Electric Slide

Auto manufacturers will be forced to get creative in an increasingly regulated and competitive landscape.

Self-driving Ubers?

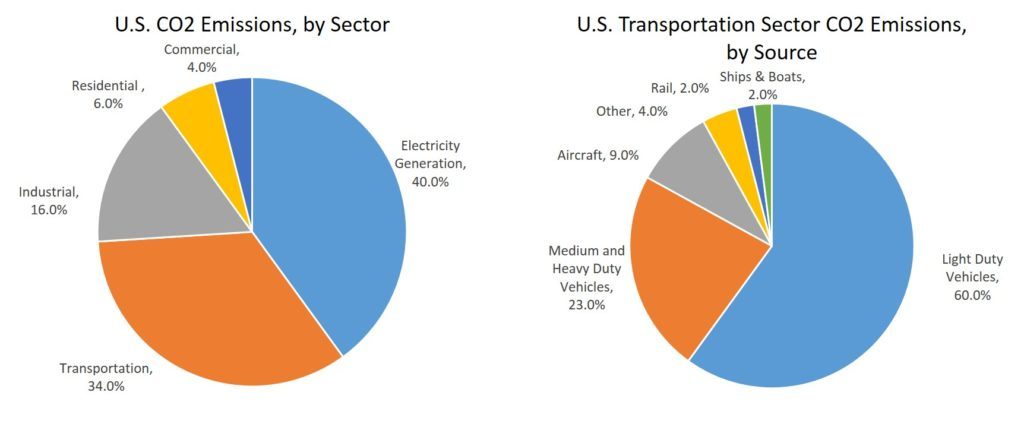

The transportation sector as a whole is one of the largest sources of U.S. carbon dioxide emissions, generating over 25% of the total U.S. greenhouse gas emissions (GHG) (Figure 1) [1]. Within the transportation sector, light vehicles (passenger cars and light-duty trucks) consume the most energy (Figure 2) [1]. Carbon dioxide comprises the majority of transportation emissions (95%), and is released during fossil fuel combustion. The federal government has regulated this industry for decades, standardizing the fuel economy and GHG emission levels that the auto manufacturers are required to meet. These standards have been adopted by the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA), and represent a monumental step towards reducing the impact of climate change. The regulation acts as a performance standard that allows automakers to develop their own diverse technology strategies and methodologies to comply. Figures 2 and 3 illustrate the interim status of auto manufacturer company compliance with the GHG standards since the standards took effect in the 2012 model year [2]. In addition to the positive effects on the planet, such regulation also has beneficial energy security and economic implications. Standards for car model years 2017 to 2015 are expected to drive fuel efficiencies reducing annual U.S. oil imports by 6% by 2025, or roughly 400,000 barrels per day. In conjunction with the current rules for model years 2012 to 2016, the U.S. oil imports could be cut by more than 2 million barrels per day by 2025, or roughly half of the oil the U.S. imports from OPEC countries each day [1]. Due to these dramatic potential savings and opportunities for climate preservation, the federal government has taken a hard stance on the standards it imparts on auto manufacturers. In turn, the auto manufacturers have a number of levers at their disposal that they can utilize in order to meet these standards, and have followed a variety of different paths in their pursuit of success.

Figure 1. U.S. CO2 Emissions, by Source [1]

Figure 2. Industry Compliance Values vs. Standards in 2012 – 2015 Model Years [2]

Figure 3. Manufacturer Compliance Values and Standards in the 2015 Model Year [2]

One such path to sustainability, as implemented by Ford Motor Company, has been an electric vehicle (EV) strategy. When it first entered the EV space in 2012, Ford attempted to compete directly with the Teslas, Chevys and Nissans of the world, with a broad product offering spanning powertrains (hybrid EVs, plug-in hybrid EVs, and full battery EVs) and segments (sedans, utility vehicles and luxury vehicles) [3]. See Figure 4. The idea was to provide consumers a range of choices that suited a variety of driving conditions, distances and terrains. While sales of plug-in electric vehicles grew dramatically from 2012 (see Figure 5), the sales were dominated by just four vehicles: GM’s Chevy Volt, Nissan’s Leaf, Tesla’s Model S, and the plug-in version of Toyota’s Prius. Together, those vehicles made up ~80% of aggregate sales since 2011 (see Figure 6) [4].

