coupons took off and infiltrated into consumer behavior, and later achieved pop-culture status on shows like Extreme Couponing. In 1957, to manage the redemption of paper coupons, Nielsen Coupon Clearing House was formed to help make the process more efficient [2]. While the business processes were improving and changing with the times, the actual coupon itself wasn’t undergoing the same transformation. With the rise of internet shopping and the pressures of the Great Recession, the industry was about to shift.

It was almost impossible to use paper coupons in e-commerce transactions. To facilitate the transition to online shopping while still offering consumers value, retailers began to offer promo codes, or coupons that could be applied to an online shopping cart. Whereas coupons were easy to distribute in stores, there weren’t easily accessible places on the web to find deals on your favorite stores.

The Start of the e-Commerce Era

Enter RetailMeNot.com. In 2006, the website was founded to help online shoppers save money across multiple retailers [3]. The site aggregates deals from across the web, leading it to have greater than 600,000 promo codes from more than 70,000 retailers on the web [4]. However, a lot of these coupons are available all around the web, and on the websites of the retailers themselves. To help combat this, RetailMeNot utilizes the power of social networks to help improve its content and increase its competitive barriers through user-generated content, which makes up roughly one-third of the offers available on site [5]. Realizing that a lot of the best deals are hard to find, the company allows users to submit new deals for points and badges. The company has even created its own mini social network, with chat rooms available on its website and private Facebook groups for its most active supporters [6]. By using technology, RetailMeNot has been able to strengthen its competitive moat compared to opponents.

Providing a savings resource for consumers is great, but would not be sustainable without revenue streams. To create value for the business, RetailMeNot uses cookie tracking through affiliate networks to earn commissions from retailers [7]. In the time of paper coupons, it was difficult to accurately attribute the value of different marketing channels. However, with the digitization of this industry, marketers were able to determine that value and pay partners appropriately, which is how the company gained credibility with retailers. This credibility also led retailers to give RetailMeNot exclusive offers, thereby increasing its competitiveness [7].

The Rise of Mobile

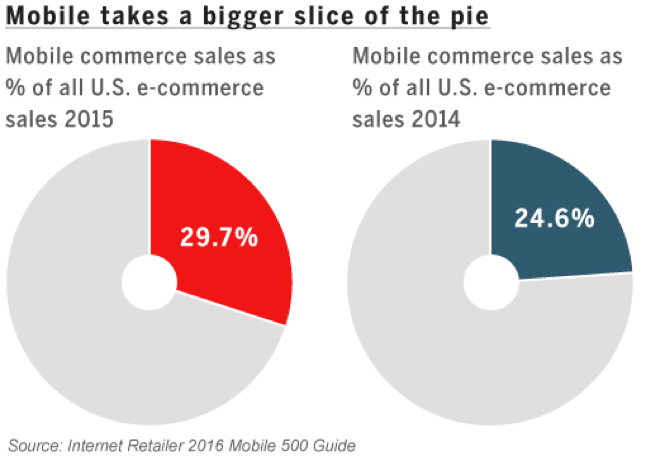

With the ubiquity of mobile devices, RetailMeNot is now entering its next phase of growth. The company launched its mobile app in 2012, and made mobile one of its key priorities for 2016 [3,8]. Focusing on bringing digital coupons to the stores, RetailMeNot launched its Mobile and In-Store Solution to help retailers digitize their in-store coupon offers and to help consumers remove their reliance on paper coupons completely [9]. The company now offers a completely omnichannel solution, helping retailers reach consumers via their phones, desktops, email, and social networks. RetailMeNot has also used its vast network of information on customers to provide key insights to retailers, which were hard to gather in a brick-and-mortar, mobile-less world.

Source: US Census Bureau

While the company has hit some stumbling blocks through this transition, there are still many opportunities to grow in the digital world [10]. E-commerce is booming, but in-store transactions still make up over 90% of transactions [11]. Additionally, with mobile shopping growing, the company should continue its investment in its mobile app. However, there are two main things the company needs to ensure happen in order to secure success. First, the sheer volume of discounts that RetailMeNot offers, once a great strength, could be overwhelming for an on-the-go or mobile shopper. To combat this, they should utilize machine learning to show users the offers they are looking for based on interests, where they are / where they are going, etc. This will help make sure shoppers get the right deal at the right time. Secondly, they need to make sure that their coupons work 100% of the time. A user might be disappointed if a coupon doesn’t work online, but there could be a sense of embarrassment that could come along with a failed coupon use in-store. By making sure coupons work all the time and showing consumers what they want, when they want it, they can strengthen their relationship with their users.

Word count: 799

Sources:

[1] Megan Geuss, “Prototype: Coca-Cola and the Birth of the Coupon,” Wired, https://www.wired.com/2010/10/pl_protoype_cocacola/, accessed November 2016

[2] Nielsen Clearing House, “NCH History,” https://www.nchmarketing.com/NCHHistory.aspx, accessed November 2016

[3] RetailMeNot, “Real Deal: History of Coupons,” https://www.retailmenot.com/blog/sc-history-of-coupons.html, accessed November 2016

[4] RetailMeNot, “About Us.” https://www.retailmenot.com/corp/about/, accessed November 2016

[5] Morey Stettner, “RetailMeNot Founder Harnesses User Generated Content,” Investor’s Business Daily, http://www.investors.com/news/management/managing-for-success/retailmenot-cotter-cunningham-stays-close-to-customers/, accessed November 2016

[6] RetailMeNot, “Community,” https://www.retailmenot.com/community/, accessed November 2016

[7] RetailMeNot, Inc., Form S-1 (June 17, 2013), http://investor.retailmenot.com/Cache/30024211.pdf, accessed November 2016

[8] “RetailMeNot Announces Fourth Quarter & Fiscal Year 2015 Financial Results,” press release, February 9, 2016, http://investor.retailmenot.com/Cache/1001206763.PDF?O=PDF&T=&Y=&D=&FID=1001206763&iid=4296416, accessed November 2016

[9] RetailMeNot, “Solutions,” https://www.retailmenot.com/corp/solutions/, accessed November 2016

[10] Jignesh Gohel, “The Real-World Impact of Panda 4.0: A Case Study of RetailMeNot,” SEM Rush, https://www.semrush.com/blog/real-world-impact-panda-4-0-case-study-retailmenot/, accessed November 2016

[11] U.S. Census Bureau, “Quarterly Retail E-Commerce Sales,” http://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf, accessed November 2016

As a shamelessly frequent use of RetailMeNot, this post really resonated with me. There were several points on the operational side that really blew me away here. Specifically, how RetailMeNot (RMN) is leveraging the power of social networks to make the act of couponing more community-oriented but also to improve the quality of the coupons provided on the service. With over 50% of adult Internet users in the U.S. using digital coupons in 2015, I see such significant value and potential in RMN’s business/operating model.[1] Let’s dig into the latter.

Before RMN, couponing was a relatively individualistic experience that revolved around “crazy coupon ladies” who scoured blogs and online forums for the best deals on anything, anytime. The industry, as Katherine notes, has significantly transformed with the advent of digital. A big question around digital is the quality of the coupons — now that everyone has access to the Internet, it can be difficult for companies and users to discern between real and fake. RMN swoops in with a social graph that actually increases the likelihood of coupon validity. By leaning on customer-generated content, RMN is effectively utilizes the strength of the average couponer to help out other couponers. This is a very positive feedback loop. Without the proliferation of digital and social networking, RMN’s business model would not be nearly as effective.

I completely agree with Katherine that the next step for RMN is meeting the customer at the right time and place in the shopping experience. Utilizing their existing cookie tracking and new machine learning technology, RMN will have the ability to recommend relevant coupons even mid-shop. This not only serves the customer well but also enables RMN to capture even more value from retailers by providing customer shopping habit data directly to brick-and-mortars and online retailers. The entire value chain benefits from this next step.

[1] https://www.statista.com/topics/1156/coupon-market-trends-in-the-united-states/

Great post Katherine! It looks like the business model has evolved materially and I started asking myself whether, as a retailer, RetailMeNot (RMN) is my saviour or the bane of my existence.

It appears the business started as an aggregator of various retail promotions (online/offline) already in existence for the benefit of RMN’s visitors. As you point out, this frustrated marketing channel attribution (similar to what we saw in the marketing case on Catalina) and likely upset retailers. However instead of fighting RMN, retailers started working together with RMN to push their existing promotions and sales. Because the bulk of RMN’s revenue comes from their retail partners, who give RMN a 5% commission on sales, RMN now has little incentive to display crowd-sourced promotions from retailers who are not their partners and from whom they don’t earn a commission.