Figure 4. Ford Fusion Hybrid, Lincoln MKZ Hybrid, and Ford C-MAX Hybrid [3]

Figure 5. U.S. Sales of Plug-in Vehicles [4]

Figure 6. Cumulative U.S. Sales of Plug-in Vehicles [4]

During Ford’s September 2016 Investor Day presentation, CEO Mark Fields unveiled a change in Ford’s EV strategy in response to the lackluster performance. Fields announced that the company would re-focus its efforts into making electrified powertrains for the vehicle categories it could and always has dominated, i.e., SUVs and light-duty trucks. It would funnel its resources into the sectors where Ford is the icon –trucks, commercial vehicles, SUVs and performance vehicles, which also happen to be the segments that generate the juiciest profit margin. Management outlined a $4.5 billion planned investment across 13 new nameplates, with a key differentiator intended to be a presence in the commercial delivery segment. Ford also revealed plans to enter the Transportation as a Service (TAAS), i.e. ride-hailing / ride-sharing space, in a fully autonomous vehicle (AV). By creating a unique position at the intersection of AV technology and miles-sharing platforms, Ford is at the forefront of the next frontier of connectivity, optimization and innovation as it relates to personal mobility [5] [6].

As evidenced by Ford’s latest initiatives, auto manufacturers are being forced to innovate and leverage their core competencies in order to compete in an increasingly regulated and competitive landscape. I believe the winners will be the companies that can scale their capabilities to expand outside the purely manufacturing realm. Ford is doing so by bridging the gap between personal, commercial and shared mobility and utilizing its core technological capabilities. One risk I see to Ford’s implementation is its lengthy timeline – management guided towards a 2030 horizon for realization of these initiatives. Capturing market share early will be critical as regulation continues to handicap manufacturers production choices and pressure margin, while players without a unique value proposition will simply slide.

(753 words)

References:

[1] Center for Climate and Energy Solutions. “Federal Vehicle Standards – Overview.” http://www.c2es.org/federal/executive/vehicle-standards, accessed November 2016.

[2] https://www.epa.gov/regulations-emissions-vehicles-and-engines/greenhouse-gas-ghg-emission-standards-light-duty.

[3] http://corporate.ford.com/microsites/sustainability-report-2013-14/environment-products-electrification-strategy.html.

[4] http://www.vox.com/2014/7/28/5944065/electric-cars-plug-in-vehicles-rising-sales-US.

[6] Mark Fields, CEO, Ford Motor Company, remarks made at Ford Motor Company’s 2016 Investor Day, Dearborn, MI, 9/14/2016. From transcript provided by Seeking Alpha, http://seekingalpha.com/article/4006587-ford-motors-f-ceo-mark-fields-hosts-2016-investor-day-conference-transcript?part=single, accessed November 2016.

One common misconception in the automobile industry is that electric vehicles result in lower emissions: the majority of the electricity generate in the United States is created through the combustion of fossil fuels (https://www.eia.gov/tools/faqs/faq.cfm?id=427&t=3). With this in mind, the concept of self-driving cars can really change the equation regarding vehicle design because one of the primary purposes of the heavy steel cage we drive around in is safety. If we can reduce the design and material required to meet the government’s safety standards, much less metal will be required and the amount of fuel required to energize our vehicles will be reduced substantially. Big fan of reducing consumption through technological innovation.

Awesome post, I had not thought about how ride-sharing, electric cars, and autonomous driving could all fit together in the future- it’s like the Jetsons’ world isn’t that far away. It’s also cool how Ford is targeting the least fuel efficient vehicles in its EV strategy (trucks and SUVs). If Ford can tap into converting these 2 segments, then maybe it can catch on and spread to “light vehicles”.

As you wrote, I am also concerned about the timeline. Is 2030 too far away to make an impact? At the same time, it will probably take at least that long to develop a network of EV recharging stations. As a consumer interested in EVs myself, I would be less worried about buying an EV if I knew there were reliable charging options. I hope Ford can continue it’s efforts since transportation is such a big contributor to the climate change problem!