In doing so, I would argue the retailers have neutered RMN’s business model and kept offline promotions off the site. Browsing through the RMN discounts confirms my suspicions, because most of the offers take me straight to a retailer’s website as opposed to providing me a super-secret discount code. Perhaps when the next RMN shows up and starts gathering the exclusive deep discounts everyone is looking for, traffic will migrate away from RMN. Furthermore if RMN stops sending traffic to retailers, retailers will stop working with RMN and the business will be toast.

I am an excessive user of RetailMeNot, so naturally I was very intrigued by this post! However, I also do 90% of my shopping online, so I was very surprised to read that 90% of sales are still executed in-store. What concerns me about RetailMeNot’s shift to mobile couponing is the fundamental shift in consumer behavior that would be necessary for this to be successful. Specifically, the current process of using coupons in store requires consumers to find the coupons before entering the store, whereas RetailMeNot’s strategy requires consumers to search for coupons after they enter the store. This seems like a simple and small shift, but as with most things concerning consumer psychology and behavior, it takes times to change the status quo for the masses. Mainly, I think it will take time for consumers to remember and adopt the practice of looking for coupons on their phones while they’re in the checkout line.

One way that RetailMeNot’s competitors have sought to catalyze this shift in consumer behavior is through GPS technology. Instead of requiring consumers to log on and search for coupons through their app, these apps send coupons to consumers via text messages based on their location (ie. The app knows that I am at J. Crew and will send me a coupon while I am shopping so that I have it in my text messages when I go check out). [1] I think this is brilliant, but I can imagine some consumers having privacy concerns around businesses knowing the location of their consumers at all times. However, with other location-based apps like FourSquare becoming increasingly popular, this concern might end up not being an issue at all.

[1] http://www.talentzoo.com/beneath-the-brand/blog_news.php?articleID=6088

Katherine, thank you for the thoughtful post about the transitioning nature of the coupon distribution industry. It was interesting to follow that change in delivery of a product that has not shifted at all. I wonder how effective this distribution channel will be going forward. This is largely a function of greater price transparency across the web as different websites allow for aggregating price views. In order for RMN to remain relevant, they must provide coupons that offer a lower price than what is available on other sites. If done effectively, this could be a powerful way for RMN to increase its relevance. In particular, this could be leveraged by its partners to return customers to their websites as opposed to third party sellers. To an earlier comment though, at what point does this inhibit broader retail distribution by favoring the offers of partners providing the largest share of revenue?

I like how you discussed the benefits of introducing deep machine learning to RMN. I think this can help refine the relevance of offers on the website and increase the targeted nature of its offers. I believe this is critical going forward as consumers begin to rely on extremely targeted offers.

Thank you for the insightful post!

To build on Catherine’s earlier comment, the use of beacon technology is certainly a compelling thought. Beacons are physical devices that retailers can place strategically in store that connect via with a shopper’s smartphone via a bluetooth connection. However, there are a number of key aspects of these connections to consider. A user must allow the application permission to connect (very similar, if not the same, to allowing location tracking) and the user must also enable push notifications from the app as well, otherwise there would only be utility if the user has the app open while walking around in store. Consumers generally permit those two functionalities to very few applications, primarily social applications (in the US, these are typically Facebook-owned). In addition to having a leg up in terms of consumer permissions, these social media apps not only have an immense source of information about their users, but are likely to also have an advertising relationship with the retailer. To that end, businesses such as RMN looking to develop in-store experiences may have a very tough time starting from the ground up. However, I’d be curious to see if RMN would pursue strategic partnerships with the likes of Facebook to enable a joint experience – particularly given the potential synergies between RMN’s content and relationships with those of Facebook.

Check out a bit of the work FB is doing with beacons and ‘place tips’ here (it’s pretty cool stuff): https://placetips.fb.com/beacons/

Thanks for the response! I can’t get too far into it without going into insider info, but here are some things available publicly:

– http://www.swirl.com/retailmenot-partners-with-swirl-to-promote-beacon-powered-in-store-offers-to-shoppers/

– http://www.retailtouchpoints.com/topics/shopper-experience/retailmenot-partners-with-gimbal-to-extend-beacon-offering

Happy to discuss beacons in more depth at anytime 🙂